극한의 속도 생존 매뉴얼: 미끄러운 사람만이 승리한다

오리지널 - 오데일리

저자 - Nan Zhi

약세장에서 다양한 거래 플랫폼은 시가총액이 작은 통화에 대한 단기 압박과 가격 상승을 반복적으로 경험했으며 자금 조달 비율은 종종 큰 마이너스 값을 나타냅니다. 시장에서 자주 사용되는 두 가지 전략이 있습니다.

또는 금리를 부과하기 전에 결제 자금 요율을 얻기 위해 롱 포지션을 개설하세요.

또는 정산 전 숏 포지션을 오픈하고 정산 후 즉시 포지션을 청산하여 롱 포지션 청산으로 인한 하락세를 확보할 수 있습니다.

오데일리는 시장 데이터를 기반으로 바이낸스의 수수료율이 -0.5%를 초과하는 경우에 대한 통계를 실시하며, 다회차 K라인 결과를 바탕으로 다른 데이터는 고려하지 않고 상승 및 하락만을 탐색한다.확률 측면에서 어떤 전략이 이익 확률이 더 높습니까?。

(표시기 설명:아래 모두높은 마이너스 금리모두 -0.5%보다 큰 상황을 의미합니다.아래 모두폴마이너스 청구율비율이 -1.5%보다 큰 상황을 말합니다.본 글은 역사적 상황에 대한 통계적 분석일 뿐이며, 향후 시장 동향에 대한 투자 가이드가 아닙니다. )

전반적인 상황

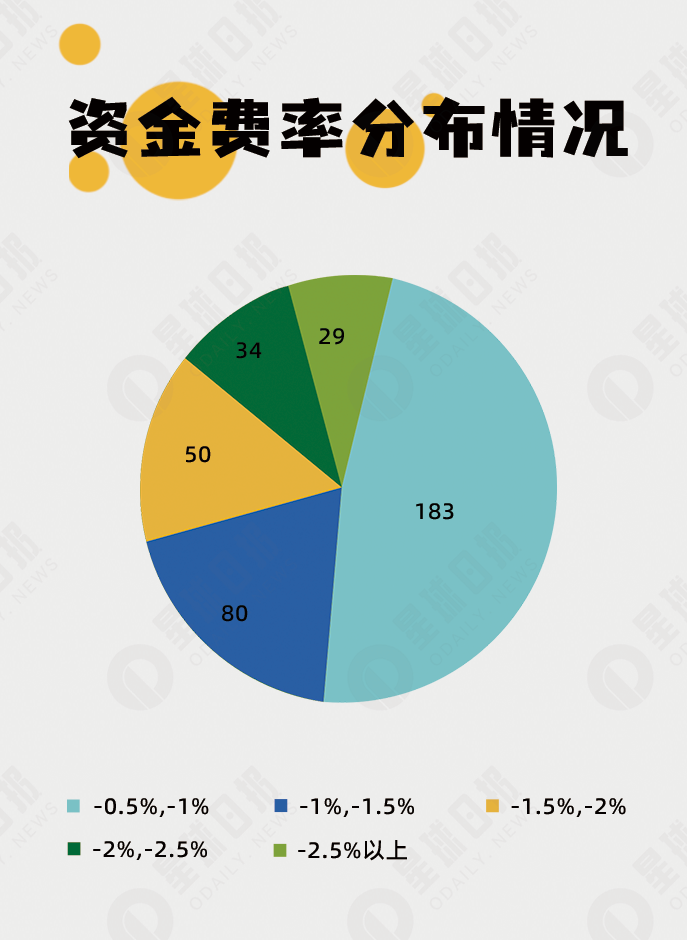

2023년 이후 바이낸스의 펀딩 비율이 -0.5%보다 높은 경우는 376번(평균 -1.209%)이었습니다. 각 금리대별 빈도는 다음과 같으며, 고금리 376회 중 -1.5%를 넘는 경우가 113회로 30.2%를 차지하며, 금리가 고금리와 마이너스 금리로 전환되기 시작하는 시점을 알 수 있다. , 극한의 가능성이 높습니다. .

일상적인 통계 차원은 다음과 같습니다.

시간:1분, 3분, 5분, 4시간, 8시간, 24시간이 포함됩니다.

단기 펀딩 비율은 수집 후 변동폭이 크며, 반드시 수집 후 1분 이내에 최저점이 발생하는 것은 아니므로 비교 대상으로 1분, 3분, 5분을 선택하였습니다.

반면에 단기 시장이 장기간 지속될 경우도 있으며 일부 장기 주문 사용자는 장기간 보유를 선택하므로 4시간, 8시간, 24시간을 선택하여 관찰합니다. 장기적인 시장 지속으로 인해 장기 주문이 수익성을 갖게 될 가능성.

가격:

수동 사용자가 최저점에서 포지션을 청산하기 어렵기 때문에 단기적으로 최저 가격과 종가를 선택합니다.

장기적으로는 최고가와 종가가 선정되며, 장기적으로 시장이 지속되어 매수 주문이 수익성을 얻을 확률도 관찰됩니다.

종가는 순간적인 극단적인 변동의 영향을 제거하기 위해 고안되었으며, 최저가/최고가와의 비교에 사용됩니다.

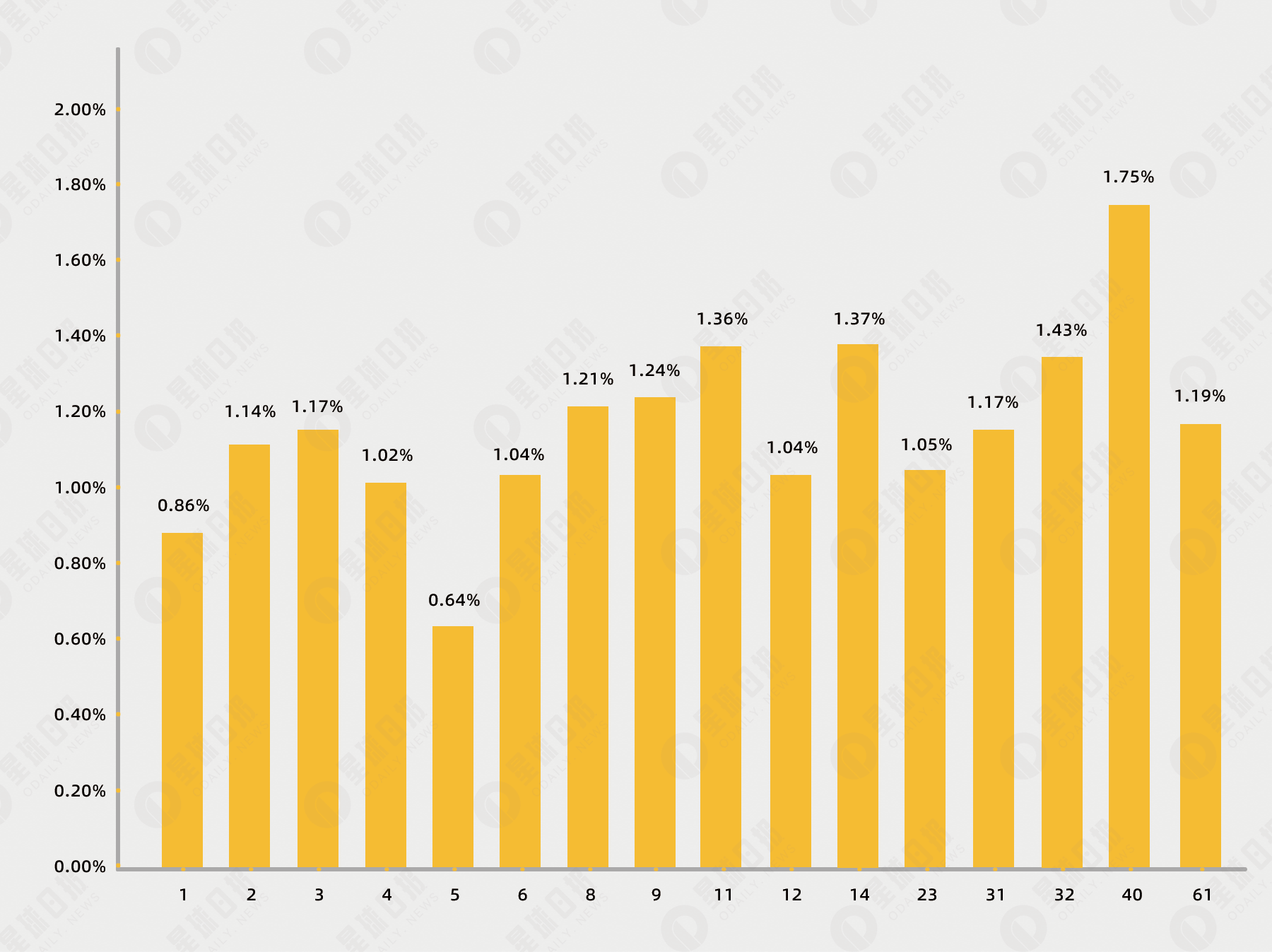

단기 상황통계

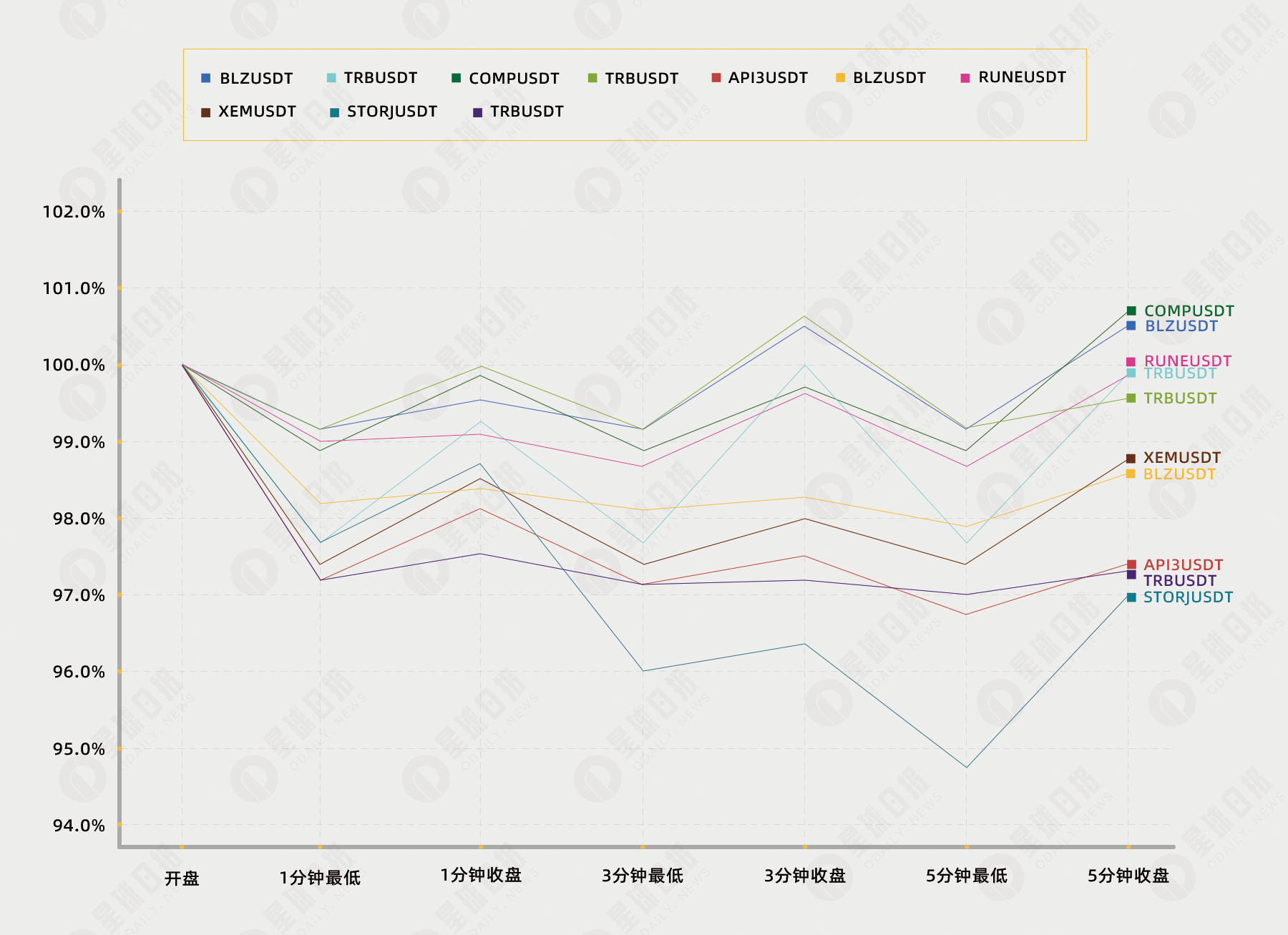

1분 평균 최대 하락률은 1.90%, 1분 평균 마감 하락률은 1.11%입니다.

3분 평균 최대 하락률은 2.12%, 3분 평균 마감 하락률은 1.05%입니다.

5분 평균 최대 하락률은 2.26%, 5분 평균 마감 하락률은 1.07%입니다.

모든 사례의 포괄적인 데이터를 바탕으로 몇 가지 예비 결론이 있습니다.

평균 수수료율 1.209%에 비하면, 충전 수수료율 종료 후 짧은 시간 내에 롱 포지션을 청산할 경우 수익을 얻을 확률은 매우 낮습니다.

1분, 3분, 5분 최대 하락폭은 계속해서 신저점을 경신했고, 해당 종가도 거의 동일했습니다. 이는 이 기간 동안의 추세가 W자형으로 크게 변동했음을 나타냅니다.

두 번째 요점에 따르면, 숏 포지션은 수익 확률이 높고 포지션 청산 기회가 더 많습니다.

아래 그래프에서는 10개의 토큰이 무작위로 선택되었으며, 대부분은 W자형 추세를 뚜렷하게 나타냅니다.

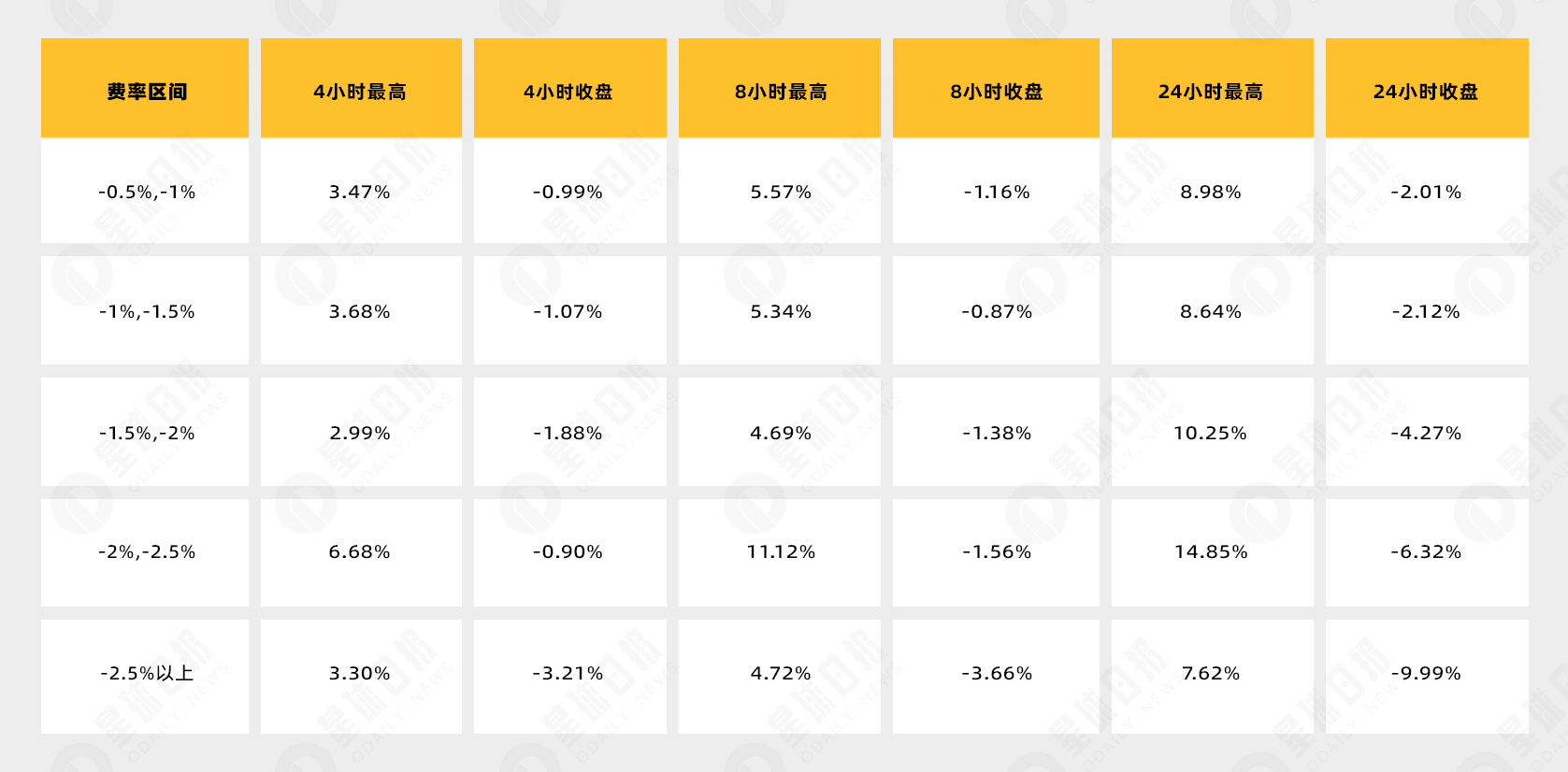

장기 통계

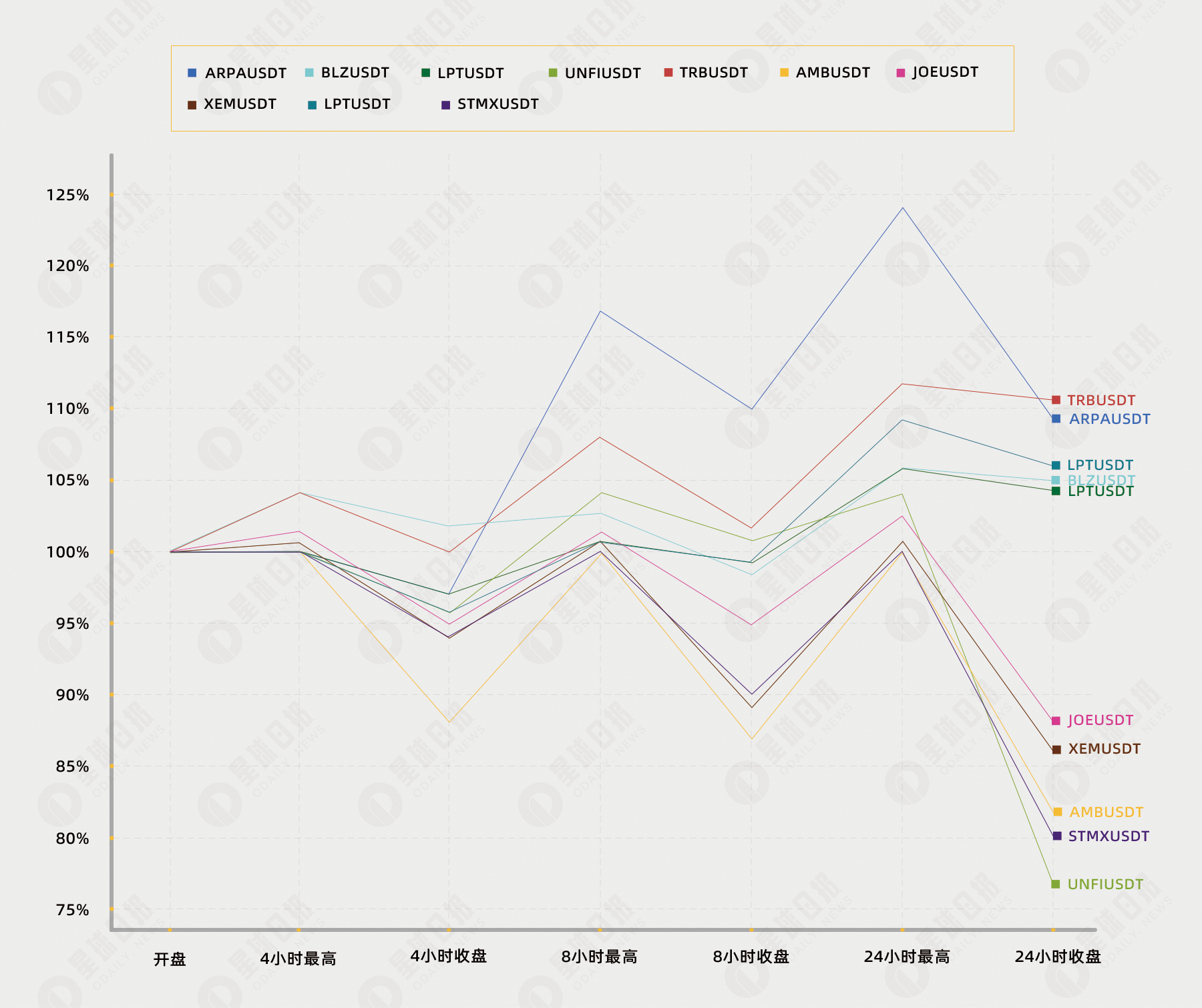

4시간 평균 최대 상승률은 3.73%, 4시간 평균 마감 상승률은 -1.29%입니다.

8시간 평균 최대 상승률은 5.84%, 8시간 평균 마감 상승률은 -1.36%입니다.

24시간 평균 최대 증가율은 9.5%, 24시간 평균 마감 증가율은 -3.34%입니다.

요약하면 결론은 다음과 같습니다.

평균 수수료율 1.209%에 비해 상승세가 일정 기간 보유하기로 선택하면 펀딩 수수료율과 수익 증가를 모두 얻을 수 있는 기회를 갖게 됩니다.

4시간, 8시간, 24시간 최대 증가폭은 계속 상승하지만 마감 증가폭은 모두 음수로 24시간 이내 이 기간 동안 추세가 M과 유사하고 변동폭이 격렬함을 나타냅니다.

24시간 종가는 8시간 종가보다 현저히 낮습니다. 이는 대부분의 마이너스 금리 시장이 24시간 이내에 종료된다는 의미일 수 있습니다.

아래 그래프를 위해 10개의 토큰이 무작위로 선택되었으며, 대부분은 상당한 M자형 추세를 가지고 있습니다.

빈도 및 비율 수준에 따른 분류 통계

빈도가 요율에 미치는 영향

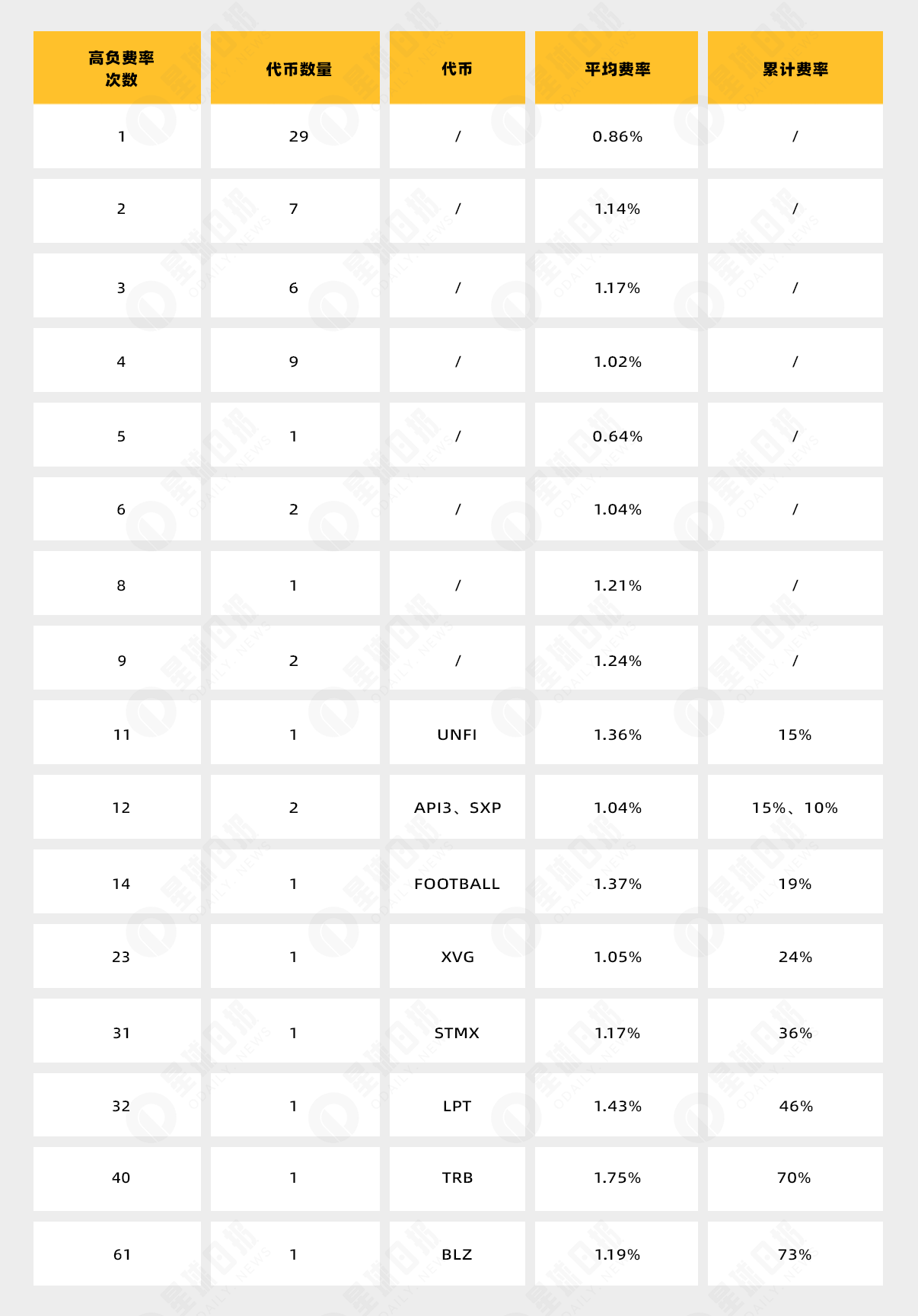

빈도:2023년 각 토큰이 높은 부정률을 경험한 횟수를 통계적 차원으로 보면 총 66개의 토큰이 포함되며, 토큰 중 거의 절반이 높은 부정률이 1회만 있고, 10배 이상의 높은 부정률이 있습니다. 상황 토큰은 9개뿐입니다.

평균 요율:높은 네거티브 수수료 발생 빈도가 증가함에 따라 크게 증가하지는 않았으나, LPT, TRB 등의 토큰은 널리 확산되면 모두 풀 네거티브 수수료(-2.5% 또는 -3%)를 가지게 되어 풀네거티브 수수료에 도달하게 되는 것을 알 수 있습니다. 마이너스 수수료(Negative Fees) 금리 전후로 장기간에 걸쳐 적당한 마이너스 금리 수준을 유지해 왔습니다.

누적 비율:15%를 넘을 확률은 낮지만, 장기 보유자의 경우 가격이 두 배로 오르기 때문에 수수료 측면에서 여전히 수입이 상당하다.

아래 그림은 다양한 빈도에 따른 평균 수수료율을 보여주며, TRB와 COMP(5개의 높은 마이너스 수수료율)만이 다른 토큰과 큰 차이를 보입니다.

가격 추세에 대한 요율의 영향

이 섹션에서는 마이너스 금리가 높을수록 단기 하락폭이 커지고 장기적 상승폭이 커지는지 살펴봅니다.

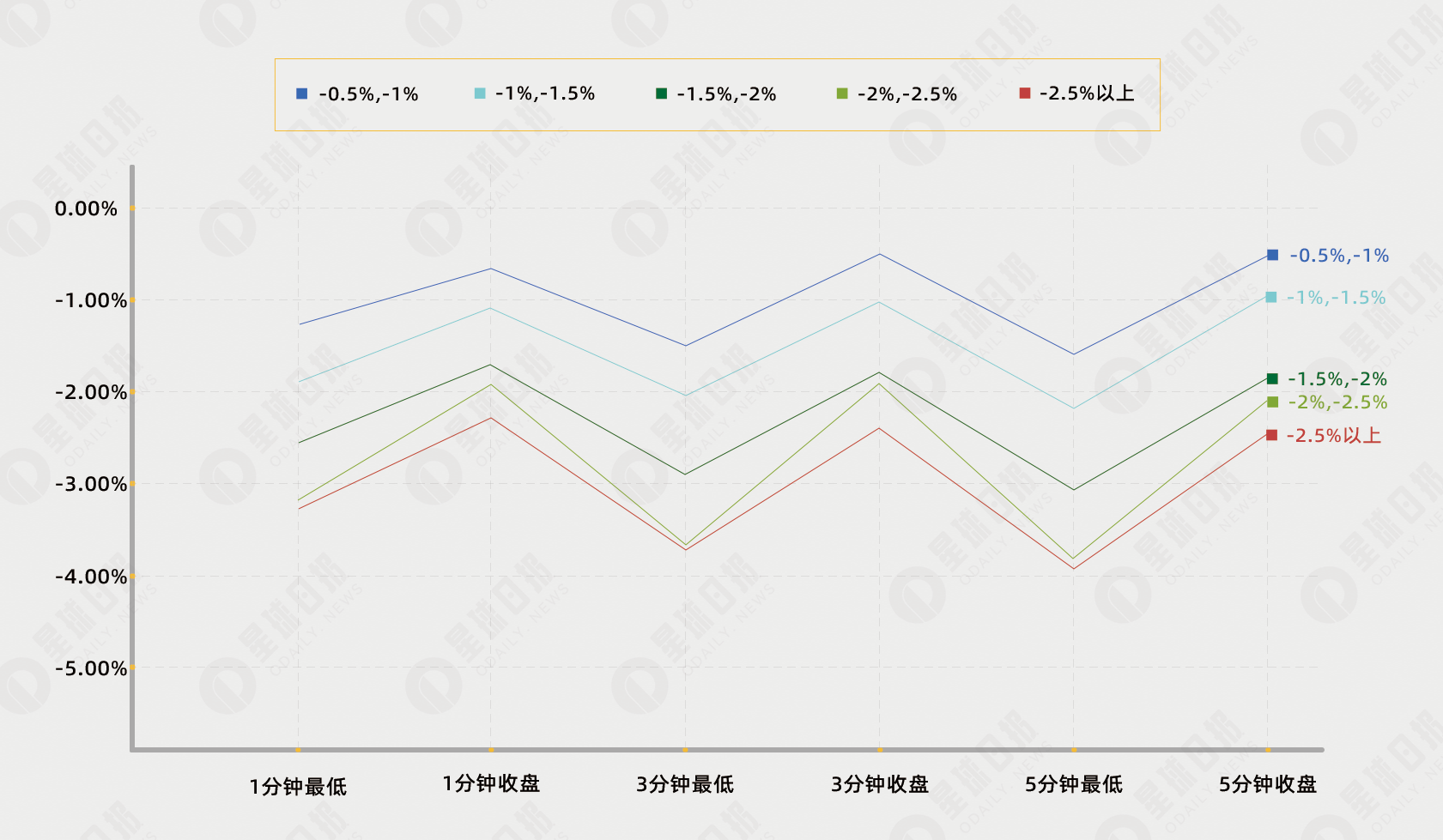

아래 차트는 모든 범위의 단기 추세를 보여줍니다.

등급을 매긴 후, 각 구간의 단기 규칙은 전체 규칙과 일치합니다. 즉, ① W자형 추세, ② 매도 포지션은 수익으로 포지션을 청산할 기회가 있고, ③ 매수 포지션은 수익 확률이 높습니다. 종가;

마이너스 수수료율의 정도가 높을수록 단기적인 하락 폭은 더욱 심해지지만, 종가는 기본적으로 수수료율과 동일합니다.

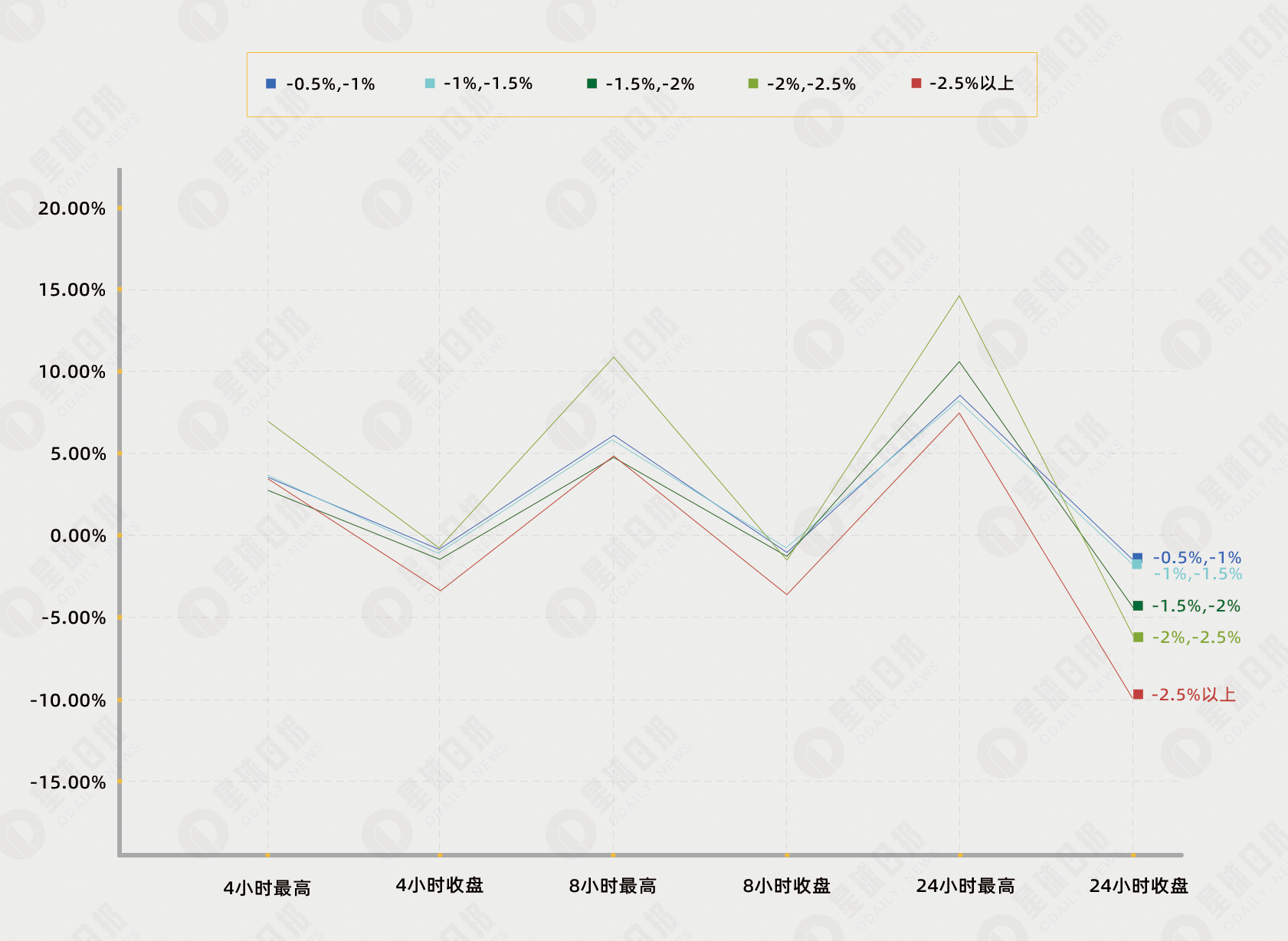

아래 차트는 모든 범위의 장기 추세를 보여줍니다.

등급을 매긴 후 각 구간의 장기 규칙은 전체 규칙과 일치합니다. 즉, ①M자형 추세 ②강세자는 이익을 보고 포지션을 청산할 기회가 있습니다. ③시장은 빠르게 종료됩니다.

마이너스 금리의 정도가 높아질수록 증가폭은 크게 늘어나지 않습니다.

가격 추세에 대한 빈도의 영향

단기 시장

높은 부정적인 비율이 하나만 있었던 토큰에 대한 29개의 높은 부정적인 비율 중,

1분 최대 하락폭은 펀딩비율 28배, 수익율은 97%에 달했고, 1분 마감 하락폭은 펀딩비율 17배, 수익률 59%에 달했습니다.

3분 최대 하락률은 100%, 3분 최대 하락률은 41%, 3분 최대 하락률은 41%입니다.

5분 최대 하락률은 100%, 5분 최대 하락률은 48%, 5분 최대 하락률은 48%입니다.

비교를 위해 LPT는 32번의 높은 부정률을 경험했습니다.

1분 최대 하락폭은 펀딩비율 32배, 수익율은 100%에 도달했고, 1분 최대 하락폭은 펀딩비율 27배, 수익율 84%에 이르렀습니다.

3분 최대 하락률은 100%, 3분 최대 하락률은 69%, 3분 최대 하락률은 69%입니다.

5분 최대 하락률은 100%, 5분 최대 하락률은 69%, 5분 최대 하락률은 69%입니다.

또는 수수료율의 극단성으로 인해 LPT의 단기 이익 확률은 단일 높은 수수료율보다 훨씬 높습니다.

비교를 위해 BLZ는 61번의 높은 부정률을 경험했습니다.

1분 최대 하락폭은 펀딩비율 61배, 수익율은 100%에 달했고, 1분 마감 하락폭은 펀딩비율 46배, 수익률 75%에 달했습니다.

3분 최대 하락률은 100%, 3분 최대 하락률은 69%, 3분 최대 하락률은 69%입니다.

5분 최대 하락률은 100%, 5분 최대 하락률은 62%, 5분 최대 하락률은 62%입니다.

BLZ의 극한율의 경우 확률은 LPT와 유사하며, 이 역시 단일고율에 비해 상당히 높습니다.

단기적으로 높은 마이너스 수수료율이든, 뚜렷한 단기 압박 상승 시장이든, 단기적인 차원은 다음과 같다는 것을 알 수 있습니다.짧은 지배력。

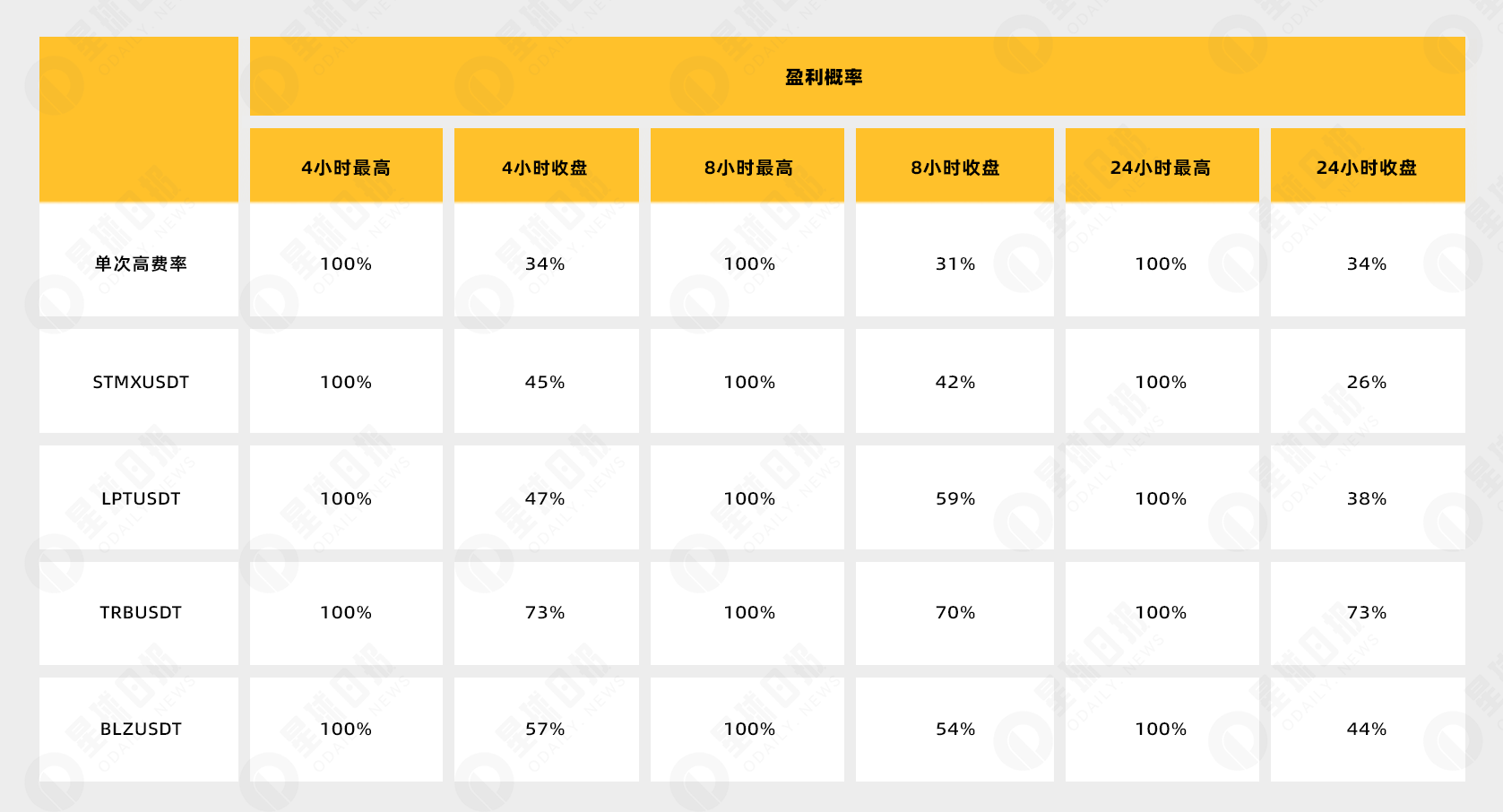

장기 시장

마찬가지로 29개의 높은 마이너스 금리 중

최대 4시간 증가폭은 펀딩비율 29배로 수익율 100%를 기록했고, 4시간 마감 증가폭은 펀딩비율 10배 높아 수익율 34%를 기록했다.

8시간 최대 증가율은 100%, 8시간 최대 증가율은 31%, 8시간 최대 증가율은 31%입니다.

24시간 최대 상승률은 100%, 24시간 최대 상승률은 34%, 최대 상승률은 34%입니다.

장기적으로는 위에서 언급한 시장의 빠른 종료 특성으로 인해 장기 마감 이익이 발생할 확률이 크게 감소합니다.

가장 높은 점수는 전적으로 개인 거래 기술에 따라 달라지며 참고용으로만 설명됩니다.충전율이 시장의 끝은 아니다.

고비율의 빈도가 가장 높은 4개의 토큰도 통계용으로 선정했는데, 발생한 숏스퀴즈 시장을 기준으로 선정되었기 때문에,이 통계에는 상당한 표본 편향이 있으며 이 섹션은 참조용으로만 사용됩니다., 후속 유사한 상황에 대한 안내 중요성이 거의 없습니다.

결론적으로

2023년 바이낸스의 높은 네거티브 수수료 상황을 기반으로 오데일리는 다음 두 가지 전략에 대한 데이터 통계를 실시했습니다.

장기 전략: 결제 자금 요율을 얻기 위해 수수료를 부과하기 오래 전에 개시합니다.

매도 전략: 결산 전에 매도 포지션을 개설하고 결산 후 즉시 포지션을 청산하여 매수 포지션 청산으로 인한 하락세를 확보합니다.

단기 운용 차원에서는 숏 전략이 확률적으로 확실한 우위를 갖고 있으며 종가에서도 숏 포지션이 수익의 대부분을 차지한다.

장기 운영 차원에서는 장기 전략이 확률적으로 약간의 우위를 갖고 있으며, 높은 마이너스 금리가 발생한 후에도 일반적으로 여전히 상승 추세를 보입니다.