Using History as a Guide, Miners Need $15,000 Post-Halving Bitcoin Price to Profit

Editor's Note: This article comes fromNakamoto Shallot (ID: xcongapp), Odaily is authorized to publish.

Editor's Note: This article comes from

Nakamoto Shallot (ID: xcongapp)

, Odaily is authorized to publish.

In the past few weeks, the price of Bitcoin has dropped from a high of $10,500 in February to as low as $3,850. Although the price of Bitcoin has now rebounded back above $6,000, it is still hovering in this range.

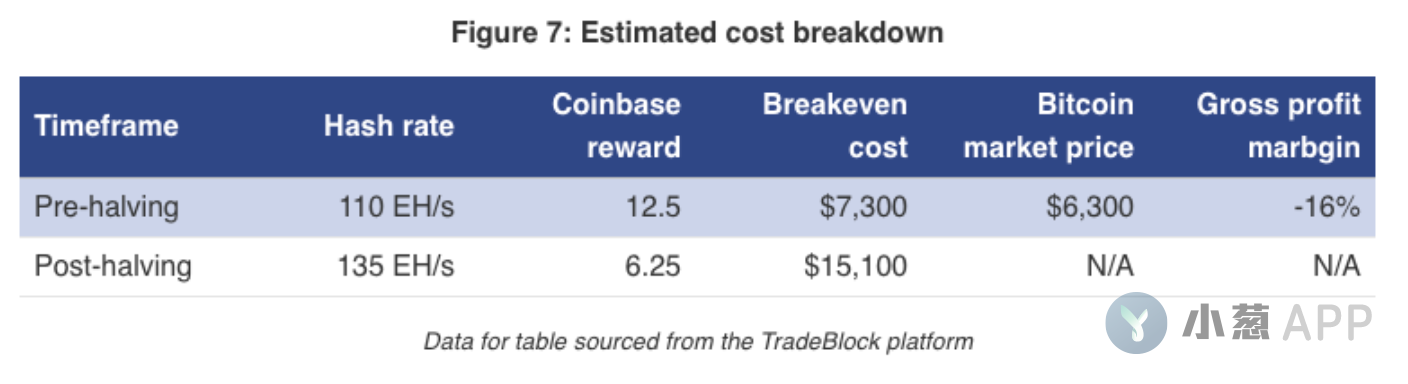

The fall in the price of Bitcoin has turned the profitability of miners into negative, as the current price of Bitcoin is around $6,000, while the cost of mining a Bitcoin has risen to $7,300 due to the increase in hash rate. According to a new report from crypto analytics firm TradeBlock, the cost of mining Bitcoin will further increase to between $12,000-$15,000 after the Bitcoin halving.

secondary title

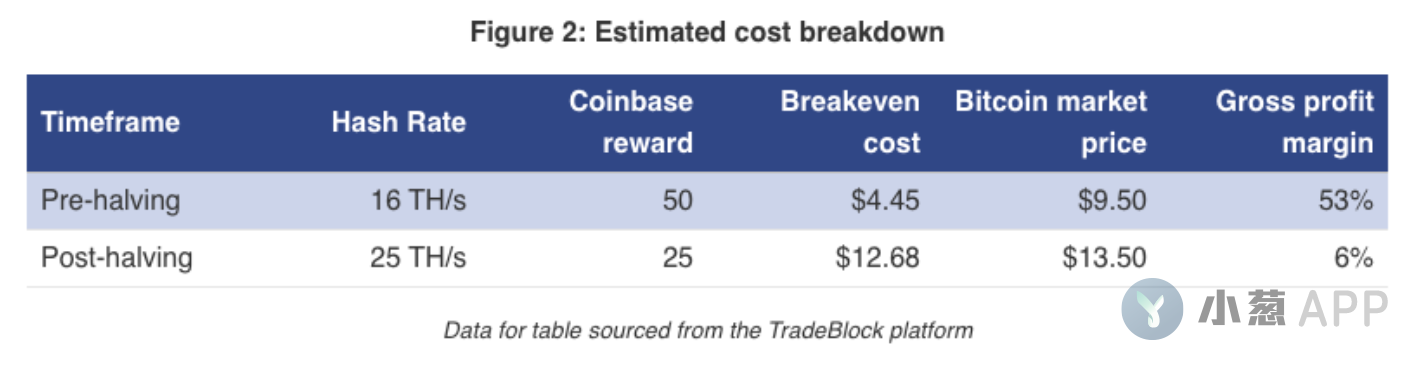

After the 2012 halving, the profit margin of miners is 6%

Before the 2012 halving, the Bitcoin network hash rate rose to a high of 27 Th/s. The increase in the hash rate means that the resources for maintaining the network also increase accordingly. As the resources used for mining increase, the efficiency or mining costs also increase.

In order to ensure the normal profitability of miners, the increase in hash rate requires a corresponding increase in the price of Bitcoin.

In the three months leading up to the 2012 halving, the equilibrium cost of mining a bitcoin was $4.45, and bitcoin was trading at around $9.50 at the same time. After Bitcoin was halved, the network hash rate reached a peak. The halving made the overall cost of mining a Bitcoin jump to $12.68. At that time, the price of Bitcoin also rose to $13.50, and miners were profitable.

After the actual halving, the hash rate of the network has declined, but the decline has not been large, and the decline has not continued.

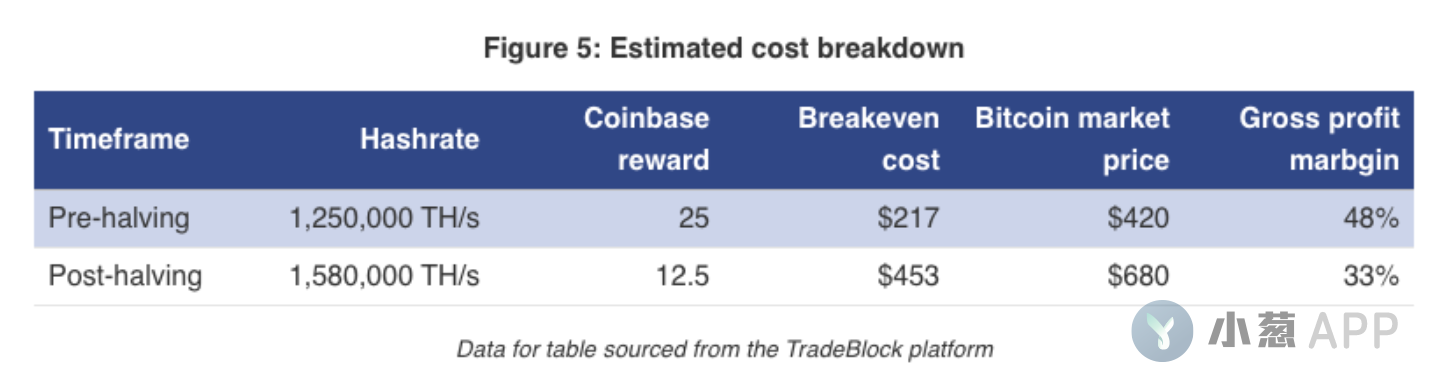

After the halving in 2016, the profit margin of miners reached 33%

Three months before the 2016 halving, the hash rate hit a new high of 1,250,000 Th/s again. At the time it cost about $217 to mine a bitcoin, compared to a bitcoin price of $400. After the halving, the network hash rate continued to rise and reached another new high.

Around that time, Bitmain launched a more efficient miner, the Antminer s9.

TradeBlock estimated that the break-even cost after the halving was $453. Considering that the price was $600 after the halving, the miners were profitable.

secondary title

The profit margin before halving this time is -16%