IOSG Ventures: DeFi credit rating agreement, let DeFi explode on a large scale?

forewordIOSG Ventures

foreword

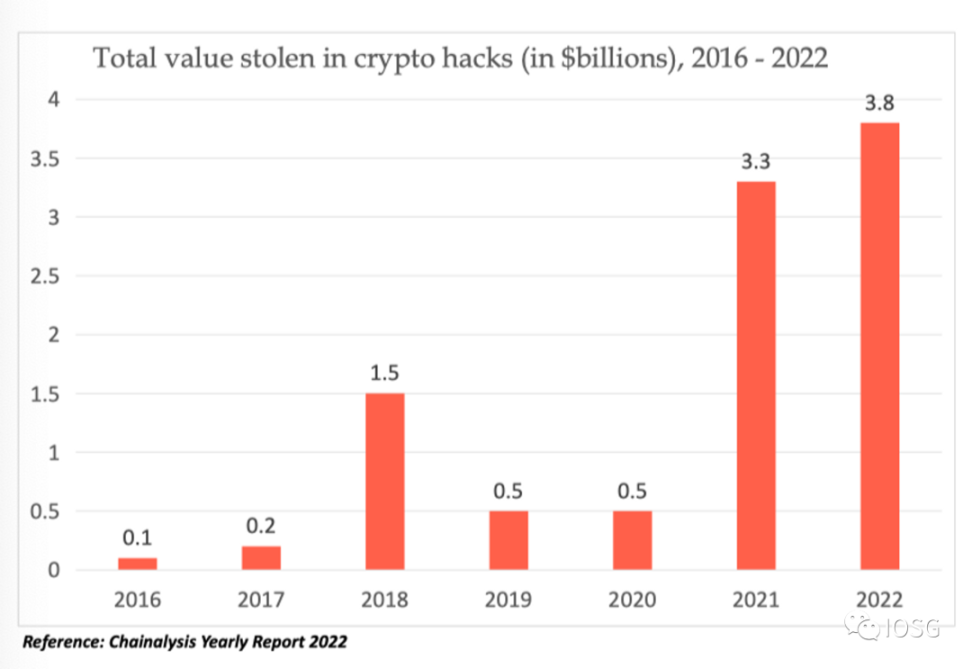

Web3 security vulnerabilities pose a major threat to the Web3 ecosystem. According to data from Chainalysis, smart contract security issues have resulted in losses of $3.8 billion. The chart below shows the rising number of Web3 hacks.

Decentralized finance (DeFi) covers a variety of risk categories, including:

Financial risks: These risks involve the financial stability of the DeFi protocol, such as bad debts in the loan agreement or extreme market fluctuations affecting the stability of the agreement.

Smart Contract Risks: These risks involve vulnerabilities in the smart contracts used by DeFi protocols.

Off-chain security risks: DeFi protocols not only include smart contracts, other network infrastructure or applications may also be compromised, including phishing attacks or mnemonic leaks.

Specific examples of DeFi risks include:

Financial Risks → Liquidity Risks: These risks relate to a user's ability to trade assets on a particular exchange or platform. In DeFi, liquidity risk can arise due to insufficient trading volume or locked funds.

Smart Contract Risk → Oracle Risk: These risks involve manipulation of oracle data, resulting in inaccurate prices or other issues.

Off-chain security risks → funds custody risks: These risks involve inability to access funds due to private key storage or security issues.

Smart Contract Risk → Smart Contract Upgrade Risk: When a smart contract upgrade goes wrong, it may lead to loss of funds or other problems.

The most well-known thing is that smart contract risks have caused DeFi security problems, but financial risks may lead to greater losses.

Take bad debt in a lending agreement as an example. In protocols like Compound, accounts are considered insolvent when the amount borrowed is greater than the total collateral value denominated in USD. If the account exceeds the collateral limit, it is usually liquidated by a third party (such as a robot), and the user loses the collateral to repay the debt. However, if the liquidation does not occur in a timely manner, the collateral sold may not be sufficient to cover the debt, leading to an increase in bad debts within the agreement. This situation can pose a risk to the protocol and lenders. If there is more debt outstanding than coverable collateral, borrowers may not be able to withdraw all their funds and the entire system is at risk. In this case, bank runs are prone to occur.

solution

https://quillhashteam.medium.com/200-m-venus-protocol-hack-analysis-b 044 af 76 a 1 ae

solution

A number of projects are addressing financial risk in the DeFi space, a key area of the Web3 world. They provide institutional investors and protocols with products that help them understand potential risks and manage products in extreme markets.

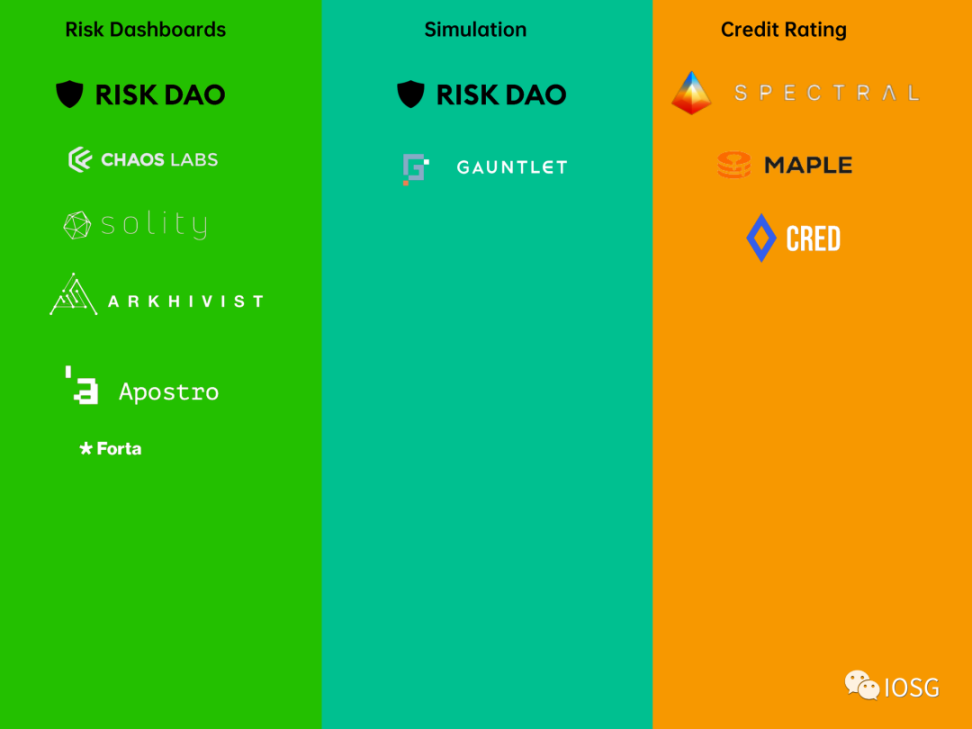

The three main research areas include:

Risk Dashboard

simulation

Credit Rating

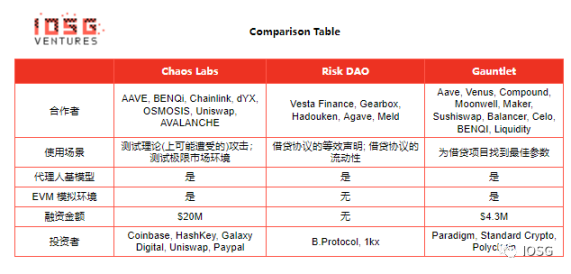

Several projects apply to these three solutions:

Risk Dashboard

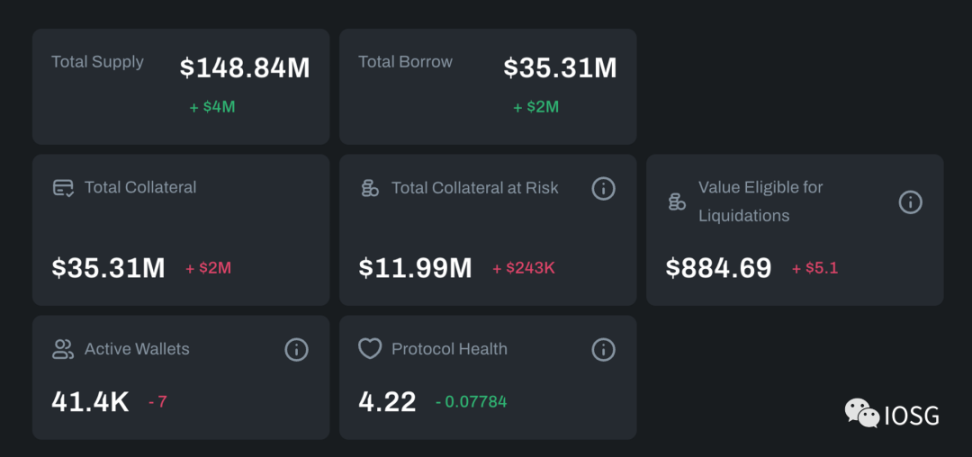

Risk dashboards are the main solution in the DeFi world, where valuable data is often buried in noise. While market data such as trading volume, TVL and market capitalization are easy to come by, liquidation data and bad debt data are more difficult to track. Developers need to build databases to monitor the core risk factors of DeFi projects.

Frequently tracked data includes:

Mortgage ratio

risky collateral

total collateral

supply and borrow

Liquidation Amounts and Events

Protocol Health

active wallet

TVL of Whales in Protocol

asset type

Oracle

Oracle

Several projects are working to fill the gap left by existing security companies such as CertiK and Runtime Verification.

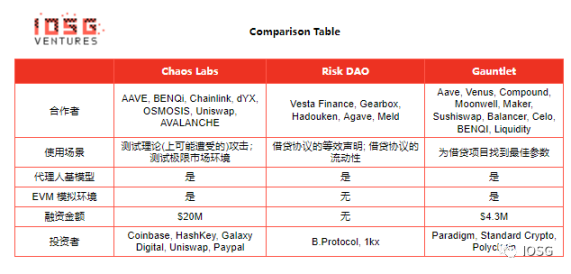

Chaos Labs

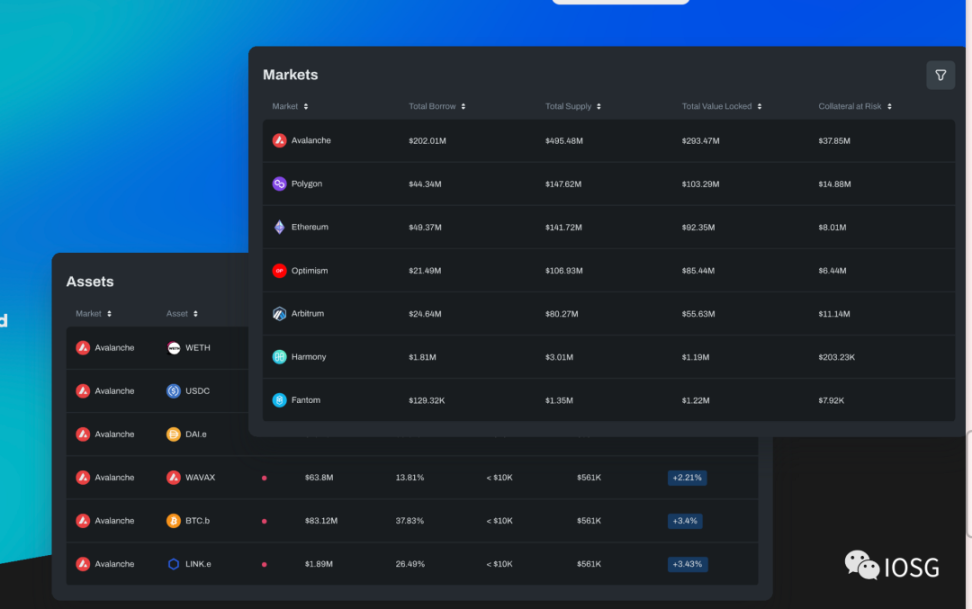

Chaos Labs specializes in risk dashboards, providing market information such as total borrowing, total supply, TVL, and risky collateral on different chains.

They also provide wallet insights, allowing users to manage wallet liquidation risk in one dashboard.

Chaos Labs is partnering with AAVE, BENQI, dYdX, Osmosis, Avalanche, Chainlink, and Uniswap Foundation to build safer DeFi protocols.

They work with BenQi to keep it safe. They built 4 dashboards that revealed some hidden data on the blockchain:

risk monitor

veQi Calculator

Liquidity Staking Analysis

reserve panel

risk monitorIt is one of the core dashboards to ensure the health of the BENQI protocol. This dashboard assesses the distribution of supply/borrowing/minting/reserve assets. In addition to the distribution, it also contains some aggregate data such as collateral, borrowing, liquidations, and active wallets.

It provides a breakdown of the different BENQI supported assets. Users can also view this data grouped by wallet. In the liquidation tab, users can view recent liquidation events and liquidation volumes.

In Risk Explorer, users can learn about extreme market conditions. Enter the price change of the underlying asset and the browser will provide predicted liquidation data.

Likewise, Chaos Labs has partnered with AAVE. The Risk Dashboard provides similar data, but with some additional useful data, such as the relationship between collateral ratios and GHO risk over time. These dashboards provide users with real-time information to better understand potential risks and make informed investment decisions.

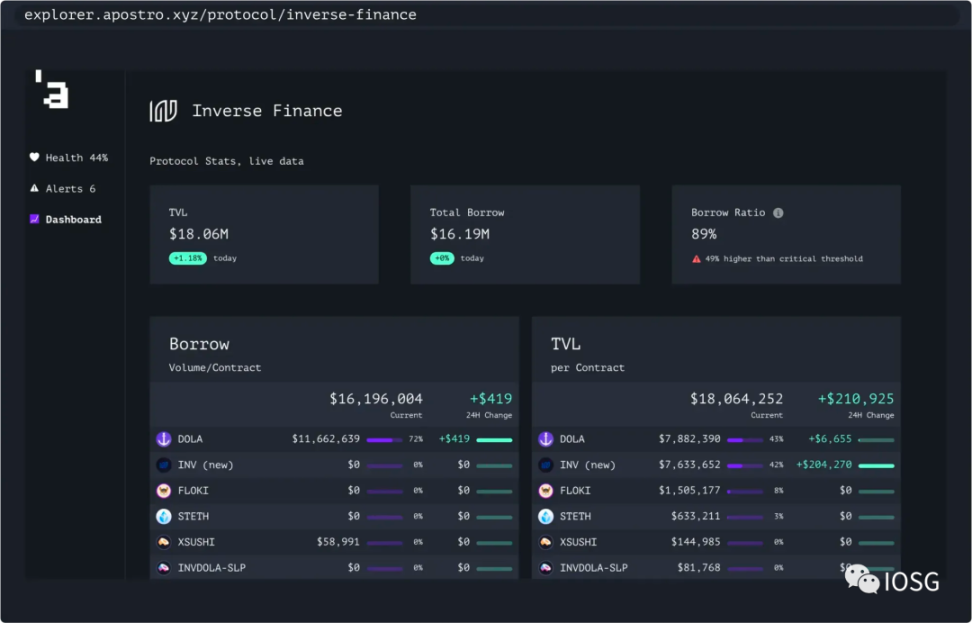

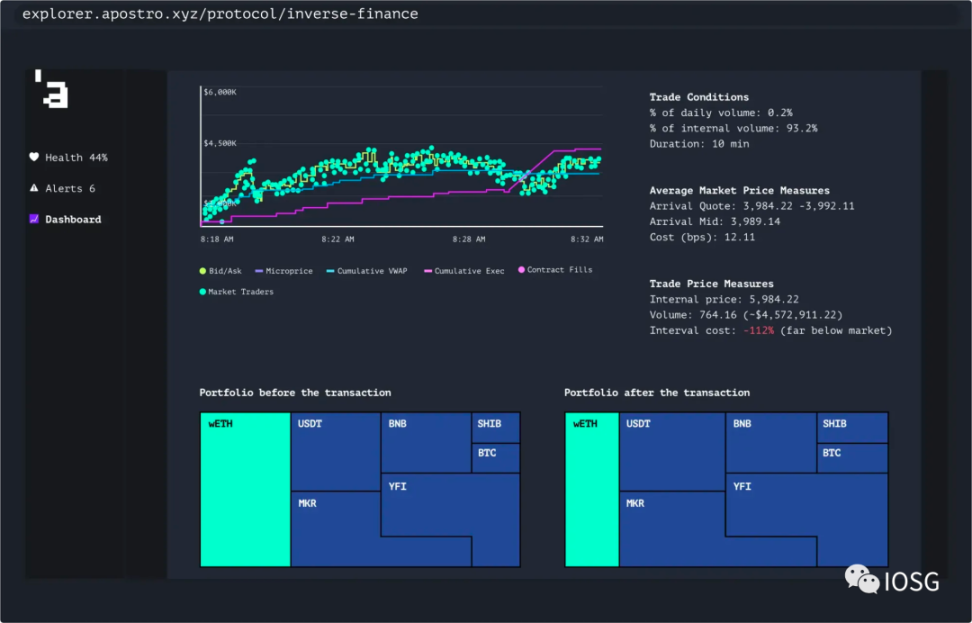

Apostro

Apostro provides risk dashboards for protocols with a focus on on-chain monitoring. By monitoring on-chain protocol data and transactions, they can alert users to potential incidents, vulnerabilities, and attacks. Apostro also keeps an eye on extreme market activity and oracle prices, which are vulnerable to manipulation. Oracle price manipulation is one of the most well-known exploits. Hackers can use this technique to implement arbitrage on the protocol.

risk

risk

Oracle price

market

Arkhivist

Arkhivist is developing risk dashboards focused on smart contract security. They allow individual investors to subscribe to the protocol page, and smart scanners continuously monitor the protocol for exploits.

The Arkhivist program offers three dashboards:

1. The main dashboard shows the security scores of different protocols and their changes over one day and seven days.

2. Dashboard showing security vulnerabilities in these protocols.

3. A dashboard for analyzing smart contract interactions and performing network analysis.

(Note: IOSG is one of the investors of Arkhivist)

Solity

Solity collects on-chain and off-chain data and uses machine learning to quantify, normalize and address underlying risks.

With on-chain and off-chain data, Solity provides customized risk analysis and monitoring. It focuses on data such as oracle data, governance data, smart contract security, protocol activity, and market volatility.

(Note: IOSG is one of Solity's investors)

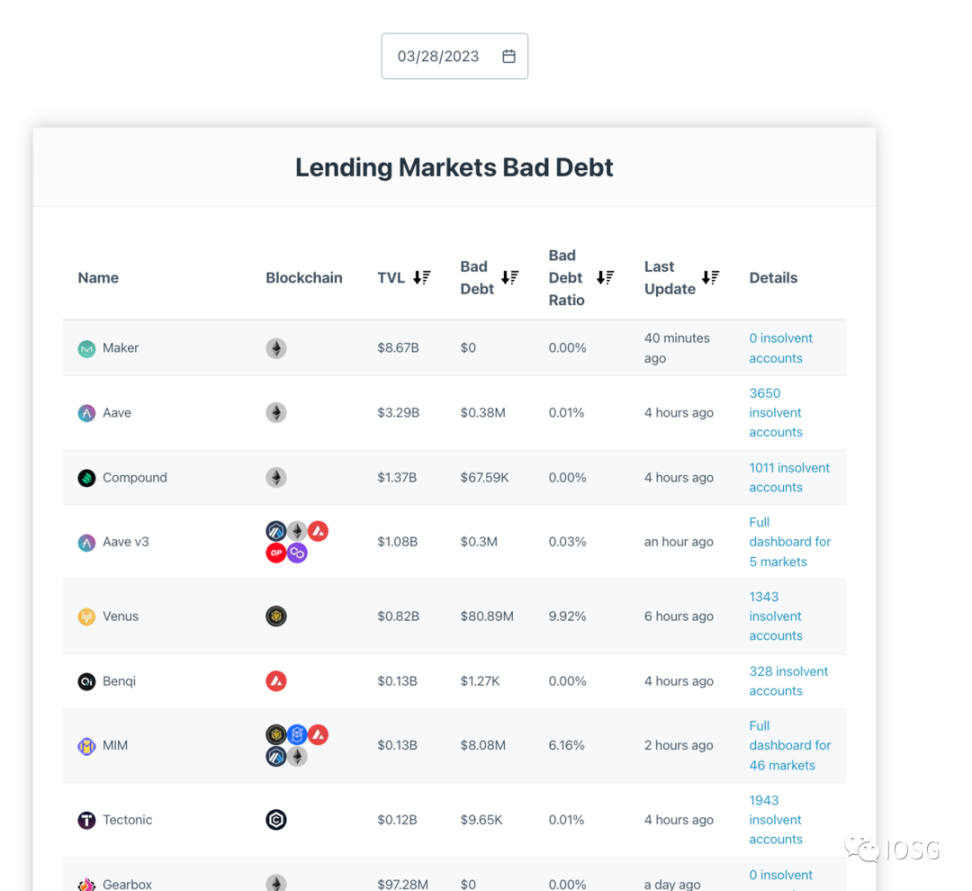

Risk DAO

Risk DAO provides two dashboards:

bad debt

Financial risk

The Distressed Debt Dashboard includes distressed debt-related information for major agreements. Users can also view by date.

Financial risk dashboards vary from project to project. Below is an example made for Vesta Finance. It provides the following data:

system status

MCRS (Minimum Collateral Ratio)

Risk Parameter Sandbox

asset distribution

stability

asset pool

to liquidate

Oracle Price Bias

DEX liquidity

Qualitative analysis of different asset pools

GLP utilization

Through these dashboards, investors can better understand the risk profile of various protocols and thus make more informed investment decisions. The goal of Risk DAO is to help investors identify and reduce potential risks and improve the transparency of the entire encryption market.

simulation

Simulation is an important technique used in traditional finance and banking. Financial institutions use simulations to construct various market scenarios, such as changes in interest rates or stock prices, to assess their impact on investment portfolios. These simulations enable institutions to better understand the risks associated with their investments and make more informed decisions.

One simulation technique commonly used in finance is Monte Carlo simulation. Monte Carlo simulation involves generating random variables to simulate various market scenarios. By running multiple simulations, institutions can understand the likelihood of different outcomes and adjust their portfolios accordingly.

Another common technique is stress testing, which involves simulating extreme market conditions to assess the impact on an institution's portfolio. Stress testing can help institutions identify potential vulnerabilities and take steps to reduce risk before a crisis occurs.

Now, simulation has also become a method to solve the risk of DeFi. In this approach, the project applies some model to the protocol. The project begins by identifying some important risk factors. They quantify these risk factors and predict potential outcomes by adjusting the risk factors one by one.

Using these methods, simulations can be used for the following purposes:

collateral ratio

Optimize handling fee

token emission

Edge cases such as unanchored, potential vulnerabilities

Through simulation technology, DeFi projects can better understand the impact of various risk factors on the protocol, and take corresponding measures to optimize and reduce risks. This helps to improve the security and stability of the entire DeFi ecosystem.

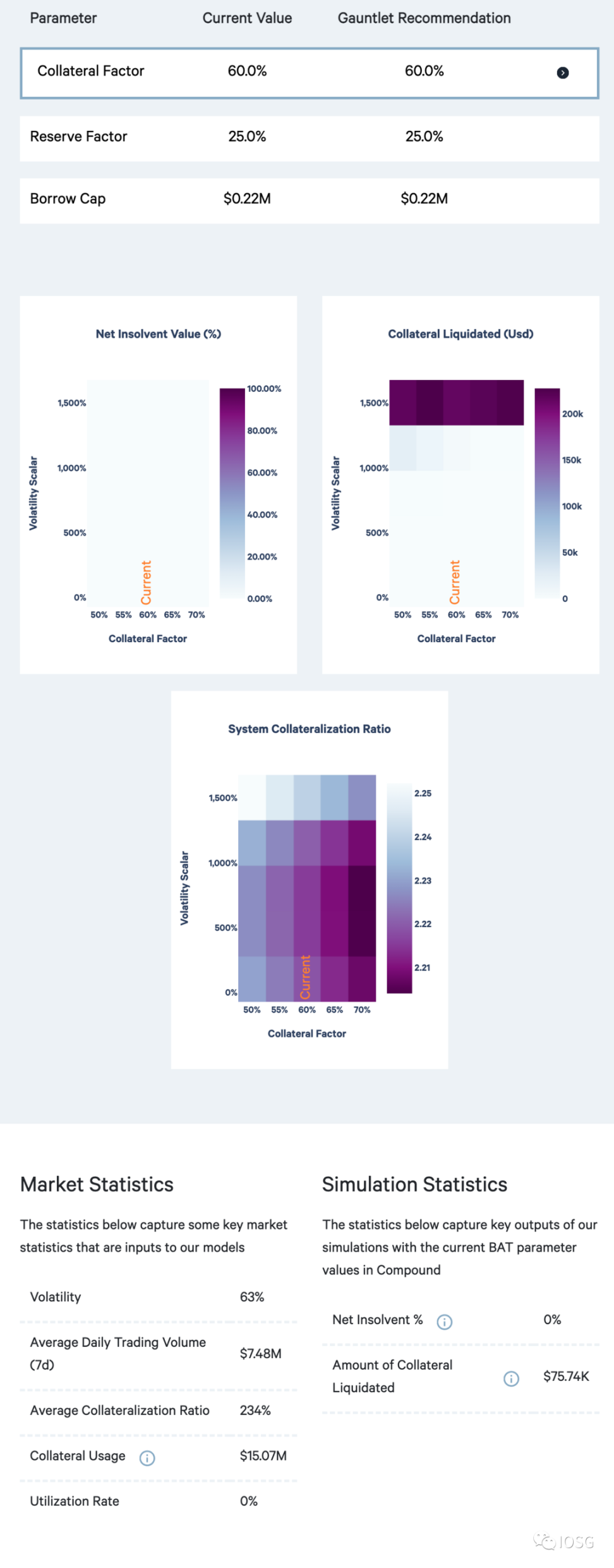

Gauntlet

Gauntlet is a project focused on simulation. They use their own simulation models to help protocols find better risk parameters. They work closely with Compound, helping Compound conduct market risk assessments, contribute to treasury management, optimize incentives, calibrate risk parameters, and upgrade protocols.

Gauntlet uses three key metrics to assess the capital efficiency and risk of DeFi lending protocols:

Value at Risk: 95th percentile of bad debts under different market volatility settings. The lower the better.

Liquidation Risk: 95th percentile of potential capital liquidations under different market volatility settings.

Borrowing utilization ratio: total collateral supply / borrowing amount

They made a dashboard for all collateral on Compound. The following is an example on $BAT.

Chaos Labs

Chaos Labs also provides simulation services to clients. They have a Python based EVM simulation environment. They can replay historical data of on-chain protocols. Their use cases are as follows:

Predict liquidations in extreme market conditions

Forecast liquidity in extreme market conditions

Unanchor simulation

pressure test

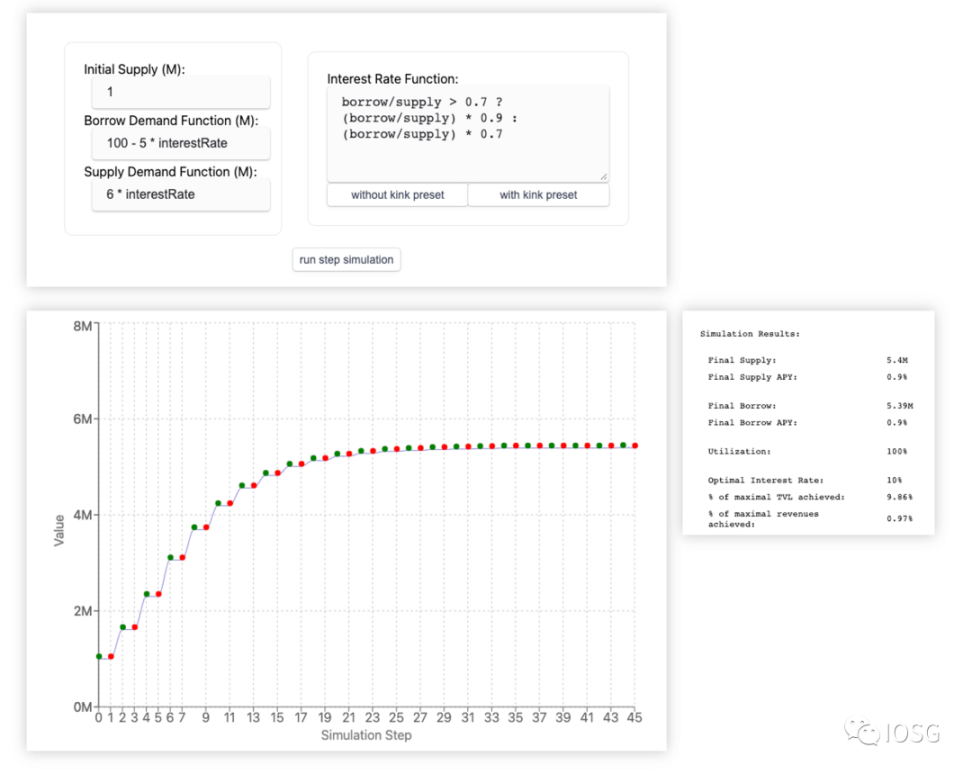

Risk DAO

Risk DAO provides interest rate simulators for lending protocols to find long-run equilibrium.

Users can input several important parameters of the lending agreement and get the final status of the lending agreement.

They also provide several mocks for risk dashboards:

Recommended risk parameters with different parameters

Liquidation under extreme market volatility

By utilizing the interest rate simulator provided by Risk DAO, the lending agreement can better find the long-term equilibrium state, thereby adjusting the interest rate to improve the capital efficiency and stability of the agreement. At the same time, by running simulations of different risk parameters and extreme market fluctuations, the project can better assess and manage risks and provide users with safer and more reliable decentralized financial services.

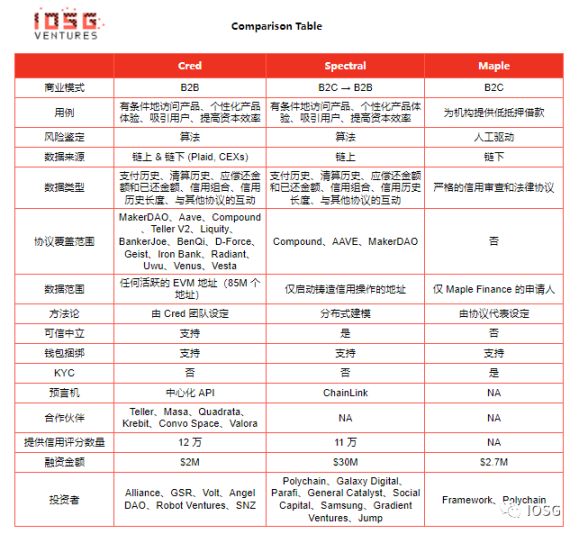

Credit Rating

Credit ratings are another way to quantify risk. Projects use users' on-chain transaction history to generate credit scores for them. Projects can use these scores to determine who is at higher risk and provide them with customized products.

Credit ratings are a common practice in the traditional financial industry to assess the creditworthiness of individuals, companies and securities. The business model of credit rating agencies is to provide independent opinions on credit risk to entities that issue debt, including governments, corporations and financial institutions. Credit rating agencies assign credit ratings to these entities based on their ability to repay their debts.

The credit rating industry is highly concentrated, with three major rating agencies - Standard & Poor's (S&P), Moody's and Fitch - dominating the market. The institutions have come under fire for their role in the 2008 financial crisis, as some of their highly-valued securities later turned out to be worthless.

In recent years, there has been growing interest in developing alternative credit rating models that rely on big data and machine learning to assess creditworthiness. These models can incorporate a wider range of factors than traditional credit rating methods and may be more effective at predicting credit risk. However, they are still in the early stages of development and may face challenges in gaining widespread application.

The Cred protocol is working in this direction. They apply machine learning to evaluate credit scores on the following data:

Borrowing History

Composition of account assets

Account health status, such as account assets, transaction volume

interactive

Trust, such as account attribution agency, KYC, ID NFT, etc.

credit history

Currently, the borrowing history only supports a handful of large lending protocols on large chains. Here is a detailed coverage list.

Insight

Currently, there are three solutions to address non-smart contract risks in the DeFi space: simulations, risk dashboards, and credit ratings. These solutions complement each other and work together more effectively.

business model

These solutions are still in their infancy and have not yet established clear and mature customer segments. Their target customers may include institutions, protocols, and individual investors, all of whom are affected parties in the event of an attack. Institutions such as DeFi funds, in particular, are likely to invest a large amount of money in the protocol and therefore have a strong interest in understanding the potential risks. Protocols require security information to maintain security and demonstrate authenticity to investors. Individual investors care about security because they don't want to lose in the event of an attack.

An early adopter of analog might be the protocol. Simulations can be one-off services, such as simulating protocol performance under extreme market conditions, or subscription services that help protocols adjust risk and incentive parameters on a regular basis. As DeFi becomes more complex, it becomes more challenging for humans to design and tune these parameters. Big data is an ever-evolving trend that allows for constant fine-tuning of parameters to provide more reliable and profitable options.

DeFi funds could be early adopters of risk dashboards. While risk dashboards may be optional for individual investors, they are essential for DeFi funds that invest heavily in protocols and want to understand potential risks. In the event of any attack, they want to be informed and acted upon in the first instance to minimize potential damage. Risk dashboards can charge DeFi funds a subscription fee, with prices varying based on the number of dashboards used.

future

future

During the last bull cycle, investors focused on APY and ignored risk. However, investors are now putting more emphasis on risk management after several major project debacles. While considering risks, the stability of the entire DeFi ecosystem is improved. The aforementioned projects provide a wealth of risk-related data, and making this data easy to read is critical. For example, projects can incorporate risk directly into APY, with risk-adjusted returns serving as a useful metric.

As DeFi protocols become more and more complex, it has become impossible for humans to accurately track all risks. The application of big data and machine learning is imperative. Simulations will become as important as security audits, ensuring not only the security of smart contracts, but also the security of the economy under stress testing. Engineering and finance are the cornerstones of the DeFi world, and both must be secured.

Risk dashboards must demonstrate their competitiveness against open source data dashboards such as Dune. They need to convince customers to pay for a subscription instead of relying on the free data dashboard on Dune. To strengthen competitiveness, Risk Dashboard is currently working on:

Real-time data

attack alert

off-chain data

However, they still lack customization, making it difficult for users to tailor risk dashboards to their needs. Users may need custom metrics, or wish to incorporate risk data into their data pipelines or automations.

Credit protocols are still in their infancy and currently cover only a small fraction of on-chain data, making it difficult for new DeFi protocols to build on top of. To realize the potential of big data, credit protocols need to expand their datasets to include both on-chain and off-chain data. This will make credit ratings more reliable and accurate.

We believe that credit protocols should expand data sets, including on-chain and off-chain data, to realize the potential of big data. Big data can lead to more reliable and accurate credit ratings.

Another important feature is customizability. DeFi protocols may wish to select specific features and adjust weights to meet their needs. For example, a protocol on Avalanche might place higher value on transactions that happen on Avalanche than transactions on other chains.

In the traditional financial industry, credit institutions have played an important role in the stability of the financial industry. They classified and rated bonds and various assets. Its purpose is to provide investors with a measure of the credit risk of the debt issuer.

Common asset and liability behaviors:

Bonds: corporate bonds, government bonds, local government bonds, convertible bonds, etc.

Short-term debt: commercial paper, short-term bonds, short-term deposits, etc.

Financial instruments: asset-backed securities (ABS), mortgage-backed securities (MBS), detachable convertible bonds, etc.

Bank deposits and debts: bank time deposits, interbank lending, negotiable certificates of deposit, etc.

Debt of insurance companies and other financial institutions

Sovereign Credit Ratings of Countries and Territories: Assessing the Ability and Willingness of Governments to Repay Their Debt

Enterprise rating: evaluate the credit risk of the enterprise, including debt repayment ability, financial status, operating risk, etc.

Credit rating agencies will rate various assets and debts based on their characteristics, repayment ability, market risk, etc., usually using letters, such as AAA, AA, A, etc. Rating results can help investors understand the credit risk of related assets and serve as a reference in investment decisions.

At present, in the field of DeFi, there is no large-scale risk analysis and rating of agreements and assets by credit institutions. With the increase in the number of high-net-worth individual investors, there will be more needs to clarify the risk level and risk exposure of DeFi agreements and assets. For high-risk agreements and assets, credit institutions will have the ability to give clear reminders to investors. Investors can intuitively and quickly understand the potential risks of investment targets from the risk rating. In order to meet this demand, we may see the rapid expansion of credit agreements, because it is difficult for small-scale credit agreements to be able to cover a wide range of DeFi agreements.

A significant risk to consider is that if credit agreements become popular in the future, current credit rating models may no longer apply. For example, a wallet with a good credit rating may act maliciously when it discovers the possibility of obtaining large unsecured loans from certain DeFi protocols. As the rules of the game change, the underlying assumptions and models of credit agreements must be adjusted accordingly.

To address this risk, credit protocols need to undergo continuous monitoring and model updating. This may include:

Predictive Models: Develop predictive models based on big data and machine learning to identify potential malicious behavior and credit risk.

Dynamic adjustment: According to market changes and changes in behavior patterns, the credit rating model is regularly adjusted to ensure its accuracy and effectiveness.

Multi-dimensional assessment: When assessing credit risk, a multi-dimensional approach is adopted, including on-chain and off-chain data, historical behavior and real-time behavior, etc., in order to gain a more comprehensive understanding of potential risks.

Community participation: Encourage community members to participate in the improvement of the credit rating model, providing feedback and suggestions so that it can adapt to the ever-changing DeFi ecosystem.

Transparency: Improve the transparency of credit rating models, let users and protocols understand the basic principles and standards of ratings, and help make adjustments when possible loopholes or deficiencies are discovered.

By taking these measures, the credit protocol can continuously optimize and improve the credit rating model while coping with potential future risks, so as to keep pace with the development and innovation of the DeFi ecosystem.

Appendix Surveillance Capitalism: The Smart Trap: https://movie.douban.com/subject/34960008/ A Critical History of Social Media: https://book.douban.com/subject/30280097/

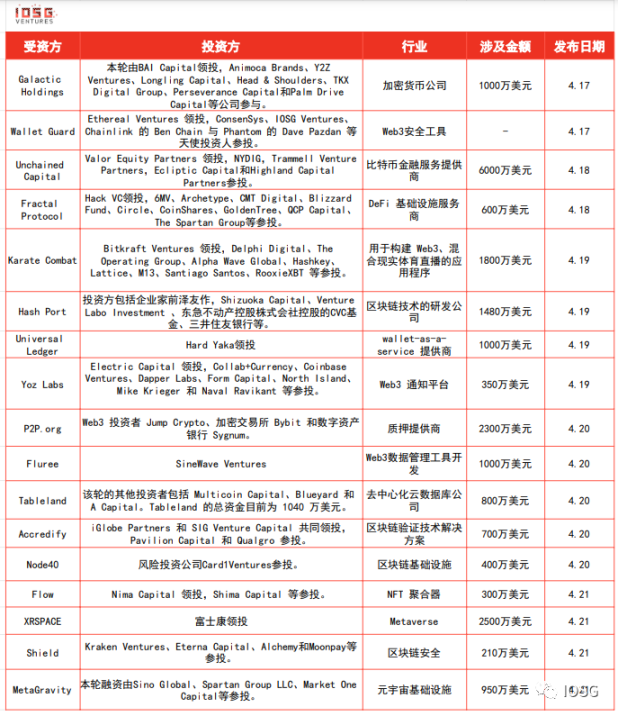

Part.2 Investment and financing events

NFT Aggregator Flow Secures $3M in Seed Funding to Build Rollup-Centric NFT Ecosystem

* NFT aggregator

Flow, an NFT ecosystem centered on Rollup, completed a $3 million seed round of financing led by Nima Capital and participated by Shima Capital and others. This round of financing will be used to build an NFT ecosystem centered on Rollup. Flow's NFT marketplace and aggregator is currently available on the Goerli testnet and in beta on the Ethereum mainnet.

Metaverse company XRSPACE completes $25 million in financing, led by Foxconn

* Metaverse

XRSPACE, a Taiwanese company in China, announced the completion of a new round of financing of US$25 million, led by Foxconn. In March 2022, XRSPACE stated that it will obtain US$100 million through three financing transactions, and this financing is the first of these three transactions. The company provides a social metaverse experience through its platform "XRSPACE MANOVA" , designed to change the way people connect, work and play.

Blockchain security firm Shield raises $2.1 million in pre-seed funding

* Blockchain Security Company

Los Angeles-based blockchain security startup Shield has raised $2.1 million in pre-seed funding, with participation from Kraken Ventures, Eterna Capital, Alchemy, and Moonpay. Shield aims to revolutionize internet security by developing products that encourage growth and innovation while maintaining the highest security standards. It was founded by Luis Carchi (Princeton University, ex-Facebook employee), Isaiah Udotong (MIT, Y-Combinator alumnus) and Emmanuel Udotong (Princeton University, ex-McKinsey).

Metaverse infrastructure provider MetaGravity completes $9.5 million in financing

* infrastructure

Metaverse infrastructure provider MetaGravity completed a US$9.5 million seed round of financing. Sino Global, Spartan Group LLC, Market One Capital, etc. participated in this round of financing. Funds from this round of financing will be used to expand its engineering and product teams to support development The infrastructure layer needed for future large-scale virtual universe experiences.

According to reports, MetaGravity is building a distributed computing infrastructure for metaverse games and virtual world simulations, aiming to play a role in the development of a scalable, sustainable, decentralized, interoperable and secure metaverse ecosystem.

Decentralized database Tableland completes $8 million Series A financing led by CoinFund

* Cloud database

Decentralized cloud database company Tableland has raised an $8 million Series A round led by cryptocurrency-focused investment firm CoinFund. Other investors in the round included Multicoin Capital, Blueyard and A Capital. Total funding for Tableland currently stands at $10.4 million. These funds will help support Tableland's mainnet launch, the release of new developer tools, and the debut of Tableland Studio later this year.

Berachain Closes $42M Funding Led by Polychain Capital

* Layer 1

Layer 1 public chain Berachain completes USD 42 million private placement token financing, led by Polychain Capital, OKX Ventures, Hack VC, Dao 5, Tribe Capital, Shima Capital, Robot Ventures, Goldentree Asset Management, former partner of Dragonfly Capital, founder of Celestia Mustafa Al-Bassam, Tendermint co-founder Zaki Manian, and 20 other founders of DeFi projects participated in the round. The Berachain network is built on the Cosmos SDK and will be compatible with the EVM. Berachain is currently available as a development network (devnet), with a public incentivized testnet launch expected in the coming weeks and a mainnet launch likely later this year.

Staking Provider P2P.org Closes $23M Funding

* DeFi

Staking provider P2P.org has raised $23 million in funding from three crypto industry heavyweights: Web3 investor Jump Crypto, crypto exchange Bybit and digital asset bank Sygnum. P2P said it will use the funds to develop blockchain infrastructure to enhance user experience in staking as well as research and develop expansion plans.

Blockchain infrastructure company Node 40 completes $4 million in funding

* infrastructure

Blockchain infrastructure company Node 40 has completed $4 million in financing, with venture capital firm Card 1 Ventures participating. Known for its innovative suite of blockchain tools and services, Node 40 is dedicated to simplifying the deployment and management of blockchain nodes. This strategic investment aims to advance the development of Node 40, enhance its product offering, and further expand its presence in the fast-growing blockchain industry.

British on-chain insurance company Nayms completes $12 million financing led by UDHC

* On-chain insurance

Nayms, a British on-chain insurance company, announced that it has completed a $12 million private placement financing at a valuation of $80 million. UDHC led the investment, and New Form, Tokentus, and Keyrock participated in the investment. Nayms will use the new funds to expand its global team and accelerate the development of its crypto-native insurance marketplace. Nayms plans to further support its product development, marketing and accelerate global business expansion. In January 2021, Nayms, a digital asset insurance company, completed a $2 million seed round of financing.

Blockchain verification technology solution Accredify completes $7 million in Series A financing

* Verify technical solutions

Accredify, a Singapore-based blockchain verification technology solutions company, completed a US$7 million Series A round of financing, co-led by iGlobe Partners and SIG Venture Capital, with participation from Pavilion Capital and Qualgro. Accredify verifies by creating identities for users on the blockchain (mainly Ethereum), the platform creates a smart wallet or file storage, and manages the private and public keys for the client, and finally extracts through the dashboard or API integration data. To date, Accredify has performed 12 million verifications on 2 million issued documents, serving 600 users. Accredify starts by working with educational institutions to prevent the use of fake degrees and certificates. It then started to expand to other use cases, including company registration and healthcare. Accredify has offices in Singapore and Australia, and plans to double down on the latter country by hiring more people.

Web3 data management tool developer Fluree completes $10 million in Series A funding

* Data management tools

Fluree, a developer of Web3 data management tools, announced the completion of a $10 million Series A round led by SineWave Ventures, with undisclosed other investors. The company's total financing to date has exceeded $16 million. The new funds will be used for the company to continue building out its "data-centric infrastructure" and assist enterprises in upgrading their legacy infrastructure to a collaborative modern data platform.

It is reported that Fluree mainly provides a semantic graph database supported by blockchain to help enterprises manage data assets. By combining permissioned blockchain technology, semantic web standards and data security policy control, developers can store data in a decentralized and trusted format. and manage data.

Web3 Notification Platform Yoz Labs Closes $3.5M Funding Led by Electric Capital

* Notification platform

Web3 notification platform Yoz Labs has raised $3.5 million in funding to further its goal of building a scalable messaging rail, enabling developers to send instant on-chain notifications directly to users. Early-stage venture capital firm Electric Capital led the round, with participation from Collab+Currency, Coinbase Ventures, Dapper Labs, Form Capital, North Island, Mike Krieger, and Naval Ravikant.

'Wallet-as-a-Service' Provider Universal Ledger Closes $10M Funding Led by Hard Yaka

* Wallet

Wallet-as-a-service (wallet-as-a-service) provider Universal Ledger announced the completion of $10 million in financing, led by Hard Yaka. Universal Ledger aims to help users build their own encrypted wallets. Its customers are mainly large financial institutions and administrative institutions. The company has built a hierarchical verification system that provides low-level verification such as phone numbers, emails, and other identification information. High-level verification to ensure transaction security.

Part.3 IOSG post-investment project progress

Web3 security tools developer Wallet Guard completes pre-seed financing led by Ethereal Ventures

* Wallet

Wallet Guard, a developer of Web3 security tools, announced the completion of pre-seed financing. Ethereal Ventures led the investment, and angel investors such as ConsenSys, IOSG Ventures, Chainlink’s Ben Chain, and Phantom’s Dave Pazdan participated in the investment. The specific financing amount was not disclosed.

It is reported that Wallet Guard is a user-centric security browser extension designed to protect users' digital assets and data from theft, scams and fraud.

Synthetix Council will conduct a new round of nominations on April 17th, with a voting period from April 21st to 30th

* DeFi

Synthetix, a synthetic asset issuance agreement, issued a document stating that a new round of nominations for the Synthetix committee will begin on April 17, and the voting period will begin on April 21 and end on April 30. All elected committee members will receive a monthly stipend of 2000 SNX from the Synthetix Treasury. Elections take place on the Synthetix governance module. This round of committees will run for four months starting April 30.

The Synthetix Committee includes Finance Committee (4 members), Spartan Committee (8 members), Grants Committee (5 members), and Ambassador Committee (5 members).

Taiko is about to abandon the alpha-2 test network and plans to launch the alpha-3 test network in the second quarter

* Layer 2

Taiko, the second-tier network of Ethereum, announced that it will abandon the alpha-2 test network today (according to the tweet release time, it is expected to be within 1.5 hours), and will launch the alpha-3 test network in the second quarter. Net will implement many fixes, improvements, and introduce new components.

The alpha-2 testnet introduces permissionless proofs, has 194 independent validators, and over 1.5 million transactions generated from over 144,000 wallet addresses.

Both Arbitrum's AIP-1.1 and 1.2 proposals to expand ARB holder oversight and governance rights were voted on

* Layer 2

Both proposals (AIP-1.1 and AIP-1.2) from the Arbitrum community to expand the oversight and governance powers of ARB token holders passed with nearly 99% support.

Proposal AIP-1.1 proposes to place the Foundation's remaining 700 million ARB in a "smart contract-controlled lock" to be unlocked within four years. According to the proposal, the foundation will not be able to use tokens until community members approve the token allocation budget. Additionally, the Arbitrum Foundation has released a transparency report on how the organization was formed.

Proposal AIP-1.2 seeks to amend several governance documents of the Arbitrum ecosystem, including lowering the threshold for the number of ARB tokens required to issue improvement proposals on-chain from 5 million to 1 million. Both proposals currently have a support rate above 98%.

Active storage transactions on Filecoin will increase by 75% quarter-on-quarter in Q1 2023

* Infra

Storage usage on Filecoin experienced accelerated growth in Q1 2023, with active storage transactions increasing by 75% quarter-over-quarter. While storage capacity fell 13% quarter-over-quarter, storage utilization increased 105%. Meanwhile, FIL fee revenue grew 5% in 1Q23 (21% in USD terms), driven by a 14% sequential increase in new storage transactions. Additionally, the Filecoin Virtual Machine (FVM), released on March 14, 2023, brings Ethereum-style smart contracts to Filecoin. As of March 31, 2023, over 440 unique contracts have been deployed, resulting in nearly 44,000 transactions.

Avalanche will activate the Cortina upgrade on the mainnet on April 25th, before validators need to update their nodes

* Layer 1

Usman Asim, developer relations engineer at Ava Labs, tweeted: "Reminder to all Avalanche validators: Cortina AvalancheGo version (v1.10.0) is now available and will be activated at 23:00 Beijing time on April 25. Validators must be in Update nodes before this date, otherwise they will not be able to process the new blocks after the upgrade.” Github information shows that the changes in the upgrade will take effect on the main network at 23:00 on April 25.

The Cortina upgrade will migrate X-Chain to run Snowman++ consensus, which means the entire network has migrated to a single consensus engine. The Cortina upgrade also introduces batch authorization rewards and increases the C-Chain gas limit to 1500 gas.

According to previous news, Avalanche activated the Cortina upgrade on the Fuji testnet on April 6.

1inch Network has been deployed to zkSync Era

* Layer 2

Decentralized transaction aggregator 1inch Network announced that its 1inch aggregation protocol and 1inch limit order protocol are now deployed to zkSync Era.

MakerDAO Approves $500M USDC Transfer to Coinbase Custody Service, 2.6% Annual Yield

* DeFi

MakerDAO approves the opening of a Real Assets (RWA) vault for Coinbase Custody Services and the transfer of up to $500 million in the USDC stablecoin. The proposal received 84% support. A related post on the Maker Governance Forum states that Coinbase Custody will pay 2.6% annual interest on deposits. The proposal prohibits Coinbase from rehypothecating assets in accounts, including lending, reinvesting or otherwise using them. Coinbase must keep tokens in a cold wallet, Maker will be able to withdraw funds from the vault within 24 hours, and funds in the cold wallet will be insured up to $500 million. According to previous news, MakerDAO approved the "MIP 81" proposal, and MakerDAO will transfer up to $1.6 billion in USDC to Coinbase custody services to obtain an annual rate of return of 1.5%.

Safe adds support for Celo network

* infrastructure

Digital asset management platform Safe (formerly Gnosis Safe) has added support for the Celo network. All existing functionality on Safe's forked version, Celo Safe, will continue to work on Safe Global, and Celo Safe users will continue to manage their safes through the Safe {wallet} app.

Part.4 Industry Pulse

Dune Analytics Announces Open Source Python Library "Harmonizer" and GPT 4 Integration

* infrastructure

Dune Analytics, an on-chain data analysis platform, officially announced the open source Python library "Harmonizer". Harmonizer mainly converts queries from Postgres&Spark into DuneSQL, and makes extensive use of SQLGlot (a Python library for processing SQL language). Dune uses SQLGlot to parse queries into An Abstract Syntax Tree, then translated into DuneSQL, passing the query through custom rules to match it to the new platform. Dune Analytics also said it is currently working on integrating GPT 4 to make Harmonizer even more powerful.

Web3 Infrastructure Provider InfStones Launches Ethereum Validator Service

* infrastructure

Web3 infrastructure provider InfStones announced the launch of the Ethereum validator service, which aims to meet the market demand after the upgrade of Ethereum Shanghai. It supports users to set up their own verification nodes with one click, and institutional entities can batch process up to 1,000 validators with one click. . In addition, InfStones will also cooperate with other liquidity staking protocols to lower the 32 ETH staking threshold.

Flashbots Launches MEV-Share Beta to Split Early Access Proceeds with Ethereum Users

* infrastructure

Ethereum infrastructure service Flashbots has launched a beta version of the MEV-Share protocol, which aims to distribute a portion of Maximum Extractable Value (MEV) earnings to Ethereum users. The MEV-Share protocol is included in Flashbots Protect, a remote procedure call (RPC) tool that can be integrated with user wallets to fend off bots trying to profit from front-running user transactions. Flashbots plans to release the MEV-Share code as open source in the future. .

Ethereum core devs: Fifth dev testnet for EIP-4844 to launch next week

* Ethereum

Christine Kim, Vice President of Galaxy Research, published an article summarizing the 107th Ethereum Core Developer Consensus (ACDC) meeting. After a brief confirmation of the success of the Shanghai upgrade, the meeting began to discuss the preparations for Deneb (ie EIP-4844). Among them, Ethereum core developer Tim Beiko said that the fifth development test network of EIP-4844 will be launched sometime next week. Developers discussed how to reinsert blob transactions into blocks during chain reorganization events. Danny Ryan proposed two solutions: let the consensus layer pass the blob data of each block to the execution layer or let the user Resubmit the transaction. For the former, the developers started a discussion and talked about the data availability sampling DAS implementation will invalidate the hypothetical scheme, but due to the lack of relevant representatives of the executive layer client, the issue will be left for the executive layer developer meeting to discuss next week. At the same time, at the Consensus meeting, developers planned to incorporate EIP-4788 into the Deneb upgrade together with 3175 and EIP-4844. Regarding EIP-6914, the developers agreed to continue finalizing the code change details and push their implementation to a post-Deneb hard fork. Additionally, the developers discussed beacon chain authentication subnets (attnets), and Adrian Manning of the Lighthouse (CL) client team proposed a solution for subscribing validator nodes to long-term attnets, saying that this change does not have to go through a hard fork to execute. According to previous news, at the first Ethereum core developer meeting in 2023, developers agreed to focus the Cancun upgrade after the Shanghai upgrade on EIP-4844.

Maple Finance Launches Cash Management Pool to Help On-Chain Participants Invest in U.S. Treasury Bills

* DeFi

Encrypted lending protocol Maple Finance issued a document announcing the launch of the Cash Management Pool (Cash Management Pool). The pool provides on-chain cash management solutions and supports non-US DAOs, offshore companies, etc. to invest restricted funds into the fund pool set up by Maple Finance. This fund pool will provide US treasury bill income and meet customer liquidity, risk control and accounting requirements .

Data: Blur's royalties revenue surpassed OpenSea's in March, reaching $12.6 million

* NFT

Blur outpaced OpenSea in royalties paid to creators in March, at $12.6 million, up from $11.2 million in February. By comparison, OpenSea's royalties fell from $17.3 million to $9.9 million.

SPACE ID established DAO Treasury, which will implement the token repurchase and destruction mechanism; cooperate with the public chain Sei, or will launch the .sei domain name service

* Domain name agreement

The decentralized universal domain name protocol SPACE ID announced the establishment of DAO Treasury, which will implement a token repurchase and destruction mechanism. Platform revenue will include all registration earnings accrued since the TGE date, moving execution forward on a quarterly basis. Specifically, 50% of the total net revenue generated by the SPACE ID platform (including revenue from domain name registrations, renewals, gift card purchases, and SPACE ID marketplace fees) will be used to purchase and burn ID tokens. The remaining 50% of the total net income will be added to the DAO treasury, which will be held in stablecoins and managed by all eligible ID token holders.

SPACE ID has reached a cooperation with Layer 1 public chain Sei Network, and Sei issued a document "Soon.sei" suggesting that the .sei domain name service may be launched.

Blockdaemon to launch an all-in-one wallet service for institutions

* wallet

Crypto infrastructure provider Blockdaemon is launching an all-in-one wallet service to help large institutions and crypto custodians manage their assets without entrusting them to third parties. Blockdaemon Wallet will combine some of the company's existing wallet infrastructure, as well as some new features, into a new platform focused on security, compliance, and liquidity.

New York Department of Financial Services Approves Virtual Currency Assessment Regulations

* Policy supervision

The New York State Department of Financial Services (DFS) has passed a final rule (Virtual Currency Evaluation Regulation) on April 18 that specifies how to evaluate the supervision and inspection costs of companies holding a Bitlicense issued by DFS. The adopted regulations put into effect a provision in New York State's FY23 budget giving DFS new powers to collect regulatory fees from licensed virtual currency businesses, similar to other licensees regulated by DFS. The regulation will allow the department to continue adding top talent to its virtual currency team to continue efficient and effective regulatory oversight.

DFS' virtual currency regulatory framework is modeled on full-scale banking regulation, requiring companies to meet strict standards in terms of capitalization, cybersecurity protections and anti-money laundering protocols. The final rule sets out a process for assessing the costs of operating a virtual currency business, comparable to regulated banking and insurance entities.