LSDFi Hè đến rồi, điểm nhanh 6 dự án LSDFi đáng chú ý

Tác giả gốc: Hemi

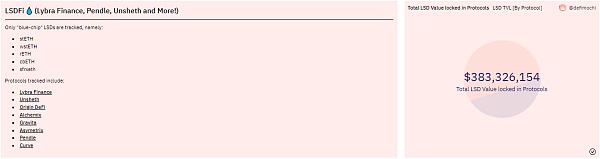

Tổng giá trị bị khóa (TVL) của LSDFi vượt quá 380 triệu đô la Mỹ, mã thông báo của các dự án như Pendle và Lybra tăng mạnh và câu chuyện về LSD và LSDFi đã trở nên phổ biến trở lại.

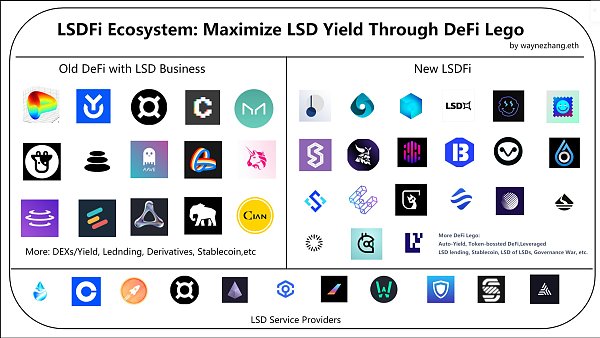

Sau khi nâng cấp Ethereum Shapella, giao thức LSD (Các công cụ phái sinh đặt cọc thanh khoản) và khái niệm LST (Mã thông báo đặt cọc thanh khoản) đã càn quét thế giới DeFi, không chỉ như một kênh để những người cầm cố ETH thoát khỏi trạng thái cầm cố bất cứ lúc nào, mà còn như một kênh cho chủ sở hữu Nó cung cấp một cách mới để kiếm thu nhập và cải thiện việc sử dụng vốn ngoài các giao dịch. Nhiều DeFi cũ và mới đang bắt đầu phát triển các hoạt động kinh doanh có liên quan đối với LSD.

"Cuộc cách mạng" về khối lượng đặt cược và tính thanh khoản đã truyền cảm hứng cho nhiều chiến lược đổi mới hơn và các dự án khác nhau hiện đang cạnh tranh để tạo ra các chức năng rộng hơn và hữu dụng hơn cho LSD của họ, không chỉ bao gồm các thành phần DeFi truyền thống như DEX mà còn cả chiến lược Lợi nhuận, tiền tệ ổn định, mang lại sự suy đoán bằng cách sử dụng các thuộc tính độc đáo của LSD.

Những DeFi mới này được xây dựng trên giao thức LSD là LSDFi.

tiêu đề phụ

1. Lybra Finance: Stablecoin được hỗ trợ bởi LSD

Điểm hấp dẫn của Lybra Finance là nó cho phép chủ sở hữu nhận được stablecoin $eUSD tự động chịu lãi suất APY 7,2% trong thời gian thực.

"Cung cấp cho bạn một stablecoin và nó sẽ nhân lên trong ví của bạn miễn là bạn giữ nó."

Để đúc $eUSD, bạn cần gửi ETH hoặc stETH và giao thức sẽ phân phối số tiền thu được do stETH tạo ra cho những người nắm giữ $eUSD. Nói cách khác, bằng cách gửi ETH hoặc stETH vào giao thức và đúc $eUSD, bạn có thể kiếm được khoảng 8,3% APY.

tiêu đề phụ

2. Pendle: Thị trường hoán đổi lãi suất

Gần đây, TVL của Pendle đạt mức cao nhất mọi thời đại, gần 100 triệu USD.

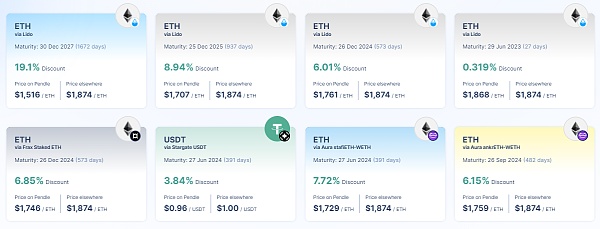

Ý tưởng của Pendle là cung cấp cho người dùng cơ hội sử dụng tài sản và thu nhập của họ một cách riêng biệt.

Trong Pendle, tài sản lợi nhuận được chia thành hai phần: Mã thông báo chính (PT) và Mã thông báo lợi nhuận (YT). PT đại diện cho tiền gốc của tài sản sinh lãi và YT đại diện cho phần lợi tức của tài sản sinh lãi. YT và PT có thể được giao dịch trên Pendle AMM.

Ví dụ: gửi 1 stETH sẽ tạo ra 1 PT-stETH và 1 YT-stETH, trong đó, 1 PT-stETH có thể đổi lấy 1 stETH và 1 YT-stETH có thể cho phép bạn nhận 1 ETH (stETH) khi gửi vào Lido của tất cả các khoản thu nhập.

Nếu bạn là một nhà đầu tư ít rủi ro theo đuổi sự ổn định, bạn có thể mua PT với thu nhập đã loại bỏ để kiếm thu nhập cố định; nếu bạn là một nhà kinh doanh lãi suất và nghĩ rằng một tài sản có thể tăng giá, bạn có thể mua YT.

tiêu đề phụ

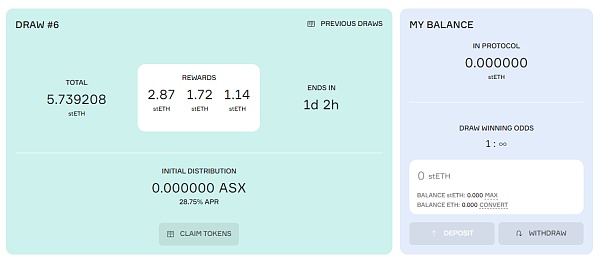

3. Asymetrix: Xổ số lợi nhuận LSD

Asymetrix là một giao thức phi tập trung, không giam giữ được thiết kế để phân phối phần thưởng bất đối xứng từ việc đặt cược, nhằm mục đích làm cho việc đặt cược Ethereum trở nên thú vị và hấp dẫn hơn đối với những người chơi nhỏ. (Đặt cược ETH truyền thống không mang lại lợi ích cho những người chơi nhỏ nắm giữ một lượng nhỏ ETH do lợi suất thấp hơn)

Giả sử 100 người dùng gửi 1 stETH mỗi người, thì sẽ có tổng cộng 100 stETH. Những stETH này sẽ tạo ra 5 stETH dưới dạng phần thưởng cam kết trong vòng 24 giờ và sau đó 5 stETH sẽ được chỉ định ngẫu nhiên cho người tham gia.

Cũng giống như xổ số, ngay cả khi bạn chỉ gửi một lượng nhỏ stETH, bạn cũng có cơ hội giành được phần thưởng cao, hoặc không có phần thưởng nào.

tiêu đề phụ

4. Chỉ số Coop: Chỉ số LSD

Index Coop là một giao thức được quản lý bởi DAO, chủ yếu cung cấp cho người dùng các sản phẩm DeFi có cấu trúc và mã thông báo chiến lược.

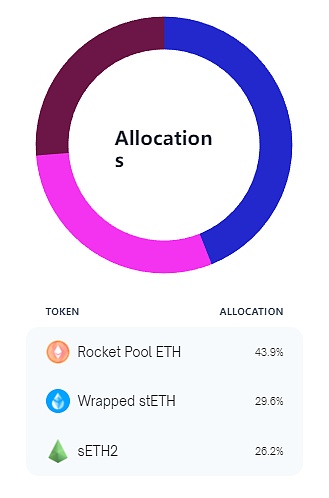

Với sự phát triển hiện tại của giao thức LSD và LST, Index Coop cung cấp cho chủ sở hữu ETH hai mã thông báo chỉ số để đơn giản hóa quá trình kiếm thu nhập: Chỉ số đặt cược ETH đa dạng ($dsETH) và Chỉ số ETH lãi kép ($icETH).

dsETH:

Với việc ngày càng có nhiều giao thức LSD xuất hiện, rất khó để một số người đặt cược lựa chọn về mặt lợi nhuận.

Vì các giao thức LSD và LST này dựa trên mạng chính Ethereum, nên việc gửi ETH vào nhiều giao thức LSD hoặc mua nhiều LST từ thị trường thứ cấp để đa dạng hóa đầu tư có thể tốn kém.

Index Coop đã giải quyết vấn đề nan giải này bằng cách gộp LST phổ biến vào một mã thông báo ERC 20 duy nhất, dsETH.

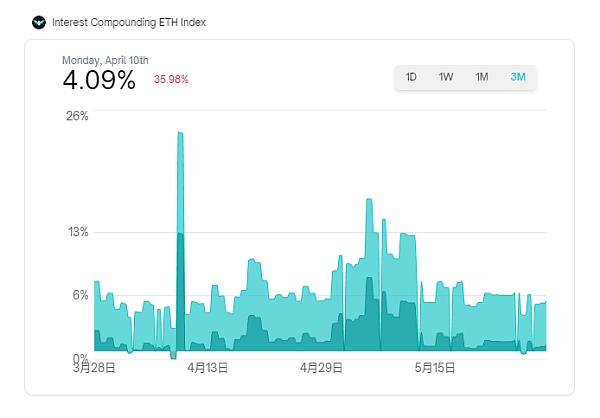

icETH:

Một số người đặt cược ETH rất muốn tích lũy ETH với lãi kép.

icETH sử dụng chiến lược đặt cược thanh khoản đòn bẩy dựa trên giao thức Set để cung cấp cho người dùng lợi nhuận ETH cao hơn. Người dùng gửi stETH có thể nhận được số lượng icETH tương tự. icETH gửi stETH vào Aave v2 làm tài sản thế chấp và cho vay ETH để có thêm stETH.

tiêu đề phụ

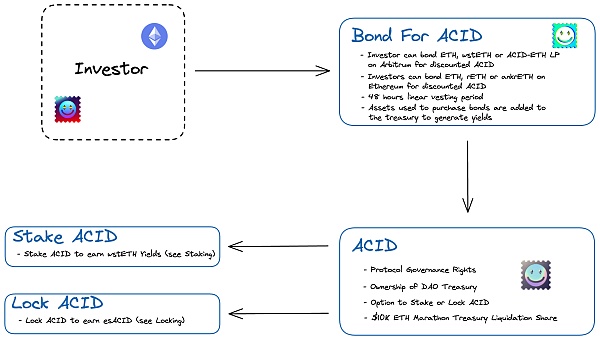

5. 0x Acid: Giao thức quản lý lợi nhuận cho những người nắm giữ ETH dài hạn

0x Acid là một giao thức quản lý thu nhập tương đối thay thế. Mục tiêu của nó là tối ưu hóa lợi nhuận của stETH, rETH, frxETH và các LST khác bằng cách cung cấp tỷ lệ lợi nhuận cao hơn nhiều so với LST thông thường (4-5%). Nó phù hợp hơn cho những người dùng tăng giá trên ETH trong một thời gian dài tham gia.

Mã thông báo gốc của 0x Acid là ACID, nguồn cung cấp là không giới hạn và nguồn cung cấp ban đầu thông qua việc bán mã thông báo là 7370.

Ngoài việc mua trực tiếp trên Paraswap, người dùng cũng có thể mua "trái phiếu" và gửi stETH, rETH và ankrETH vào kho bạc để nhận ACID. Việc người dùng nắm giữ ACID tương đương với việc gián tiếp nắm giữ LST và nhiều thu nhập trong kho bạc, bởi vì bất cứ khi nào giá ETH đạt 10.000 đô la Mỹ, thỏa thuận sẽ phân phối tất cả LST trong kho bạc cho những người nắm giữ ACID.

tiêu đề phụ

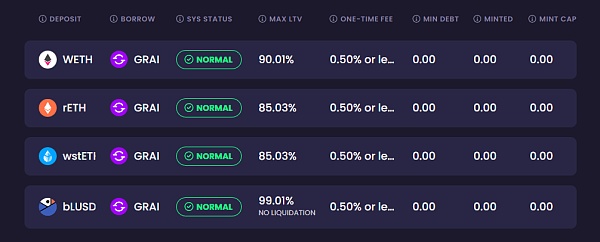

6. Gravita Finance: Cho vay LSD không lãi suất

Gravita Finance là một thỏa thuận cho vay không tính lãi với LST làm tài sản thế chấp, giống như phiên bản LSDFi của Liquity Protocol.

Điểm nổi bật:

Điểm nổi bật:

a) Nếu người dùng hoàn trả khoản vay trong vòng sáu tháng (khoảng 182 ngày), tiền lãi sẽ được hoàn trả theo tỷ lệ và tiền lãi tối thiểu chỉ tương đương với tiền lãi của một tuần.

cảnh báo rủi ro:

cảnh báo rủi ro:

Theo "Thông báo về việc tiếp tục ngăn chặn và xử lý rủi ro thổi phồng trong giao dịch tiền ảo" do ngân hàng trung ương và các ban ngành khác ban hành, nội dung bài viết này chỉ mang tính chất chia sẻ thông tin, không quảng bá hay xác nhận bất kỳ hoạt động và đầu tư nào. Tham gia vào bất kỳ hoạt động tài chính bất hợp pháp nào