Derivatives are flooding, is there still a chance for Bitcoin's "big bull market"?

Recently, the stock market has been relatively hot (when I wrote this article, basically everyone in the currency circle was speculating in stocks, of course it is down today), but the activity of the currency circle has been deteriorating. I believe most people will not understand the dull and narrow fluctuations in the currency circle from May to June. The memory is still fresh. At one point, the volatility was within 3% for a week.

image description

Figure 1: Bitcoin’s (Daily Change %) Volatility Has Hit a New Low in the Past 2 Months

secondary title

Whether the mainstream currency represented by Bitcoin will fall into low volatility for a long time, and discuss the causes and influencing variables behind it.

According to the report of an overseas third-party consulting agency I have in hand, the daily spot transaction volume of Bitcoin is about 500 million U.S. dollars or less. According to the transaction volume data released by contract exchanges, the combined daily turnover of active exchanges such as Binance, Huobi, BitMex, BitCoke, and FTX is at least US$5 billion. Compared with the sluggish spot market, the active derivatives market amplifies the wealth effect and is obviously more popular with speculators.

secondary title

The idea that currency prices have been hijacked by derivatives is popular, but many people disagree.

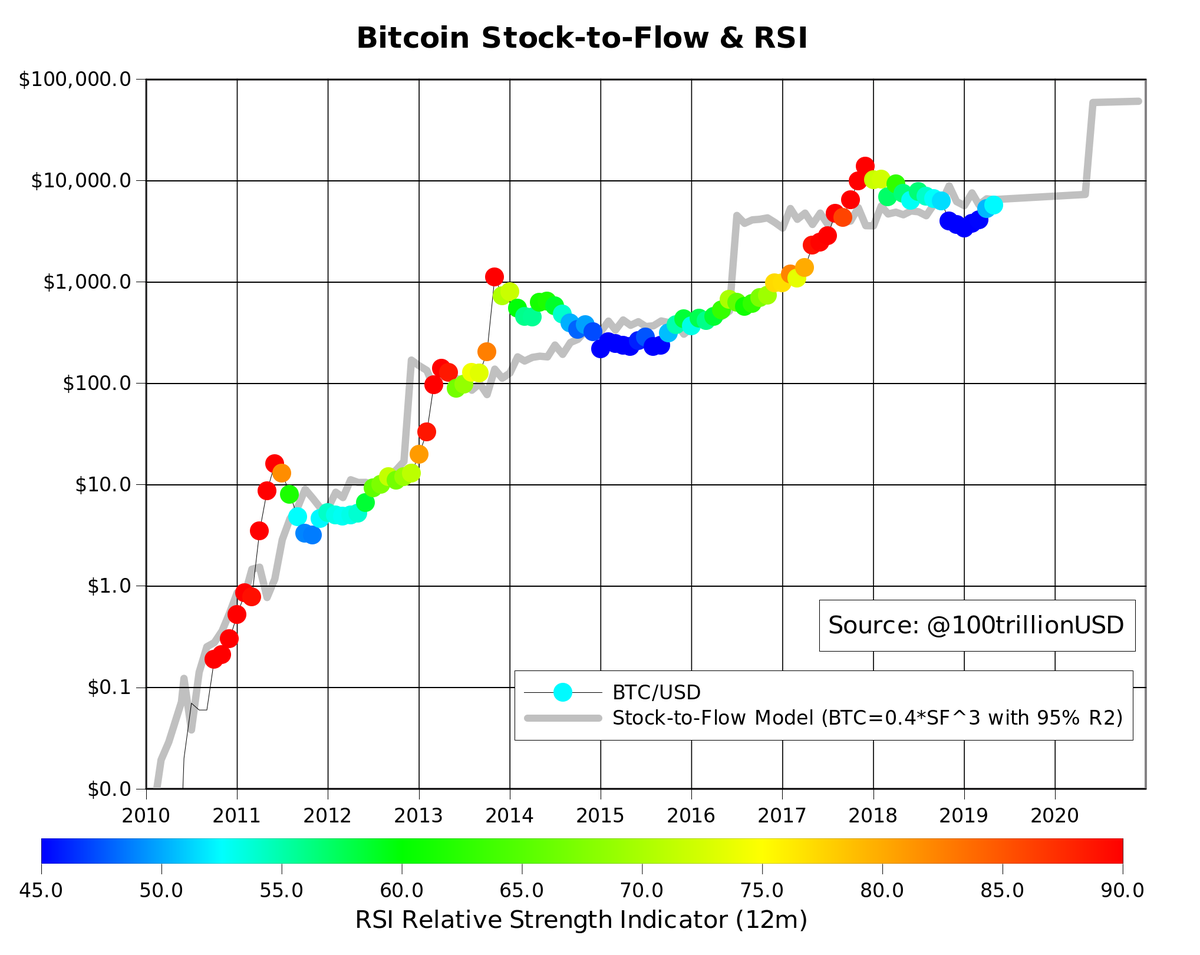

image description

Figure 2: The Stock-to-Flow model predicts a better fit for Bitcoin prices

Some people take the stock market as an example, claiming that the trading volume of US stock index futures and options is also huge, but it does not affect the ten-year unilateral bull market that affects the S&P and Nasdaq.

I don't think derivatives of digital currencies can be understood simply by the logic of derivatives of stocks, bonds or commodities. Taking stock index futures as an example, there are huge differences in product design, transaction structure, participants, underlying asset pricing models and digital currency derivatives:

Stock index futures are generally centralized transactions, and liquidity is concentrated on one exchange. However, there are many contract exchanges in the currency circle, and their liquidity is isolated from each other.

The underlying asset of stock index futures is the stock index, and the arbitrage mechanism of the index ETF enables the excessive deviation of the underlying asset price to be quickly corrected. The perpetual contract in the currency circle can keep up with the spot price under the exquisite "funding rate" mechanism, but the arbitrage mechanism of spot and derivatives is not perfect, and the relationship and role between futures and spot are completely different from the traditional financial asset model.

The leverage of stock index futures is fixed, and there are restrictions on opening positions and a seat and position reporting system. The digital currency contract leverage is flexible and adjustable, and users can bet on the direction with 1 times or 100 times the direction.

The stock index is composed of constituent stocks and is a "public product". The number of investors participating in the stock is the majority, and the types and purposes of investment entities are rich and diversified. No one can control the direction of the trend. Speculators in the currency circle generally aim at trading price differences, lacking the ability to identify and discover value.

image description

secondary title

text

From the perspective of currency functions extended by commodity attributes, gold is the most similar currency equivalent to Bitcoin in the real world.

Today, gold has a rich spot market, and its futures trading also plays an important role in commodity futures. Analyzing the price changes of gold with reference to the formation and development of gold derivatives may bring some enlightenment to the evolution of digital currency.

At the beginning, gold was also dominated by spot products, and spot counter transactions such as banks, ticket offices, and pawnshops accounted for the vast majority of gold trading volume. In the 1970s, the U.S. dollar was decoupled from gold, and the capitalist world entered the era of the credit currency system. In the 1980s and 1990s, financial control was relaxed under the wave of financial liberalization in Europe and the United States. Various financial innovations became popular, and derivatives transactions exploded.

image description

Figure 4: The price of gold has been suppressed for 20 years in the era of derivatives development

secondary title

If the history of gold is any indication, it is that thematic changes in fundamentals are the main source of major trends

In the past two years, we have seen that the currency circle has indeed experienced large fluctuations.

Take Bitcoin as an example. In 2017, ICO drove the entire digital currency from the community to the public. That round of bull market was similar to the tech dotcom bubble in 2000. People are always optimistic that new technologies will change life and society in the short term. The financial market There was a frantic pursuit of the Internet, and the unsustainable rise in prices triggered a crash. After the BTC crash at the end of 2018, it fell to $3,200 at the end of the year, a drop of nearly 80%. In 2019, Bitcoin was hyped to $13,500 under the theme of "safe haven assets", an increase of nearly three times. At the beginning of this year, BSV, ETC, etc. There has been a wave of brilliant halving concept hype in the currency, while Bitcoin has seen a smaller increase.

The popularity of digital currency has been increasing, and it has long been no longer the exclusive plaything of programmers. Institutional investors in Europe and the United States continue to increase their acceptance of digital currencies represented by BTC and ETH. Digital currencies have also gained a place in the investment portfolios of Internet elites, community KOLs and Open-minded investors. With the acceptance of BTC and ETH There are more and more investors in mainstream digital currencies, payment applications are gradually landing, and there are more and more factors affecting the prices of mainstream currencies. The possibility of manipulation of large-cap currencies such as BTC and ETH is also increasing. Low. Other small-cap cryptocurrencies are still subject to manipulation. In the future, there is a high probability that the volatility will gradually decrease like commodities. In other words, even if the price trend is upward, the price trajectory that has been continuously violently raised and in place for a few days should not appear again.After that, the market will last longer and the range of daily price highs and lows will be smaller.

2019 is the year when digital currency derivatives became popular, and a large number of contract exchanges emerged, launching products such as perpetual contracts, USDT contracts, contract insurance, and options. Derivatives give investors a greater risk-return ratio, and the speed and scale of wealth change are accelerating under the stimulation of leverage. According to TokenInsight's "2019 Derivatives Trading Report", the annual trading volume of derivatives in 2019 was $3 trillion, much higher than in 2018. The average daily derivatives trading volume is US$8.5 billion, and the annual derivatives trading volume accounts for 20% of the annual spot trading volume.

secondary title

long term outlook

From the perspective of industry development, after the outbreak of digital currency in 2017, in addition to USDT being used as a US dollar digital currency in contract transactions, gray production and trade, ETH's 2.0 public chain project, and blockchain applications in other industries Still scarce, new users are not optimistic.

Without a new story vision, without a large capital portfolio with unity of beliefs, all digital currencies (Bitcoin, mainstream currency, altcoin, platform currency, etc.) will not be driven by large fluctuations in the same direction. In the future, digital currencies will be like stocks, paying more attention to fundamentals surface development and application.

For example, under the background that unlimited QE makes banknotes close to waste paper, BTC's currency storage, privacy, and decentralization attributes will be re-recognized, and the price trend will still be upward. The prospect of ETH, which has been doing things, will get greater recognition. After changing to the PoS mechanism, the inflation rate will drop, and DeFi applications can be regarded as a real financial landing scenario. ETH is more suitable to be regarded as a growth stock.