A low-risk strategy within reach, giving you stable happiness in the currency circle

At the end of July, the currency circle came out of a narrow range that lasted for two months. The leading ETH led the mainstream currencies to run wildly, and Bitcoin also rose. Altcoins continue to run wildly under the leadership of LINK and ADA. Undoubtedly, the current currency circle is still in a bull market after the 312 leverage is emptied.

The market is extremely lively and with increased volatility, it seems that opportunities to make money are everywhere.

Rational and experienced investors know that a bull market does not mean that it is rising every day, and it will let you lie down and win without risk. On the contrary, the bull market seems to be easy to make a fortune, but if it is not grasped properly, it will accelerate the change of wealth and the elimination of traders.

For example, on August 2nd, amid the exclamation of the leading ETH breaking through 400, the market suddenly plummeted. Bitcoin fell by 10%, Ethereum fell by about 20%, and LTC and BCH both fell by more than 20%. In this case, if you make an inverse contract with currency as the margin, under normal circumstances, the leverage of more than 4 times will face the risk of liquidation.

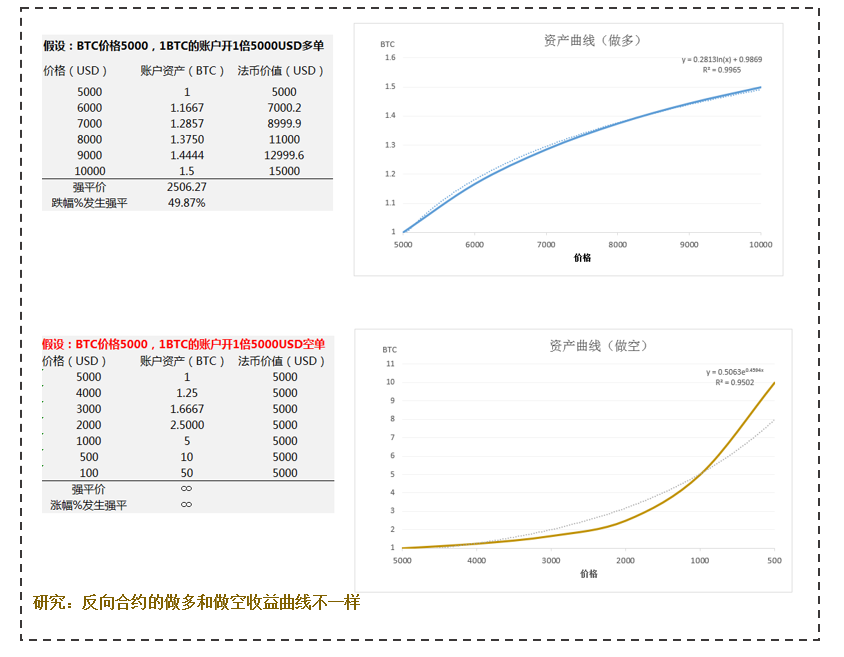

image description

Inverse contract (mainstream perpetual contract form) long and short curves (in the example, the default direction is correct)

In fact, many trading strategies in a bull market can shine brightly to achieve profitability. In the end which trading method to adopt, a decision should be made after comprehensively weighing factors such as risk preference, personal personality, capital scale, trading frequency and loss tolerance.

The topic of this article is to outline low-risk trading strategies in the currency circle and guide practical operations, but it does not prevent me from briefly commenting on the typical high-risk trading strategies I observed in the market:

One-way High Leverage Stud. If you do it in one direction, you will either get rich or lose your position. This is a great way to accumulate wealth quickly. This strategy is also the way many people become famous in the bull market. Because the higher the price, the greater the potential volatility, and it is easy to liquidate if you don't stop loss.

Roll Stud.This strategy takes one-way stud a step further. Now under the cross-margin leverage mode of many exchanges in the market, floating win can be used to increase new positions. This strategy makes the position bigger and bigger, the stop loss price will gradually rise, and it is easy to liquidate the position when the market is in deep correction.

100 times leverage short term.After the market fluctuates, it opens up space for short-term operations. Many people use high leverage to do short-term, and they can earn as much money as the trend. Short-term operations test the judgment and discipline of the market. Due to high leverage, it naturally carries high risks.

The whole family bucket is long or short all varieties.Although the correlation of digital currencies is high, they rise and fall at the same time. But in the bull market, there are still leaders and tails. For example, in this round of bull market, ETH’s rise is very impressive, but BTC is relatively average. LTC and BCH are more passive and follow the rise, and the decline is unambiguous. It is better to be long on the strongest variety than to be long on the family bucket, and to be short on the weakest variety than to be short on the family bucket. Under normal circumstances, if you use the cross-margin mode, the consequences of the failure of the family bucket strategy will be more serious, and those coins with poor performance will accelerate your losses.

This article is not a critique of high-stakes strategies. As long as you have a good position, focus on keeping an eye on the market, and strictly use the stop-profit and stop-loss functions, I believe that masters can make high yields with small drawdowns.

In the eyes of the outside world, digital currency transactions (whether contracts, spot, options, etc.) naturally have high-risk attributes, but it is the immature and imperfect market that presents many low-risk or risk-free arbitrage opportunities. These are categorized as low risk trading strategies (not without any risk).

first level title

1. Funding rate arbitrage

image description

The price of ETH, the main bull market variety, on the BitCoke exchange

For example, I had about 330 BTC at the beginning when I was in the real currency market. As the currency price rises, I currently open an empty order of about 1.2 million US dollars (0.4 times hedging), and I can charge 1,000-3,000 US dollars per day. For the interest, it has been firm for less than a month, and I have made a profit of 10% (denominated in fiat currency). This is a very comfortable and stable income for me who has a lot of funds and is unwilling to keep an eye on the market.

The difficulty of obtaining stable income in the currency circle is much lower than that of traditional financial markets.

Many people who do long with small funds naturally resist the funding rate, thinking that it is a blood draw on their own principal. In fact, the funding rate is completely negligible compared with the profit of the bull market, not to mention that the funding rate only changes every 8 hours. Charge once.

first level title

2. Perpetual-delivery contract spread arbitrage

image description

The 1H price difference between the near-term OK delivery contract and the BM perpetual contract

The discount and premium of the quarterly contract and the perpetual contract are a good indicator to judge the market atmosphere, and the convergence of the price difference between them is also a good low-risk trading strategy. In a sharing event hosted by Jinse Finance last year, I mentioned that in a bull market, when the price difference between the BTC quarterly contract and the perpetual contract reaches more than $500, it basically indicates that the market is starting to overheat. The price difference is generally around $800 to $1,000.

The operation method of spread arbitrage is to open a perpetual long order and a quarterly contract short order.Generally, after a sharp drop, the quarterly contract will quickly smooth out the price differenceimage description

In the violent bull market in mid-2019, the price difference between the OK quarter and BM perpetual reached an exaggerated $800

You need to open positions in quarterly contracts and perpetual contracts at the same time, but there are almost no platforms for quarterly contracts and perpetual contract accounts to share margins (that is, combined margin mode), which are generally calculated separately.

The margin is sufficient so that neither party's position will be liquidated, which may take up a lot of margin

Close positions in time

3. Cross-variety strong and weak matching strategy

This is a trading strategy that I highly recommend that not only follows the trend, but also reduces income fluctuations and avoids plunges and liquidation. Every round of bull market has a theme narrative, there are the strongest coins, and there are coins that follow the trend, and there is also a sharp drop in the middle to clean up the market and clean up the leverage. I speculate that many people have to watch the market 24x7, which is tiring enough.

The strength-weakness matching strategy is to go long on the leading currency, short to follow the currency, and realize the arbitrage of the relationship between strength and weakness. Of course, you can use the position ratio to control the risk.

For example, if you only have 50,000 yuan, you have the ambition to get rich, but you don't have time to keep an eye on the market all the time. Take the market of the above two weeks as an example, assuming you are trading in bitcoke, you can choose the cross position mode, long ETH 50000USD, short EOS equivalent position 50000USD. In this way, your assets are also well protected during the plunge on August 2. The factors that affect your income are no longer the ups and downs of the market, whether the direction is correct, but whether ETH is stronger than EOS.

first level title

4. The price of USDT rebounded

conclusion

conclusion

Due to the immaturity of the participants in the currency circle and the imperfection of the mechanism, it provides a stage for many low-risk trading strategies. It is too easy to outperform bank interest with large funds in the currency circle, and it is not difficult to achieve an annualized rate of 10%-20%.

I know that many people also want to see me take the lead in doing long positions with high leverage after seeing me take the firm offer of coins, open positions of hundreds of millions, and obtain several times the income. For me, there is absolutely no need to take such a risk.The market obviously has a stable and risk-free way that allows me to make money lying down. I choose to embrace a low-risk strategy that does not need to watch the market and worry-free to achieve stable growth in assets.

I hope that through the sharing of this article, everyone can have a correct understanding of the market and profitability. Making money does not necessarily depend on brainlessness. Judging the right direction is of course very important, but the market does not only have ways to make profits in one direction.

Behind different yields are different strategies, positions, risk preferences and execution, and these factors are difficult to quantify and compare. We should not think that people with high yields must be correct and worth learning. Everyone still has to tailor their own strategies and methods.