LD Capital: Saufriend.tech, hệ sinh thái Base sẽ tiếp tục như thế nào?

Tác giả: Jaden, LD Capital

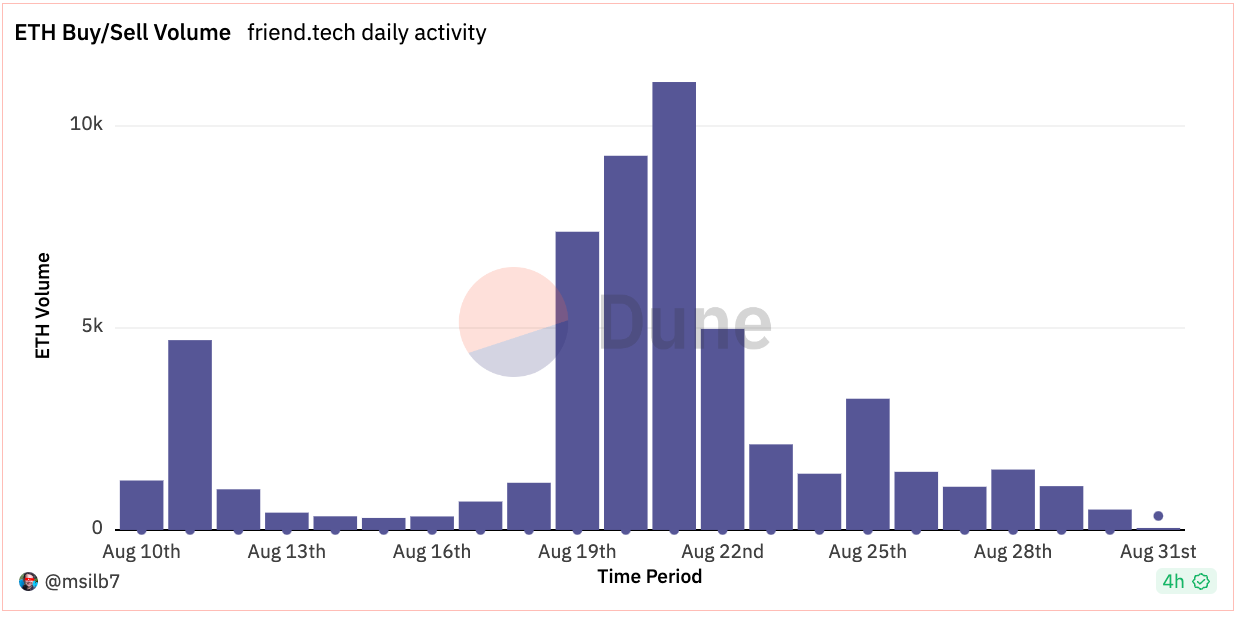

Hai tuần sau khi bạn.tech ra mắt chuỗi Base, hoạt động của người dùng giảm dần, thậm chí còn có một dòng ETH chảy ra ròng trong hợp đồng vào ngày 22 tháng 8. Tổng số ETH giữ lại trong hợp đồng hiện vẫn ở mức khoảng 3.500 đơn vị, trị giá xấp xỉ 5,8 triệu USD. Ngoàifriend.tech, sự phát triển sinh thái của chuỗi Base như thế nào?

1. Dữ liệu trên chuỗi

1. TVL

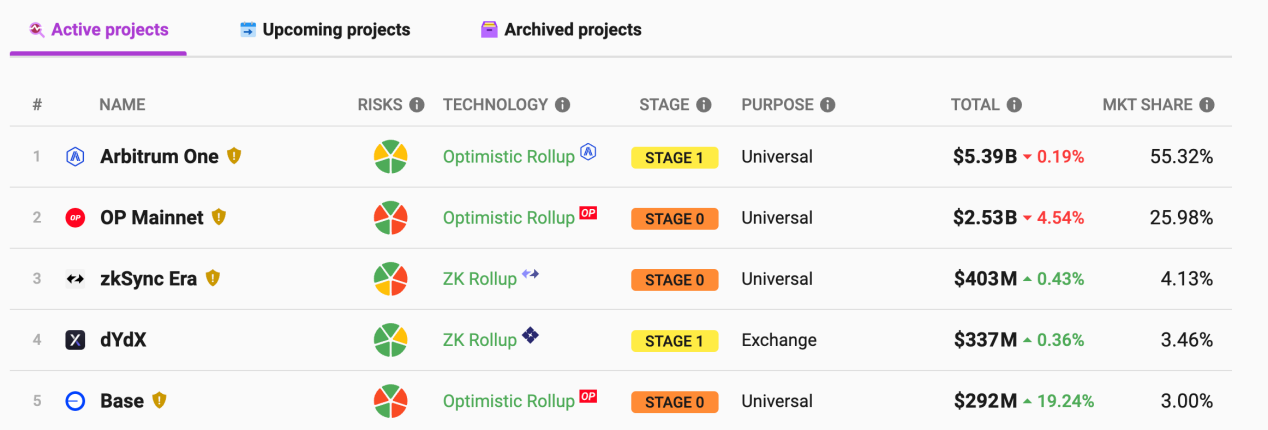

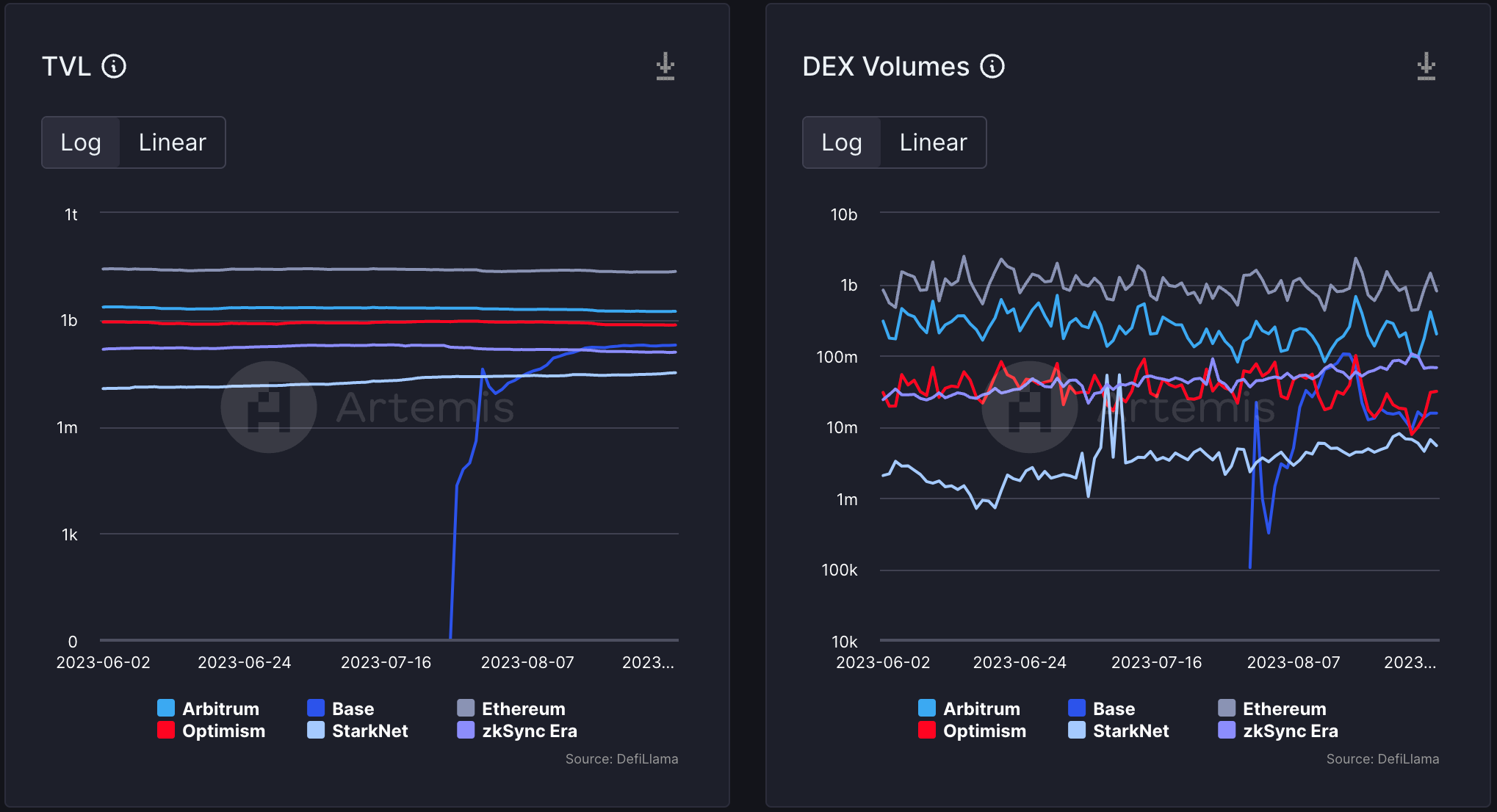

Tính đến ngày 27 tháng 8, TVL chuỗi cơ sở đạt 292 triệu, đứng thứ 5 trong mạng cấp hai, chiếm 3% thị phần cấp hai. Cả Base và zkSync đều có mức tăng trưởng TVL chậm và tương đối trì trệ.

2. Khối lượng giao dịch và số lượng địa chỉ hoạt động

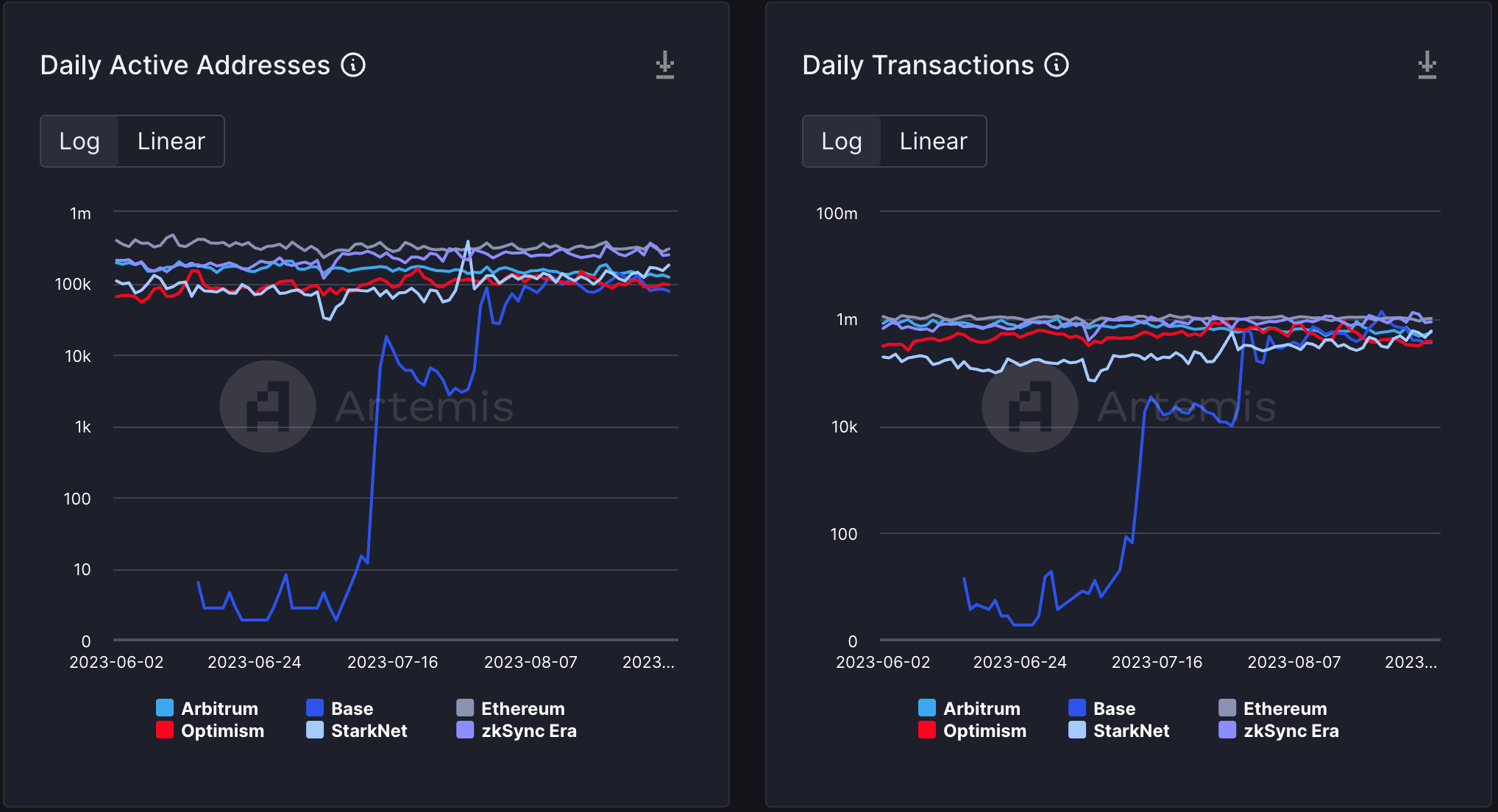

Số lượng địa chỉ hoạt động hàng ngày và khối lượng giao dịch hàng ngày trải qua hai giai đoạn tăng trưởng nhanh chóng và các sự kiện tương ứng là sự ra mắt của Mainnet chuỗi Base vàfriend.tech. Tính đến ngày 31 tháng 8, số lượng địa chỉ giao dịch hoạt động hàng ngày là 77.000 và số lượng giao dịch hàng ngày là 356.000, thấp hơn so với Arbitrum, Optimism và zkSync.

Khối lượng giao dịch của DEX trên Base chạm mức thấp vào ngày 3 tháng 8 sau khi thị trường tiền tệ meme kết thúc, sau đó xuất hiện hàng loạt dự án mới trên chuỗi. Khối lượng giao dịch tăng trở lại, nhưng khối lượng giao dịch bắt đầu trở lại sau thị trường giảm vào ngày 16 tháng 8

2. Dự án sinh thái

Tính đến ngày 27 tháng 8, trang web chính thức của cơ sở đã có tổng cộng 143 dự án/đối tác. Defilama đã bao gồm tổng cộng 69 dự án, trong đó chỉ có 23 dự án có TVL trên 1 triệu, trong đó có 12 dự án là DEX.

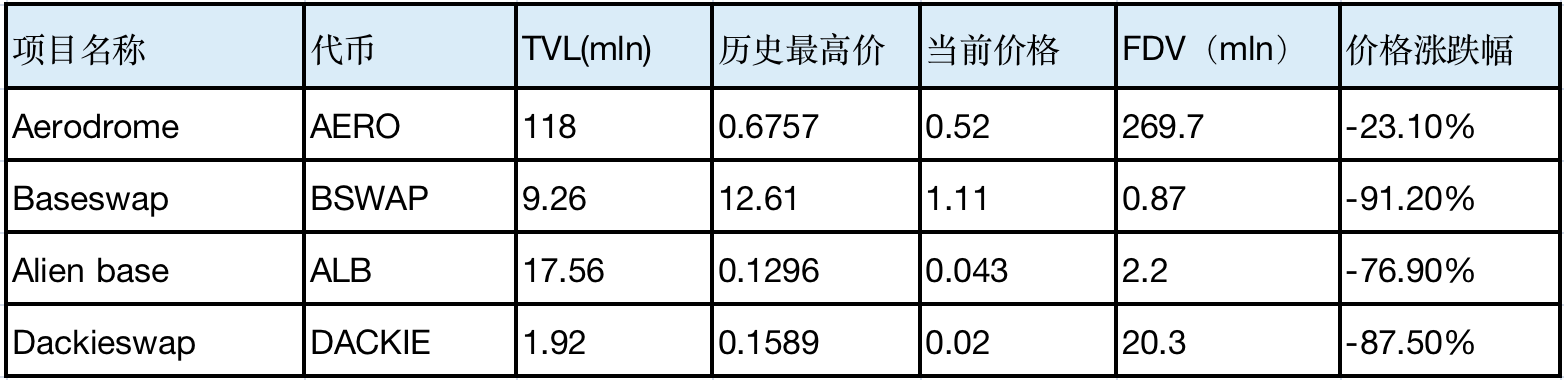

DEX

Các DEX có khối lượng giao dịch ban đầu lớn hơn trên chuỗi Base là Leetswap và Rocketswap, nhưng cả hai đều gặp phải sự cố bảo mật.

Hiện tại, dex gốc đứng đầu là Aerodrome và TVL là dex đầu tiên ở trạng thái lỗi. DEX này mới bắt đầu khai thác thanh khoản và cung cấp APY cao. Aerodrome là lớp thanh khoản cơ sở được phát triển bởi các nhóm và đối tác của Velodrome và Base. Nguồn cung ban đầu là 500M AERO, trong đó 450M (90%) sẽ được khóa vào veAERO. Số lượng lưu hành ban đầu của AREO là 10 triệu và trong tuần thứ 1 đến tuần thứ 14, lượng phát hành hàng tuần sẽ tăng 3% so với tuần trước. Lượng phát hành hàng tuần giảm 1% từ tuần 14 xuống khoảng tuần 67. Nhìn chung, AERO là một đồng tiền khai thác và lượng lưu thông của nó đã tăng nhanh trong một khoảng thời gian ngắn. Sau khi Baseswap và căn cứ Alien xuất hiện trên Aerodrome, cả TVL và giá đều giảm.

Lending

Hiện tại, thỏa thuận cho vay lớn nhất trên chuỗi Base là Hợp chất, với TVL là 23,35 triệu. Tiếp theo là giao thức cho vay gốc của Moonbeam, Moonwell, có TVL là 19,42. Aave đã thông qua cuộc bỏ phiếu và trực tuyến trên chuỗi cơ sở vào tối ngày 20 tháng 8. TVL hiện tại là 1,68 triệu.

Người triển khai hợp đồng của Magnate Finance, thỏa thuận cho vay gốc lớn nhất trên chuỗi Base, có liên quan đến vụ lừa đảo Solfire và tài khoản Twitter của dự án đã bị hủy. Các thỏa thuận cho vay còn lại Grannay Finance và UncleSam Protocol có TVL dưới 1 triệu USD, so với các thỏa thuận cho vay đã thiết lập của Composite và Aave, chúng không có lợi thế cạnh tranh về thương hiệu, tính bảo mật hoặc tính thanh khoản.

Các dẫn xuất

EDEBASE đã thiết lập cơ chế thanh khoản kết hợp cho phép chủ sở hữu ELP cung cấp thanh khoản thông qua bộ định tuyến thông minh, với 45% doanh thu giao thức được phân phối cho chủ sở hữu mã thông báo ELP và các bên liên quan, với cơ chế tương tự như GMX. TVL hiện tại là 0,19 triệu.

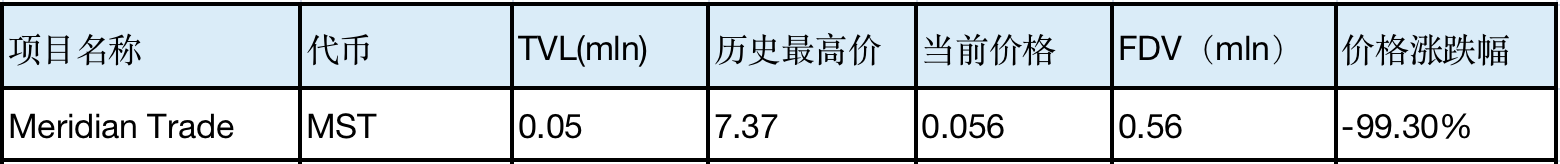

Meridian Trade cung cấp dịch vụ cho vay stablecoin không lãi suất, giao dịch có đòn bẩy và giao dịch không trượt giá. Người dùng có thể giao dịch tài sản tiền điện tử nằm trong danh sách cho phép với đòn bẩy lên tới 50 lần và nhận các khoản vay ETH được thế chấp quá mức không lãi suất. TVL hiện tại là 50.000 USD.

Nền tảng xã hội

friend.tech đã tạo ra tiếng vang lớn và dòng tiền đổ vào khổng lồ vào giữa tháng 8. Tuy nhiên, bắt đầu từ ngày 22 tháng 8, dòng vốn chảy vào friend.tech đã xuất hiện và hoạt động giao dịch giảm đáng kể.

trò chơi

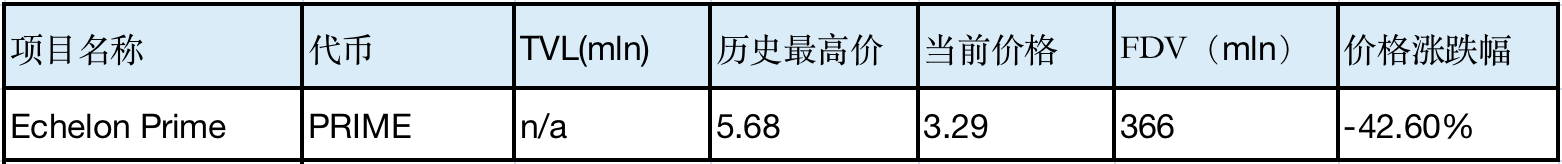

Parallel là một trò chơi thẻ giao dịch đã nhận được khoản tài trợ 50 triệu đô la Mỹ từ Paradigm vào năm 2021. Vào thời điểm đó, định giá của nó lên tới 500 triệu đô la Mỹ. Vào cuối tháng 7, bản thử nghiệm beta của trò chơi đã được đưa lên mạng và trò chơi đã đưa các thẻ NFT của mình vào chuỗi Cơ sở để rèn.

Tóm tắt

Các dự án gốc trên chuỗi Base thường xuyên có các sự kiện Rug. Từ góc độ hiệu quả giá, rủi ro tham gia thứ cấp là tương đối cao. Từ góc độ phát triển sinh thái, các dự án nổi tiếng như Unibot vẫn đang tích cực tham gia hệ sinh thái Base.