กฎระเบียบใหม่ของฮ่องกงเกี่ยวกับสินทรัพย์เสมือนจะมีผลบังคับใช้ในวันที่ 1 มิถุนายน และนัก

แหล่งที่มาดั้งเดิม:

แหล่งที่มาดั้งเดิม:ฮ่องกงพาณิชย์รายวันเผยแพร่ซ้ำโดย Odaily โดยได้รับอนุญาต

คณะกรรมการกำกับดูแลหลักทรัพย์ของฮ่องกงประกาศเมื่อวานนี้ (23) ข้อสรุปการปรึกษาหารือเกี่ยวกับ "หลักเกณฑ์สำหรับผู้ดำเนินการแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนจริง" โดยยืนยันว่ากฎระเบียบของผู้ดำเนินการแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนจริงจะมีผลบังคับใช้ในวันพฤหัสบดีหน้า (1 มิถุนายน) และจะ นักลงทุนรายย่อยจะได้รับอนุญาตให้เข้าร่วม

ชื่อระดับแรก

ยอมรับใบอนุญาตแพลตฟอร์มการซื้อขายใหม่ 6‧1

มีรายงานว่าใบอนุญาตใหม่สำหรับแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนภายใต้กฎหมายหลักทรัพย์และสัญญาซื้อขายล่วงหน้าและกฎหมายต่อต้านการฟอกเงินและต่อต้านการก่อการร้ายทางการเงินจะเริ่มรับใบสมัครในวันพฤหัสบดีหน้า สำหรับแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนจริงที่มีอยู่นั้น Cai Zhonghui กล่าวว่าไม่มีแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนจริงที่ดำเนินการในฮ่องกงก่อนวันพฤหัสบดีหน้า และพวกเขาไม่สามารถดำเนินการต่อไปได้ สำหรับแพลตฟอร์มที่ดำเนินการในฮ่องกงก่อนวันนั้น จะมีช่วงเปลี่ยนผ่านซึ่งต้องดำเนินการให้แล้วเสร็จภายใน 9 เดือน ยื่นขอใบอนุญาตกับสำนักงานคณะกรรมการกำกับหลักทรัพย์และสัญญาซื้อขายล่วงหน้า

ชื่อระดับแรก

Stablecoins ไม่สามารถซื้อขายได้จนกว่าจะมีการควบคุม

ประเด็นสำคัญประการหนึ่งในกฎระเบียบของธุรกรรมสินทรัพย์เสมือนในฮ่องกงคือการอนุญาตให้นักลงทุนรายย่อยเข้าร่วมหรือไม่ จากข้อมูลของ SFC ผู้ตอบแบบสอบถามส่วนใหญ่ตกลงที่จะให้บริการซื้อขายสินทรัพย์เสมือนจริงแก่นักลงทุนรายย่อย

อย่างไรก็ตาม มีผู้แสดงความคิดเห็นว่านักลงทุนรายย่อยไม่ได้รับอนุญาตให้เข้าร่วมในธุรกรรมสินทรัพย์เสมือน เนื่องจากสินทรัพย์เสมือนจำนวนมากไม่มีเนื้อหาจริง หรือนักลงทุนรายย่อยไม่สามารถเข้าใจและเข้าใจความเสี่ยงที่เกี่ยวข้องได้อย่างสมบูรณ์ ในเรื่องนี้ China Securities Regulatory Commission ระบุว่าตกลงว่านักลงทุนรายย่อยต้องเข้าใจความเสี่ยงที่เกี่ยวข้องกับการลงทุนในสินทรัพย์เสมือน ดังนั้น China Securities Regulatory Commission จะยังคงทำงานร่วมกับนักลงทุนและคณะกรรมการการศึกษาทางการเงินเพื่อให้ความรู้แก่นักลงทุนในทุกด้าน ของสินทรัพย์เสมือนและการทำธุรกรรม

SFC ยังย้ำว่าการอนุมัติแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนที่ได้รับอนุญาตเพื่อรวมสินทรัพย์เสมือนสำหรับการซื้อขายรายย่อยนั้นไม่ใช่คำแนะนำหรือการรับรองสินทรัพย์เสมือน และไม่ได้รับประกันถึงความต้องการในเชิงพาณิชย์หรือประสิทธิภาพของสินทรัพย์เสมือน

ชื่อระดับแรก

ธุรกรรมอนุพันธ์ที่ต้องพิจารณาแยกต่างหาก

เกี่ยวกับการซื้อขายตราสารอนุพันธ์ของสินทรัพย์เสมือน ข้อสรุปจากการปรึกษาหารือของ SFC กล่าวว่าผู้ตอบแบบสอบถามส่วนใหญ่เสนอว่าควรจำกัดการซื้อขายตราสารอนุพันธ์ของสินทรัพย์เสมือนสำหรับนักลงทุนมืออาชีพเท่านั้น หากนักลงทุนรายย่อยสามารถซื้อขายอนุพันธ์ของสินทรัพย์เสมือนได้ ควรมีมาตรการคุ้มครองนักลงทุนที่ครอบคลุม

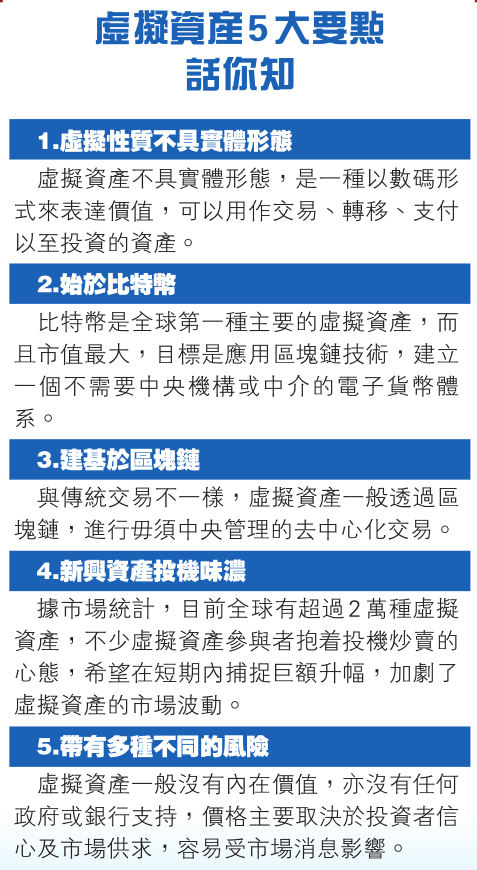

คำอธิบายภาพ

ชื่อระดับแรก

ฮ่องกงควบคุมกระบวนการสินทรัพย์เสมือนจริง

พฤศจิกายน 2561SFC ประกาศเจตจำนงที่จะควบคุมแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนจริง และกล่าวว่าระบบการออกใบอนุญาตเป็นไปตามความสมัครใจ

ธันวาคม 2563คณะกรรมการกำกับดูแลหลักทรัพย์ออกแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนจริงครั้งแรกให้กับ OSL Digital Securities ซึ่งเป็นบริษัทในเครือของ BC Group ( 863 )_

กุมภาพันธ์ 2565รัฐบาลฮ่องกงส่ง "กฎหมายต่อต้านการฟอกเงินและต่อต้านการก่อการร้ายทางการเงิน (ฉบับแก้ไข) ร่างกฎหมายปี 2022" ต่อสภานิติบัญญัติ โดยเสนอให้ใช้ระบบการออกใบอนุญาตสำหรับผู้ให้บริการสินทรัพย์เสมือน

ตุลาคม 2565รัฐบาลฮ่องกงออกประกาศนโยบายสินทรัพย์เสมือนจริงในงาน Fintech Week โดยแสดงเจตจำนงที่จะผ่อนคลายสินทรัพย์เสมือนจริงสำหรับนักลงทุนรายย่อยที่จะเข้าร่วม

ธันวาคม 2565ร่างกฎหมายต่อต้านการฟอกเงินและต่อต้านการจัดหาเงินทุนเพื่อต่อต้านการก่อการร้าย (ฉบับแก้ไข) ปี 2022 ผ่านการพิจารณาอย่างเป็นทางการโดยสภานิติบัญญัติ

กุมภาพันธ์ 2566SFC เผยแพร่เอกสารให้คำปรึกษาเกี่ยวกับข้อกำหนดด้านกฎระเบียบที่เสนอสำหรับผู้ให้บริการแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนจริงที่ได้รับใบอนุญาตจาก SFC

พฤษภาคม 2566ชื่อระดับแรก

China Securities Regulatory Commission: ไม่มีระยะเวลาผ่อนผันหลังการซื้อขายสำหรับสินทรัพย์เสมือน

นอกเหนือจากการพิจารณาว่านักลงทุนรายย่อยจะได้รับอนุญาตให้เข้าร่วมหรือไม่ จุดเน้นอีกอย่างของการปรึกษาหารือเกี่ยวกับ "แนวทางปฏิบัติสำหรับผู้ดำเนินการแพลตฟอร์มการซื้อขายสินทรัพย์เสมือน" คือการคุ้มครองนักลงทุน มีความเห็นในตลาดว่าควรเลียนแบบผลิตภัณฑ์ประกันภัยเพื่อ "ให้กลไกช่วง cool-off period" สำหรับนักลงทุนรายย่อยก่อนหรือหลังธุรกรรมสินทรัพย์เสมือน ลูกค้ารายอื่น ๆ ของธุรกรรมสินทรัพย์

SFC ระบุว่าขณะนี้ไม่มีการกำหนดระยะเวลาผ่อนผันหลังบัญชีกับลูกค้ารายย่อยของตัวกลางที่ดำเนินกิจกรรมควบคุมอื่น ๆ รวมถึงการให้บริการซื้อขายอัตโนมัติ ลูกค้ารายย่อยใด ๆ ที่สร้างความสัมพันธ์ทางธุรกิจควรได้รับการประเมินโดย ผู้ประกอบการแพลตฟอร์มที่เหมาะสมสำหรับการซื้อและขายสินทรัพย์เสมือน

ด้วยเหตุนี้ SFC จึงพิจารณาว่าช่วงเวลาพักหลังการซื้อขายไม่สามารถทำได้ เนื่องจากบริการการซื้อขายอัตโนมัติเกี่ยวข้องกับการจับคู่การซื้อขายกับลูกค้า และการคลี่คลายหรือยกเลิกการซื้อขายจะส่งผลกระทบต่อลูกค้ารายอื่นของแพลตฟอร์ม

นอกจากนี้ เกี่ยวกับความเห็นที่ว่า China Securities Regulatory Commission ควรห้ามแพลตฟอร์มการซื้อขายสินทรัพย์เสมือนที่ได้รับใบอนุญาตจากการให้สิ่งจูงใจและผลประโยชน์ทางการเงินแก่นักลงทุนรายย่อย China Securities Regulatory Commission เห็นพ้องกัน และชี้ให้เห็นว่าการให้ของขวัญเป็นสิ่งต้องห้ามอย่างชัดเจนใน "หลักเกณฑ์สำหรับแพลตฟอร์มการซื้อขายสินทรัพย์เสมือน" แต่ไม่รวมส่วนลดค่าธรรมเนียมหรือค่าบริการต่างๆ

ชื่อเรื่องรอง

【การตรวจสอบธุรกิจรายวัน】การควบคุมสินทรัพย์เสมือนควรนำไปใช้ได้จริง

Li Mingsheng ผู้ประกาศข่าว Hong Kong Commercial Daily

เมื่อปลายปีที่แล้ว รัฐบาลได้ออก "ประกาศนโยบายการพัฒนาสินทรัพย์เสมือนจริงในฮ่องกง" ซึ่งชี้แจงจุดยืนและแนวทางนโยบายของทางการ รวมทั้งการกำกับดูแลผ่านระบบการออกใบอนุญาต เมื่อต้นปีนี้ ดำเนินการให้คำปรึกษาสาธารณะเกี่ยวกับข้อกำหนดด้านกฎระเบียบที่เสนอสำหรับผู้ให้บริการแพลตฟอร์มที่เกี่ยวข้อง เมื่อวานนี้ คณะกรรมการกำกับดูแลหลักทรัพย์ของจีนได้ออกข้อสรุปการปรึกษาหารือที่เกี่ยวข้อง และผู้ตอบแบบสอบถามแสดงการสนับสนุนโดยทั่วไป หลังจากพิจารณาข้อกำหนดด้านกฎระเบียบที่แก้ไขแล้ว "หลักเกณฑ์ที่ใช้บังคับกับแพลตฟอร์มการซื้อขายสินทรัพย์เสมือน โอเปอเรเตอร์" จะมีผลบังคับใช้ในวันที่ 1 มิถุนายน นักลงทุนรายย่อยจะซื้อขายได้เร็วที่สุดบนแพลตฟอร์มการออกใบอนุญาตในช่วงครึ่งหลังของปีนี้ สินทรัพย์เสมือนได้กลายเป็นส่วนสำคัญของระบบนิเวศทางการเงิน และฮ่องกง ในฐานะศูนย์กลางการเงินระหว่างประเทศ ไม่ควรขาดไป ตรวจสอบให้แน่ใจว่าการกำกับดูแลสินทรัพย์เสมือนเป็นของจริงและไม่เป็นเท็จ และจะไม่มีปัญหาเนื่องจากการขาดแคลน ของการควบคุมจะทำให้ตลาดมั่นใจในสิ่งนี้มากขึ้นและลงทุนมากขึ้น ความสงบของจิตใจเอื้อต่อการพัฒนาผลิตภัณฑ์ทางการเงินที่เป็นนวัตกรรมนี้อย่างมีระเบียบ ดีต่อสุขภาพ และยั่งยืน

สำหรับสินทรัพย์เสมือนจริง บางคนคิดว่าการเพิ่มขึ้นได้ผ่านไปแล้ว และการดำเนินการของฮ่องกงก็เกินกำหนดไปนานแล้ว แต่ในขณะเดียวกัน บางคนคิดว่ามันอยู่ในลัคนา และแม้กระทั่งทิศทางของการพัฒนาทางการเงินในอนาคต ใครถูก? ไม่ว่าในกรณีใด สินทรัพย์เสมือนได้ถูกรวมไว้อย่างกว้างขวางในตะกร้าการจัดสรรสินทรัพย์ของภาคการเงิน และกำลังถูกดึงศักยภาพในด้านต่าง ๆ ตั้งแต่เทคโนโลยีบล็อกเชนไปจนถึงสกุลเงินดิจิทัล หากมุมนี้ของภูมิทัศน์ทางการเงินของฮ่องกงหายไป มันจะส่งผลเสียต่อสถานะของการเป็นศูนย์กลางทางการเงินระหว่างประเทศและศูนย์การจัดการสินทรัพย์อย่างหลีกเลี่ยงไม่ได้ สิ่งที่เรียกว่าการพลาดโอกาสส่วนใหญ่มาจากการเก็งกำไรและการเก็งกำไร เนื่องจากปริมาณธุรกรรมและราคาธุรกรรมของ NFT สกุลเงินที่เข้ารหัส ฯลฯ มีจุดสูงสุดและลดลง อย่างไรก็ตาม สิ่งนี้กลับเน้นย้ำถึงความจำเป็นในการกำกับดูแล เพื่อไม่ให้นักลงทุนต้องสูญเสียเนื่องจากความไม่รู้ของกษัตริย์ โดยเฉพาะอย่างยิ่งจากบทเรียนที่ได้รับจากอดีต ฮ่องกงสามารถกำกับดูแลได้อย่างมีประสิทธิภาพมากขึ้นและหลีกเลี่ยงการหลงทาง

หากไม่มีสถานที่รักษาความปลอดภัยก็ยากที่จะมีการพัฒนาอย่างมั่นคงเหตุผลที่ตลาดสินทรัพย์เสมือนมีความเสี่ยงเป็นเพราะขาดการควบคุมดูแล ตัวอย่างเช่น ในสหรัฐอเมริกา "แวดวงสกุลเงิน" เคยประสบกับ "ภัยพิบัติจากค่าเงิน" บ่อยครั้ง ไม่ใช่เรื่องแปลกที่จะเกิดการล่มสลายอย่างกะทันหันของราคาสินทรัพย์เสมือน รวมถึงเหรียญ Stable Coin และแพลตฟอร์มการซื้อขายในทันใด ไม่สามารถเทรดหรือหยุดเทรดได้ เงินทุนลูกค้า ส่งผลให้นักลงทุนสูญเสียเงิน...เพราะความวุ่นวายของตลาดต่างๆ ทำให้หลายๆ แห่งกำลังคุมเข้มอยู่ในขณะนี้ เช่น กระทรวงการคลังของสหรัฐอเมริกาเผยแพร่การประเมินความเสี่ยงทางการเงินที่ผิดกฎหมายทั่วโลก บริการทางการเงินแบบกระจายอำนาจเมื่อเดือนที่แล้ว และรัฐสภายุโรปในเดือนเดียวกัน กฎระเบียบฉบับแรกของโลกที่มีเป้าหมายเพื่อควบคุมตลาดสกุลเงินดิจิทัลอย่างครอบคลุมก็ได้รับการอนุมัติเช่นกัน สำหรับฮ่องกง การปรึกษาหารือของ SFC แสดงให้เห็นว่าผู้ตอบแบบสอบถามส่วนใหญ่เห็นด้วยกับข้อเสนอที่อนุญาตให้ผู้ประกอบการแพลตฟอร์มการซื้อขายที่ได้รับใบอนุญาตสามารถให้บริการแก่นักลงทุนรายย่อยได้ การรับรอง ความเหมาะสม ธรรมาภิบาล การตรวจสอบสถานะของโทเค็นที่เพิ่มขึ้น เกณฑ์การรวม และการเปิดเผยข้อมูล การดูแลที่ปลอดภัย ของทรัพย์สิน การแยกทรัพย์สินของลูกค้า การหลีกเลี่ยงผลประโยชน์ทับซ้อน และความปลอดภัยทางไซเบอร์ในกระบวนการสร้างความสัมพันธ์ทางธุรกิจกับลูกค้า ในหมู่พวกเขา หากแพลตฟอร์มไม่มีใบอนุญาตภายใน 9 เดือนหลังจากบังคับใช้กฎระเบียบก็จะไม่สามารถดำเนินธุรกิจซื้อขายสินทรัพย์เสมือนในฮ่องกงและไม่สามารถส่งเสริมความเสี่ยงในการลงทุนในฮ่องกงได้

ตามที่ระบุไว้โดย Leung Fung-yee ประธานเจ้าหน้าที่บริหารของ SFC กรอบการกำกับดูแลเป็นไปตามหลักการของ "ธุรกิจเดียวกัน ความเสี่ยงเดียวกัน กฎเดียวกัน" โดยมีเป้าหมายเพื่อให้การคุ้มครองนักลงทุนที่เหมาะสมและจัดการความเสี่ยงที่สำคัญ เพื่อส่งเสริมการพัฒนาที่ยั่งยืน ของอุตสาหกรรมและสนับสนุนนวัตกรรม ฮ่องกงต้องเริ่มต้นบนเส้นทางของตัวเองในการพัฒนาสินทรัพย์เสมือนจริงอย่างปลอดภัย ท้ายที่สุด หากตลาดไม่มีความเชื่อมั่นก็จะไม่มีใครเข้าร่วม ภายใต้การนำของเสถียรภาพ ฮ่องกงไม่ได้ติดขัดด้านเงินสดมาหลายปี ลองพิจารณาดู สิทธิของนักลงทุน เฉพาะเมื่อการพัฒนามีความสมดุลและปลอดภัย และมีการบังคับใช้การกำกับดูแลสินทรัพย์เสมือน ตลาดจะเป็นระเบียบเรียบร้อยและมีสุขภาพดี และการพัฒนาที่ยั่งยืนสามารถบรรลุได้ และสภาพแวดล้อมของดินที่ดีขึ้นสามารถจัดหาให้สำหรับนวัตกรรมทางการเงิน แทนที่จะลดลงเหลือ "ต้นหอม" พื้นที่เสี่ยงภัย