每周编辑精选 Weekly Editor's Picks(0224-0301)

「每周编辑精选」是Odaily星球日报的一档“功能性”栏目。星球日报在每周覆盖大量即时资讯的基础上,也会发布许多优质的深度分析内容,但它们也许会藏在信息流和热点新闻中,与你擦肩而过。

因此,我们编辑部将于每周六从过去 7 天发布的内容中,摘选一些值得花费时间品读、收藏的优质文章,从数据分析、行业判断、观点输出等角度,给身处加密世界的你带来新的启发。

下面,来和我们一起阅读吧:

投资与创业

HashKey Capital: 2024 年Web3投资赛道全解析

HashKey Capital 对 ZK、AA、意图、DA、Rollup Frameworks & RaaS、Cosmos、安全、AI、DeFi、Gaming & Entertainment、机构服务、比特币、DePIN 赛道进行的分析和梳理,对快速建立对当前行业的认知有很大帮助。

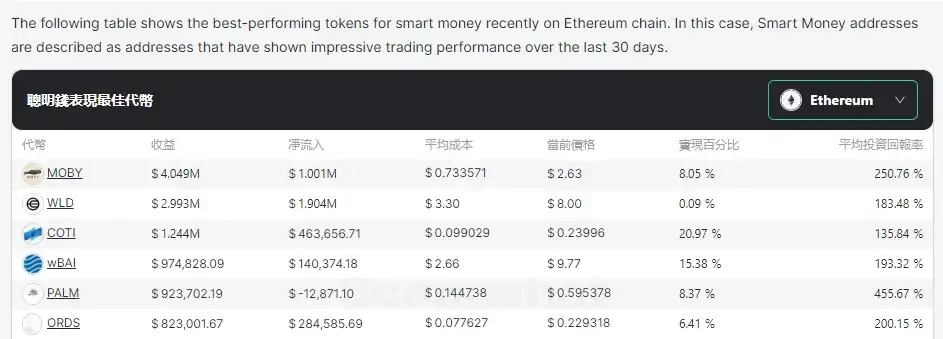

0xScope 的 Smart Money 获利最大币种排名榜单中 AI 概念代币占据半壁江山,主要是 Sora 引发的市场热情延伸至加密市场,而榜首的 MOBY 则是社区人气颇高的项目,主打“社区驱动”和“代币分发公平理念”。

0xScope 的 Smart Money 获利最大币种排名榜单中 AI 概念代币占据半壁江山,主要是 Sora 引发的市场热情延伸至加密市场,而榜首的 MOBY 则是社区人气颇高的项目,主打“社区驱动”和“代币分发公平理念”。

综上,市场关注度+公平分发+小流通市值是这轮行情链上高收益品种的共同点。

总量要大,单价要低;设计流行文化符号;凝聚更多“社区共识”;尽量选择资金与用户最多的主流公链(以太坊与 Solana);善用空投吸引市场目光数据.

空投机会和交互指南

近半年,积分制(交易量为主或存款为主)成为大部分项目的空投参考指标,采用存款积分制的项目一般会使用一些软性的反女巫方法。跟明码标价 APY 的 DeFi 挖矿不同,积分制引导下的用户,把自己的一切行为参考建立在“项目未发布的代币经济模型、未发布的空投分配方案、无法预测的市场未来状况”等条件下,进行盲挖,挖积分实际上是用户与项目方之间针对信息不对称展开的博弈,考验用户的投研能力。

空投积分本质上是无限通胀的,对于资金小的用户来说,大户们的参与是对空投份额的稀释。空投对象愈发注重核心玩家,“阳光普惠”给多链用户。

未来的空投规则参考条件趋势有:官方背景的 NFT 绑定空投份额,项目方空投有重视开发者的倾向,与专业猎巫机构合作筛选合格用户。撸毛用户也在从 EVM 链向其他链扩散,从关注大额融资项目到关注小而精。空投标准从交互式到存款式,未来以用户的沉淀资金为主要标准,可能是常态,这反映的是用户和项目方之间的博弈和需求的变化。

对于羊毛党来说,大众空投、遍地捡钱的黄金时代已然成为历史,未来的空投叙事将何去何从,一切都要考虑到那具经典的“一个人的成功固然要靠自身的努力,但也要考虑历史的进程”。

出售空投代币的最佳时间可能是在收到空投代币后的 14 天内。

重点介绍了 Berachain、OKX 的 X 1、Axiom、Metis、Pryzm、Taiko、Fuel。

依次介绍了 Rabby Wallet、Rainbow 钱包、MetaMask、Eigenpie、Kelp DAO、Renzo、ether.fi、Meteora、Drift Protocol、Pike、Bungee、Jumper、deBridge、Owlto Finance、Polyhedra Network、El Dorado、Azuro、Clip Finance、Struct Finance、Scroll、Linea、zkSync、Mode、Rysk Finance、LogX、Hyperliquid、Aevo。

比特币生态

2023 年定期出现的交易费用飙升帮助矿工收入显着增加。 2023 年交易费用总计 23445 枚比特币,其中 Ordinals 交易贡献 5000 枚比特币。 2023 年的费用是 2022 年交易费用总和的 4 倍以上,总计 5375 枚 BTC。

随着区块空间需求的波动, 2024 年算力价格波动性将增加,导致交易费用急剧波动,从而导致算力进一步变化。预计 2024 年网络算力将在 675 EH 到 725 EH 之间。

面临收入波动和对交易费用高度依赖的比特币矿商正在积极评估新的风险管理策略,包括算力衍生品合约等工具,以确保收入的可预测性、稳定性并维持投资者的信心。

减半后,交易费用波动性上升,将成为哈希价格、难度和区块时间差异的重要驱动因素,并对矿池支付计划和矿工削减信号产生更广泛的影响。

在 Bitcoin Magazine 的定义下,比特币L2需使用比特币作为原生资产,使用比特币作为结算机制来强制执行交易,展示对比特币的功能依赖性。

水滴资本创始人大山认为,从广义的 BTC Layer 2 上来说,只要消耗 BTC 作为 Gas 或者以 BTC 为底层资产,可以做为 DApp 平台,性能又远优于 BTC 一层,都算比特币 Layer 2 (包括但不限于基于 Indexer 的应用平台、EVM rollup、EVM crosschain、侧链、闪电网络和 RGB 等)。而从狭义的 BTC Layer 2 上来说,需要同时至少满足下面两个条件:

1、是否跟 BTC 共享安全。

2、是否抗审查。

定义和实际情况的混乱本身并不意味着失控或无序,相反,它是一种探索和实践的过程,是建设性发展的前奏。

以太坊与扩容

Layer 2 估值存在理论上的“玻璃天花板”,以太坊 L1 通过其共识机制保障了 L2 活动的安全性,从而理论上限制了 L2 的价值不应超过 L1。

激进的代币释放和激励措施会在这个周期中持续下去,直到 Layer 2 竞争出现明显的赢家为止。

因此,Layer 2 作为一个类别,总体上在价格表现方面将落后。

多生态

Metis 的 Hybrid Rollup 使得 Metis 在处理大量交易时既高效又安全,而且整个系统的可扩展性不会受到限制,任何与 EVM 兼容的 DAPP 都可以无缝接入到 Metis 上。其最让人眼前一亮的,是即将上线的去中心化排序器。Metis 推出的 MetisEDF 发展计划是过去两年以来所有L1/L2中最大的生态激励基金(按 METIS 约 106 U 计算)。

Metis 生态的质押协议如 ENKI 降低的是排序器节点质押的门槛。这给到了普通用户更多的收益机会。

其他生态重点项目还有 DEX 聚合器 Hera Finance、借贷协议 Aave、DEX Hermes Protocol 和 Net Swap、永续交易协议 Tethys Finance、跨链桥 Stargate、专为 Metis 去中心化排序器池设计的流动性质押协议 Artemis Finance、DeFi 协议 WAGMI。

Metis LSD 生态挖掘:Layer 2 与 LSD 的首次碰撞

Metis 独特的去中心化排序器池技术方案形成了质押需求,因而 LSD 成为了社区参与去中心化建设最便捷高收益的通道。

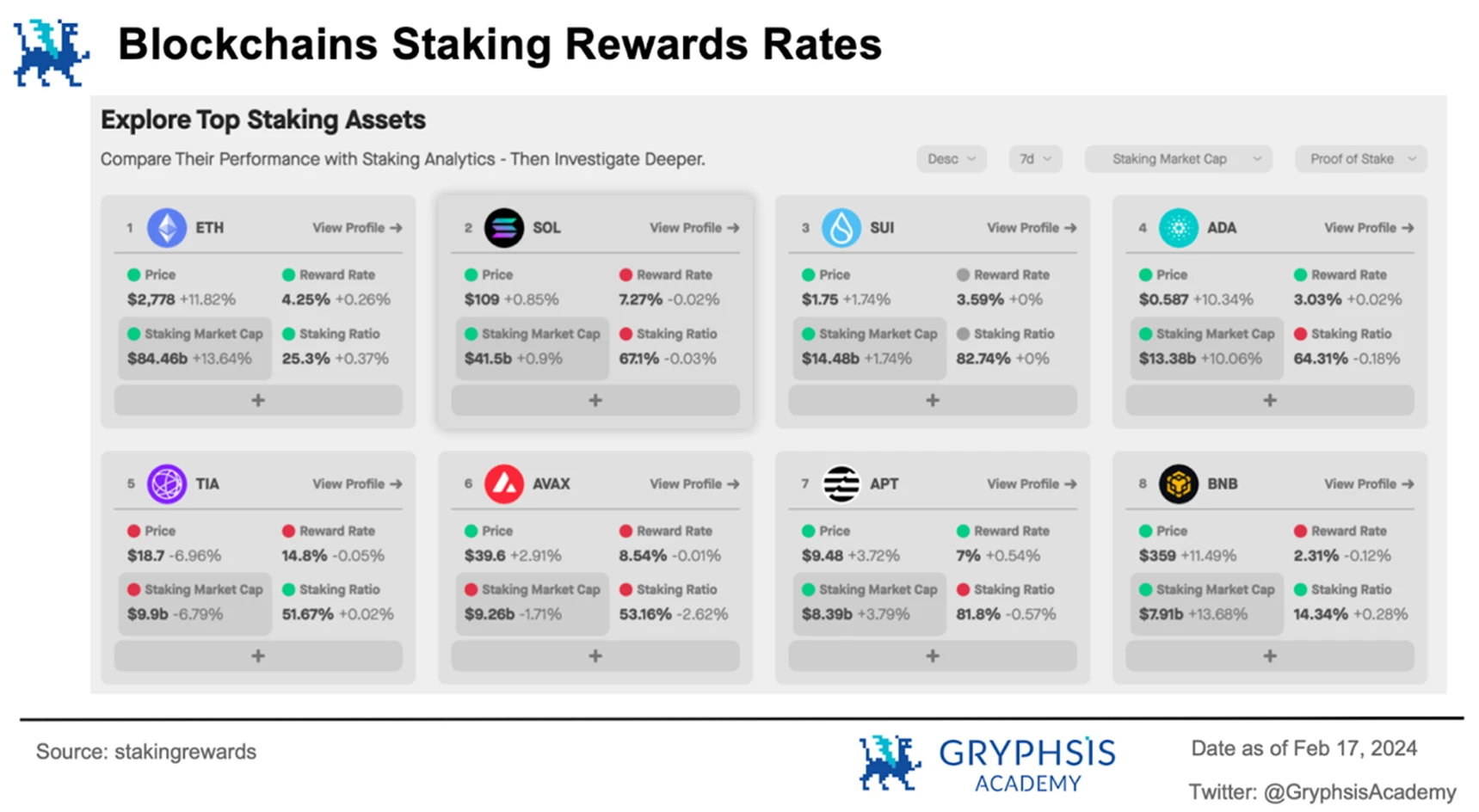

为了大力发展流动性质押赛道,Metis 官方发行了众多生态激励计划如 MetisLSB,给予 LSD 协议 20% 的年度挖矿收益率,远超只有 4.25% 的以太坊和其他网络。

新兴协议如 ENKI、Artemis 已经发起社区提案,其代币经济学和即将推出的生态活动将作为早期空投的重要标准,值得关注。

DeFi

Galaxy: 10 张图解读 RWA、DeFi 和以太坊生态的活力

DeFi 中对加密原生资产取代 RWA 的需求持续存在。

尽管大规模空投已经结束,用户仍继续涌向 DeFi,但 1 月份 DEX 的保留率有所下降。 这表明 DeFi 用户出现了一些流失或投降。

IOSG Ventures:详解 OEV 的来源、工作原理与相关协议

当现实世界的资产价格与它们在区块链上的(滞后的)更新之间存在差距时, OEV(预言机可提取价值)就会出现,为那些利用这种预言机更新后行动的 searcher 提供了盈利机会。

Uma 的 Oval 采用了一种新颖的方法来管理 OEV,通过利用包装 Chainlink 预言机更新,让 searcher 对价格 feeds 进行出价。然后,它被发送到 MEV-Share,以促进一个私人订单拍卖流程,并最终将价值返回给协议。

虽然 OEV 的存在呈现了问题,但像 Uma Oval 这样的创新解决方案可以缓解其负面影响,为一个更公平、更可持续的 DeFi 未来提供了一个蓝图。

SocialFi

解读 Farcaster:「DEGEN」成为应用内最高频词语

在增长的这个阶段,保持 Farcaster 参与度的是一种核心文化,即人们慷慨地分享他们的问题、回答、点赞、打赏和想法。

长内容更受欢迎。

另一个值得赞许的点是:底层协议及其社交图谱是开放且可分析的。

一周热点恶补

过去的一周内,BTC 突破 6.4 万美元,带动加密市场大涨,加密货币概念股集体上涨,Coinbase 跃升为全球第四大上市交易所,美国法官批准币安支付 43 亿美元罚款的认罪协议,FTX 同意以 3270 万美元将 FTX Europe 回售给其创始人;

此外,政策与宏观市场方面,美 SEC 就引入比特币现货 ETF 期权交易的可能性征求公众意见;

观点与发声方面,中本聪的早期言论及电子邮件历史记录见光,区块链之父:区块链是为 NFT 诞生的,而不是加密货币,Vitalik 推荐 Elon Musk 在新电脑上使用 Linux 开源操作系统,Arkham:美国政府地址转移超 10 亿美元比特币,来自被扣押的 Bitfinex 黑客资金,灰度 CEO:去年胜诉 SEC 后经常收到并购提议,对此持开放态度,Matrixport 分析师:牛市会持续到明年二月或九月,BTC 会到 12.5 万美元,EOS CEO 表示将扭转代币通胀,分析:Worldcoin 面临价值泡沫风险,隐性增发或触发价格峰值回落,SBF 与狱警分享加密市场投资建议,并推荐投资 SOL;

机构、大公司与头部项目方面,苹果将逐步结束长达十年的电动汽车项目 Titan,转向生成式 AI 领域,Matrixport HK 已递交香港虚拟资产交易平台牌照申请,DWF Labs 推出 OTC 交易平台 Liquid Markets,Uniswap 推出无需 Gas 费用的网页端限价订单功能,推出网页插件钱包,Frax Finance 考虑引入类似 Uniswap 的代币质押者奖励机制,Jupiter LFG Launchpad 投票将于下周开启,Ethena:Shard Campaign 第 2 期本周上线拟新增支持 Pendle,Telegram拟向长期投资者折价出售 TON 以限制其代币持仓比例至 10% ,Telegram 创始人:广告平台拟于三月开放,频道所有者可获 Toncoin 经济奖励,Arweave 上线并行计算层 AO,Blast BIG BANG 公布竞赛结果,Blast主网上线,空投的 50% 将分配至积分用户,Portal 启动质押,Aevo:已进行两次快照,下周末将进行另一轮快照,空投分配优先早期用户和挖矿提升计划参与用户;

NFT、GameFi、SocialFi 领域,Gas Hero 游戏将暂停,重回封闭测试状态,重新设计规则,friend.tech 发文并配图暗示或将于今年春季进行空投,Lens Protocol 宣布放开许可限制,允许所有用户公开访问;

安全方面,MicroStrategy X 帐户疑遭攻击并发布钓鱼空投链接……嗯,又是跌宕起伏的一周。

附《每周编辑精选》系列传送门。

下期再会~