Matrixport: Bitcoin Turns Bullish in Short Term, Influenced by Capital Structure and Participation

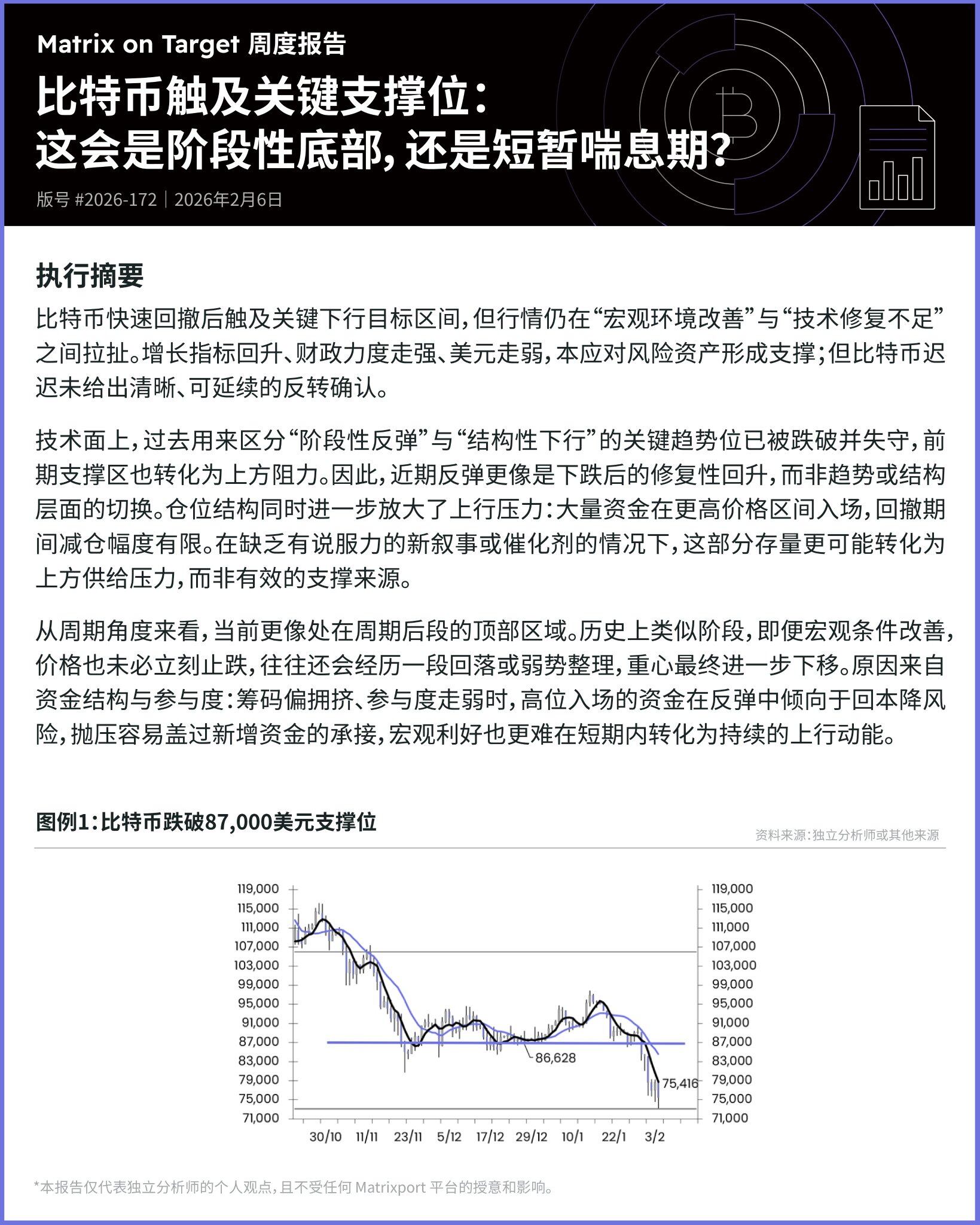

Odaily News Matrixport's weekly report indicates that Bitcoin, after a rapid pullback, touched a key downside target zone, but the market remains caught between "improving macro conditions" and "insufficient technical repair." Rising growth indicators, stronger fiscal support, and a weaker dollar should theoretically support risk assets; however, Bitcoin has yet to provide a clear, sustainable confirmation of a reversal.

From a technical perspective, the key trend level previously used to distinguish between a "phase rebound" and a "structural downtrend" has been breached and lost. Previous support zones have also turned into overhead resistance. Therefore, the recent rebound appears more like a corrective recovery after a decline rather than a shift in trend or structure. The positioning structure has simultaneously amplified upward pressure: a significant amount of capital entered at higher price ranges, with limited position reduction during the pullback. In the absence of compelling new narratives or catalysts, this existing supply is more likely to turn into overhead selling pressure rather than effective support.

From a cyclical standpoint, the current phase resembles the top region of a late-cycle stage. Historically, during similar phases, even with improving macro conditions, prices may not immediately stop falling and often experience further declines or weak consolidation, with the price center ultimately shifting lower. The reason lies in the capital structure and participation: when holdings are relatively crowded and participation weakens, capital that entered at high levels tends to seek breakeven and reduce risk during rebounds. Selling pressure can easily outweigh the absorption by new capital, and macro positives are also harder to translate into sustained upward momentum in the short term.