EigenLayer研报:加固以太坊安全,激发质押新纪元

以太坊升级后,一场质押狂潮席卷而来!而在这股潮流中,有一个协议引人注目:EigenLayer。它不仅能让你通过再质押获得额外收益,还能大幅提升以太坊的安全性。它是如何做到的呢?让我们一起探索 EigenLayer 所带来的无限可能。

背景

以太坊升级后掀起一股质押热

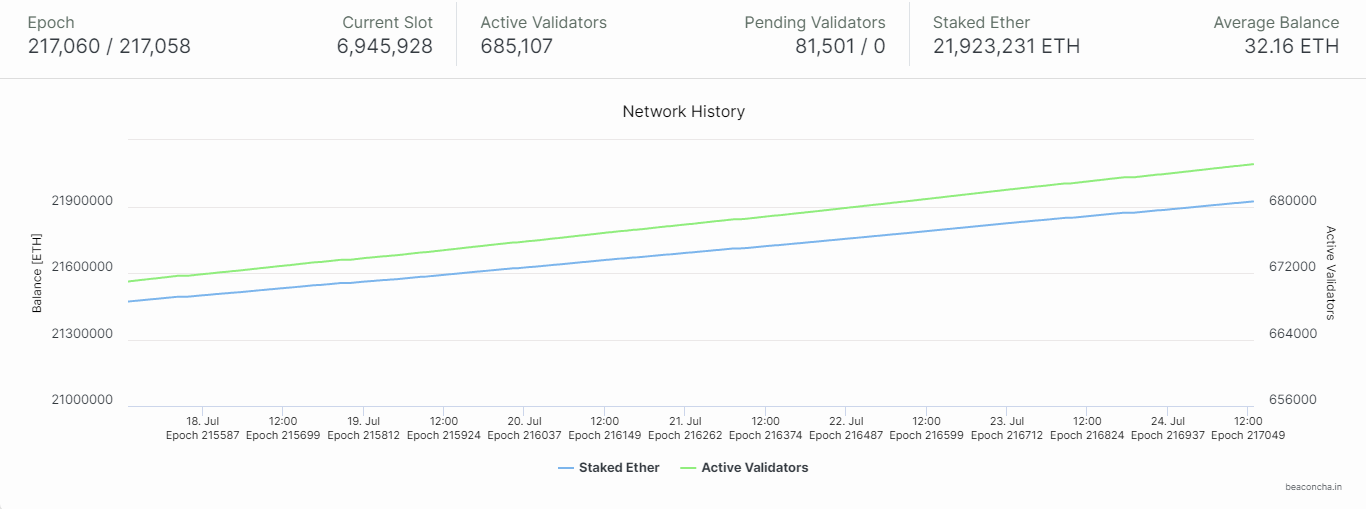

2023 年 4 月 12 日以太坊上海升级后,进一步激活了以太坊网络的活力,吸引了更多的验证者质押 ETH。根据 beaconcha.in 的数据显示,截止 7 月 24 日以太坊总质押量达到 21923231 ETH,并且质押量仍在不断上升。

同时根据欧科云链的数据显示,上海升级后除了前几日 ETH 的提取量大于新增质押量外,总体上日新增质押量大于提取量,并且这是自 2022 年 9 月 15 日 The Merge 后日新增质押量最大、持续时间最长的一股以太坊质押热。

以上两组数据不仅反映了投资者对于以太坊未来发展的看好,并且也刺激了 ETH 再质押赛道的发展,随着被质押 ETH 的增长,ETH 质押者不会只满足于质押的年化收益,他们也在寻找获得更大收益的方式,EigenLayer 正好可以满足他们的需求。

破裂的信任网络

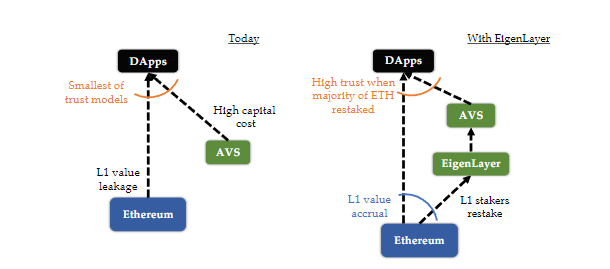

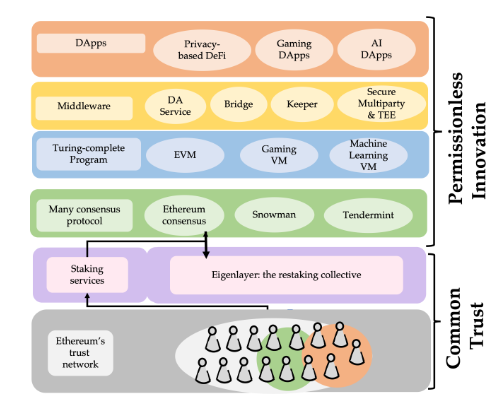

以太坊通过在以太坊虚拟机(EVM)上的完全可编程性和模块化区块链的概念,支持开发者可以在以太坊的共识层上无需许可的构建 DApps,以太坊的共识网络为所有构建在其上的 DApps 提供信任与安全性。

但是现在许多的协议或中间件并没有完全利用以太坊的信任网络。例如 Rollup,虽然其通过将执行交易从 EVM 上剥离,交易结算时再回到以太坊的方式扩展了以太坊的性能,但本质上因为没有在 EVM 上部署和证明所以无法完全利用以太坊的信任网络。

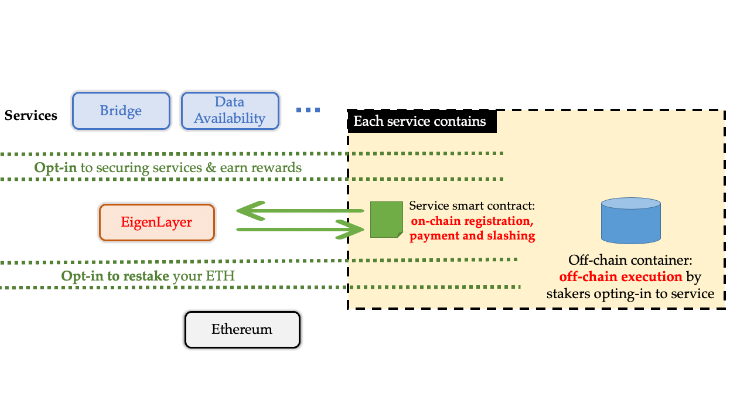

不仅是 Rollop,其他的非以太坊应用如基于新共识协议的侧链、数据可用层、新的虚拟机、预言机、跨链桥等都无法直接使用以太坊的共识。所以为了安全性与防止作恶,它们必须构建自己的信任层,也就是主动验证服务(AVS)。

然而,自己构建 AVS 有以下四个缺点:

新型共识网络启动困难:搭建一个新的共识网络并非易事,并且还要投入成本引导用户信任其共识网络,这会占据团队大量的资源、精力,普通的小团队是承担不起的。

价值流失:随着 AVS 的增多,这就意味着用户向以太坊支付交互费用外,还要向这些 AVS 支付信任费用。

资本成本负担过大:AVS 的质押验证者实际承担了很大的资金成本和机会成本。那么为了激励 AVS 的质押验证者们,AVS 必须提供足够高的质押回报以覆盖质押者的机会成本。然而这对于现在运营中的大多数 AVS 来说,要覆盖的资本成本已经远高于运营成本。

使 DApps 的安全性降低:使用 AVS 会削弱 DApp 的安全性,因为使用甚至依赖中间件的 DApp 的安全本质上是由以太坊的共识层和 AVS 共同维护的。但是相比于以太坊,黑客攻击中间件的成本较低且成功可能性更大。例如对于像预言机或者跨链桥这样只有少量质押量或节点来保护的关键模块,以太坊提供安全保障意义可能就不大,因为攻击 AVS 的成本远低于攻击以太坊的成本。

EigenLayer 是什么

简单的理解,EigenLayer 是一个基于以太坊的再质押(Restaking)协议,允许用户将 ETH、lsdETH(流动性质押的 ETH)及 LP Token 重新质押在其他侧链、预言机、中间件等,作为节点并得到验证奖励,这样第三方项目可以享受到 ETH 主网的安全性,ETH 质押者也能得到更多收益,实现了双赢。

以下将详细介绍 EigenLayer 运行的三个部分:再质押模式、自由市场治理以及委托模型。

再质押模式

EigenLayer 也提供多种再质押方式。

1、原生 ETH 再质押:

此模式适合 ETH 的独立质押者,他们可以通过将质押 ETH 获得的提款凭证指向 EigenLayer 的智能合约来重新质押他们质押的 ETH 并获取收益。一旦独立质押者作恶或者不诚实,EigenLayer 就可以直接罚没其提款凭证。

2、LST 再质押:

LST 全称为“Liquid staking Token”,意为流动性质押代币。没有 32 个 ETH 的普通投资者可以通过 Lido、Rocket Pool 等流动性质押协议进行“拼车”,他们将 ETH 存入质押池,并收到流动性质押代币(LST),该代币代表对其 ETH 及其质押收益的索取权。

已经在 Lido、Rocket Pool 质押 ETH 的用户可以将其拥有的 LST 转移到 EigenLayer 的智能合约中,实现再质押获得收益。

3、LP Token 再质押:

LP Token 再质押又可以分为 ETH LP 再质押和 LST LP 再质押。

ETH LP 再质押:用户可以将在 DeFi 协议中包含 ETH 在内的一对 LP Token 再次质押到 EigenLayer 上。

LST LP 再质押:用户可以将包含 lsdETH 的一对 LP Token 再次质押在 EigenLayer 上。例如 Curve 的 stETH-ETH LP Token 就再次质押到 EigenLayer 上。

自由市场治理

在再质押的基础上,EigenLayer 建立了一个信任的自由市场。ETH 再质押者以供给方的身份,与作为需求方的应用层协议通过自由市场机制决定交易内容及价格。再质押者根据自己偏好的风险偏好选择是否加入或者退出某个协议。协议开发者也可自行选择接受哪种质押代币及对不同类型质押代币的奖励分配权重。例如,偏好强去中心化的协议可能只接受原生 ETH 再质押。

委托模型

许多持有 ETH 或 lsdETH 的用户想参与再质押获取收益,但又不想自己花费成本充当协议验证节点,那么这些用户可以将他们的 ETH 或 lsdETH 委托给其他 EigenLayer 运营节点,运营节点在质押收益中收取一部分费用。委托包括两种模式:

单独质押模式:适用于原生 ETH 再质押者,他们可以只将 EigenLayer 上的操作委托给其他运营商,同时自己继续作为以太坊的验证节点。

完全委托模式:用户选择信任的运营商来完全代替他操作,如果选择的运营商出现不诚实行为,那么其作为委托人的资金将会受到罚没。

此外,再质押者需要考虑和委托人的费用比例,这里有望形成一个新的市场,每个 EigenLayer 运营商将在以太坊上建立一个委托合约,该合约规定如何将费用分配给委托人。

EigenLayer 的优势与风险

优势

利用质押者的差异,高效利用资源

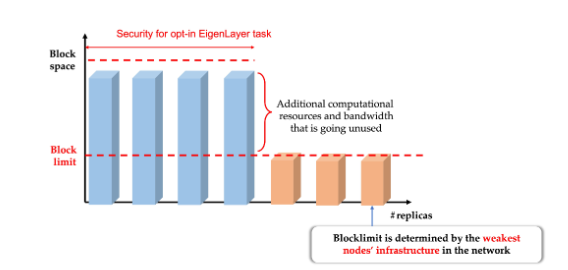

以太坊为了去中心化考虑会根据最弱的节点性能设置区块限制,如此的话拥有更多计算能力的质押者无法利用自己的多余资源。EigenLayer 可以通过创建只能由性能更强的节点执行的验证任务来利用多余的计算资源。

同时,以太坊的节点在风险偏好、收益偏好,身份特征方面都存在差异,EigenLayer 也可以利用这些差异来招募节点验证者。

提高 AVS 和以太坊共识层的去中心化程度与安全性

通过 EigenLayer,AVS 可以明确指定参与其验证任务的节点必须是原生 ETH 质押者或者为原生 ETH 质押者分配更高的奖励权重,从而有助于保持 AVS 去中心化。更高的质押收益会激励更多的人参与以太坊独立质押,运行以太坊节点,从而提升整个以太坊信任层的去中心化程度。

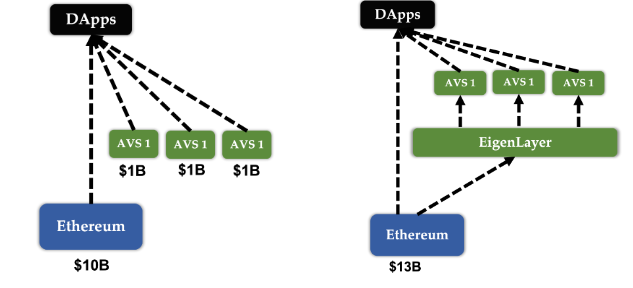

同时,AVS 和以太坊的安全性也得到了提升。例如下图,假设 ETH 通过 EigenLayer 都重新质押到三个 AVS 模块,则此时黑客攻击其中一个 AVS 都需要对以太坊的共识层下手,显然成本与难度会大幅增加。由于三个 AVS 的额外收益机会,也会反向促进 ETH 的质押量增多,从而提升整个网络的安全性。

加速协议创新

通过建立信任的交易市场,应用层协议可以通过市场化的价格便捷地购买“信任”,从而能够专注于应用层的协议创新和运营,实现自身安全性和性能的平衡。

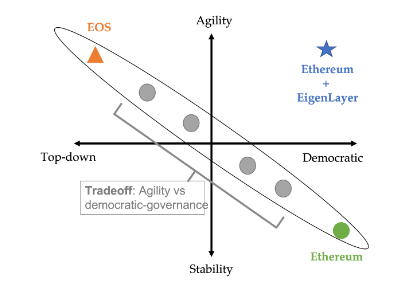

打破了以太坊追求民主性而对灵活性的妥协

以太坊的治理与升级通过稳健的链下民主方式缓慢推进,缺乏灵活性导致以太坊的创新步伐缓慢,EigenLayer 可以让以太坊两全其美。EigenLayer 可以让创新想法基于以太坊的共识层快速地部署,在这种配置下,长期稳定性依然由以太坊主网提供,而短期内创新项目所需的敏捷和灵活性则通过 EigenLayer 的自由市场进行分配。

风险

任何事物都具有两面性,EigenLayer 带来额外收益机会的同时,一些风险我们也不能忽视。

再质押制造的杠杆过高

在 EigenLayer 的设计中,再质押的收益是市场化行为,不同的 AVS 提供不同的收益率。当某一 AVS 提供可观的收益率时,再质押者们为了获得更多收益会不断为其加注资金,可能会因为杠杆过高,吸引更多的攻击者盗取资金,降低 AVS 的经济安全性。

意外罚没风险

罚没是指当节点有不诚实行为时会冻结其在质押池的资产,但在真实应用场景中可能还会存在因为代码 bug 或者协议问题而产生的意外罚没,使诚实节点的资金被冻结,这会大大损害以太坊共识层的安全性。

对于这种风险,EigenLayer 采取了两种应对方法。一是严格审计 AVS 代码,二是提供了对罚没的一票否决制度,由以太坊和 EigenLayer 社区的杰出成员组成的治理层可以通过多签对罚没进行一票否决。但是这两个应对方案都依赖于 EigenLayer 的主观治理,没有从根本上消除这种风险。

运营商串通作恶

理想状态下,一个 AVS 会有许多的不同的节点来进行验证服务,使串通攻击变得困难。但在现实情况中,一些 AVS 只有部分运营商充当验证者,那么这极有可能引发运营商串通盗取资金。

对此,EigenLayer 提出两种解决方法,一种是限制特定 AVS 能被提走的资金,另一种方式是 EigenLayer 主动增加运营商的作恶成本,对运营商在其他 AVS 上的质押验证进行监控。但这些方式都无法从根源上杜绝运营商作恶风险。

融资情况

到目前,EigenLayer 总共进行了两轮融资。

2022 年 8 月进行种子轮融资,完成融资金融 1450 万美元,由 Polychain 和 Ethereal Ventures 领投,Figment Capital、Robot Ventures、P2P Validator 等跟投。

今年 3 月 28 日进行 A 轮融资,完成融资金融 5000 万美元,并被估值 5 亿美元,由 Blockchain Capital 领投,Coinbase Ventures、Hack VC、IOSG 等跟投。

团队情况

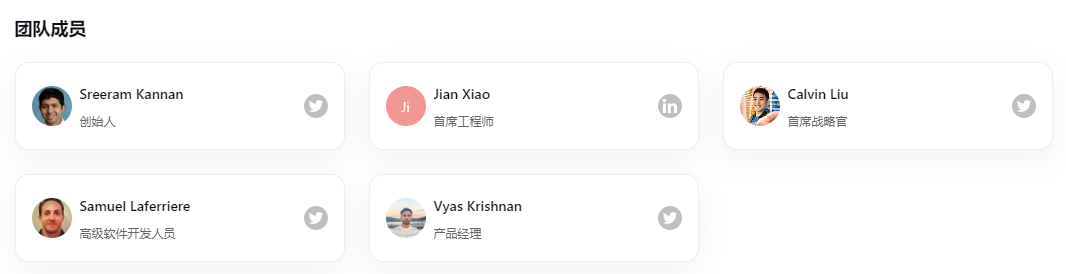

Eigenlayer 的创始人 Sreeram Kannan 是华盛顿大学的信息科学家、企业家和副教授,在高通与微软有过职业经历。团队的其他成员也有丰富的创业与从业经历,首席工程师曾在 Google 担任 9 年的高级软件工程师、 首席战略官曾在 Compound Labs 担任战略主管。

展望与总结

Eigenlayer 提出的新的再质押方案能够形成正向闭环,为再质押者提供额外收益的同时也为以太坊和链上协议提供了更高的安全性,这是非常吸引人的。虽然主网预计在 2024 年一季度才全面开启,但是 EigenLayer 已经开放了原生 ETH 再质押和总量为 4.5 万的 LST 再质押额度,截止 7 月 24 日总共有 8320 枚 ETH 在原生 ETH 再质押池中, 4.5 万的 LST 再质押额度也在短时间内被填满。

但是值得思考的是,现在 EigenLayer 上没有任何实质上的应用项目,很多的应用场景也仅仅在白皮书的构想中,且据官方表示,EigenLayer 目前并没有任何发币计划,那在未来竞争中是否能吸引更多的协议和客户进来其实很难说。同时,因为币圈的不稳定性,谁也无法保证到 2024 年 ETH 质押赛道是否还会如今天这般红火。

总之,EigenLayer 对于以太坊和L2的影响并不会马上体现,其发展还任重而道远。

免责声明:本站所有内容可能涉及项目风险事项,仅供科普与参考之用不构成任何投资建议。请理性看待,树立正确的投资理念,提高防范风险意识。建议在交互与持有之前,综合考虑各种相关因素,包括但不限于个人购买目的以及风险承受能力等。

版权须知:引用信息版权属于原媒体及作者。如未经鉴叔 J Club 同意,其他媒体、网站或个人不得转载本站文章,鉴叔 J Club 保留追究上述行为法律责任的权利。