Weekly Token Unlocks: STRK Unlock Accounts for Approximately 4.6% of Circulating Supply

- Core Viewpoint: This week, two projects, Starknet and Kamino, are set for significant token unlocks, expected to release tokens worth nearly $20 million in total into the market. This may impact the secondary market liquidity and price of their respective tokens.

- Key Elements:

- Starknet, as an Ethereum Layer 2, will unlock 127 million tokens this time, valued at approximately $6.34 million at current prices.

- Kamino, as an automated liquidity protocol on the Solana ecosystem, will unlock 12.5 million tokens this time, valued at approximately $13.63 million.

- Starknet utilizes zk-STARKs technology to enhance Ethereum transaction speed and reduce costs, developed by the Israeli company StarkWare.

- Kamino is based on a Concentrated Liquidity Market Maker (CLMM) mechanism, aiming to improve capital efficiency for liquidity providers through automated strategies.

- The token unlocks for both projects follow preset release schedules and are part of the original plan.

Starknet

Project Twitter: https://twitter.com/Starknet

Project Website: https://starknet.io/

Unlock Amount This Time: 127 million tokens

Unlock Value This Time: Approximately $6.34 million

Starknet is an Ethereum Layer 2 that utilizes zk-STARKs technology to make Ethereum transactions faster and cheaper. Its parent company, StarkWare, was founded in 2018 and is headquartered in Israel. Its main developed products include Starknet and StarkEx. By using STARKs, Starknet validates transactions and computations without requiring all network nodes to verify every operation. This significantly reduces the computational burden and increases the throughput of the blockchain network.

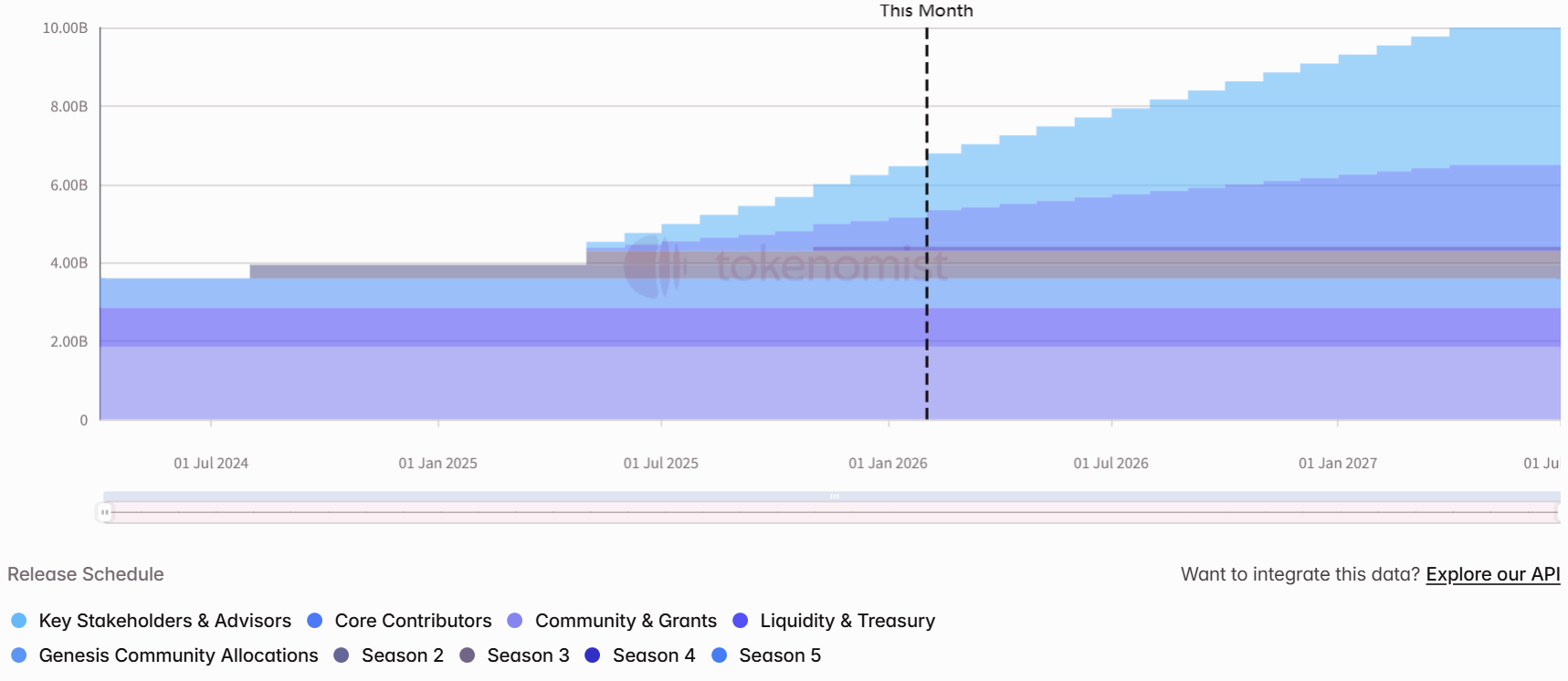

The specific release schedule is as follows:

Kamino

Project Twitter: https://x.com/kamino

Project Website: https://kamino.finance/

Unlock Amount This Time: 12.5 million tokens

Unlock Value This Time: Approximately $13.63 million

Kamino is an automated liquidity solution based on the Concentrated Liquidity Market Maker (CLMM) mechanism. Liquidity Providers (LPs) seeking to improve capital efficiency can utilize Kamino's automated market-making vaults to enhance the expected yield from fees and returns. Kamino was incubated by Hubble Protocol.

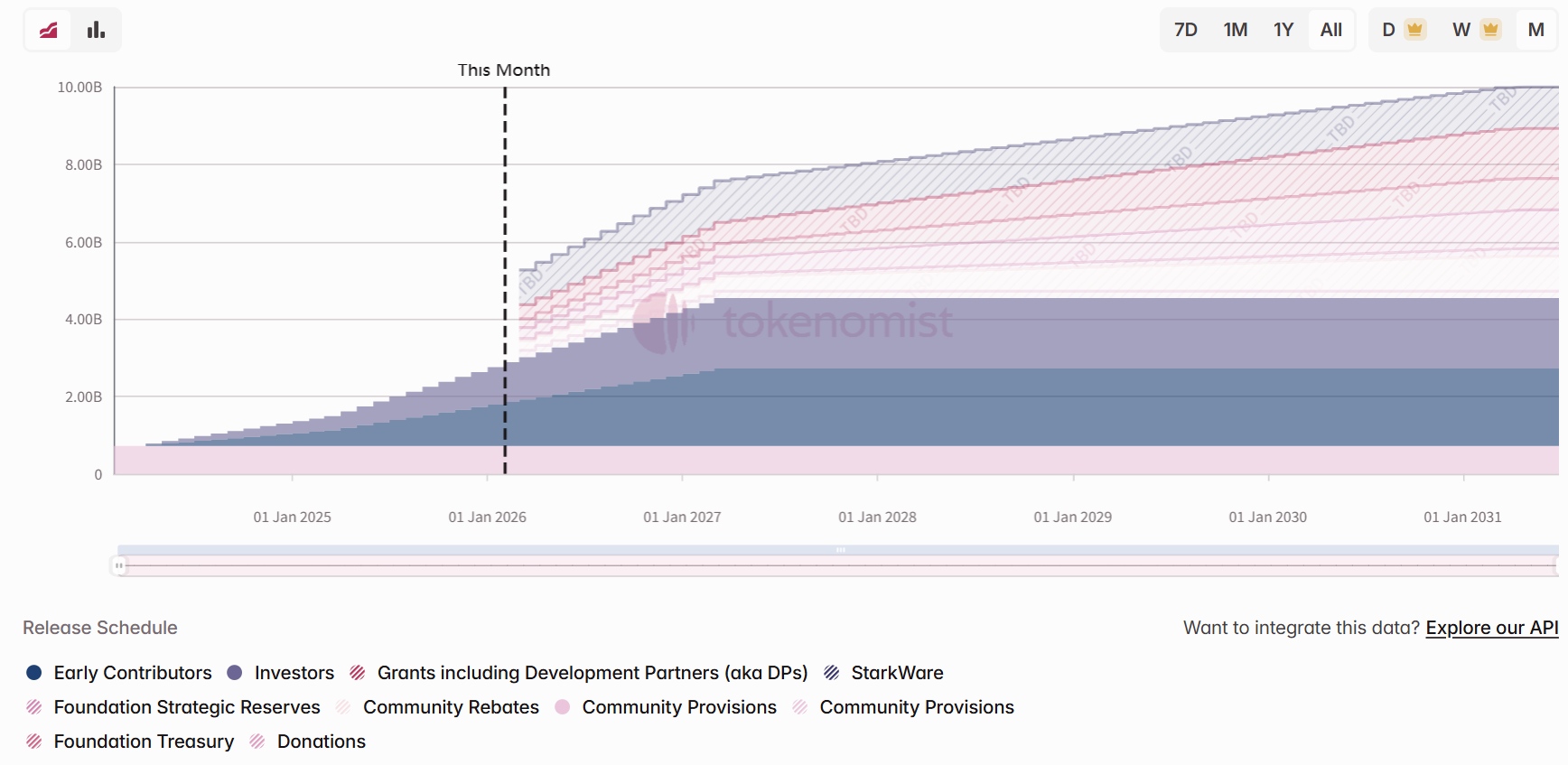

The specific release schedule is as follows: