That’s right, Bitcoin’s correlation with U.S. stocks is hitting record highs

Editor's Note: This article comes fromNakamoto Shallot (ID: xcongapp), Odaily is authorized to publish.

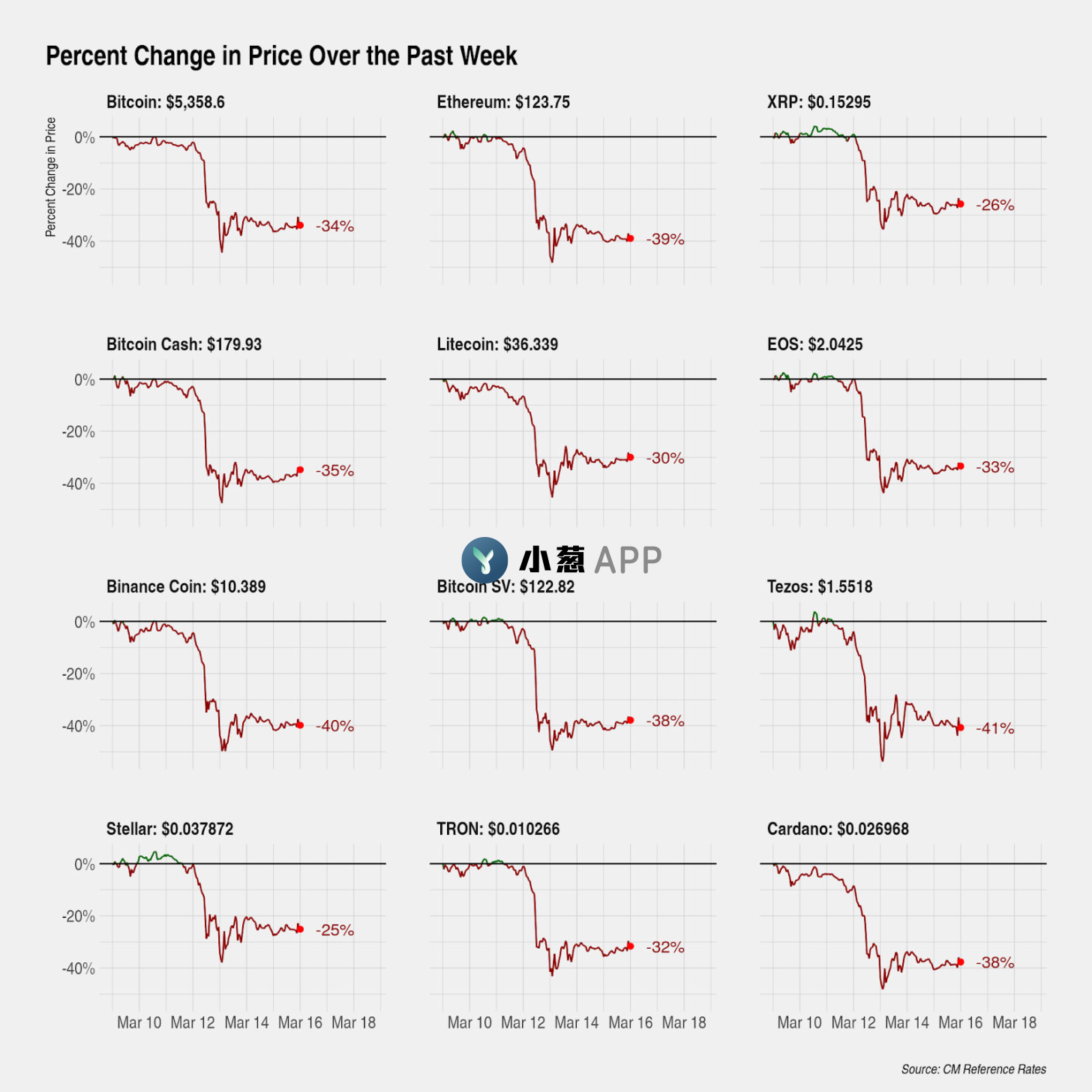

On March 12, due to the panic caused by the rapid spread of the new crown pneumonia, the price of Bitcoin fell sharply in a single day, and the rest of the cryptocurrencies generally followed suit. Most cryptocurrencies fell by more than 30% on a weekly basis.

Source: Coin Metrics Reference Rates

Nakamoto Shallot (ID: xcongapp)

Nakamoto Shallot (ID: xcongapp)

On March 12, due to the panic caused by the rapid spread of the new crown pneumonia, the price of Bitcoin fell sharply in a single day, and the rest of the cryptocurrencies generally followed suit. Most cryptocurrencies fell by more than 30% on a weekly basis.

image description

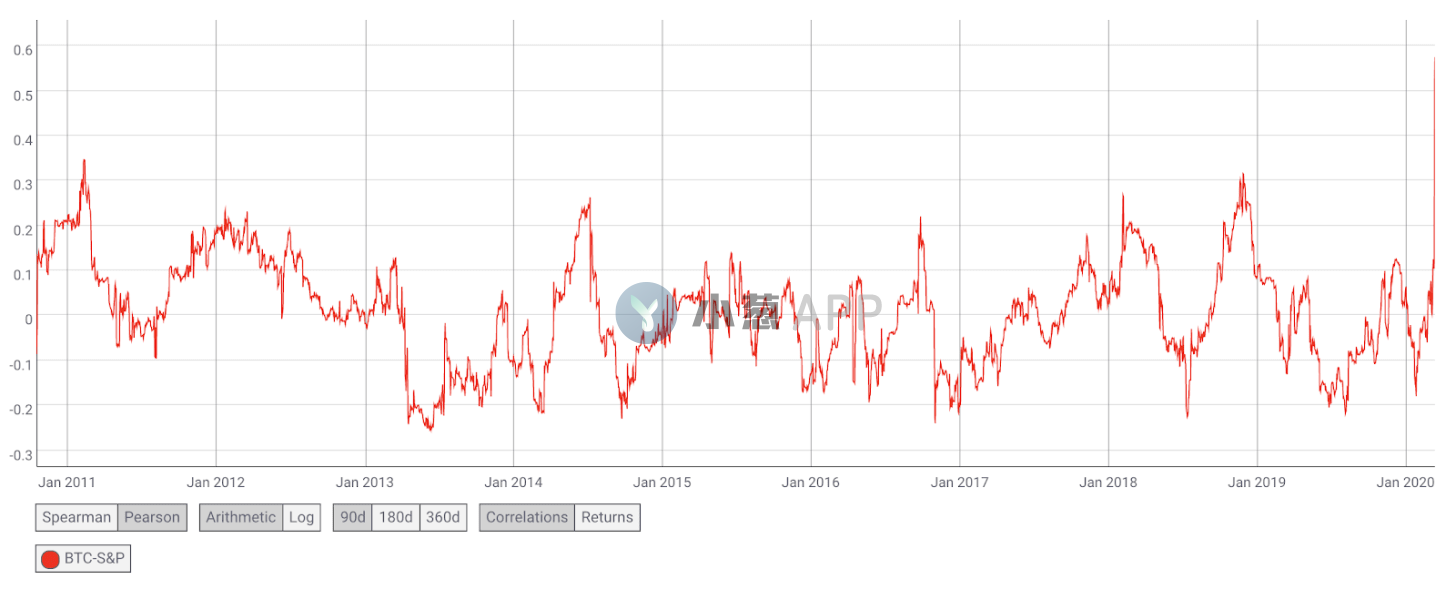

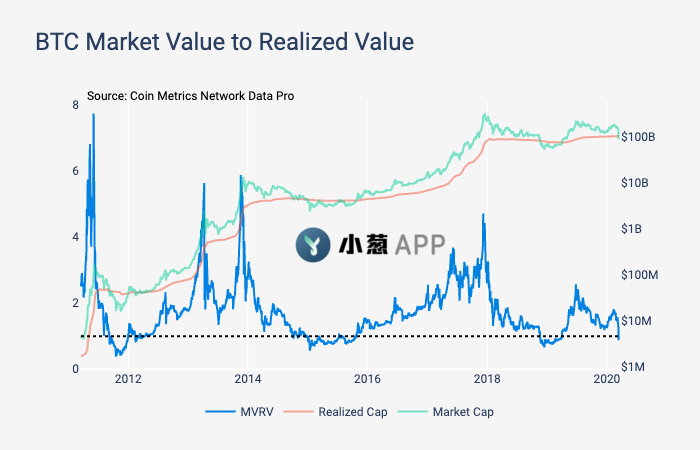

The latest report from Coinmetrics analyzed the reasons for the crash, specifically pointing out that the correlation between Bitcoin and the S&P reached a new high. At the same time, the data showed that short-term investors drove the large sell-off of cryptocurrencies.

BTC and S&P correlation hits all-time high

BTC’s historic one-day price drop coincided with the worst day for the U.S. stock market since 1987. On March 12, the Pearson correlation coefficient between BTC and the S&P 500 surged to an all-time high of 0.52, up from the previous all-time high of 0.32. This shows that the cryptoasset market is increasingly connected to existing traditional markets and is more responsive than ever to external events.

image description

Source: Coin Metrics Community Data

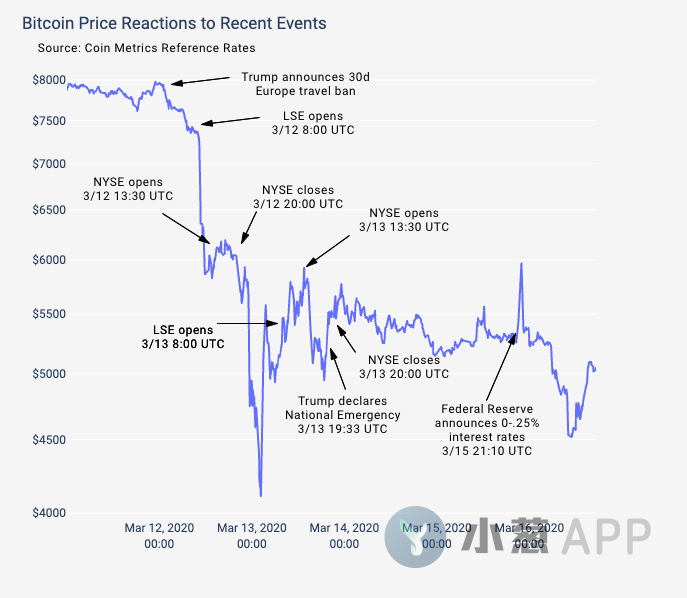

Over the past week, bitcoin prices have reacted to a number of key events, including President Trump's announcement of a 30-day travel ban between the U.S. and Europe, and the Federal Reserve's announcement that it will cut the federal benchmark interest rate to 0.00%-0.25%. level etc. The chart below compares the timing of some key events over the past week to Bitcoin’s price action.

Source: Coin Metrics Community Data

secondary title

BTC sellers appear to be mostly short-term holders

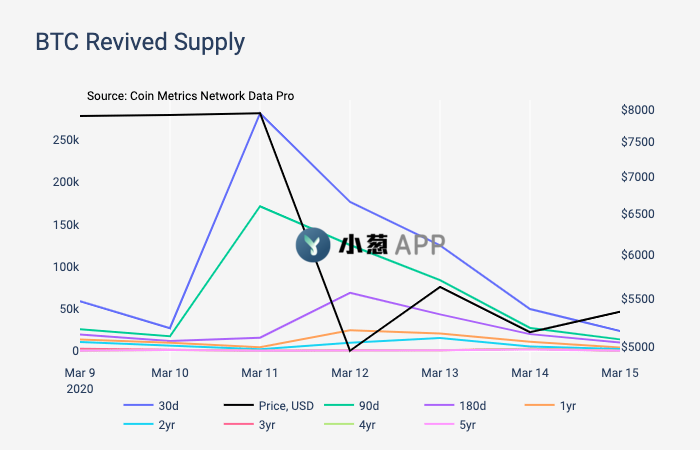

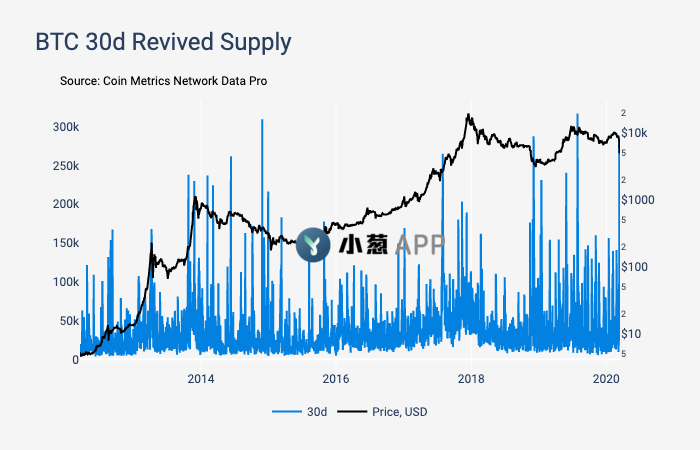

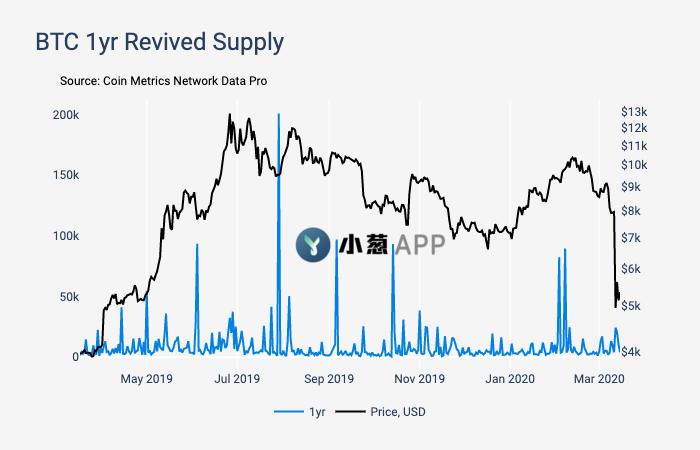

Coin Metrics' Supply Activation Index tracks how many coins that have not moved for a particular period of time are re-entered into circulation. On March 11, approximately 281k bitcoins that had not moved in thirty days were re-entered into circulation, compared to only 4,131 bitcoins that had not moved in a year. This suggests that the two-day moves on March 11 and March 12 did not involve much bitcoin with one-year long-term holders.

Summarize

March 11 marked the fourth-largest peak in the number of unmoved bitcoins re-entering circulation over a 30-day period over the past eight years.