Matrixport: Bearish sentiment in the BTC and ETH options markets has eased somewhat.

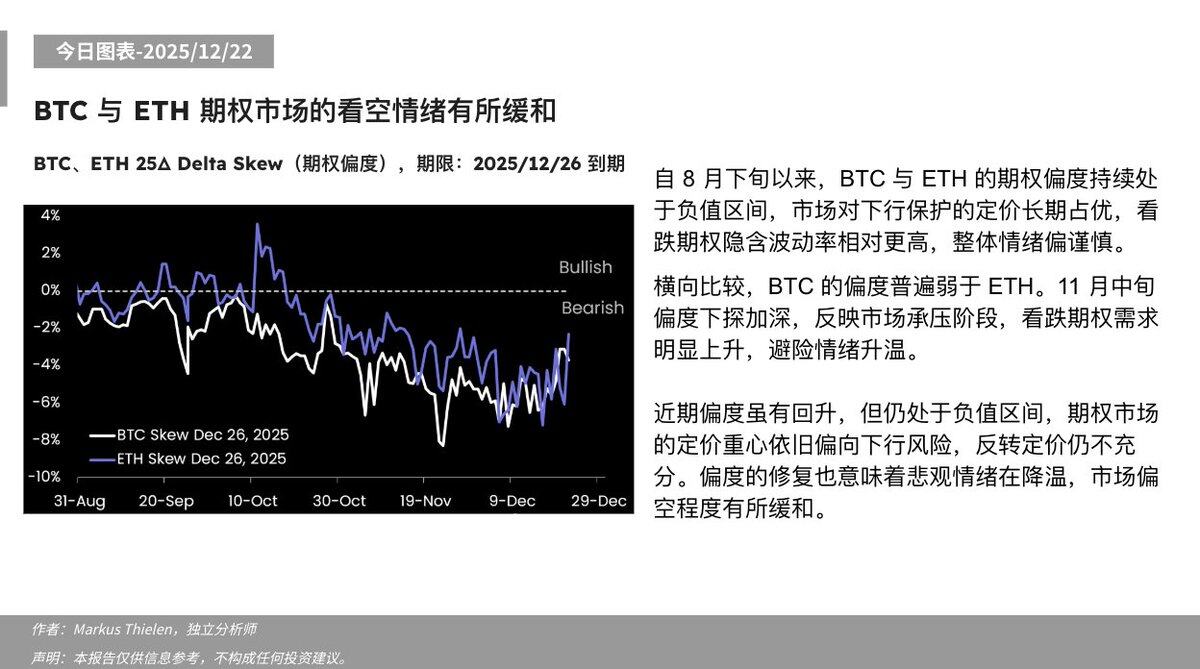

According to a chart released today by Matrixport, as reported by Odaily Planet Daily, since late August, the option skewness for both BTC and ETH has remained in negative territory, indicating that the market has consistently priced in downside protection. Put options have relatively higher implied volatility, reflecting an overall cautious sentiment. Comparatively, BTC's skewness is generally weaker than ETH's. The skewness deepened in mid-November, reflecting a period of market pressure and a significant increase in demand for put options, indicating heightened risk aversion.

Although the skewness has recently improved, it remains in negative territory, indicating that the pricing focus in the options market is still biased towards downside risk, and reversal pricing is still insufficient. The improvement in skewness also suggests that pessimistic sentiment is cooling, and the market's bearish bias has eased somewhat.