TVL超7500万美元,年内增幅超3倍,如何获得RWA平台Parcl潜在空投?

ต้นฉบับ - โอเดลี่

ผู้เขียน-สามีอย่างไร

ตั้งแต่ปีที่แล้ว RWA (Real World Assets) ได้กลายเป็นส่วนยอดนิยมของ Web3 บางโครงการยังคงสำรวจการนำสินทรัพย์มาสู่โลก crypto อย่างต่อเนื่อง เช่น อสังหาริมทรัพย์

โปรเจ็กต์ Parcl ที่ Odaily สังเกตเห็นเมื่อเร็วๆ นี้ก็เป็นหนึ่งในนั้น ไม่เหมือนกับโครงการโทเค็นอสังหาริมทรัพย์เดี่ยวอื่นๆ Parcl ได้สร้างชุดผลิตภัณฑ์การซื้อขายดัชนีราคาอสังหาริมทรัพย์ระดับภูมิภาค ซึ่งได้รับการขยายไปยัง 10 ภูมิภาค (เมืองในอเมริกาเป็นหลัก) และจะเปิดตัวในฮ่องกง จีน ลอนดอน สหราชอาณาจักร และจาการ์ตา อินโดนีเซียในอนาคตและผลิตภัณฑ์ดัชนีอสังหาริมทรัพย์ในเมืองอื่นๆ

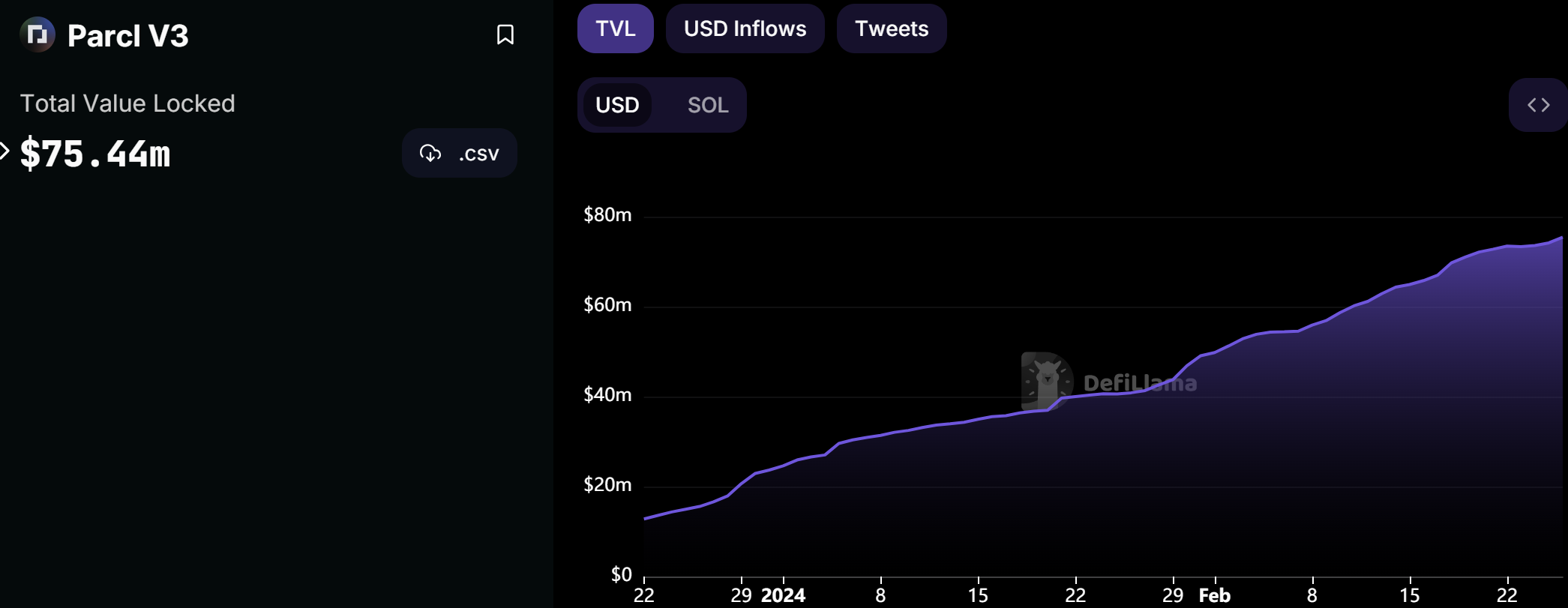

เมื่อเร็วๆ นี้ มีการประกาศอย่างเป็นทางการว่าโทเค็น PRCL จะเปิดตัวในเดือนเมษายนปีนี้ TVL ยังคงพุ่งสูงขึ้นอย่างต่อเนื่องและขณะนี้มีมูลค่าเกิน 75 ล้านดอลลาร์สหรัฐ เพิ่มขึ้นมากกว่า 3 เท่าจากต้นปี วิธีรับโอกาสในการส่งเครื่องบินที่อาจเกิดขึ้น Odaily สรุปวิธีการบางอย่างไว้

ภาพรวมโครงการ

Parcl เป็นแพลตฟอร์มอนุพันธ์ดัชนีอสังหาริมทรัพย์แบบกระจายอำนาจ โดยอิงจากเครือข่ายสาธารณะของ Solana

ดัชนีอสังหาริมทรัพย์ของ Parcl มีความคล้ายคลึงกับ REIT ทางการเงินแบบดั้งเดิม (กองทุนทรัสต์อสังหาริมทรัพย์) แต่แทนที่จะสร้างโทเค็นผลิตภัณฑ์ REIT ที่ครบกำหนดชำระโดยตรง Parcl ใช้ Parcl Labs เพื่อรวบรวมจุดข้อมูลในเขตเมืองบางแห่งเพื่อคำนวณและสร้างพื้นที่ปัจจุบัน ดัชนีราคาตลาดจะถูกส่งบนห่วงโซ่ผ่าน Pyth oracle โดยทีมพัฒนา Parclหมายเหตุ Odaily: แหล่งข้อมูลราคา Parcl Labs (PLPF) ใช้เพื่อระบุราคารายวันต่อตารางฟุตโดยประมาณสำหรับอสังหาริมทรัพย์เพื่อการอยู่อาศัยในตลาดและประเภทอสังหาริมทรัพย์ที่หลากหลาย

Parcl ได้นำเวอร์ชัน V2 มาใช้ก่อนหน้านี้และได้ออนไลน์เพื่อการใช้งานแล้ว Odaily ได้รวบรวมบทความที่เกี่ยวข้องด้วย โซลูชั่นเต็มรูปแบบสำหรับ Parcl แพลตฟอร์ม RWA ออนไลน์ของ Solana: RWA เปลี่ยนแปลงการลงทุนด้านอสังหาริมทรัพย์อย่างไร สิ่งที่แนบมาด้วยคือคู่มือผู้ใช้ฉบับเต็ม》.เกี่ยวกับขั้นตอนการใช้ผลิตภัณฑ์บทความนี้จะไม่ลงรายละเอียด หากสนใจ สามารถอ่านบทความก่อนหน้านี้เพื่อเรียนรู้ได้

Parcl รันเวอร์ชันโปรโตคอล V3 ซึ่งขยายปัญหาสภาพคล่องเมื่อเทียบกับเวอร์ชันก่อนหน้า แนะนำฟังก์ชันการกำกับดูแลแบบกระจายอำนาจและการควบคุมความเสี่ยงเพื่อปกป้อง LP (ผู้ให้บริการจำนำสภาพคล่อง) และเทรดเดอร์จากความไม่สมดุลของตลาดที่มากเกินไป โดยพื้นฐานแล้วจะดีกว่าเวอร์ชันก่อนหน้า มี ประสบการณ์ผู้ใช้ไม่แตกต่างกันมาก

ตามหน้าผลิตภัณฑ์ Parcl ซื้อขายดัชนีตลาดอสังหาริมทรัพย์ทั้งหมด 10 รายการ โดยส่วนใหญ่อยู่ในเขตเมืองของสหรัฐอเมริกา อย่างไรก็ตาม จะมีการเปิดตัวในเมืองต่างๆ เช่น ฮ่องกง จีน ลอนดอน สหราชอาณาจักร และจาการ์ตา ประเทศอินโดนีเซีย ในอนาคตอันใกล้นี้

ในปัจจุบัน ไม่มีข้อจำกัดอื่นๆ เกี่ยวกับธุรกรรมของ Parcl และสามารถทำธุรกรรมได้มากกว่า 1 USDT อย่างไรก็ตาม ผู้เขียนสังเกตดัชนีในแต่ละภูมิภาคและพบว่าความเข้มข้นของการเพิ่มขึ้นและลดค่อนข้างต่ำ ข้อมูลในแผนภูมิด้านบนแสดงอัตราการเพิ่มและลดเลเวอเรจ 10 เท่าใน 3 เดือน ดังนั้น Parcl จึงเหมาะสำหรับนักลงทุนที่มีเงินทุนขนาดใหญ่และต้องการผลตอบแทนจากสินทรัพย์ที่หลากหลาย นักลงทุนทั่วไปอาจคุ้นเคยกับความผันผวนสูงของตลาดสกุลเงินดิจิทัล และอาจชอบตลาดการเงินแบบดั้งเดิมสำหรับสินทรัพย์ระยะยาวและค่อนข้างมีเสถียรภาพ

ตามข้อมูลของ DeFiLlama Parcl TVL มีมูลค่า 75.44 ล้านดอลลาร์สหรัฐ เพิ่มขึ้นมากกว่า 3 เท่าจากต้นปี Parcl airdrop ใกล้เข้ามาแล้ว และจำนวน LP และผู้ค้าในโครงการก็เพิ่มขึ้น นี่อาจเป็นเหตุผลหลักที่ทำให้ Parcl TVL เติบโต

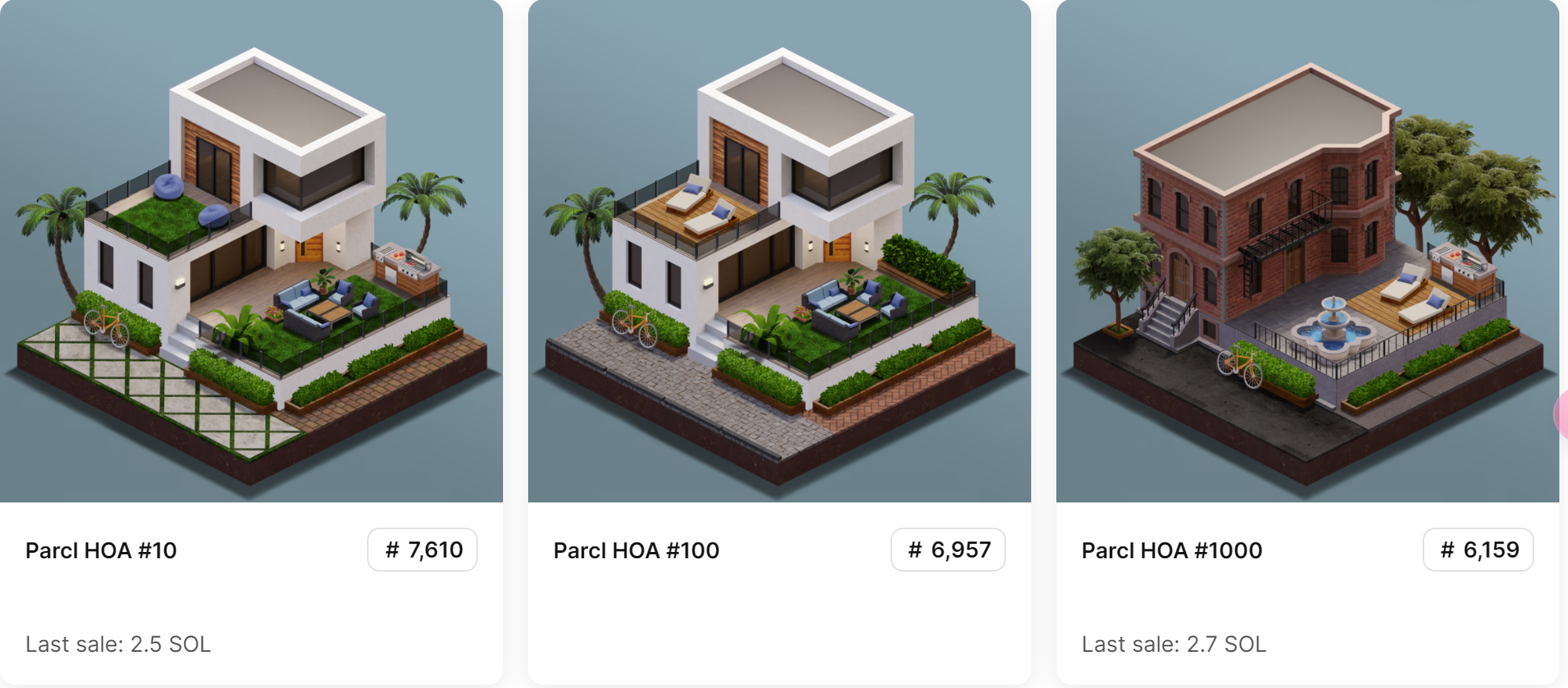

จากการคาดการณ์มาตรฐานการส่งทางอากาศของ Parcl บางทีผู้ถือ NFT อาจมีโอกาสได้รับการส่งทางอากาศ

ตามข่าวอย่างเป็นทางการ Parcl ได้เปิดตัวโทเค็น PRCL ในเดือนเมษายนปีนี้ โดยมีอุปทานรวม 1 พันล้านและอุปทานชุมชนเริ่มต้นที่ 7% -8% วัตถุประสงค์ของโทเค็น PRCL สามารถสรุปได้ดังนี้:

ฟังก์ชันการทำงานของข้อมูล: โทเค็น PRCL ถูกรวมเข้ากับ Parcl Labs API เพื่อเป็นกลไกการรักษาประตูสำหรับข้อมูลอสังหาริมทรัพย์ที่อยู่อาศัยคุณภาพสูง

โปรแกรมสิ่งจูงใจเพิ่มเติมของพิธีสาร: ผู้ถือ PRCL ที่มีสิทธิ์มีโอกาสเข้าร่วมใน Perpetual Network Incentives (เช่น คะแนน) ซึ่งจะเปิดตัวไม่นานหลังจากกิจกรรมการแจกจ่ายครั้งแรก

เนื้อหาเฉพาะของเศรษฐศาสตร์โทเค็นอื่นๆ จะได้รับการเปิดเผยอย่างเป็นทางการในเดือนมีนาคมปีนี้ และ Odaily จะยังคงให้ความสนใจต่อไป

ผู้เขียนได้สอบถามเกี่ยวกับประวัติการพัฒนาของโครงการ Parcl อย่างไร และพบมาตรฐานการแจกแจงทางอากาศที่เป็นไปได้ดังต่อไปนี้

กิจกรรมคะแนนที่ Parcl จัดขึ้น: ขณะนี้อยู่ในช่วงฤดูกาลที่สอง กิจกรรมคะแนนนี้ใช้สามมาตรฐาน: ผู้ให้บริการ LP 4 คะแนน/USD; เทรดเดอร์ 2 คะแนน/USD (คำนวณเมื่อเปิดตำแหน่ง) ผู้ใช้ใหม่จะได้รับเชิญ (10% สำหรับผู้ใช้ใหม่) อินทิกรัล) จากข้อมูลปัจจุบันมีผู้เข้าร่วมงานเกือบ 150,000 คน

ผู้ถือ NFT: Homeowners Association ที่ออกโดย Parcl ในเดือนพฤษภาคม 2022 โดยมีราคาออก 0.5 SOL แต่กลับต่ำกว่าราคาออกภายในเวลาไม่ถึงครึ่งปีหลังจากออก ได้รับผลกระทบจากความคาดหวังของ airdrop ราคาจึงเพิ่มขึ้นเป็น 15 SOL ในช่วงปลายปี 2566 และขณะนี้อยู่บน Opensea ยังไม่มีใครขาย

สรุป

Parcl แตกต่างจากโครงการอสังหาริมทรัพย์ RWA อื่นๆ โดยเฉพาะอย่างยิ่งจากรายละเอียดทางเทคนิคของดัชนีตลาดอสังหาริมทรัพย์ที่พัฒนาโดย Parcl Labs ทีมงานค่อนข้างเป็นมืออาชีพโดยมีสมาชิกจำนวนมากมาจาก Microsoft และสถาบันการเงินที่มีชื่อเสียง การออกแบบของ โครงการยังค่อนข้างแปลกใหม่โดยใช้ดัชนีที่พัฒนาตนเอง เป็นแพลตฟอร์มการซื้อขายอนุพันธ์ที่ใช้ Parcl ซึ่งแตกต่างจากสินทรัพย์ทางการเงินแบบโทเค็นโดยตรงอื่น ๆ Parcl ไม่มีข้อจำกัดในการเข้าร่วม อนุญาตให้ผู้ใช้ Web3 ส่วนใหญ่เข้าร่วมได้โดยตรง (ยกเว้น สหรัฐอเมริกา) ซึ่งทำให้ขยายธุรกิจได้ง่ายขึ้น

แม้ว่าเกณฑ์จะไม่ถูกจำกัด แต่รายได้ที่จำกัดอาจกลายเป็นหนึ่งในปัจจัยจำกัดสำหรับการขยายธุรกิจ เนื่องจากคุณสมบัติตามธรรมชาติของอสังหาริมทรัพย์ ความผันผวนของตลาดจึงต่ำกว่าตลาด crypto ทำให้เหมาะสำหรับนักลงทุนที่แสวงหาความมั่นคงและคุ้นเคยกับอสังหาริมทรัพย์มากขึ้น ความกระตือรือร้นในการซื้อขายของผู้ใช้ Web3 อาจถูกขัดขวาง

นอกจากนี้ ตามแบบจำลองทางเศรษฐกิจโทเค็นที่เผยแพร่อย่างเป็นทางการโดย Parcl อุปทานเริ่มต้นมีเพียง 7% -8% เท่านั้น โทเค็นบางตัวอาจได้รับรางวัลสำหรับการเข้าร่วมในการทำธุรกรรมหรือเพิ่ม LP ให้กับโมเดลเพื่อดึงดูดผู้ใช้ให้เข้าร่วมมากขึ้นและดำเนินการต่อ ดึงดูดการจราจร

โดยสรุป พื้นฐานของโครงการ Parcl นั้นดี และการพัฒนาในภายหลังขึ้นอยู่กับกลยุทธ์โทเค็นหลังการ Airdrop