Why Was Goldman Sachs Completely Wrong? On Encrypted Investment from the Perspective of Assets

Article title: Discussing the crypto space from the perspective of assets -- why Goldman Sachs is completely wrong

Translator: Li Yi

Translator: Li Yi

Translation Agency: DAOSquare

Translation Agency: DAOSquare

Word count: 1319

executive Summary

——Typto

executive Summary

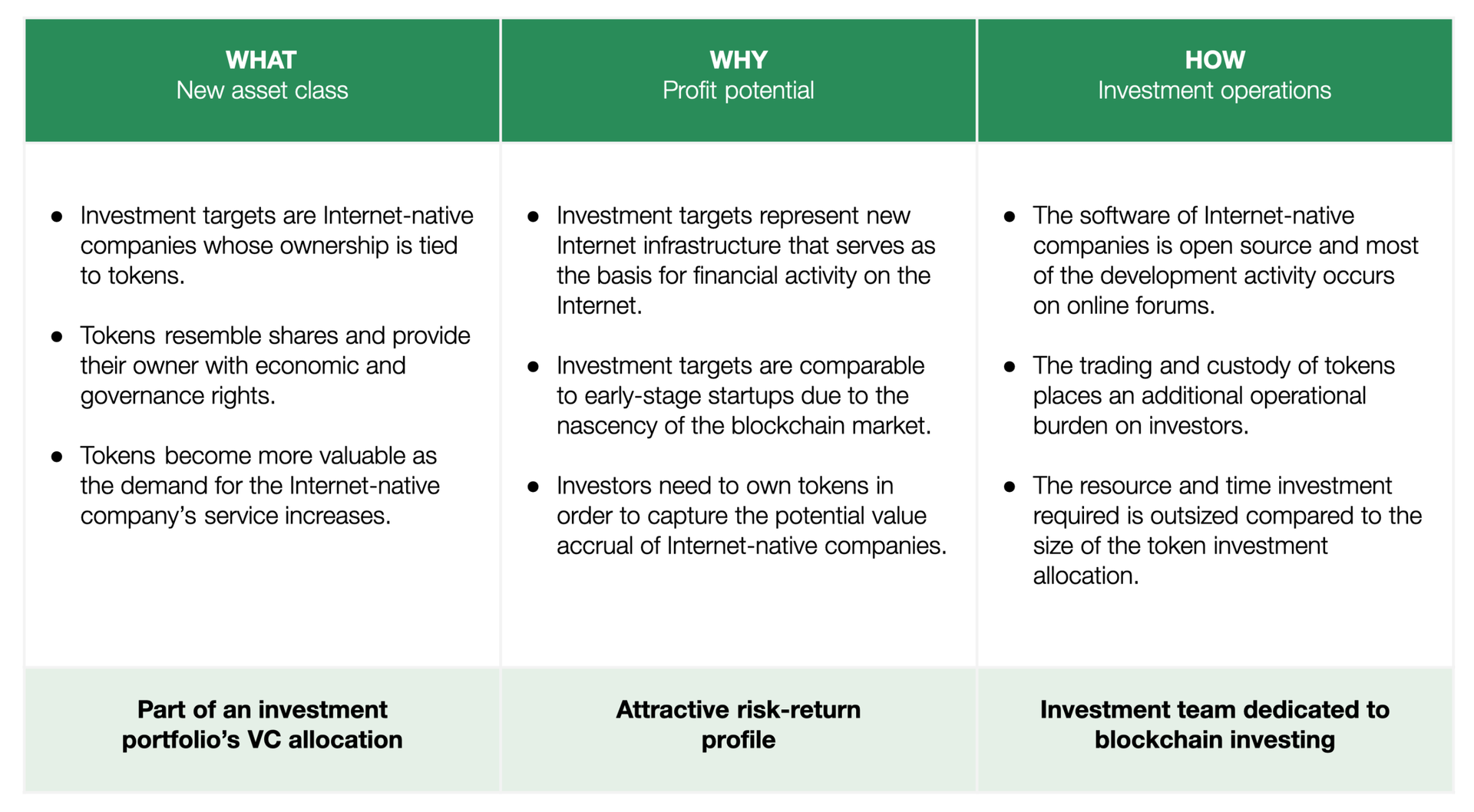

This article is primarily aimed at institutional and other professional investors who are considering investing in the crypto space. The article analyzes the best practices of global institutional investors investing in the encryption field. In this article, crypto investments refer to investments in tokens. The article excludes traditional equity investments in startups using blockchain technology.

Investors interested in an attractive risk-return profile for new assets need to consider additional technical and operational requirements related to token investing.

first level title

secondary title

Participation in regulated professional markets is on the rise

In the early days of the crypto space (2009-2013), the trading and custody market infrastructure for tokens did not meet the requirements of institutional investors. The maturation of institutional and regulatory services over the past few years has made it possible for more professional investors to participate in the crypto space.

ReportReport, in the past three years, 22% of US institutional investors have invested in tokens. Nearly half (47%) of investors who participated in the survey considered token investing as part of their overall investment portfolio. Fidelity considered mining bitcoin as part of its internal research and development efforts as early as 2014. Today, the company provides trading and custody services for the token to its institutional clients in the U.S. and Europe.

Examples of other well-known technology and traditional financial services companies investing heavily in the cryptocurrency market:

Andreessen Horowitz: In the summer of 2018, Andreessen Horowitz launched their dedicated crypto space investment fund a16z crypto (AUM: $300 million). In April 2020, the company raised its second investment fund in the crypto space (AUM: $515 million).

Venture capital firm Sequoia Capital (Sequoia Capital): In 2018, Matt Huang, former partner of Sequoia Capital, and Fred Ehrsam, co-founder of Coinbase, founded Paradigm, an investment company in the encryption field (asset management scale: $400 million). In addition to Sequoia, investors in the fund include the Yale University Endowment. The fund's chief information officer, David Swensen, is known for pioneering an investment strategy focused on alternative investments.

Chicago Mercantile Exchange Association (Chicago Mercantile Exchange): Chicago Mercantile Exchange included Bitcoin futures in its service scope in December 2017. The company launched bitcoin options trading in January 2020.

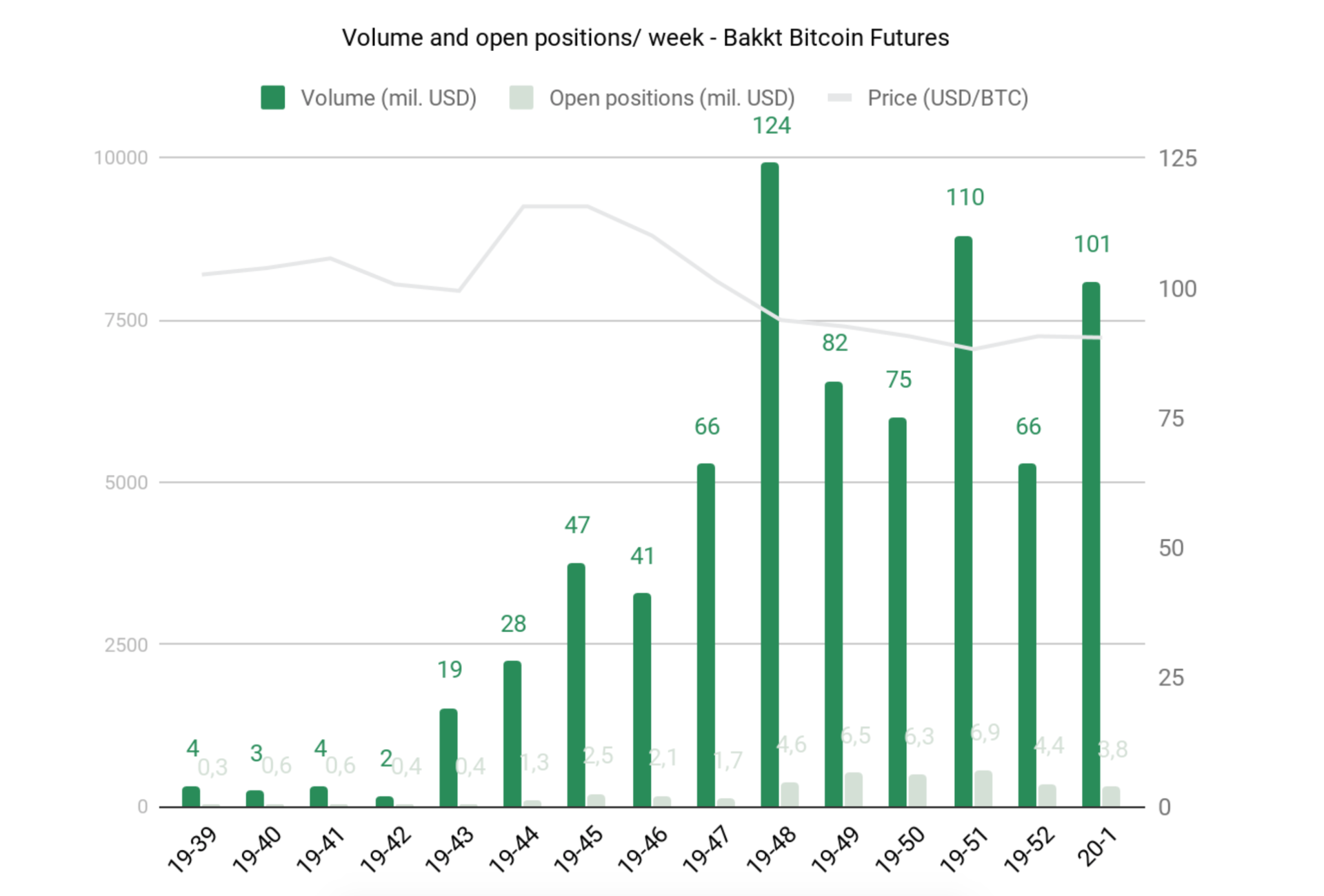

The parent company of the New York Stock Exchange, New York Intercontinental Exchange (Intercontinental Exchange). In 2019, ICE launched Bakkt, a token trading and custody platform.

ICE Group operates its own token trading platform Bakkt.

secondary title

Token investment in the native Internet environment

Investing in native Internet companies (token investing) differs from venture capital investing in several ways. Native Internet companies are based on open source software and are developed primarily on the Internet—initially by a small core team and later through members of a global online forum.

Daily development activity is concentrated on online forums such as Twitter, Discord, Medium, and Github. Because native Internet companies are based on open source and open data, their trading activities canreal timemonitor. In addition to deal activity, investors need to be able to analyze how their investees are doing by being able to track the core team's development work and the investee's popularity with third-party developers. Investors need to actively participate in these online forums to obtain relevant information and partners.

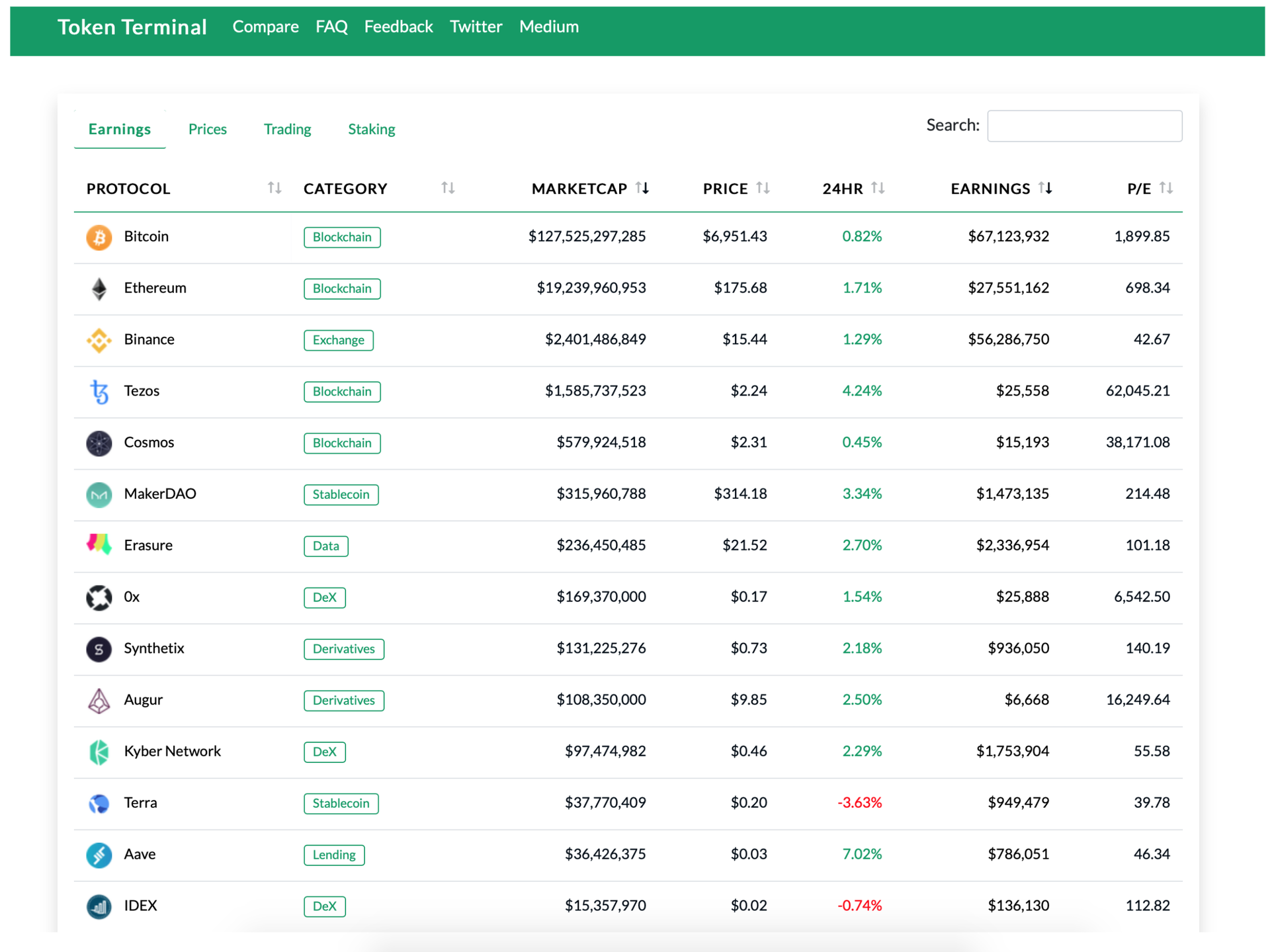

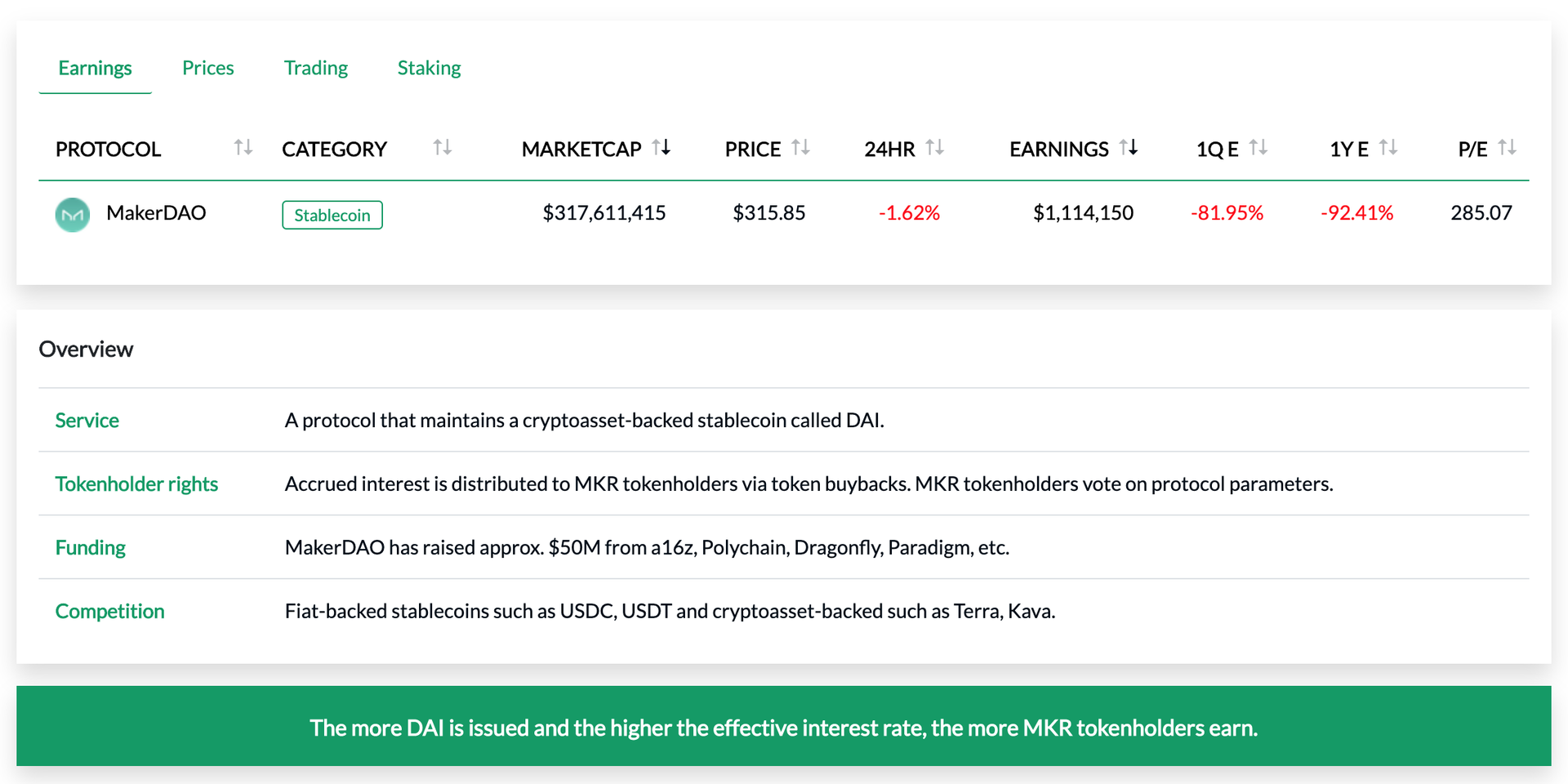

Examples of different native Internet companies or token projects. Source: Token Terminal

first level title

secondary title

The early stage of the token market tends to combine long-term strategies with active trading investment strategies

Token investment combines the investment strategies of venture capital and hedge fund investment and is more inclined to the former. In the early development stage of a project, even if the ownership shares of native Internet companies can be freely traded on the Internet, in reality, only a few projects have real meaningful liquidity. Venture investors enter the market with long-term strategies that are not as susceptible to market volatility and low liquidity as hedge fund strategies.

When investing in tokens, institutional investors have three investment options: one is internal investment, the other is investment through passive management funds, and the third is investment through active management funds. The challenge of internal investment comes from the need for internal resources - which in many cases are often disproportionate to the size of the token distribution. After all, token investments should represent only a small portion of an institutional investor's overall portfolio. And because the current market inefficiency includes some low-quality assets, passive index funds (such asTop 10 Index) tend to perform poorly.

As a result, most fund managers in this space opt for a closed-end fund structure, ie investing in operations that span more than 7 time zones geographically, as is often the case for much of venture capital. Even though tokens may be in a vibrant secondary market, token projects are more akin to startups than public companies. Early secondary market liquidity for native internet companies is a novelty because it might allow managers of closed-end venture capital funds to rebalance their portfolios during fund weeks.

Due to the non-traditional investment objects and investment process in the crypto space, many traditional venture capital funds choose to invest funds of funds in other venture capital funds that specialize in the crypto space.

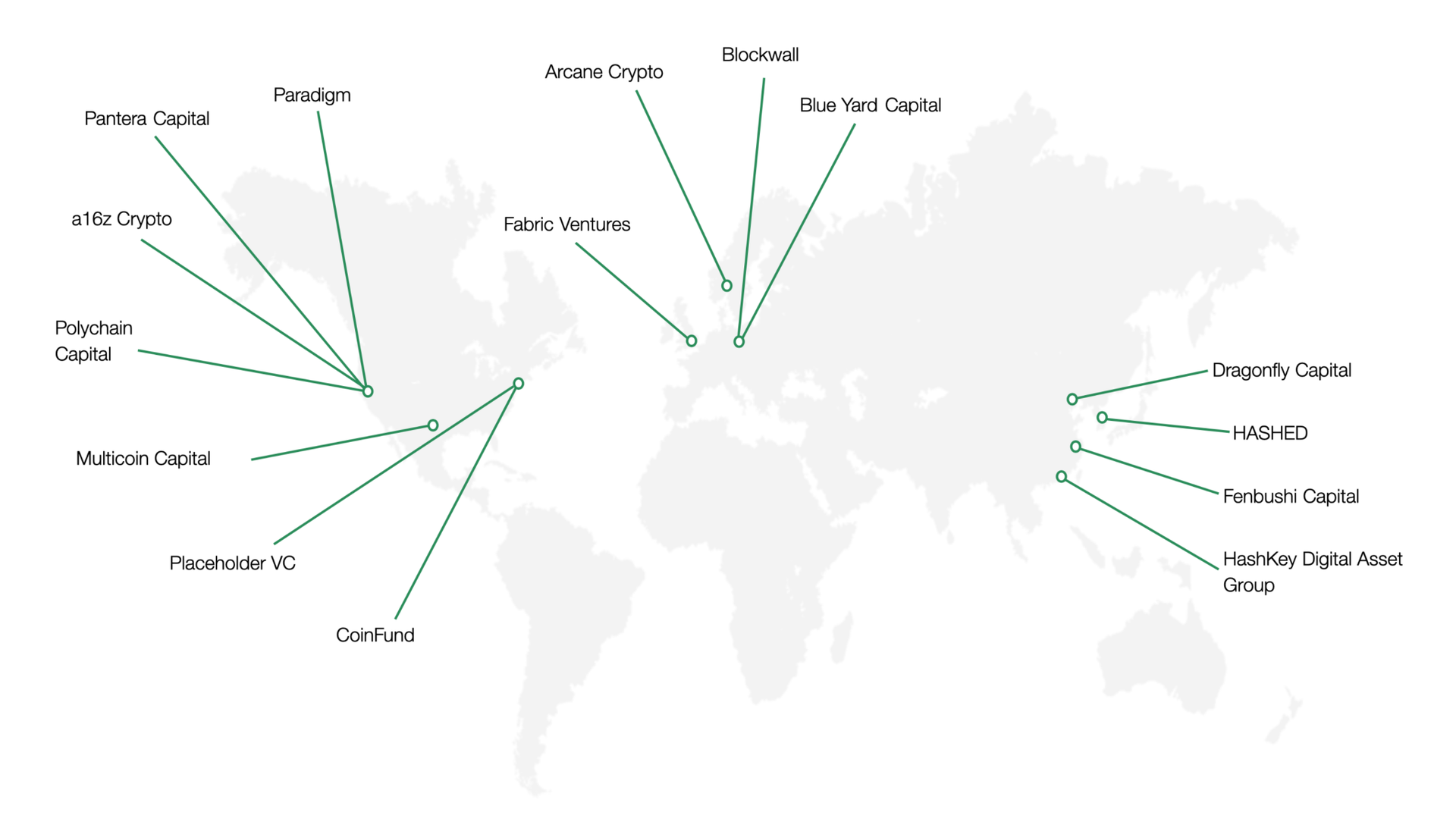

There are currently several active crypto venture capital funds operating globally.

The complexity, regulatory issues, and rapid development of the asset class in the crypto space make investing in the crypto space suitable for a long-term and active investment strategy. Blockchain technology is more similar to the Internet in many respects, and it belongs to a network of different industries rather than a singlevertical fieldImpactful technology, which is why a successful investment operation often requires a dedicated team.

For the above reasons, the most common form of investment in the crypto space has been tilted towards venture capital funds dedicated to the crypto space. Fund managers who run token funds tend to be younger and less experienced than traditional fund managers.

Token Terminal provides financial and business metrics about protocols in the crypto space—metrics we often see applied to traditional companies, such as P/E ratios. Cryptosphere protocols operate just like traditional commerce, except they take place directly on the Internet.

For more information, see Token Terminal'sOriginal link:、websiteandTwitter。

Original link:https://medium.com/