Why did AC, the king of DeFi mergers and acquisitions, become the "public enemy" of decentralized finance?

Text | Edited by Nancy | Produced by Tong | PANews

Text | Edited by Nancy | Produced by Tong | PANews

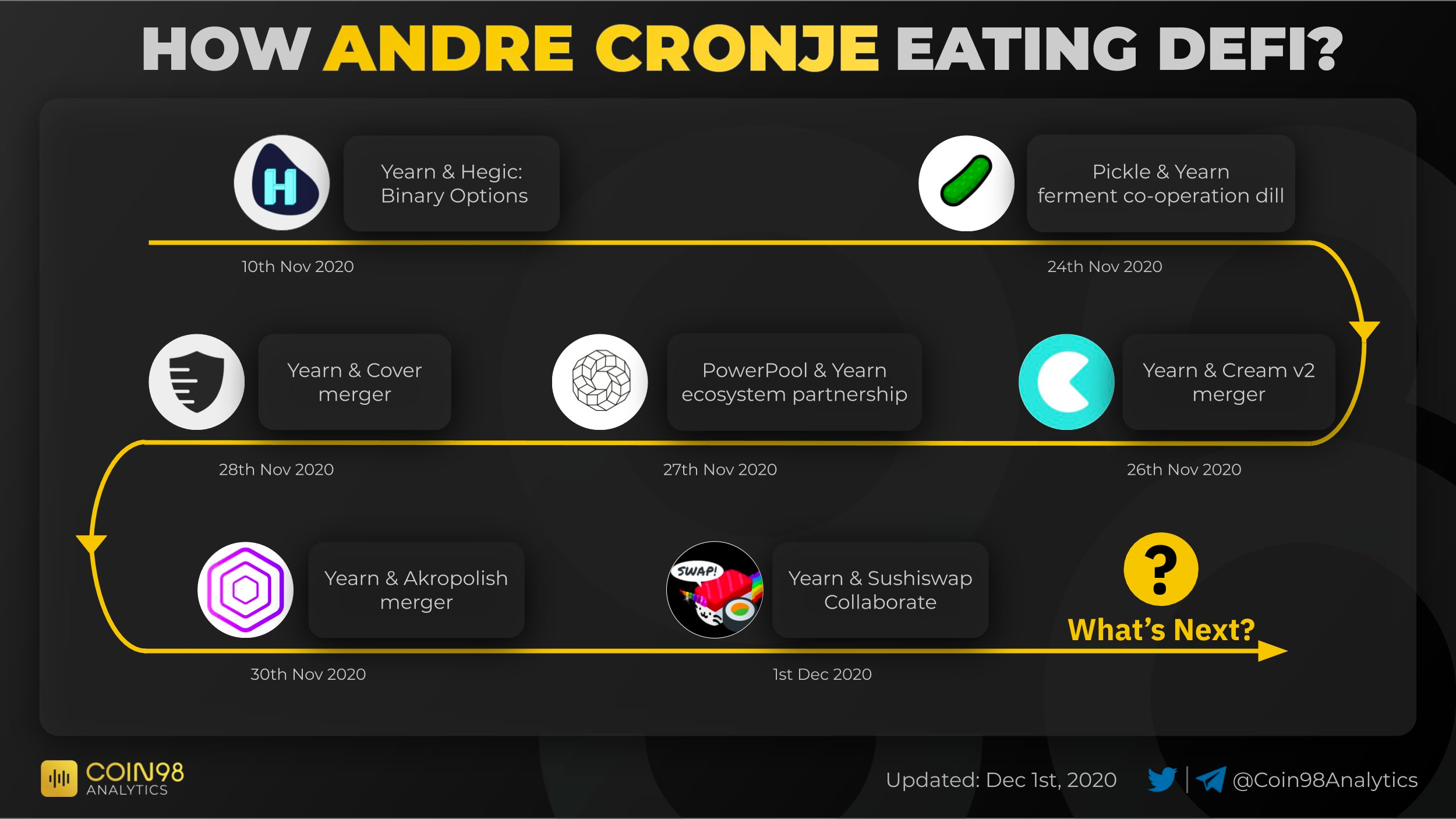

Today, Yearn.Finance (YFI) has also copied the expansion of mergers and acquisitions to decentralized finance (DeFi), from aggregated wealth management, lending, insurance, to DEX (decentralized exchange), Andre Cronje (AC) It seems to be becoming the "public enemy" of the DeFi circle.

secondary title

Behind the mass mergers and acquisitions is the monopoly of talents and resources

At the end of 2011, the most tragic "Thousand Regiments War" occurred in the history of China's Internet. In this bloody battle, there are not a few who have ended or transformed, and Meituan is a survivor and a winner.

"I always believe that Meituan is only a few months away from bankruptcy." Although it has broken through in this commercial melee, Wang Xing does not think that Meituan's future can rest easy. In 2015, the shocking merger with Dianping became an important starting point for the rise of Meituan. Since then, it has made more and more steps to diversify its business in the merger and expansion strategy of "surrounding cities from rural areas".

In the DeFi field where homogeneous competition has intensified, YFI staged a DeFi merger and acquisition drama. Although it is essentially different from Meituan's merger and acquisition, YFI's expansion momentum is comparable to it. On November 24, AC announced that the developers of Pickle and YFI had devised a structure that would allow the two projects to work together symbiotically, with plans for further integration. Just two days later, AC announced again that Yearn and Cream developers have cooperated to launch Cream v2, which will focus on core loan and leveraged products. When everyone was still in shock, Yearn merged with Cover Protocol and Sushiswap in one breath. Under lightning mergers and acquisitions, AC seems to be building its own "DeFi business empire".

"Each joint venture is similar to a merger of teams, protocols leverage each other, and all team members are aligned and share a vision." But AC believes that this is different from previous mergers and acquisitions. He said, "Decentralized finance allows us to both Collaborative, symbiotic, while maintaining individuality.”

In the view of Google payment engineer Tyler Reynolds, motivating, training, and introducing new developers are YFI's priorities, and poaching talented developers and monopoly talents is its direct action.

secondary title

"Marriage" mixed blessings

AC's words and deeds have already become the "weather vane" of investors' decision-making.

Once the news of mergers and acquisitions of various DeFi agreements was announced, the price of tokens rose without exception. PICKLE rose by 80%, CREAM rose by 70%, and SUSHI rose by 30%. Investors who waited for the opportunity made a lot of money.

For these projects that had been sluggish or even mired in the past, YFI undoubtedly boosted morale. Take Pickle as an example. On November 22, due to a loophole in the Jar strategy, Pickle was stolen by hackers for $20 million. Affected by this, its token plummeted by more than 62% on the day. When Pickle was in dire straits, a group of white-hat hackers including YFI core developers extended a helping hand, and the components of the Pickle protocol involved in the attack were also repaired, but its market value has been cut in half. When Pickle was on the verge of trust, YFI resolutely extended a helping hand. In the merger plan, in addition to Pickle's distribution mechanism and other business aspects have been greatly improved, it also compensated for the losses of previous attacks. Obviously, the merger plan is undoubtedly the best choice for Pickle at present, at least in terms of the sharp recovery of the currency price. There are also many negative comments on the three vertical merger projects of Cream, Cover and Sushiswap. From the current point of view, YFI's mergers and acquisitions are positive.

It is worth mentioning that the projects acquired by AC are basically forked projects. Can this improve the homogeneous competition pattern of the industry? Since the codes of most DeFi projects are open source, since the YFI fire, various protocols have begun to fork in turn, which makes the application scenarios of DeFi very limited, and the homogenization of products is becoming more and more serious. Although these micro-innovative or pseudo-innovative projects have taken away part of the liquidity of the original protocol, with the departure of speculative arbitrage participants, there are few forked projects that can compete with the original protocol. By aggregating and optimizing these Fork projects, AC may provide more space for more innovative projects in the stock market.

Under the leadership of AC, will the acquired DeFi projects repeat the mistakes of the above-mentioned Internet companies? Of course, AC himself also admitted that he does not know whether the relationship between Yearn and these projects is a merger or a cooperation. The mutual empowerment between teams and protocols may not exist in traditional industries.

secondary title

Under the "buy, buy, buy" mode, DeFi is still a one-word decision

It started with aggregated financial management, but not limited to aggregated financial management.

YFI is undoubtedly the most eye-catching existence this summer. With the concept of "smart pool" and the setting of "no private placement, no pre-mining, and no team share", YFI, which was born in the early stage of liquidity mining, has been wildly sought after and imitated by investors and many projects since its launch.

Especially after AC completely handed over all governance to the community, the high degree of decentralization made YFI further recognized by the outside world, and the outside world even called it "Bitcoin in DeFi". However, AC's recent M&A behavior seems to contradict the concept of 100% purely community-driven. In the article "Terms of Mergers, Acquisitions, Partnerships, and Cooperation in the Encryption Field" published by AC, it is pointed out that the role of holders of governance tokens is similar to that of Ethereum miners-they decide whether to upgrade the agreement. But in fact, these mergers and acquisitions that affect the YFI ecology are decided by AC and the YFI development team, and the decision-making power of YFI holders is useless.

At the same time, from the current point of view, it seems that AC will not stop the pace of merging other projects, but excessive mergers and acquisitions will inevitably distort the market order and weaken the fairness of market competition. In particular, at the moment when the AC behavior with its own effects is infinitely magnified, no one can guarantee whether there will be a wave of mergers and acquisitions in the market. For DeFi, which focuses on the vision of open finance and has just grown, the monopoly that YFI may bring, or even trigger, will actually harm the industry.

From another perspective, in the field of DeFi where the gameplay is constantly iterative, once the project lacks innovation, it mostly means that the life cycle is getting shorter and shorter. In the past few months, factors such as innovation stagnation and business rigidity have made YFI gradually fall from the altar. According to DefiPulse data, in the past three months, the total lock-up volume of YFI has seen a spiral decline, with a maximum drop of more than 52%.

At the same time, new projects such as EMN, LBI, and KPR of the AC series have been under thunder one after another, which is undoubtedly a further consumption of YFI's credibility. Under internal and external troubles, can the diversified business strategy really make YFI develop to a higher level like Meituan? In fact, just like Meituan, its diversified business also means that it will have strong enemies in every segment. In the future competition of diversification and specialization, the success of AC's "buy, buy, buy" strategy has yet to be tested.