BRC-20、ORC-20の次はBRC-21とは何ですか?

BRC-20 の爆発により、ビットコイン ネットワークを中心に構築された他の資産標準も出現し始めています。

5月7日、クロスチェーン相互運用性プロジェクトInterlayの創設者であるアレクセイ・ザミャティン氏は、完全に分散化されたクロスチェーン資産をビットコインネットワークに導入し、ライトニングネットワークで使用するためのBRC-21標準を立ち上げることを提案した。

Interlay Labs は、BRC-21 トークン標準に関する V0.1 ドキュメントもリリースしました。文書の説明によると、BRC-21 アセットは本質的には BRC-20 アセットのままですが、「何もないところから生まれた」BRC-20 アセットとは異なり、BRC-21 は初期チェーンでアセットをロックすることによって生成される必要があります ( ETH、DOT、ATOM、DAI など)、つまり、BRC-21 標準は、ビットコイン ネットワーク上の ETH、DAI、およびその他のオンチェーン資産の BRC-20 バージョンを鋳造する可能性を提供します。

技術的な観点から見ると、BRC-21 アセットのクロスチェーンは 3 つのコンポーネントに依存するだけで完了し、プロセス全体で完全な分散化が達成されることが期待されます。

StartChain スマート コントラクト: StartChain でのコインの鋳造と償還操作の処理を担当します。

カスタム インデクサー: BRC-21 の鋳造、転送、償還、およびビットコイン ネットワーク上のその他の操作と、初期チェーン上のスマート コントラクトのステータスの検証を担当します。

ビットコインリレー (BTC-Relay): スマートコントラクトの効果を実現するビットコインネットワーク上のライトクライアントとして、ビットコインネットワーク上のトランザクションの包含を検証および分析する必要があります。

Interlay Labsはまた、この文書の中でBRC-21アセットのデプロイメントをデモンストレーションしましたが、初期チェーン上でスマートコントラクトを設定する方法については今のところ言及されていませんが、注目に値するのは、それをビットコインネットワーク上にデプロイする方法です。

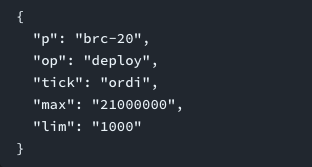

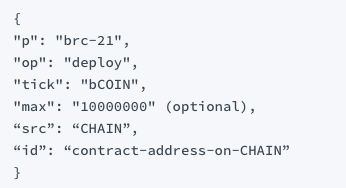

一般的に、BRC-21 トークンの展開は BRC-20 トークンの展開とほぼ同じですが、詳細にはいくつかの違いがあります。、例えば:

最大供給量を定義するために使用される「max」フィールドは必須ではなくなりましたが、オプションとなりました。これは、BRC-21 の背後にある元のアセットの最大供給量は通常、最初のチェーンで定義されており、オプションは追加のレイヤーのみを提供するためです。事故保護。

BRC-21 資産には厳格な鋳造および償還ルールが適用されるため、鋳造制限を定義する「lim」フィールドが削除されました。そのため、1 回のトランザクションで鋳造できるトークンの数を制限する必要はありません。

新しいフィールド「src」を追加して、開始チェーンを指定します。開始チェーンには、文字列 (イーサリアムなど) または数値 (ただし、追加のリストが必要です) を指定できます。

画像の説明

画像の説明

BRC-21 資産導入フォーマット

ユースケースに関しては、BRC-21 標準は理論的には ETH、DOT、SOL、およびその他のさまざまなチェーン資産をビットコイン ネットワークに導入できるものの、Interlay Labs の見解では、この標準が実際に役立つのは、分散型ステーブルコインを導入し、それをライトニングネットワークやその他の支払いプロトコルの上に展開することです。

Interlay Labsはさらに、DAIやRAIのような分散型ステーブルコインは、効果的なアンカリングを維持するために複雑な鋳造、償還、清算のメカニズムを必要とすることが多いと説明した。ビットコイン ネットワークにはプログラマビリティがもともと備わっていないため、MakerDAO などのプロトコルは、DAI などのステーブル コインをビットコイン ネットワークに直接展開することができず、この状況は今後も変わる可能性は低いです。

Interlay Labs は、BRC-21 標準を通じて完全に分散型の形でこれらの資産をビットコイン ネットワークに橋渡しし、ビットコイン ネットワークの分散型の性質を最大限に活用する方が、ビットコインに多くの時間を費やすよりも優れていると考えています。プログラミング プロトコルの最上位にあるこの方法は、数行のコードを実行するだけで有効になるため、大量採用を達成する可能性が高くなります。