Aion will launch Moves Crypto, a stablecoin lending product

The North American blockchain infrastructure OAN Open Application Network (The OAN, formerly Aion Network) has announced the upcoming launch of a new product - Moves Crypto.

According to reports, Moves Crypto is a lending market product that serves lenders in Moves, a financial technology platform under The OAN that serves gig workers. Thinking and blockchain, cryptocurrency technology, serving gig workers who are not covered by banks.

What Moves Crypto has to do is to connect the growing financial credit needs of gig workers with the rapidly expanding capital market in the cryptocurrency field.

secondary title

Moves Crypto: Three-Party Dynamic Lending Market

In view of the dynamic changes, volatility and risk characteristics of the cryptocurrency market, The OAN specially designed several important features when building Moves Crypto to ensure the realization of the goal.

For price volatility, users are only required to lend stablecoins to the Loan Pool (USDT will be supported first).

For credit risk, an on-chain collateral pool composed of Aions pledged by community members will be established as a guarantee for the lending pool. In addition, individuals who contribute USDT will not be exposed to the risk of a single specific loan, all contributions are lent to Moves' thousands of borrowers in the form of a common lending pool.

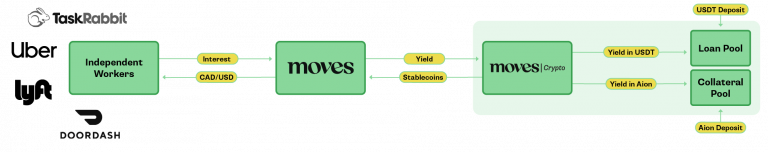

In short, Moves Crypto is a dynamic three-party platform that connects lenders, guarantors and Moves (borrowers), and ultimately achieves the purpose of providing affordable credit services for independent workers and predictable fixed income for funders .

Participation and capital flow of all parties: (from left to right) independent workers, Moves, Moves Crypto, lending pool/collateral pool

As a member, you will be able to decide whether to lend USDT, or provide Aion to back the collateral pool. Regardless of the form, the funder can obtain benefits, but the risk profiles and returns they face may be different in the long run.

secondary title

Alpha release details

The first version (alpha version) of Moves Crypto will be publicly released in mid-October. The upper limit of the initial lending pool will be 50,000 USDT, and it will be 100% guaranteed by Aion-denominated on-chain asset collateral—that is, about 500,000 Aion(Subject to change based on market volatility).

Investors participating in the Alpha version, whether lending in USDT or providing collateral in Aion, must abide by the 3-month lock-in contribution period.

As a lender (USDT), the investor can obtain an annualized return of 8% (2% for a 3-month period).

As a guarantor (Aion), the collateral pool contributor can obtain an annualized 8% return, which will be distributed in Aion based on the dollar value at the time of deposit. Moves, as an entity, will also provide Aion as collateral to the collateral pool, but will not receive benefits.

Like many Alpha products, the purpose of Moves Crypto is to learn from users and incorporate the feedback gathered into subsequent updates to the product. The OAN said that based on the product differences, it will push this product to the highly competitive DeFi (decentralized finance) and CeFi (centralized finance) markets. The problem being solved resonates.

Alpha version information summary:

Launch time: mid-October

Loan pool upper limit: 50,000 USDT

Duration (locked): 3 months

Annualized income of lending pool: 8% (USDT)

Collateral pool upper limit: 100% of the loan pool (about 500,000 Aion)

Collateral contribution ratio of Moves: 75% of the borrowing pool (no income received)

Community collateral contribution amount: 25% of the lending pool

Collateral pool annualized return: 8% (based on the USD amount contributed, paid in Aion)