Chain Hill Capital: Deconstructing the Grayscale Bitcoin Trust

Original Title: Deconstructing the Grayscale Bitcoin Trust

Original author: Ann Hsu | Chief Index Analyst at Chain Hill Capital

secondary title

Bitcoin Trust attracts 1.5 billion monthly

image description

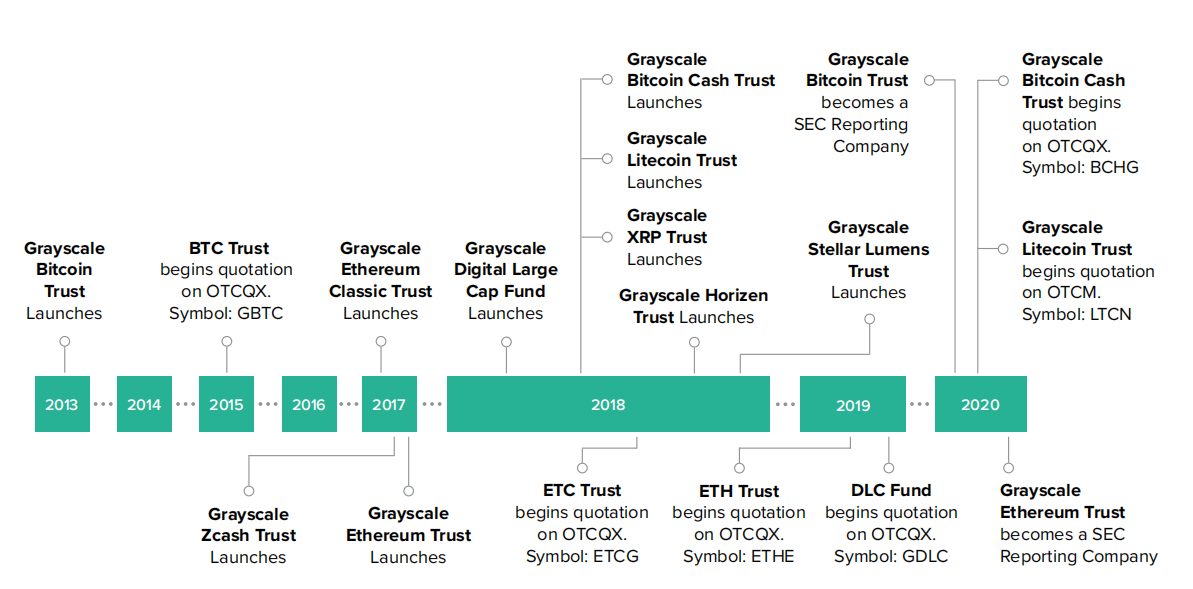

Figure 1: Timeline of the establishment of Grayscale products Source: "Grayscale Investor Deck October 2020"

image description

secondary title

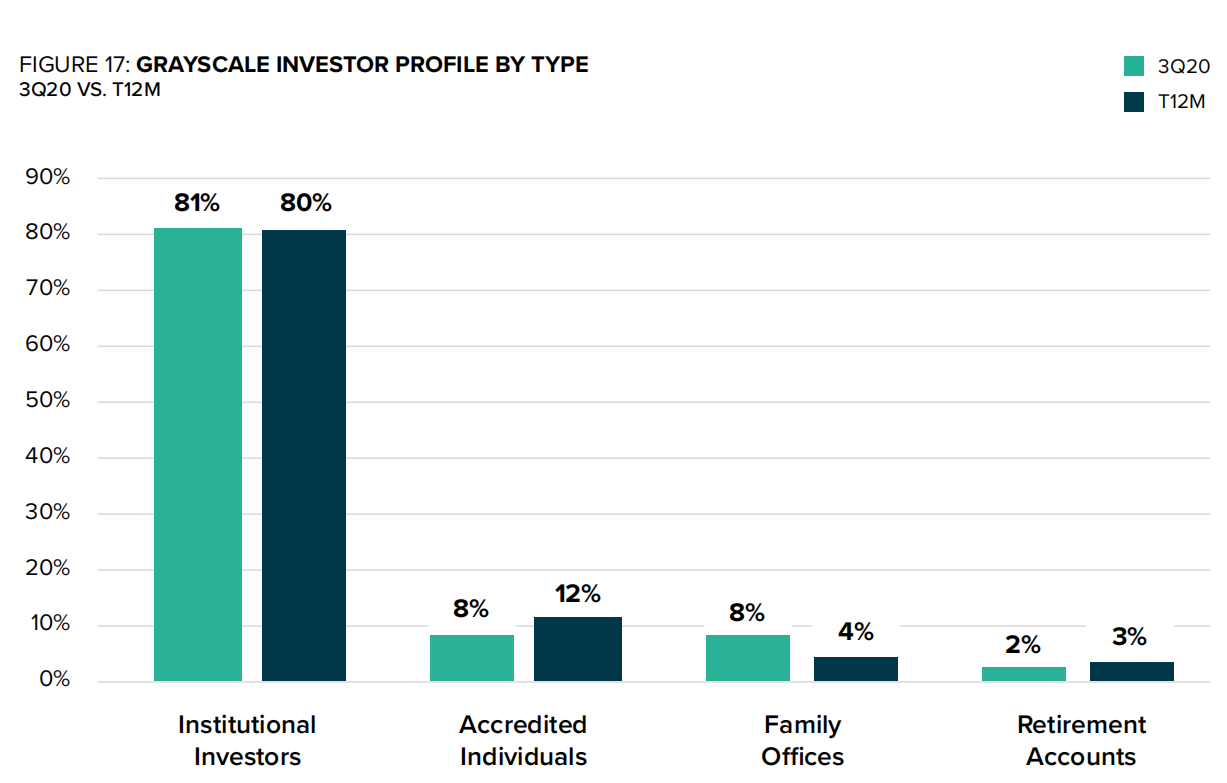

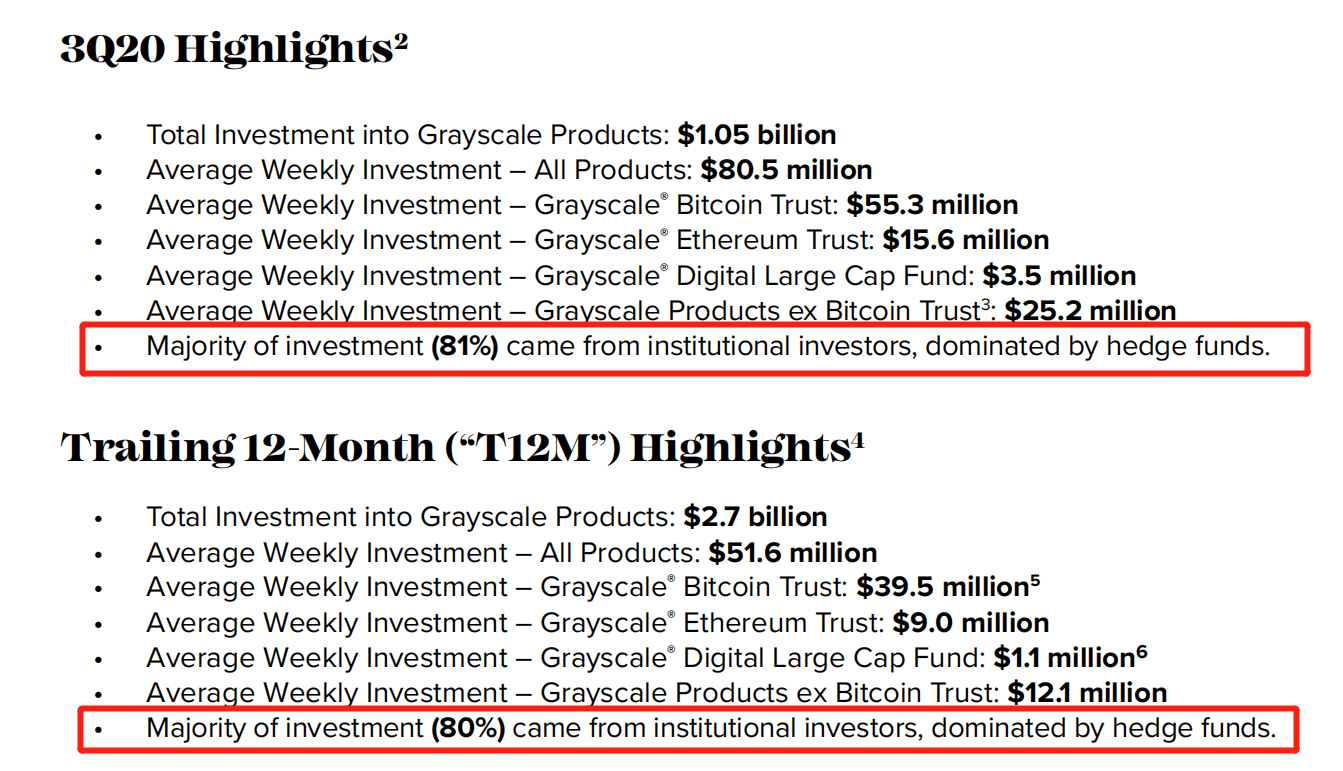

Hedge funds contribute the most

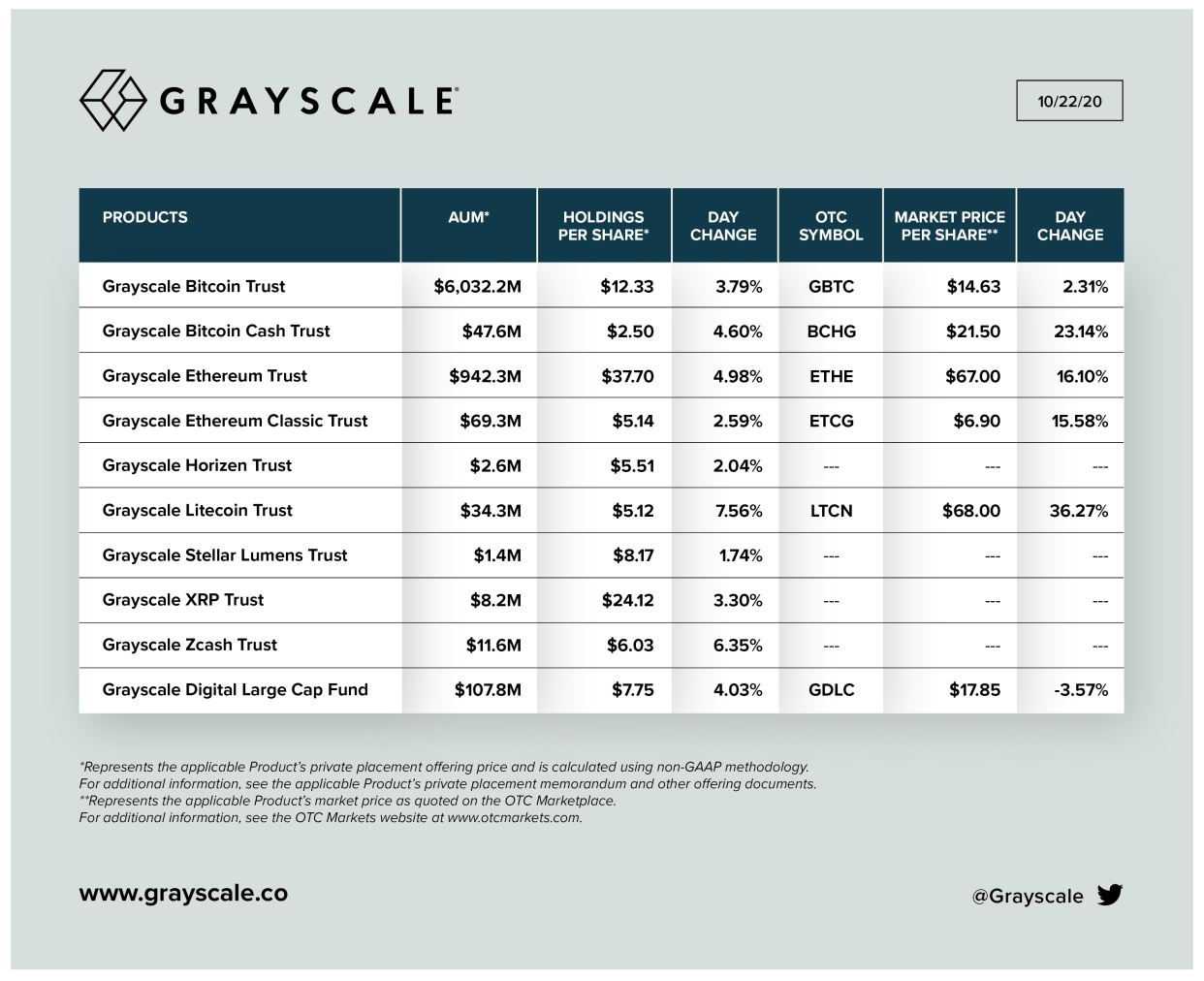

image description

image description

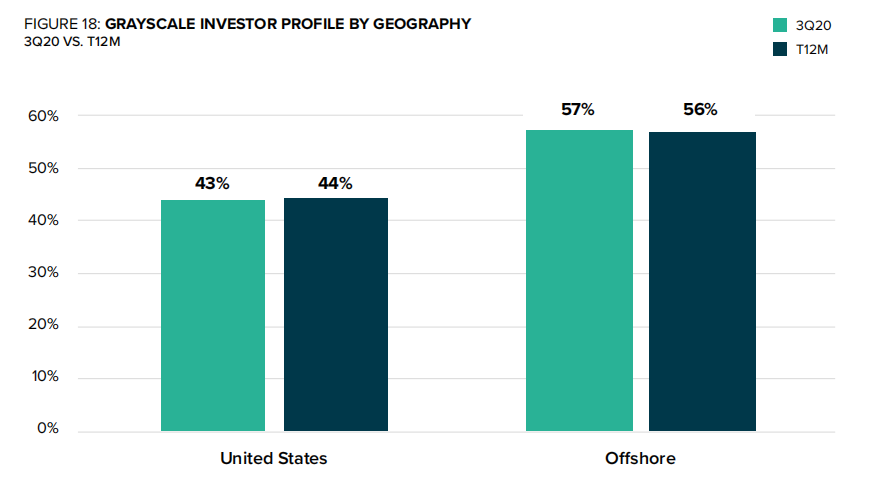

Figure 4: Grayscale investor structure by region Source: "Grayscale Digital Asset Investment Report Q3 2020"

image description

secondary title

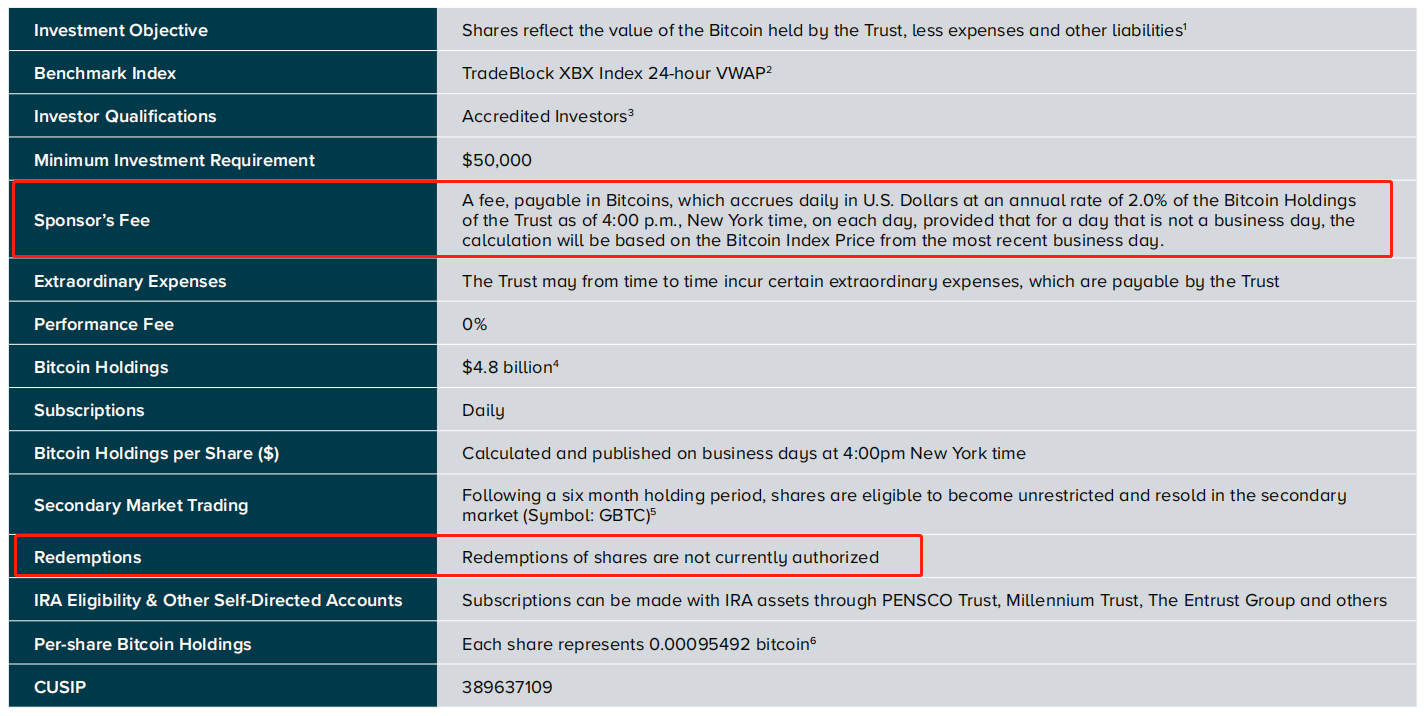

"No maturity date + no redemption + currency-based fees" makes Grayscale a huge profit

image description

Figure 6: Grayscale Bitcoin Trust Terms Source: "Grayscale Investor Deck October 2020"

image description

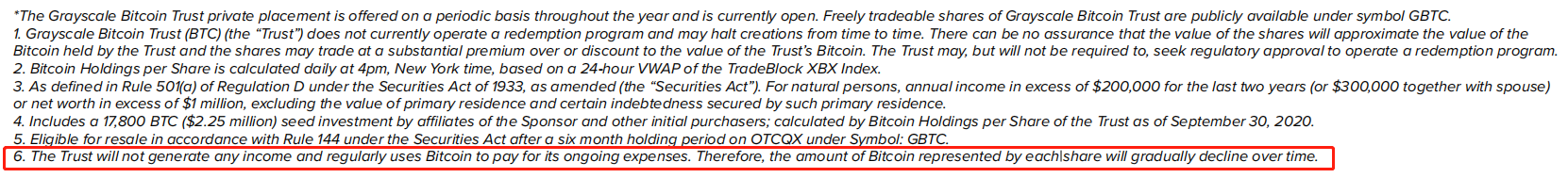

Figure 7: The number of Bitcoins per share is gradually decreasing Source: "Grayscale Investor Deck October 2020"

“The Trust will not generate any income and regularly uses Bitcoin to pay for its ongoing expenses. Therefore, the amount of Bitcoin represented by each share will gradually decline over time.” ——《Grayscale Investor Deck October 2020》

image description

secondary title

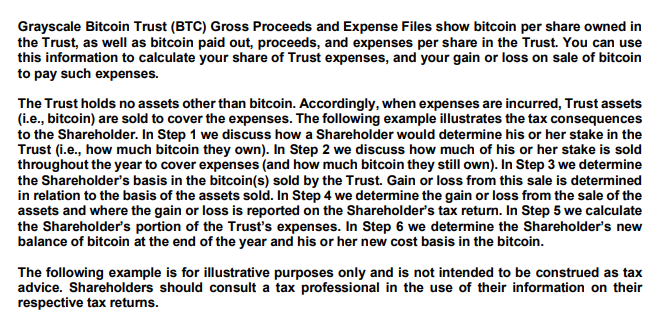

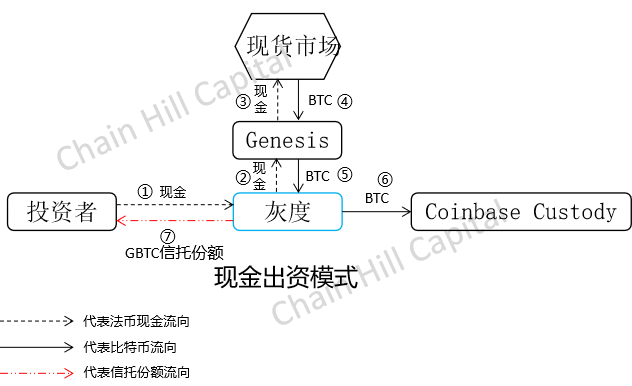

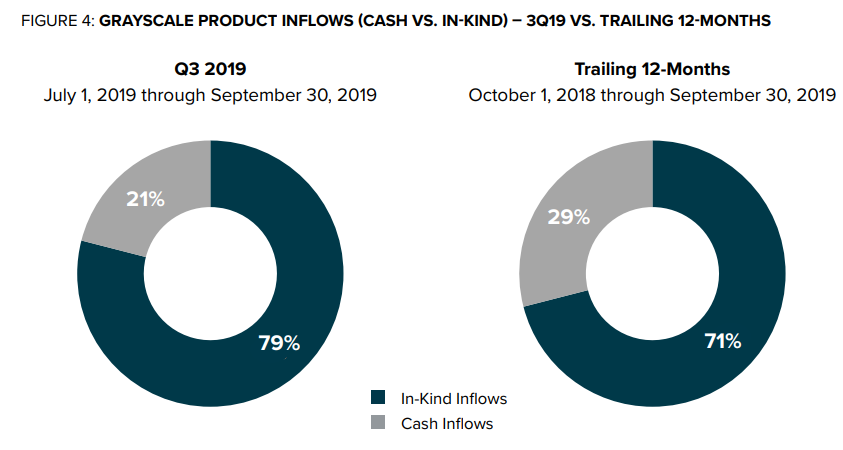

Grayscale’s Bitcoin Trust accepts two forms of contributions, cash contributions and contributions in kind (BTC).

Grayscale’s Bitcoin Trust accepts two forms of contributions, cash contributions and contributions in kind (BTC).

image description

Figure 9: Grayscale Bitcoin Trust Cash Contribution Model Source: Chain Hill Capital

image description

Figure 10: Grayscale Bitcoin Trust Funding Model in Kind Source: Chain Hill Capital

secondary title

Ingenious workmanship: the selling pressure is transferred to the US stock market, and the funds are brought back to the currency circle

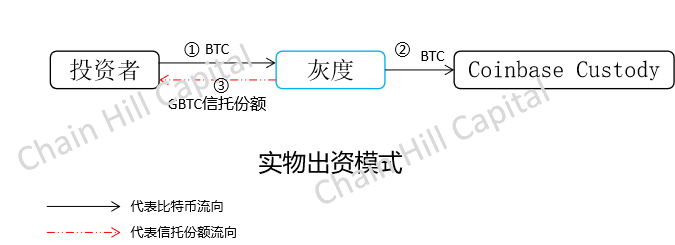

image description

Figure 11: Discount and premium of GBTC Source: yCharts.com

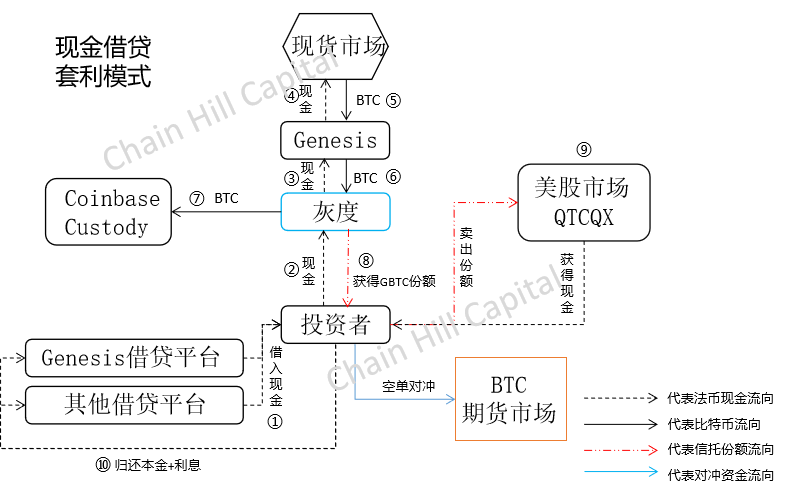

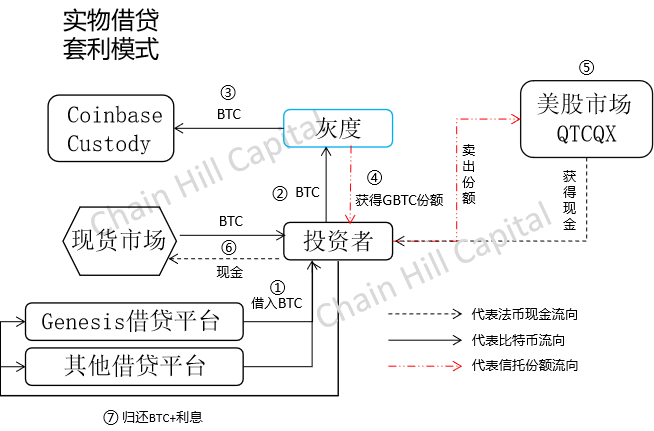

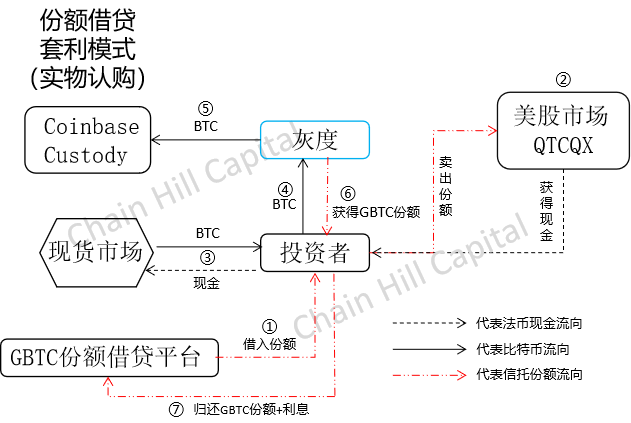

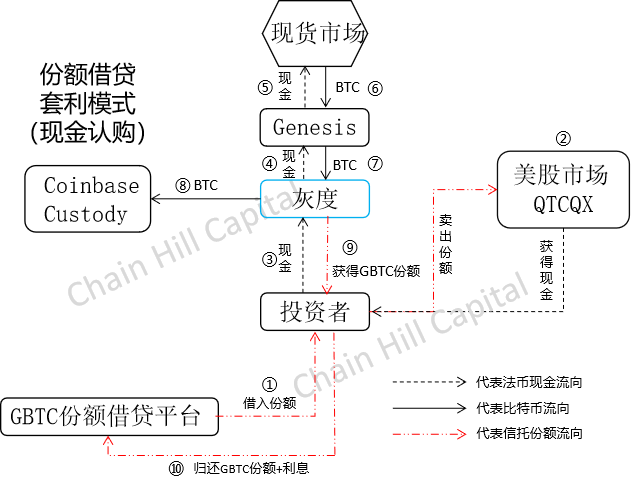

Where there is a premium, there is an arbitrage opportunity. There are three common arbitrage models, cash loan arbitrage, physical loan arbitrage and share loan arbitrage.

In the cash lending arbitrage model, as long as the arbitrage profit in the market is higher than the cost of cash borrowing, there is theoretically room for arbitrage. Investors can borrow funds from companies such as Genesis or other lending platforms, and subscribe to Grayscale's bitcoin trust shares. After the 6-month lock-up period of trust shares expires, investors can sell GBTC on the U.S. stock market (OTCQX). If there is a positive premium space, the remaining part after returning the principal and interest of the lender is the profit of the arbitrageur.

image description

Figure 12: GBTC Cash Lending Arbitrage Model Source: Chain Hill Capital

image description

Figure 13: GBTC cash physical arbitrage model Source: Chain Hill Capital

In the physical lending arbitrage model, the physical objects that investors initially borrow may not be bitcoins, but may also be other digital currencies. For example, Genesis, Grayscale’s brother company, can provide physical lending of bitcoins, as well as the stable currency USDC lending. If the investor borrows stablecoins, they need to exchange them for BTC and then subscribe to the trust shares from Grayscale, and the stablecoins will be returned to the lending institution in the end.

The share lending arbitrage model is special compared to the previous two. Its principle is that investors first borrow GBTC trust shares from the GBTC securities lender (trust share lender). After the cost, there is room for positive arbitrage.

image description

Figure 14: GBTC share lending arbitrage model (contribution in kind) Source: Chain Hill Capital

image description

Figure 15: GBTC share lending arbitrage model (cash contribution) Source: Chain Hill Capital

secondary title

Potential arbitrage funds return, Bitcoin rally is expected to continue

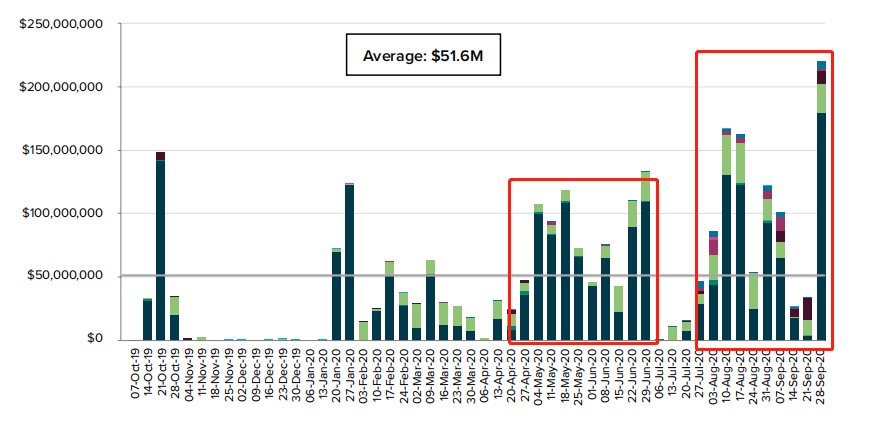

image description

Figure 16: 2019 Q3, 2018 Q3 to 2019 Q3 in the form of investment in Grayscale family products Source: "Grayscale Digital Asset Investment Report Q3 2019 October 2019"

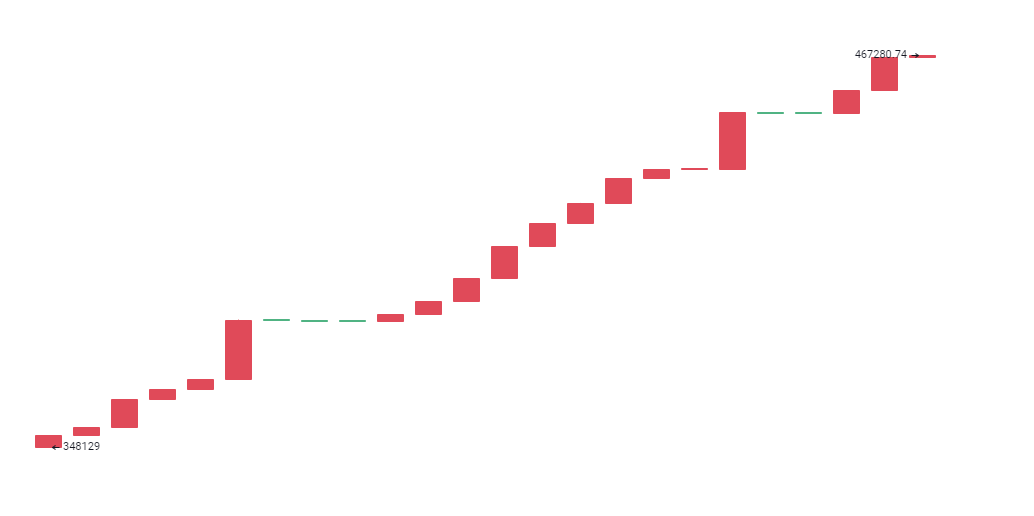

image description

image description

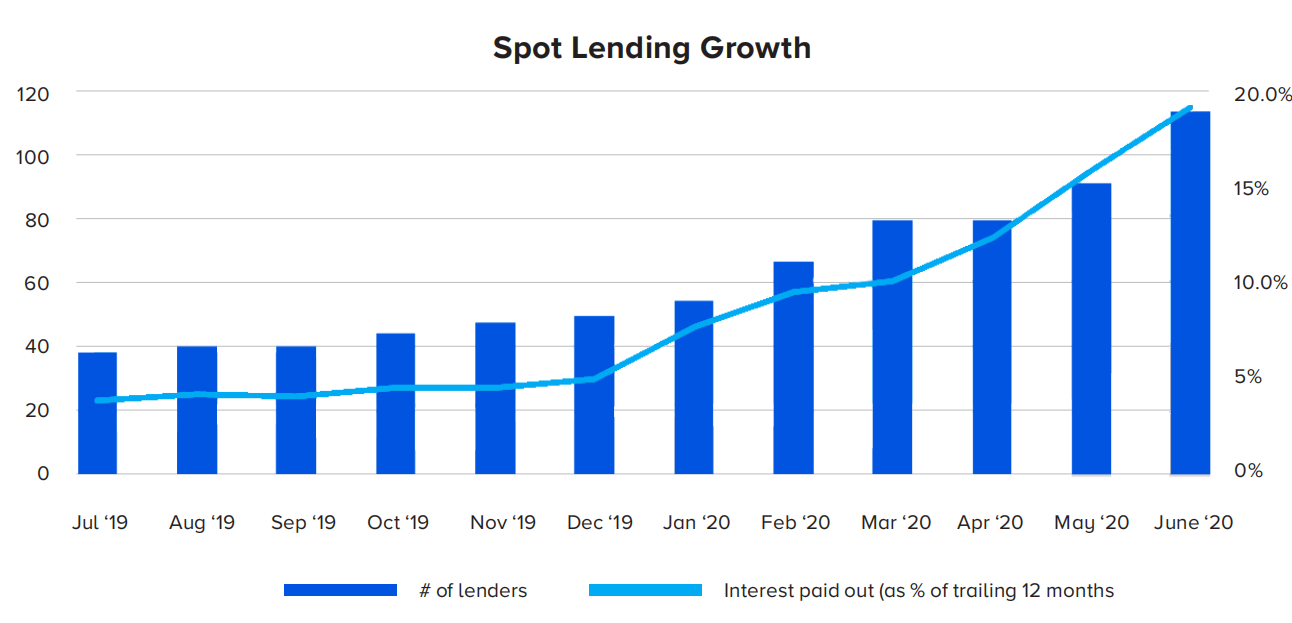

Figure 18: Growth in loan scale of Genesis, a Grayscale brother company Source: Genesis

image description

in conclusion

in conclusion

Supported by a professional team with multicultural backgrounds, members of the core departments - Investment Research Department, Trading Department, and Risk Control Department are all from well-known universities and institutions at home and abroad. They have a solid financial background, excellent investment research capabilities, and a keen sense of the market Sensitive ability, highly awe of the market and risks. The Investment Research Department combines rigorous basic research with mathematical and statistical models to obtain investment strategies such as "Pure Alpha" and "Smart Beta", and will soon export institutional-level research reports and project due diligence reports.

About Chain Hill Capital

Since its establishment in 2017, Chain Hill Capital (Qianfeng Capital) has focused on the value investment of global blockchain projects. It has created early-stage and growth-stage equity investments and encrypted digital asset investment matrices of Alpha Strategy and Beta Strategy. Global resource relationship network, strategic layout of Chicago, New York, Tokyo, Beijing, Shanghai, Shenzhen, Hong Kong, Xiamen and other city nodes. With a wealth of overseas investment institutions and a global high-quality project resource pool, it is an international blockchain venture capital fund.

Supported by a professional team with multicultural backgrounds, members of the core departments - Investment Research Department, Trading Department, and Risk Control Department are all from well-known universities and institutions at home and abroad. They have a solid financial background, excellent investment research capabilities, and a keen sense of the market Sensitive ability, highly awe of the market and risks. The Investment Research Department combines rigorous basic research with mathematical and statistical models to obtain investment strategies such as "Pure Alpha" and "Smart Beta", and will soon export institutional-level research reports and project due diligence reports.