"Fracture price" sells ETH trust, and the DCG crisis is basically resolved?

Original Author: Mary Liu

Original source: BitpushNews

Original Author: Mary Liu

Original source: BitpushNews

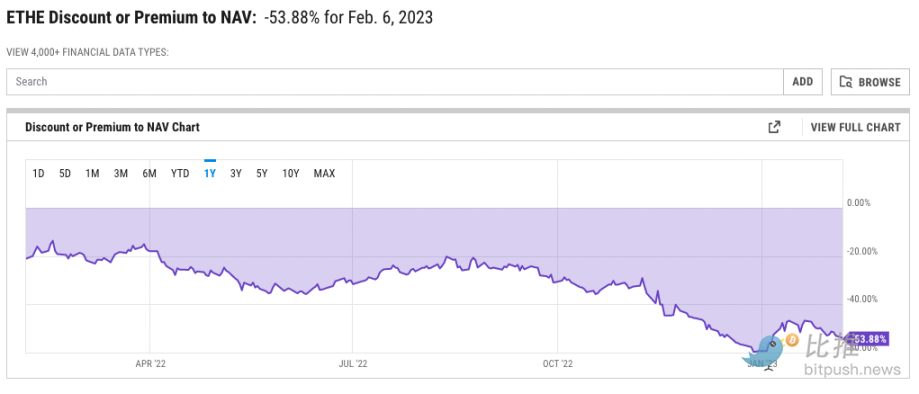

Cryptocurrency conglomerate Digital Currency Group (DCG) has begun selling shares in several of its crypto funds, with a focus on Grayscale Ethereum Trust (ETHE), at "bracket prices" in order to pay off debt for subsidiary Genesis.

The Financial Times reported late Monday, citing filings, that DCG had sold a quarter of its stake in ETHE since Jan. Approximately $22 million in capital was raised in the transaction.

DCG also sold a small amount of shares in Grayscale's Litecoin Trust, Bitcoin Cash Trust, Ethereum Classic Trust and Digital Large Cap Fund, which collectively manage about $700 million in assets.

Grayscale's largest investment product is its Bitcoin Trust (GBTC), which launched in 2013 and has $14.5 billion in assets. Grayscale earned $303 million in management fees from GBTC in the first nine months of 2022, according to securities filings.

first level title

Spot market unaffected

The prices of bitcoin and ethereum have remained relatively stable, according to push terminal data. After recovering 38% so far this year, bitcoin rose 0.7% to more than $23,000 on Tuesday; ethereum rose 1.4% to around $1,631. The year-to-date gain is 36%.

Swan bitcoin managing director and former Goldman Sachs veteran John Haar commented on this, saying that this shows that the bad news of the DCG crisis has been digested by the market.

It is unclear whether DCG plans to sell or has already sold its GBTC stake to improve liquidity. DCG purchased nearly $800 million worth of GBTC stock between March 2021 and June 2022, giving the company an estimated 9.67% ownership of GBTC's outstanding shares. Selling those shares appears to be an option if DCG needs to raise more cash.

However, selling them could further deepen the current negative premium of 43.08%, making them less attractive to investors. In addition, it should be noted that DCG is not allowed by law to sell more than 1% of its outstanding shares per quarter unless it obtains separate approval from the US SEC. At this rate, it will take DCG approximately 2.5 years to sell all of its GBTC holdings.

Ram Ahluwalia, CEO of Lumida Wealth, told the Financial Times: “DCGs face a trade-off: they can allow redemptions and achieve liquidity at face value, including assets they A lot of money is made in fees, and closing discounts means giving up this cash cow.”

In general, ETHE and GBTC sales will not have a direct impact on the spot market, it depends on who and under what conditions the shares of Bitcoin and Ethereum Trust are sold - DCG allows redemption to provide liquidity at par sex.

first level title

DCG and Genesis reach agreement with creditors

Genesis filed for Chapter 11 bankruptcy protection last month after being hit hard by last year's market turmoil. Genesis's Chapter 11 filings show it owes more than $3 billion to its top 50 creditors, with seven creditors owed at least $100 million. After negotiations, the company on Monday reached an agreement in principle on a restructuring plan with Gemini and other creditors. Before Genesis went bankrupt, Gemini Earn users lent over $900 million to Genesis. Genesis will now cover that payment.

As part of the agreement, DCG will exchange $1.1 billion in notes due 2032 for convertible preferred stock. In addition, DCG will refinance its existing 2023 term loan by disbursing a new junior secured term loan to creditors totaling $500 million in two tranches.

The agreement also involves the sale of Genesis' lending arm and its crypto trading arm, with all Genesis entities to be brought under the same holding company, Genesis Global Holdco.

If these funds are insufficient to cover the losses of Gemini Earn creditors, Gemini will step in. The company has pledged to donate up to an additional $100 million to help compensate Earn users.

Much work remains to be done on the new restructuring agreement, including due diligence on Genesis' finances and judicial approval of the plan.