Matrixport: In the current crypto market, fund flows have a stronger impact on prices than fundamentals.

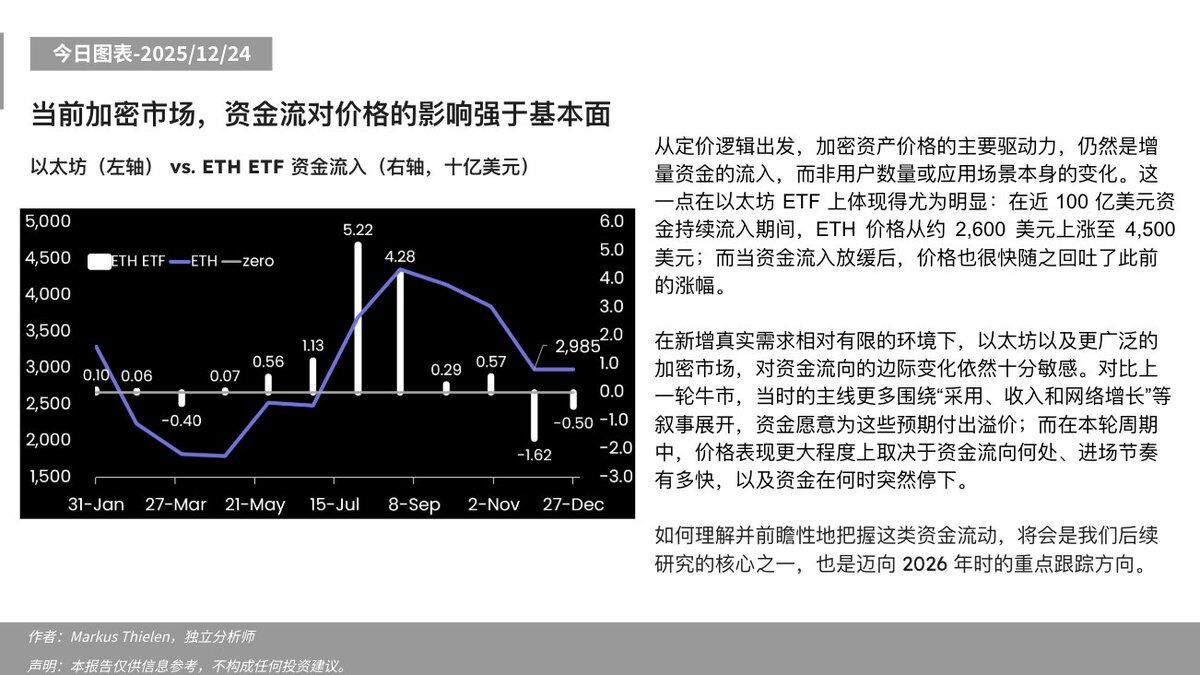

According to a chart released today by Matrixport, Odaily Planet Daily reports that, from a pricing logic perspective, the main driver of crypto asset prices remains the inflow of new funds, rather than changes in the number of users or application scenarios themselves. This is particularly evident in the Ethereum ETF: during a period of sustained inflows of nearly $10 billion, the price of ETH rose from approximately $2,600 to $4,500; however, when the inflows slowed, the price quickly gave back those gains.

In an environment where new real demand is relatively limited, Ethereum, and the broader crypto market, remains highly sensitive to marginal changes in fund flows. Compared to the previous bull market, where the main themes revolved around narratives such as "adoption, revenue, and network growth," and funds were willing to pay a premium for these expectations, in this cycle, price performance depends more on where funds flow, how fast they enter the market, and when funds suddenly stop flowing.

Understanding and proactively grasping these types of capital flows will be one of the core focuses of our subsequent research, and also a key area to track as we move towards 2026.