BTC ได้รับความเดือดร้อนจากการลดลงหนึ่งวันครั้งใหญ่ที่สุดนับตั้งแต่เกิดความผิดพลาดของ FTX ถึงเวลาที่ต้องตามล่าจุดต่ำสุดมาถึงแล้วหรือแนวโน้มขาลงจะดำเนินต่อไปหรือไม่?

ต้นฉบับ - โอเดลี่

ผู้เขียน - หนาน จื้อ

เมื่อวาน BTC ลดลง 5,675 USDTลดลงถึง 8.39%การลดลงในวันเดียวครั้งใหญ่ที่สุดนับตั้งแต่ FTX ขัดข้องเมื่อวันที่ 9 พฤศจิกายน 2022(14.15%). ในทำนองเดียวกัน ตลาดมีการลดลงโดยรวม โดย ETH ลดลง 10.28% เมื่อวานนี้ BNB ลดลง 8.59% และ SOL ลดลง 13.3% ตลาดยังคงมีความผันผวนเล็กน้อยในวันนี้ โดยไม่มีสัญญาณการฟื้นตัวที่ชัดเจน

ข้อมูล CoinGecko แสดงให้เห็นว่ามูลค่าตลาดรวมของสกุลเงินดิจิทัลลดลงเหลือ 2.43 ล้านล้าน ลดลง 24 ชั่วโมง 4.4%Alternativeข้อมูลแสดงให้เห็นว่าความกระตือรือร้นในการซื้อขายของผู้ใช้ crypto ลดลงอย่างมากเมื่อเทียบกับเมื่อวาน ดัชนี Panic and Greed ของวันนี้อยู่ที่ 74 ซึ่งจัดอยู่ในระดับ “โลภ” ในขณะที่ Greed Index ของเมื่อวานและสัปดาห์ที่แล้วอยู่ที่ 79 และ 81 ตามลำดับ ซึ่งทั้งคู่จัดระดับว่า “โลภมาก” .

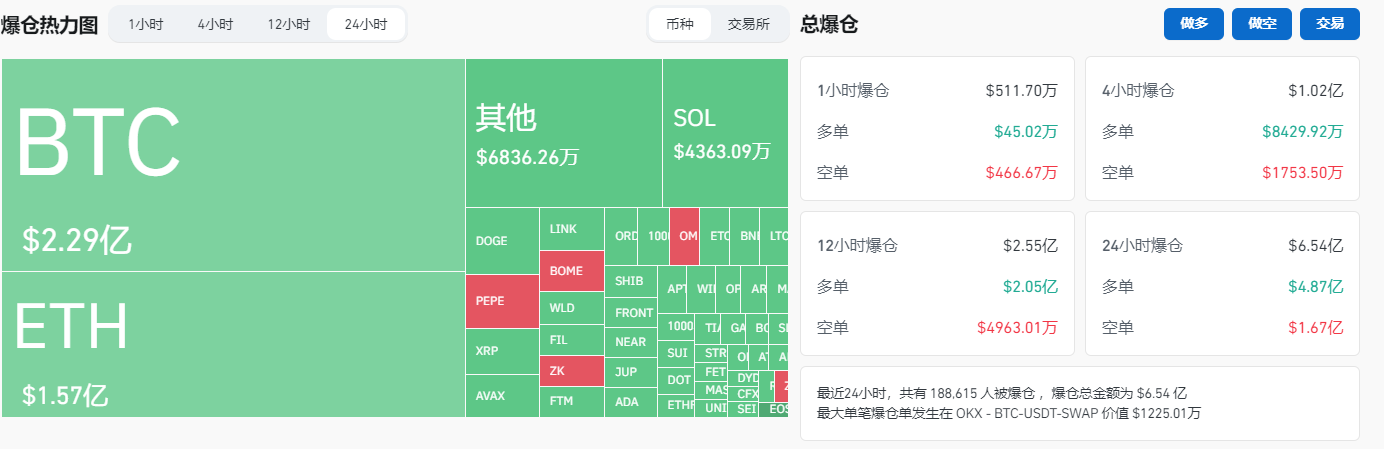

ในส่วนของการซื้อขายสัญญาซื้อขายล่วงหน้าCoinglassข้อมูลแสดงให้เห็นว่าเครือข่ายทั้งหมดชำระหนี้ 654 ล้านดอลลาร์ในช่วง 24 ชั่วโมงที่ผ่านมา โดยคำสั่งซื้อระยะยาวชำระหนี้ 487 ล้านดอลลาร์ และคำสั่งซื้อขายสั้น ๆ ชำระหนี้ 167 ล้านดอลลาร์ BTC ชำระหนี้ 229 ล้านดอลลาร์ และ ETH ชำระหนี้ 157 ล้านดอลลาร์

ทำไมมันถึงตก? หรือเพราะ ETF เริ่มไหลออก

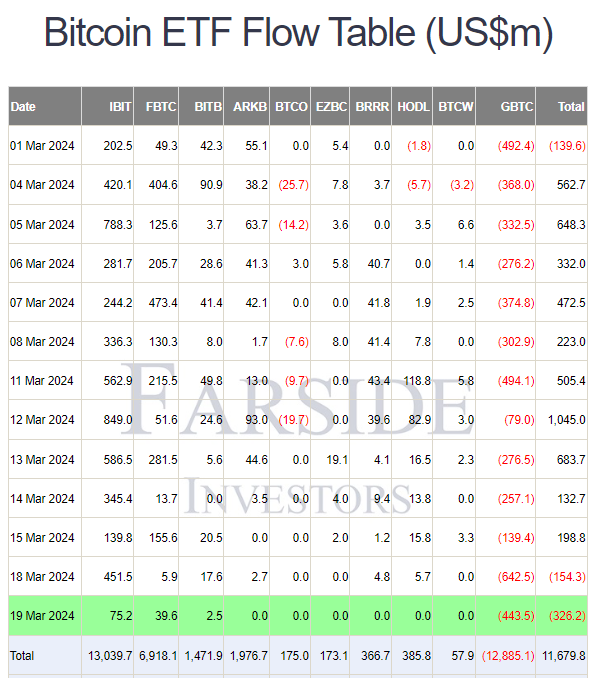

ตามการติดตามของ Farside Investors,Bitcoin Spot ETF มีการไหลออกสุทธิ 326.2 ล้านดอลลาร์เมื่อวานนี้ในขณะที่ Bitcoin Spot ETF ประสบกับการไหลออกของ $154 ล้านในวันที่ 18 มีนาคม แต่การไหลเข้าของ Bitcoin Spot ETF อย่างต่อเนื่องล้มเหลวที่จะดำเนินต่อไป การเปลี่ยนแปลงที่สำคัญคือการไหลเข้าของ BlackRock IBIT อ่อนตัวลงเมื่อวานนี้ IBIT มีการไหลเข้าสุทธิ 75.2 ล้านดอลลาร์สหรัฐ ซึ่งเป็นเพียง 8.8% ของจุดสูงสุดที่ 849 ล้านในวันที่ 12 มีนาคม อย่างไรก็ตาม ขนาดของการไหลออกของ GBTC ไม่ได้เปลี่ยนแปลงอย่างมีนัยสำคัญ ดังนั้นการไหลออกสุทธิโดยรวมจึงเริ่มต้นขึ้น แผนภูมิด้านล่างแสดงการเปลี่ยนแปลงล่าสุดในกระแสกองทุน ETF

เทรดเดอร์และนักเศรษฐศาสตร์ Alex Kruger กล่าวว่าการลดลงของราคา BTC เมื่อเร็ว ๆ นี้ได้รับการกระตุ้นโดยปัจจัยหลายประการ ซึ่งลำดับความสำคัญคือ:

เลเวอเรจของตลาดสูงเกินไป

Ethereum ผลักดันตลาดให้ตกต่ำ (ตลาดเชื่อว่าความเป็นไปได้ที่สปอต ETF จะผ่านนั้นต่ำ)

การไหลเข้าของ Bitcoin ETF นั้นเป็นลบ

Meme ความบ้าคลั่งบนโซลานา

เมื่อสองสัปดาห์ที่แล้ว JPMorgan Chase ยังเตือนถึงความจำเป็นที่ต้องใส่ใจกับความเสี่ยงจาก ETF ที่กระทบขีดความสามารถในการลงทุน ทีมวิเคราะห์ออกแถลงการณ์ว่า: Bitcoin มีการจัดสรรพอร์ตการลงทุนที่ใหญ่กว่าทองคำโดยพิจารณาจากความผันผวน”(บทความอ้างอิง: JPMorgan Chase: เมื่อเปรียบเทียบข้อมูลการลงทุนทองคำ Bitcoin กำลังจะถึงจุดสูงสุดแล้ว》)

คุณคิดอย่างไรกับแนวโน้มตลาด?

การวิจัย 10 เท่า: BTC ร่วงต่ำกว่า 60,000 ดอลลาร์ มองหาการต่อรองราคา

เมื่อวานนี้ Markus Thielen ผู้ก่อตั้ง 10x Researchโพสข้อความเพื่อแสดง,ราคา Bitcoin อาจลดลงต่ำกว่า 60,000 ดอลลาร์ก่อนที่จะดีดตัวขึ้น. รายงานอธิบายว่าทำไมเขาถึงกลายเป็นขาลงเมื่อ 10 วันก่อน และระบุเพิ่มเติมว่ายังเร็วเกินไปที่จะซื้อในช่วงขาลง. จุดลบที่สำคัญคือความเชื่อมั่นในการซื้อขายรายย่อยกำลังเย็นลง ซึ่งสะท้อนให้เห็นจากปริมาณการซื้อขายของ Altcoins และ Meme Coin ที่ลดลงอย่างมีนัยสำคัญ นอกจากนี้ Bitcoin Spot ETF ยังมีการไหลออกสุทธิเป็นเวลาสองวันติดต่อกัน ในทางเทคนิค Markus Thielen ยังคงเชื่อว่า Bitcoin จะมีการซื้อขายต่ำกว่า 60,000 ดอลลาร์ ก่อนที่จะเริ่มดำเนินการฟื้นตัวที่มีความหมายมากขึ้น จากสัญญาณสูงสุดใหม่ก่อนหน้านี้เชื่อว่า BTC คาดว่าจะดีดตัวขึ้นเป็น 83,000 ดอลลาร์ และ 102,000 ดอลลาร์ แต่ปัจจุบันมุ่งเน้นไปที่การจัดการความเสี่ยงขาลงมากขึ้น。

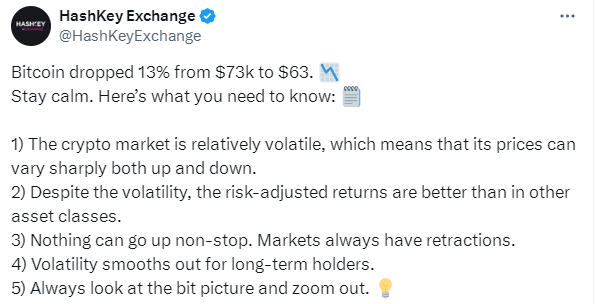

HashKey: ผลตอบแทนของตลาด crypto ที่ปรับปรุงแล้วมีประสิทธิภาพเหนือกว่าสินทรัพย์อื่น ๆ

การแลกเปลี่ยน HashKey บนแพลตฟอร์ม Xโพสข้อความเพื่อแสดงแม้ว่าราคาของ Bitcoin จะลดลง 13% จาก $73,000 เป็น $63,000 แต่ตลาดจำเป็นต้องสงบสติอารมณ์และนักลงทุนจำเป็นต้องให้ความสนใจ:

ตลาดสกุลเงินดิจิทัลมีความผันผวนค่อนข้างมาก ซึ่งหมายความว่าราคาอาจขยับขึ้นหรือลง

แม้จะมีความผันผวนแต่ผลตอบแทนที่ปรับตามความเสี่ยงของสกุลเงินดิจิทัลยังคงเหนือกว่าสินทรัพย์ประเภทอื่น;

สำหรับผู้ถือระยะยาว ความผันผวนจะลดลง

Ethereum Spot ETF คาดว่าจะได้รับการอนุมัติในเดือนพฤษภาคม

James Seyffart นักวิเคราะห์ของ Bloomberg ETFโพสข้อความเพื่อแสดงโอกาสที่ ETF ของ Ethereum จะได้รับการอนุมัติในเดือนพฤษภาคมนั้นมีน้อยมาก เขากล่าวว่า: “การมองโลกในแง่ดีอย่างระมัดระวังของฉันเกี่ยวกับ Ethereum Spot ETF ได้เปลี่ยนไปในช่วงไม่กี่เดือนที่ผ่านมา ตอนนี้เราเชื่อว่าในที่สุดใบสมัครเหล่านี้จะถูกปฏิเสธในรอบวันที่ 23 พฤษภาคมก.ล.ต. สหรัฐยังไม่ได้สื่อสารกับผู้ออกในเรื่องเฉพาะที่เกี่ยวข้องกับ Ethereum ตรงกันข้ามกับสิ่งที่เกิดขึ้นกับ Bitcoin Spot ETF เมื่อฤดูใบไม้ร่วงปีที่แล้ว。”

ปัจจุบันมีผู้ออกตราสาร 7 รายที่หวังจะเปิดตัว Ethereum Spot ETF ได้แก่ BlackRock, Fidelity, Invesco Galaxy, Grayscale, VanEck, ARK 21 Share และ Hashdex สองสัปดาห์ที่ผ่านมา ก.ล.ต. ของสหรัฐอเมริกาได้เลื่อนการตัดสินใจเกี่ยวกับ Hashdex และ ARK 21 Shares Ethereum เพื่อรับใบสมัคร ETF และขยายกำหนดเวลาเป็นวันที่ 30 พฤษภาคม และ 24 พฤษภาคม ตามลำดับ

ตัวใหญ่กำลังมาเหรอ?

Lin Chen ผู้นำธุรกิจ Deribit เอเชียแปซิฟิกบนแพลตฟอร์ม Xโพสข้อความเพื่อแสดงความผันผวนโดยนัยของ IV ของ ETH เพิ่มขึ้นเป็นมากกว่า 80 ปัจจุบันอยู่ที่ 81.8 ซึ่งบ่งชี้ว่าตลาดเชื่อว่าพายุกำลังจะมา หลินเฉินกล่าวเพิ่มเติมว่า: “นี่ไม่ได้เป็นการบอกว่าจะยังคงร่วงต่อไป จริงๆ แล้วราคาได้ขายเกินไปแล้วแล้ว… ตลาดตื่นตระหนกมาก ในฐานะเทรดเดอร์ นี่คือเวลาที่เหมาะที่จะขายฟิวเจอร์สขาลงและระยะสั้นเพื่อป้องกันความเสี่ยง เพื่อสร้างรายได้ให้กับ Vega และ Theta

(หมายเหตุประจำวัน: ตัวบ่งชี้ Vega ของออปชั่นจะวัดความอ่อนไหวของราคาออปชั่นต่อการเปลี่ยนแปลงใน IV เมื่อเหตุการณ์เริ่มไม่แน่นอนและใหญ่ขึ้น Vega ก็จะเพิ่มขึ้น การขาย Put เทียบเท่ากับการได้รับ Vega การได้รับ Theta หมายถึงการใช้ประโยชน์จากการเสื่อมถอย ของมูลค่าเวลาของออปชั่นเพื่อทำกำไร)

สรุปแล้ว

เมื่อ Bitcoin Halving ใกล้เข้ามา ความผันผวนของตลาดก็เริ่มรุนแรงมากขึ้น ในเวลาเดียวกัน การหยุดการไหลเข้าสุทธิของ Bitcoin Spot ETFs แสดงให้เห็นว่าพลังงานพาเลทจากสหรัฐอเมริกาจะไม่มีประสิทธิภาพเหมือนเมื่อก่อนในระยะสั้นอีกต่อไป แม้ว่าตลาดจะตกต่ำลงแล้ว แต่นักลงทุนยังคงต้องให้ความสนใจกับปริมาณเลเวอเรจเพื่อหลีกเลี่ยงความเสี่ยงที่จะเกิดการชนแบบฉับพลันที่ 60,000 ดอลลาร์หรือต่ำกว่านั้น