Yala's stablecoin YU is experiencing suspicious activity similar to USDX, with related addresses lending USDC at extremely high interest rates but failing to repay.

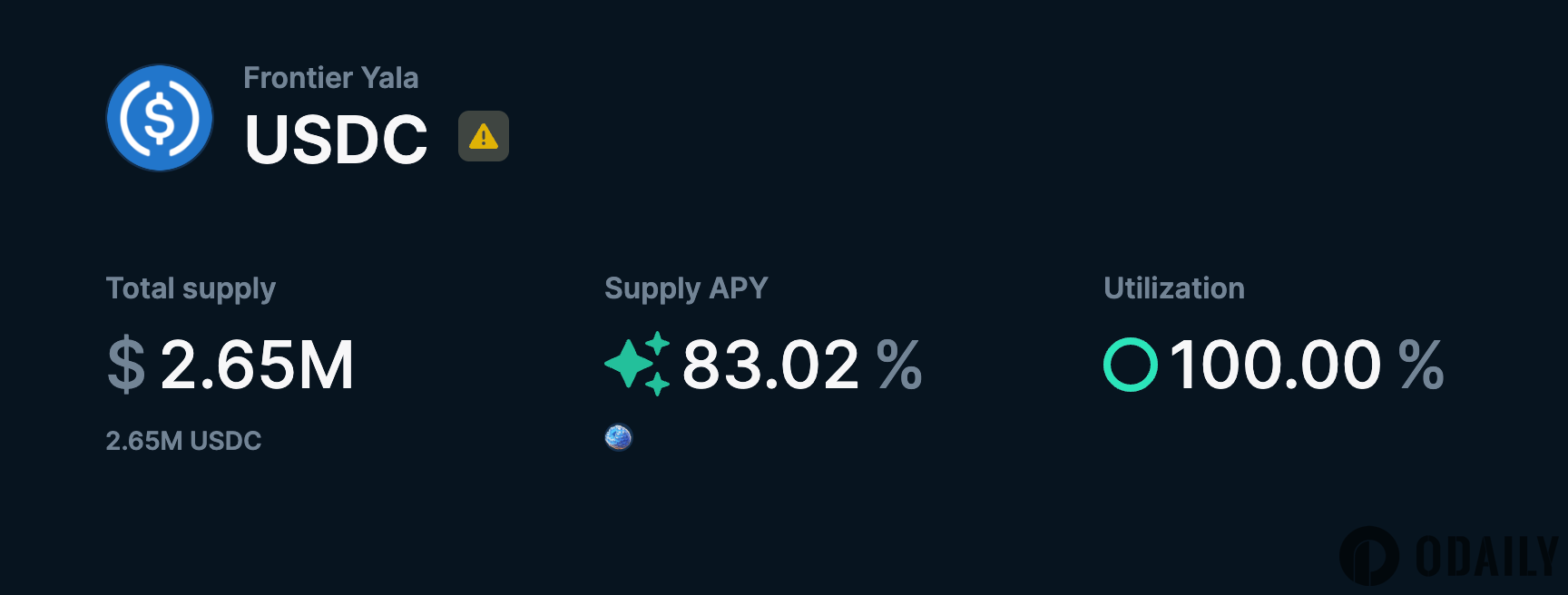

Odaily Planet Daily reports that DeFi community member YAM posted on X that they have observed dangerous signs regarding the Yala stablecoin YU. An address closely associated with Yala is borrowing the full amount of USDC and most of the YU from the Yala Frontier market on Euler, and despite persistently high interest rates, has not made any repayments. Currently, the market's liquidity utilization has reached 100%, meaning lenders are unable to withdraw any liquidity. The Euler team has also set the lending limit for the Yala market on Frontier to zero. It is understood that the Yala team has not yet responded to inquiries from the Euler team or Discord community users.

YAM added that YU is currently still pegged to the exchange rate on Solana, and its liquidity pool still has nearly one million USDC available for exit at the pegged price. This article is more of a risk warning, and we are not yet sure whether Yala is really in trouble.