Uniswap mining is over, will Ethereum be smashed?

Produced | Odaily (ID: o-daily)

Produced | Odaily (ID: o-daily)

At 8:00 this morning, Beijing time, Uniswap's initial liquidity mining plan officially ended, and users who provided liquidity for the four pools of ETH/USDT, ETH/USDC, ETH/DAI and ETH/WBTC will no longer receive any UNI rewards.

secondary title

"Divide Uniswap" Season 2

Uniswap has always been the undisputed king of DeFi.

In September, a number of imitation projects represented by Sushiswap appeared one after another, and successfully drained a large amount of Uniswap's liquidity by providing incentives for Uniswap LP tokens. The total lock-up volume of the latter was within a week (9.02 -9.09) plummeted from $1.95 billion to $518 million.

In the early morning of September 17th, Uniswap launched a counterattack. While distributing red envelopes to old users, Uniswap also launched a two-month initial liquidity mining plan, distributing 20 million tokens to users who provided liquidity for the above four pools. UNI rewards.

Uniswap’s coin-spreading initiative was quite successful. Since then, it has once again secured its position as the leader of DEX, while Sushiswap on the other side is getting weaker and weaker. With the cold tide of liquidity mining, the price plummeted, and Shushi’s total lock-up The volume dropped from a peak of US$1.58 billion to US$250 million.

Feng Shui turns, and because Uniswap has not finalized the follow-up plan at the end of the initial liquidity mining plan, Sushiswap's counterattack opportunity has come.

In the early hours of this morning, Sushiswap officially announced that it will provide income incentives for four liquidity pools including ETH/USDT, ETH/USDC, ETH/DAI, and ETH/WBTC. Obviously, it wants to undertake the unlocked tokens in Uniswap.

According to OKLink data, driven by this incentive plan, the total lock-up volume of Sushiswap has skyrocketed, with an intraday increase of 59.13%.

In addition to Sushiswap, the decentralized trading protocol Bancor also announced a new liquidity mining plan. Among the first six large fund pools (ETH, WBTC, USDT, USDC, DAI, LINK) given by Bancor, Uniswap liquidity All five tokens involved in sexual mining schemes are listed. According to OKLink data, Bancor's total lock-up volume has increased by more than 40% today.

secondary title

Where did the funds go?

Will Uniswap face the crisis of liquidity being drained again?

One thing to note is that there is a huge difference in the lock-up base between different DeFi applications, so it is not possible to simply compare the rise and fall. Calculated in absolute terms (based on the current lock-up volume and changes), the total outflow of funds from Uniswap today is about 1.25 billion U.S. dollars, while the total inflow of funds from Sushiswap today is only about 220 million U.S. dollars. It took about 17.5% of the former’s fleeing funds, and some other DeFi applications with a lower base did not receive too much outflowing funds.

So, where did the funds outflowed from Uniswap, especially half of the ETH go?

Wangarian, a partner at DeFiance Capital, had previously assumed three possible ETH flows after Uniswap ended mining:

Continue to participate in liquidity mining provided by other platforms, such as switching to Sushiswap or participating in ETH2.0 pledge;

Sell immediately and exchange for other tokens;

Be a Holder and hold the currency without moving.

Let's look at the first possibility first. As mentioned above, although DeFi applications such as Sushiswap that can still provide mining incentives do undertake a part of Uniswap's outflow funds, the proportion is not high. Compared with yesterday, the total lock-up amount of DeFi applications today has decreased by about 780 million US dollars, but only Uniswap among the projects with more than 500 million US dollars locked-up has experienced a decline. Therefore, it can be judged that Uniswap is the absolute main force of the overall capital outflow in this round. And most of the funds outflowed by the project actually flowed outside the DeFi market.

Looking at the ETH 2.0 pledge, as of 15:45 today, the ETH balance in the ETH 2.0 deposit contract address was 98,816, an increase of only more than 3,000 (approximately US$14 million) from yesterday afternoon. Obviously, this is not the main inflow direction of ETH funds.

Looking at the second possibility, as of 15:45 today, ETH was quoted at Binance at 464.66 USDT, an increase of 2.29% in 24 hours, and the market has not seen too much selling pressure for the time being.

Only the third possibility remains.

secondary title

Uniswap's choice

As mentioned above, Uniswap has not yet finalized the follow-up plan to give Sushiswap people an "opportunity to take advantage of", so what does the Uniswap community think about whether to continue mining?

At 1 am on November 13, Uniswap held a community conference call. One of the core issues was whether to continue the liquidity mining plan, but the meeting failed to reach a clear solution. A community member who participated in the conference call that day once said that Uniswap's community meeting was too loose in form and extremely inefficient.

Since then, community members put forward suggestions on the official forum, hoping to discuss whether it is necessary to establish a working group to guide the liquidity mining plan. However, the proposal did not receive the minimum support votes of 25,000 UNI in the opinion survey (Temperature Check). can go to the next stage.

Today, the Uniswap community once again launched a public opinion poll, suggesting that the liquidity mining plan be extended for two months, and continue to provide liquidity mining rewards for WBTC/ETH, USDC/ETH, USDT/ETH, and DAI/ETH. Compared with the monthly reward of 2.5 million UNI per fund pool in the previous plan, the new proposal proposes to halve the reward, that is, 1.25 million UNI per fund pool per month (a total of 10 million UNI rewards).

As of 13:45 today, the approval rate of the proposal is 57.03%, and the opposition rate is 42.45%. The number of votes in favor has exceeded the minimum requirement of 25,000 UNI at this stage. If the approval rate is still ahead of the opposition rate after three days, the proposal will enter the 5-day consensus check (Consensus Check) stage; after that, the governance proposal (Governance Proposal) will be officially created and enter a 7-day governance voting period; if the governance vote If passed, formal execution still needs to wait for a 2-day timelock.

Vault Research, an encryption research organization, previously issued a document stating that since the new mining plan will release more tokens and cause greater downward pressure on prices, there is no reason for UNI token holders to vote to resume liquidity mining; only When Uniswap really faces the risk of its liquidity being drained again (the current trend is quite fierce), currency holders may choose to support continued mining.

In addition, in Uniswap’s governance design, the threshold for initiating a governance vote is 10 million UNI, and the threshold for passing a governance vote is as high as 40 million UNI. Therefore, whether the above proposal can be successfully passed depends on the degree of community participation.

Previously, Dharma had led the initiation of Uniswap Governance Proposal No. 1. The problem it wanted to solve was to lower the excessively high governance participation threshold, but ironically, the proposal itself failed because it did not meet the threshold requirements—the final number of votes in favor was 39596759, 696857 votes against, only about 400,000 votes away from the minimum requirement of 40 million.

Taking a step back, even if the proposal can get enough support votes at each stage in the future, and the approval rate has always been higher than the opposition rate, according to Uniswap’s governance process (poll—consensus check—governance vote—time Lock), the official implementation is at least half a month later.

————————————

Update: Twitter user NickC sorted out some of Uniswap's large capital flow data, as follows:

Addresses starting with 0xe0e withdraw USD 1.7 million worth of ETH/DAI trading pair funds from Uniswap and flow into cAssets, cDAI, and cETH;

The address starting with 0x975 withdrew USD 2.8 million worth of ETH/DAI trading pair funds from Uniswap and transferred them to Binance, and it did not convert ETH to DAI, nor did it convert DAI to ETH;

The address starting with 0x7bb withdrew USD 5.5 million worth of ETH/DAI trading pair funds from Uniswap, kept ETH, DAI was exchanged for USDC and transferred to multiple wallets, most of which were transferred to the trading platform FTX, and some were deposited into Yearn;

The address starting with 0xf92 withdrew USD 3.3 million worth of ETH/DAI trading pair funds from Uniswap and deposited them into SushiSwap, and used ETH-DAILP tokens for SUSHI mining;

The address starting with 0x161 withdrew $400,000 worth of ETH/DAI trading pair funds from Uniswap, ETH was deposited into Compound, and DAI was converted into dDAI (DeFireXDAI);

also,

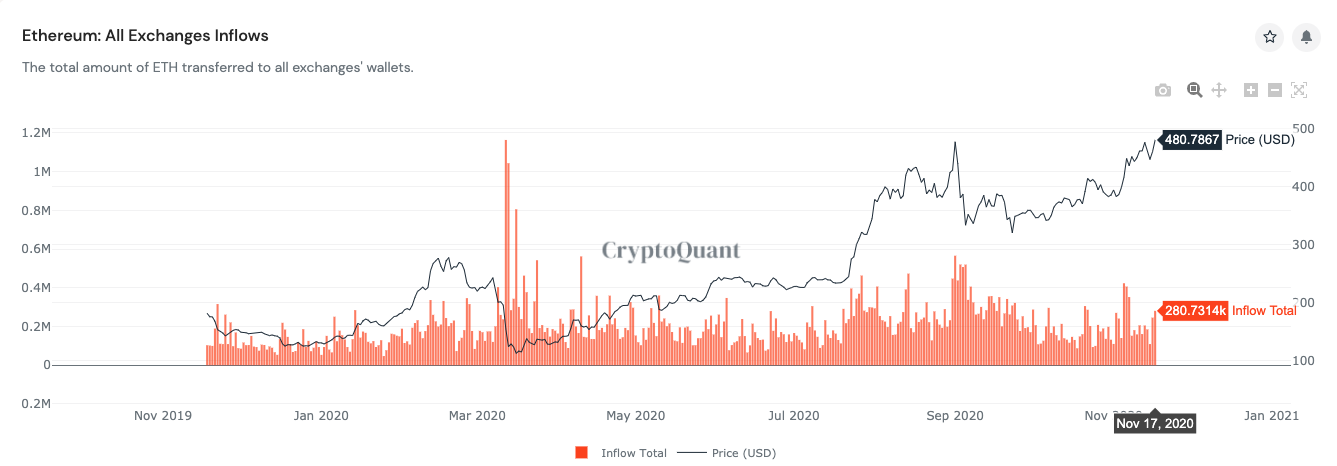

also,CryptoQuantThe data shows that the amount of ETH flowing into exchange addresses did not increase significantly yesterday.