Understanding Binance’s New Favorite TUSD: Opportunities and Risks

After BUSD encountered supervision, its market value has dropped by nearly 74% from the US$16.57 billion at the beginning of the year, and it is gradually withdrawing from the stage of history. The stablecoin market structure has also undergone significant changes. With the support, it has entered the mainstream field of vision, its share has grown rapidly, and news has continued.

TrueUSD, referred to as TUSD, because Binance transferred the previous zero-fee pending order activity of BUSD to TUSD, it is currently the largest trading pair of Bitcoin on Binance, and it is also an important part of the current stablecoin financial system in the encrypted world. Recently, TrueUSD has frequently appeared in the headlines of the encryption media due to events such as the suspension of automatic certification and the large-amount minting of Binance.

What is TrueUSD?

TrueUSD is a stablecoin issued on Ethereum and Binance Smart Chain, with a current market cap of around $3.1 billion. It is an asset stable currency, that is, through sufficient asset reserves to achieve a 1: 1 exchange with the US dollar. Holders can mint the same amount of TUSD by depositing USD, or convert TUSD to USD at any time. The deposited U.S. dollars will be kept in different bank accounts, and will be supervised and audited by a third-party organization.

Stablecoins are a bridge between the encrypted world finance and traditional finance, allowing investors to exchange US dollars for assets on the chain for encryption-related transactions. Stablecoins themselves are divided into algorithmic stablecoins and asset stablecoins. The former uses algorithms and arbitrage transactions to maintain a 1:1 peg between the stablecoin and the US dollar. However, the collapse of the Terra ecosystem and its native stablecoin UST in May 2022 caused the algorithm to Stablecoins have lost the trust of crypto users. Currently, the vast majority of stablecoins on the market are stablecoins with reserve assets, and TUSD is one of them.

TrueUSD was created in March 2018 by Rafael Cosman and Danny An, who co-founded San Francisco-based startup TrustToken, which was later renamed Archblock. The company has raised funding from Founders Fund, Stanford University-owned StartX, Andreessen Horowitz, and Jump Trading, but TrueUSD is currently owned by Asian investment group Techeryx. According to TrueUSD’s official website, the group is based in Singapore. Archblock remains the operator of TrueUSD, managing TrueUSD reserves, working with banking partners, and overseeing TrueUSD compliance.

Current status and development history of TrueUSD

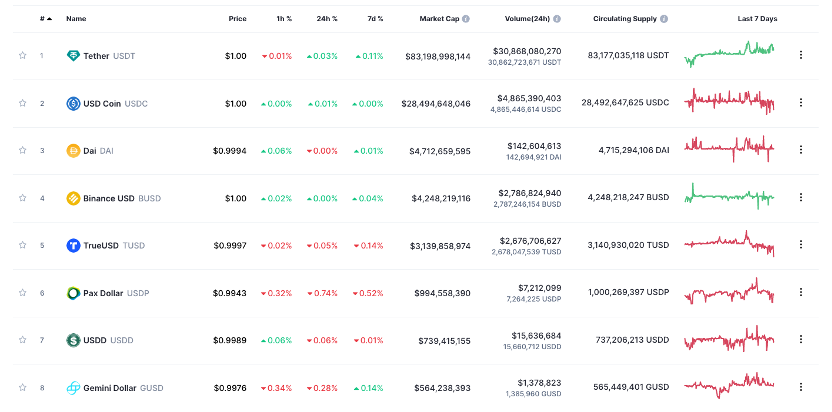

According to Coinmarketcap data, the current market capitalization of TUSD is stable at the fifth place among stablecoins, at about US$3.1 billion, three times that of the sixth-ranked Pax Dollar, and the gap from Binance USD is about US$1 billion, but the 24-hour trading volume On par with it.

Previously, after Binance’s native stablecoin BUSD was ordered to stop issuing by the New York State Department of Financial Services in February, the market value of BUSD began to decline all the way. Then, in March, Binance removed the fees for spot trading between TrueUSD and Bitcoin, and TUSD’s market capitalization began to soar after that. After the suspension of BUSD, Binance claimed that more "diversified stablecoin products" are needed, and TUSD is clearly a bright spot among the rising stars.

But at the same time, this connection to Binance also brings associated risks for TUSD. After the CFTC and SEC sued Binance successively this year, Archblock’s chief operating officer Alex de Lorraine said, “If regulations change and we suddenly can’t cooperate with a certain party for compliance reasons, then the other party can no longer have dealings with us. "

The major events of TUSD this year are as follows:

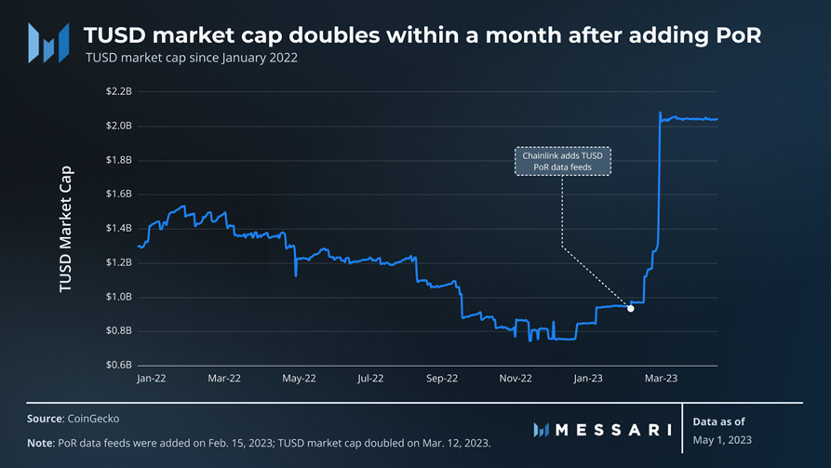

February 2023: TUSD (TrueUSD) implements Chainlink's Proof of Reserves mechanism to ensure the security of minting and further ensure transparency and reliability.

March 2023: TUSD hired The Network Firm LLP, an independent US accounting firm specializing in the blockchain industry, to provide real-time confirmation of its USD reserve coverage.

April 2023: TUSD launches native support on the BNB chain. TUSD has successfully circulated on 5 local public chains and 7 other public chains, realizing cross-chain functions through cross-chain solutions.

The current market value comparison of mainstream stablecoins. Source: Coinmarketcap

Recent Updates: Proof of Reserve, Automated Proof, and Prime Trust

TrueUSD uses LedgerLens' real-time proof mechanism to verify the amount of reserve assets. This proof mechanism will automatically generate TUSD bank asset mortgage records every day, which will be confirmed by The Network Firm mentioned above and can be downloaded on the official website. This real-time proof needs to satisfy the ripcord mechanism, that is, there must be no factors that affect the generation of proofs, such as temporary imbalances or situations where liabilities are greater than assets. On June 21st, this mechanism was triggered and the automatic proof was not generated on that day. However, when you log in to the TUSD official website on June 23rd, you can find that the real-time proof has returned to normal.

TUSD market capitalization growth after adopting Chainlink PoR. Source: Messari

TrueUSD also uses the Proof of Reserve service provided by Chainlink to verify the reliability of offline assets. According to Chainlink’s official statement, “Chainlink Proof of Reserves provides smart contracts with the data needed to calculate cross-chain or off-chain reserve collateralization ratios for any on-chain asset. Chainlink Proof of Reserves is run by a decentralized oracle network, It can automatically audit the collateral in DeFi applications in real time to ensure the safety of users' funds, and prevent phenomena such as reserve ratios not meeting the requirements or off-chain custodian fraud." Thus, DeFi applications can monitor TUSD's reserve coverage ratio through this service. In the month since TUSD added PoR, its market capitalization has grown by more than 120%.

Odaily previously reported that TUSD encountered FUD on June 10 because its casting partner Prime Trust suspended casting, and was briefly decoupled slightly.

However, in the recent series of fluctuations in which Prime Trust stopped being acquired by BitGo, was reviewed by Nevada regulators, and stopped deposits and withdrawals, TUSD did not seem to be affected. TrueUSD stated that its stablecoin TUSD funds are still safe, TrueUSD has no risk exposure to Prime Trust, and users' funds are safe.