MVC 2023年6月报:Echo Bubble进入尾声,乱纪元已经到来

市场走势与宏观

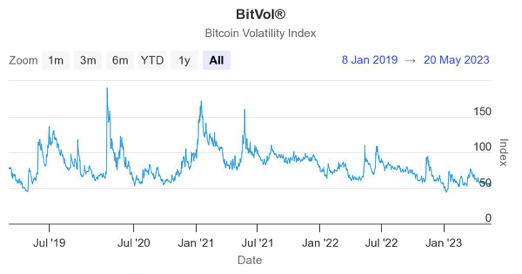

自从进入四月以来,经历 meme season 带来的短暂狂欢,市场波动率迅速陷入冰点,人气逐渐低迷,按照目前的波动率而言,在最近的一两周内,市场将出现较大的波动变化,以提升短期波动率水平。

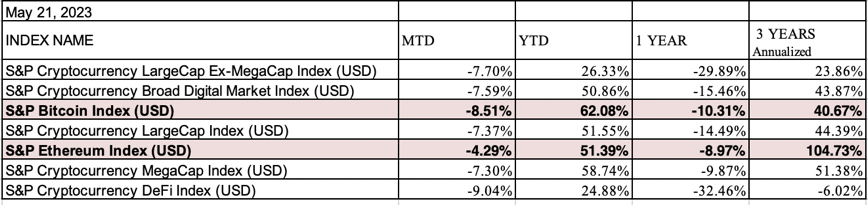

从标准普尔加密指数显示的市场结构来看,开年至今的反弹仍然属于以比特币主导,题材快速轮动的存量博弈行情,从 Bitcoin Dominance 的不断上升也可以印证这个判断。

市场虽然看似度过了热闹非凡的五个月,但是我们观察的重点代币列表中前期热门项目都已经自反弹最高点下跌超过 50% ,而且大部分甚至已经回到了 1 月中旬行情启动的价格。

从题材轮动的角度,我们也已清晰地观察到一轮比特领涨,LSDfi、AI 概念、DWF 合作概念、香港概念、Arbitrum Season、到以 Pepe 为首的 Meme Season,直至近期资金开始回流 LSD 概念,甚至开始挖掘小 LSD-Fi 项目,这一轮题材轮动已经完成了由大到小,由点到面的扩散,大部分题材代币利好频发,叠加解锁高峰,已经完成了充分的炒作,而且某一题材兴起的时候必然吸血前一题材,充分体现了存量博弈的特征。

从情绪层面来看,市场贪婪情绪正在回落,但总体仍然处于中等偏高位置。近期非常受到关注的 Zksync 生态和 Sui 生态相继开局不利,对市场情绪产生一定打击。

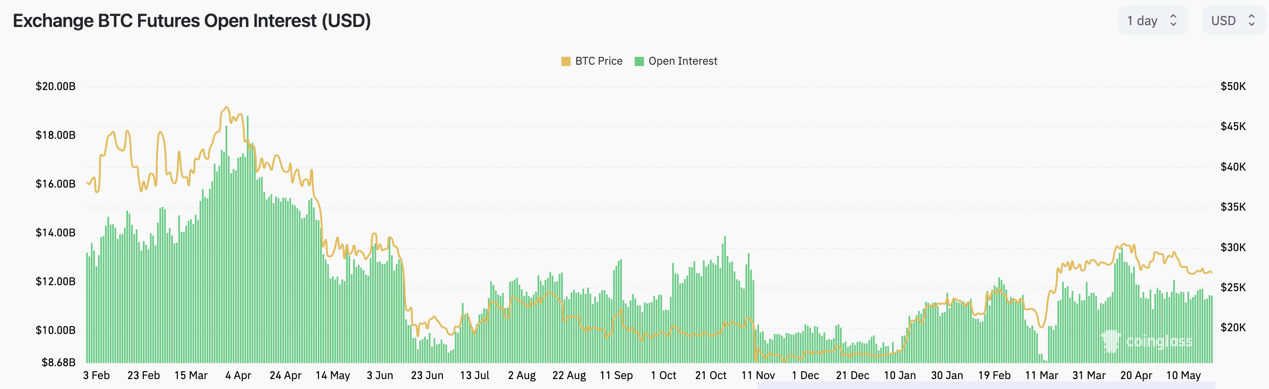

定量地评价,目前合约持仓量与本年 3 月美国银行业危机之前的峰值相近, 6 月季度基差小幅为正,自 5 月 10 日以来,市场合约多头持续增仓抄底,但在现货市场遇到了较为沉重的抛压,流动性也显著不足,若是近期不能有效清洗这些合约多头,行情也较难出现趋势性的上涨。

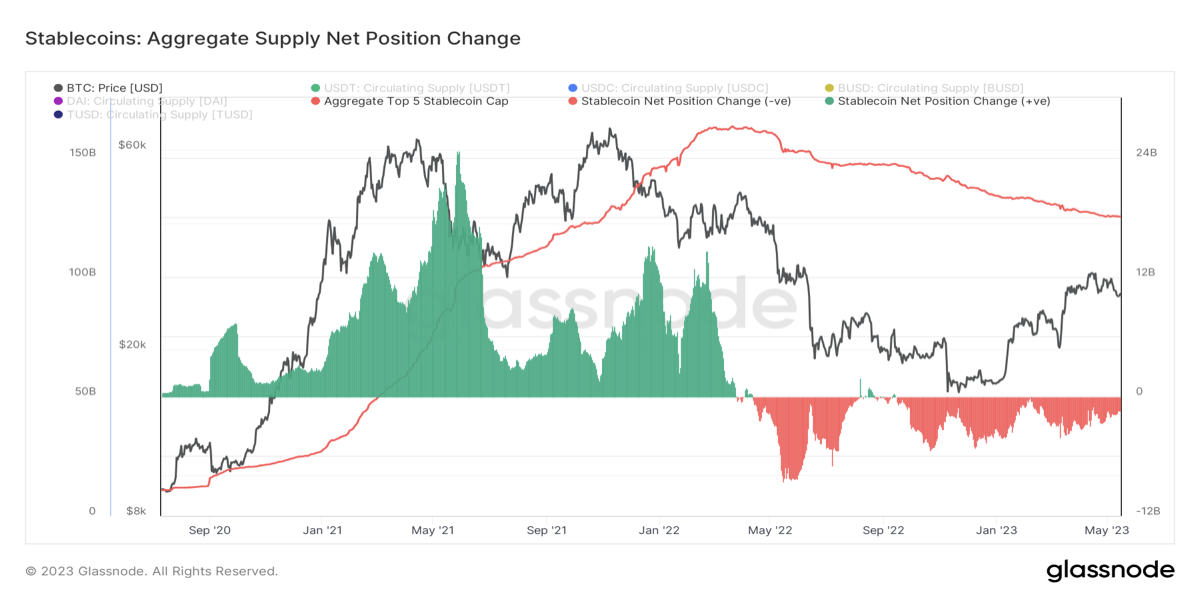

从资金层面来看,根据 Glassnode 数据显示,加密市场的资金状况并未扭转颓势,虽然稳定币的流出速度在缓解,但仍然面临持续的阵痛和失血。从与一些市场一线做市商的调研中,我们也可以直观感受到目前中小市值币种的流动性其实比较惨淡。

而从我们关注的综合杠杆倍数指标来看,该指标描述市场中一单位稳定币所支撑的加密市值的泡沫程度,目前该指标已经运行至长期趋势上沿,经过近期的市场反弹,目前市场的泡沫程度已经接近 2021 年 3 月及 9 月的市场峰值,虽然与直观感知不符,但其实当前市场仍然处于泡沫较高的阶段,市场继续上行的动力已经初显不足

上文提及加密市场进入了历史级的低波动率区间,其实不仅加密货币市场,我们关注到传统权益市场与商品市场也出现了同样的低波动状态,可能是所有的大类资产都在等待美联储货币政策的某种信号,市场进入了明显的乱纪元。

近期宏观关注主要集中在美国债务上限和加息停止时点这两点,但市场反应却出现了耐人寻味的情绪反应。

对于美债上限问题,如果美国还不起债,那么就要削减民生,保证利息偿付,那么对美债是巨大的利好;反之,如果美国成功解决了债务上限问题,那么债务偿还更有保障,更加是利好中的利好。

对于停止加息的问题,美国不停止加息,但是经济持续不衰退,对美股是很大的利好;如果经济真的衰退了,那么就要降息,更加是利好中的利好。

当一件事情正反两面都被解释成了利好,显然是哪里出了问题,流动性没有实质性的边际改善就是当前大类资产市场普遍进入乱纪元的问题所在。

身处乱纪元之中,市场的短期走势越发不可预测,我们只能从资金、筹码、情绪的角度观察目前市场的状态,更重要的是在市场周期中找到目前所处的周期身位。

从之前的报告中,我们已经从链上盈利水平和长短期持币人结构的角度分析过, 2022 年 12 月的底部已经是本轮熊市周期的绝对大底,未来基本不会跌破新低,这也与历次周期的减半规律相符,市场会在减半日期的前满一年左右停止下跌,并持续震荡半年,到减半事件后出现加速上涨。

未来半年将总体处于减半前的宽幅震荡区间,这种震荡是开启下一轮牛市的充分前提,从筹码结构的角度来看,只有满足长短期投资者持仓成本几乎一致的条件,才有发动牛市的条件。

如果用移动平均线来近似参考长短期投资者的持仓成本,以 25 周的周线作为短期投资者的持仓成本,以 120 周的均线作为长期投资者的持仓成本,历次行情发动前都需要通过一段时间的震荡让 WMA 25 (蓝色)与 WMA 120 (黑色)靠拢,这种走势的本质就是通过中长期的筹码换手,让长期套牢盘割肉,让短期投资者进场换手,使得长短期投资者的成本逐渐拉平。

我们目前所处的周期位置从下图可以看到,本轮 Echo Bubble 的力度其实相对于之前几次比较弱势,BTC 和 ETH 反弹均未能触及 WMA 120 ,长期投资者的平均成本仍然处于被严重套牢的区间,所以市场同时面临短期获利盘出逃和上方套牢盘的双重压力,仍然需要长期的震荡波动去消化这两种压力。

市场所处的乱纪元是交易情绪带来的发散,而周期则是行情的收束。

未来半年市场总体的走势就是通过不断震荡,让长短期投资者的持仓成本互相靠拢,所以从此刻开始,我们将珍惜每一次市场可能的向下重挫的机会,寻求 BTC 在 21000 以下及 ETH 在 1500 以下的建仓机会。

市场动态与行业前沿:Degen 向左,VC 向右

Degen 追求极致的公平,VC 追求极致的估值,市场在寻找更好的“博弈”模型

新生态层面:

空投工作室和羊毛用户统治 zksync,虽然用户和资金规模已经很大(zkSync ERA 独立钱包地址已超 68 万个,生态总 TVL 达到 3.38 亿美元,位列 Layer 2 第四位),但真实用户和沉淀在生态内的”投资“资金却很少,“鬼城”情况很严重。

数个在 zksync 上面的项目无论从融资规模和交易成交量来说都不尽人意。我们认为 zksync 的真正爆发需要出现首个具有致富效应的项目才能带动生态的真正繁荣,目前我们对于 zksync 生态的项目以观察为主,重点关注 zksync 上面头部 dex

$iziswap, TVL 增长很快,目前排名第一,后面还要推出免 gas 交易产品

$ice 主打集中流动性,是从 fantom 迁移到 zksync 的项目,并在本月中针对其新 dex $wagmi 进行换币,预计新资产发行和换币的过程中的价格波动会引来一波市场关注

以太坊坎昆升级确定在 2023 年 10 月前后进行。

在架构层面,EIP-4844 引入了新交易类型 Blob-carrying Transaction,这是以太坊第一次为 L2 单独构建数据层,也是之后 Full Danksharding 实现的第一步;

在经济模型层面,EIP-4844 将为 blob 引入新的 Fee Market,这也会是以太坊迈向 Multi-dimensional Market 的第一步;

在用户体验层面,用户最直观的感知就是 L2 费用大幅降低,同时降低 zk 数据的证明成本,提高单区块能承载的证明大小。

这将为 L2 及其应用层的爆发提供重要基础,预计将进一步推动 Layer 2 生态,以及会有 zk 相关应用和 layer 2 生态随之爆发。我们将在此前后密切关注 Layer 2 生态及其相关生态项目。同时我们也将关注支持 EIP 4844 的存储类项目的业务进展

应用层面:

LSDFi 经历一轮泡沫后沉淀出来一批头部项目,从链上交互数据看来有汹涌的资金涌入。

目前,只有价值约 2.5 亿美元的 LSD 被锁定在这些 LSDfi 协议中。这相当于不到流通的 172 亿美元 LSD 总量的 1.46% 。

而 ETH 原生 yield 的特性保证 LSDFi 长期发展的价值基础,市场上也出现了推销 ETH 收益本位的地推团队,用传统金融的收益故事培育新用户。相比于和头部协议竞争存量资产的市场,为市场上沉淀的 LSD 资产提供金融服务显然具有更高的成长空间。我们预计未来会有更多 LSD 资产以及为其提供交易、借贷、流动性、收益套娃等相关类型的产品出现并获得市场关注。

AI+区块链结合开始从概念阶段过渡到探索阶段。我们认为 AI+区块链的方向包含:

Trustless 数据市场协议

人工反馈和数据标注系统

AI 执行器集群(结合 socialfi,整合智能合约和web2相关入口和 API 的应用)

GPU 集群等

当前一级市场已经开始出现对 AI+区块链结合项目的投资热度。在二级市场方面,我们的关注点主要在于通过分布式激励网络吸引长尾 GPU 设备,为满足 AI 需求提供 GPU 算力的项目。虽然从业务落地角度来看,分布式 GPU 的效率远不如集群式 GPU,没法满足当下 AI 训练的实际需求,但是通过代币经济体激励来构建 GPU 的网络的操盘方式在捕捉市场当下叙事的同时可以借力二级市场的资金积累 GPU 资产,通过累计 GPU 资产在中长期实现价值捕捉。

老 DeFi 开始返春

MakerDAO 发布新白皮书,重点包括:

换币:将 DAI 和 MKR 换成 Wrapped 代币,DAI 将不再硬 peg 美元。MKR 开启通胀时代,MKR 将用户 Makerdao 的生态激励

SubDAOs:每个 SubDAO 都将有自己独立的新 Token,MKR 将按照 SubDAO 的业绩表现向 SubDAO 释放代币奖励。逻辑与目前 DeFI 主流的代币经济 ve-Token model 一致,在 Gauge 测算的过程中引入了更多 SubDAO 的业务指标。当前退出的 SubDAO 包含

MKR 创始人 Rune 近期也在市场进行了多笔 MKR 公开购买活动,我们在密切关注 MKR 相关 SubDAO 的业务指标,包含借贷量,资金周转率,DAI 和 EtherDAI 的铸币量等, 寻求业务量变的转化节点。

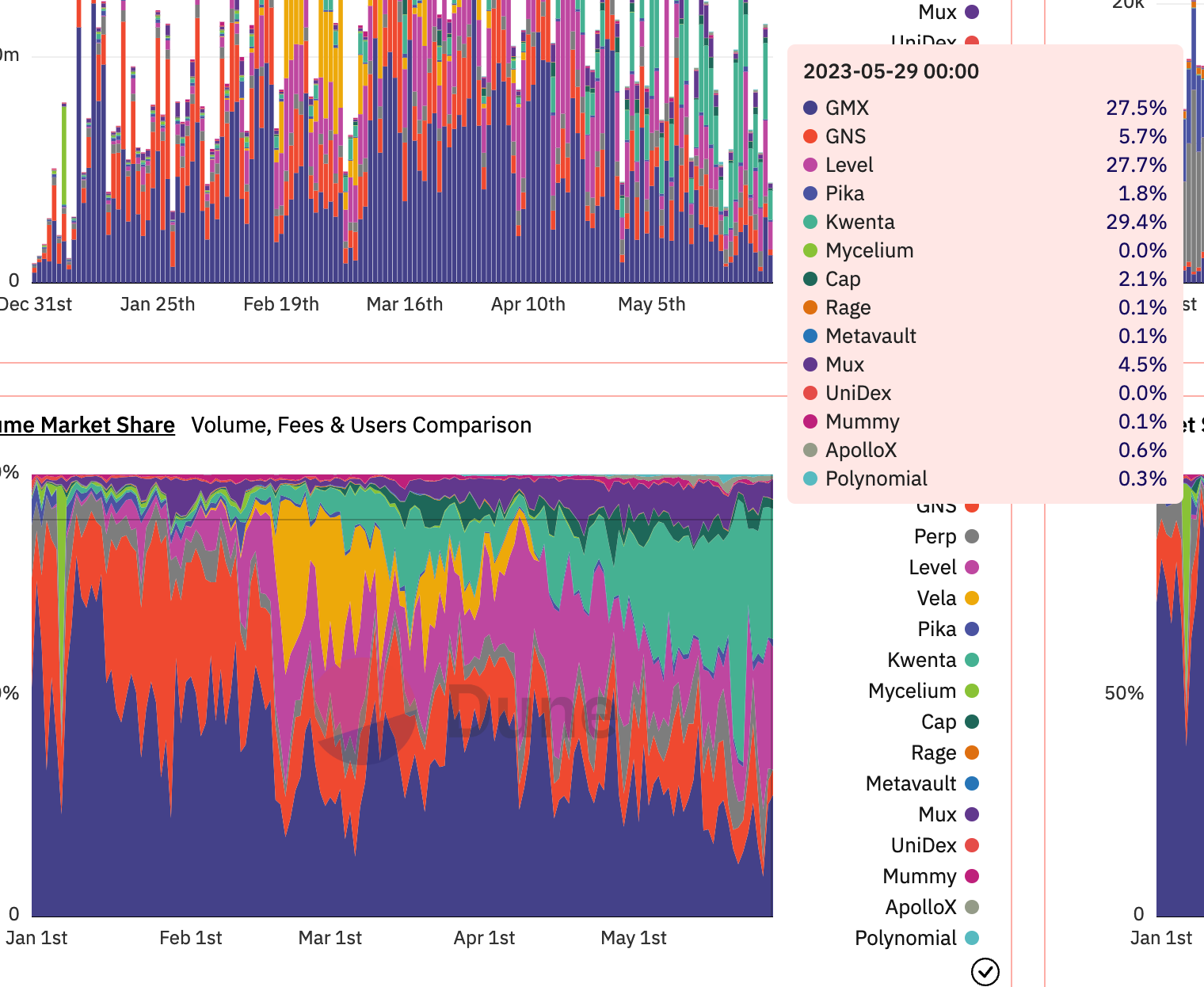

SNX 的交易量超过 GMX:

SNX 在推出v3版本之后,凭借低手续费和交易激励开始从 GMX 手上夺取市场占有率。同时 SNX 的创始人发布关于 SNX 代币模型升级的讨论,并提出对 SNX 代币进行拆分以及用国库收入回购市场上的 SNX。

越来越多 Defi 协议开始采用 ve-Token 的代币经济模型。正如我们在 2023 年展望里描述的,未来以手续费作为主要收入来源的 Defi 协议将把 ve-model + ve-booster/流动性贿选市场作为代币模型核心设计逻辑。在关注头部 Defi 协议的演变同时,我们也将密切关注其生态上的头部 ve-贿选协议。

熊市 Degen 开始追求极致公平,新的资产发行和做市方式在慢慢涌现,资产定价完成向 dex 倾斜:

BRC 20/ERC 20/BER 20 满足了 Degen 们对更公平的赌场的需求。新推出的“mint”机制赋予人人平等的铸币权;代币的发行方,团队或者 whale 无法像在以太坊智能合约中通常做的那样,给自己或相关利益方预留一部分免费(低价)代币,也没有办法通过早期“盲挖”,“冲 TVL”获得超额筹码。在熊市通过这样的机制和早期的低流动性,吸引了众多 Degen 参与。

随着 uni v3专利放开和以 traderjoe,izimi 等离散型 AMM 算法的创新出现,Dex 上 market making 的在逐渐逼近中心化交易所,这些项目都引入了主动做市管理,利用高资产周转率提高资金效率。

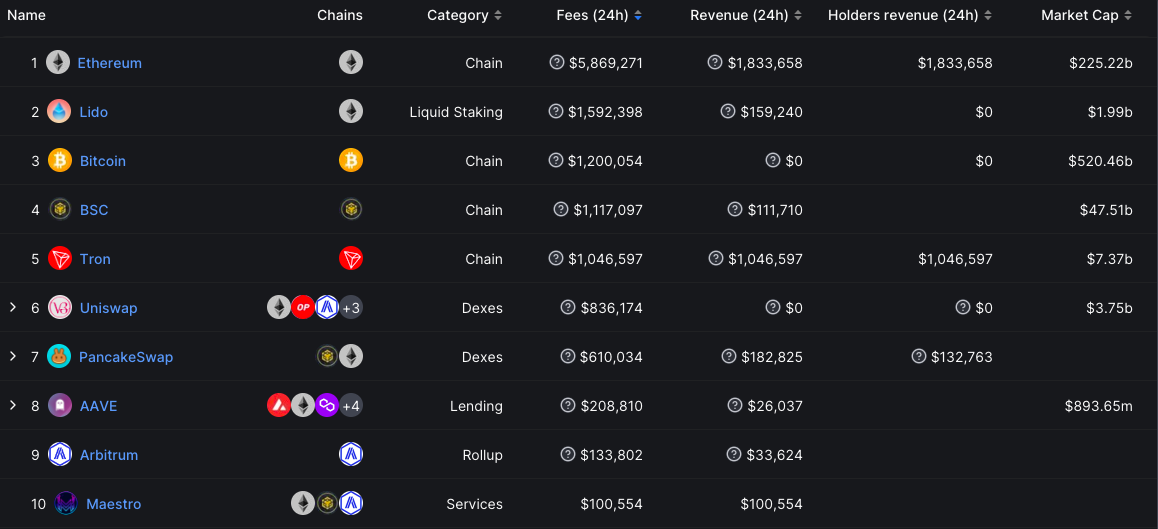

Sniperbot 和节点服务机器人在逐渐吸引散户注意:随着 Meme 币的火爆,为散户提供监测 memepool 资产和流动池部署的机器人服务近期获得了大量用户增长。@MaestroBots 以 24 小时 100 k 的收入进入协议收入前十。当下这些机器人的服务多结合 telegram,在聊天页面中绑定 EOA 钱包,为散户提供便捷的抢买新部署资产,跟单大户交易的功能。虽然当下的 bot 服务多使用 EOA 钱包,私钥存在很大的安全隐患。但我们认为这样的交易符合未来用户的使用习惯,尤其是在web2接口可以提供诸多 AI 交易策略和社交讨论情况下,会有越来越多的散户使用社交软件作为自己的交易前端,结合社交图谱资产化的趋势,有望作为 Socialfi 爆发的重要场景。结合对资产管理安全和智能合约权限管理的需求,我们认为这个趋势在智能合约钱包普及后会更加明显,也会在 EIP 4337 正式落地前着重关注此类资产。