From historical data, will BTC have a "red envelope market" during the Spring Festival?

Disclaimer: This article is only a retrospective analysis of historical data and does not constitute any investment advice.

The Spring Festival is approaching, and the A-share market has started the "red envelope market". According to the report of "Financial Associated Press", as of January 16, nearly 180 stocks in the two cities have increased by more than 20% this year. new highs. In the encrypted market, all kinds of assets have also started "rising mode", and the total market value of the market has risen to 968.810 billion US dollars, reversing the sideways trend in the past 3 months. Among them, according to the data of CoinMarketCap, as of January 19, the increase of BTC in the last 7 days reached 14.01%. At present, it has stood firm at the integer mark of 20,000 US dollars for 5 consecutive days.

Wind data shows that in the past 20 years, the probability of A shares rising in the five trading days before and after the Spring Festival has been 80%, and the "red envelope market" has a high probability of running through the entire Spring Festival. So, is there a similar "red envelope market" in the encryption market? How long will the "red envelope market" last? What is the money-making effect of BTC during the Spring Festival?

To this end, PANews data news column PAData reviewed the market data of BTC during the Spring Festival in the past 5 years, and also reviewed the market data of the recent popular tokens during the Spring Festival in the past 3 years. The statistics found that:

1) In the past 5 years, BTC has had a "red envelope market" every year during the Spring Festival, with a minimum increase of about 5% and a maximum increase of more than 16%. Based on this, it is speculated that the probability of a "red envelope market" for BTC during the Spring Festival this year is also very high.

2) Buying BTC on New Year’s Eve and selling on any day thereafter has the highest average yield of 9.4%. In addition, if you buy before the fourth day of the lunar new year, the average yield of selling on any day after that can also exceed 6.7%, but if you buy after the fifth day of the lunar new year, the average yield of selling on any day after that will drop sharply to 6.7%. 2%, and the probability of loss will be greatly increased.

3) Under the "Red Envelope Market", the maximum daily average amplitude of BTC is the same as usual, and it does not show a smaller amplitude and a higher increase. Among them, the maximum daily amplitudes of the fourth day, the eleventh day of the new year and the twelfth day of the new year all exceeded 7%, and the single-day fluctuations were relatively large.

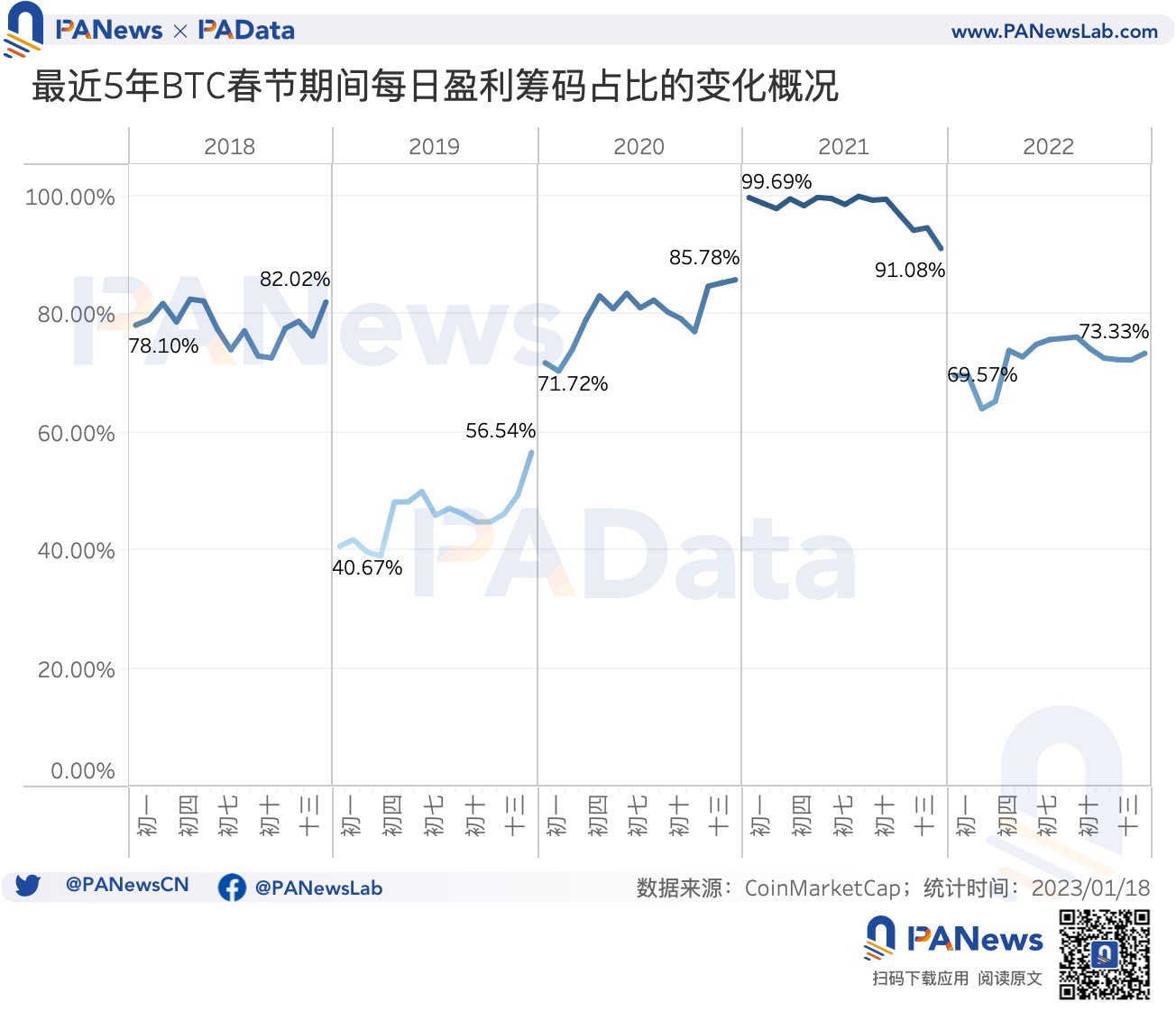

4) During the Spring Festival in 2019 and 2020, the increase in the proportion of BTC profit chips increased by about 15 percentage points. During the period from the second to the fourth day of junior high school, the proportion of profitable chips increased significantly.

first level title

The average return of BTC in different cycles after buying on New Year’s Eve exceeds 9%. During the Spring Festival, we still need to be vigilant against the high fluctuations in a single day

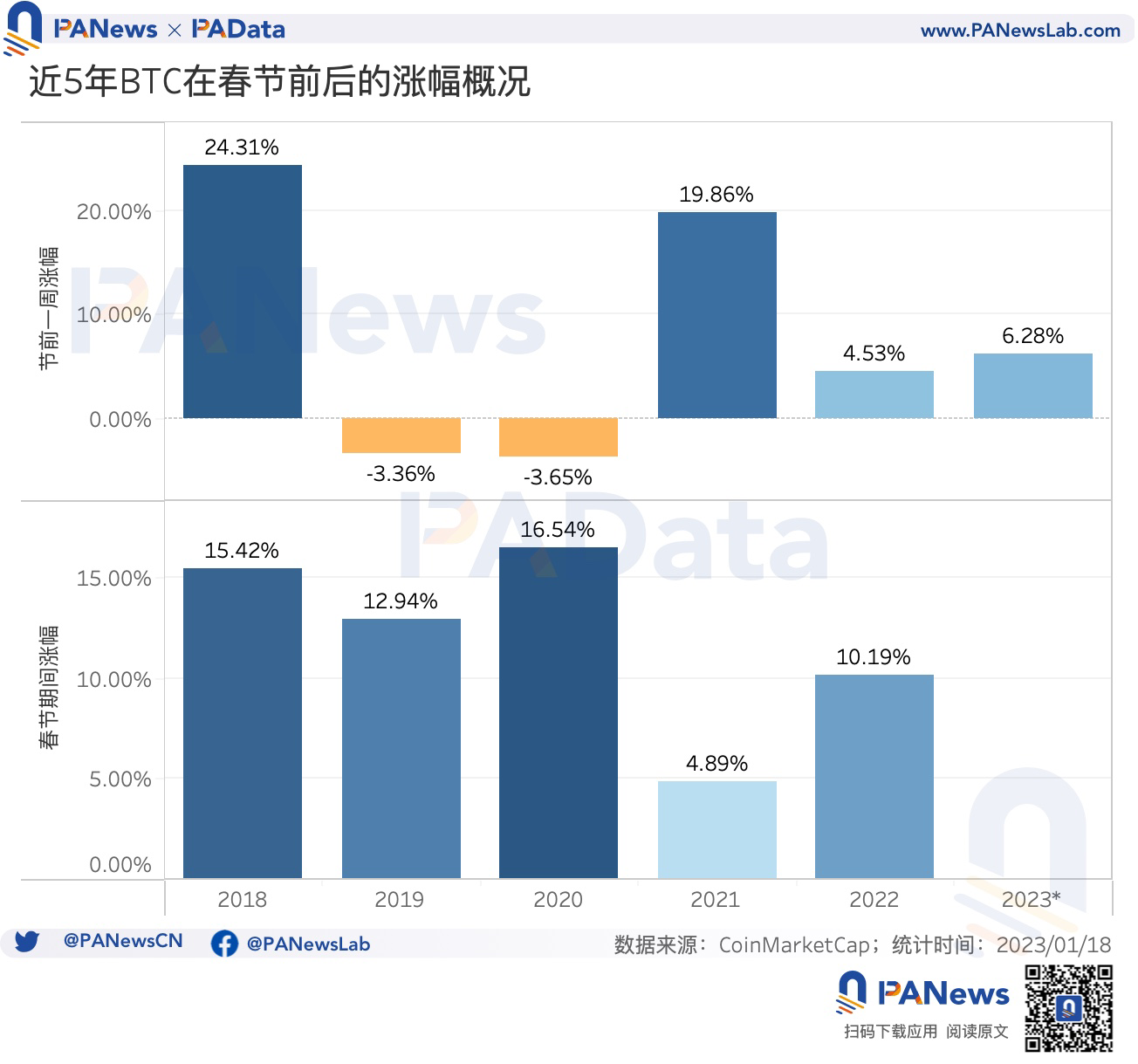

In the past 5 years, BTC has fluctuated in the 7 days before New Year's Eve (excluding New Year's Eve). Among them, the currency price of BTC rose within 7 days before New Year's Eve in 2018, 2021 and 2022, while it fell during the same period in 2019 and 2020. From the perspective of the number of rising trends, in the last five years, the probability of BTC’s “red envelope market” before the Spring Festival is 60%, and the strength of the “red envelope market” before the festival has a downward trend. This year, BTC has already started to rise before the Spring Festival. As of January 17th, in the four days before New Year’s Eve, the increase was about 6.28%, slightly higher than last year.

However, in the past five years, BTC has risen every year during the Spring Festival (New Year's Eve to the fourteenth day of the new year), and the "red envelope market" has a minimum increase of about 5%. Among them, BTC has increased by more than 10% during the Spring Festival in 2018, 2019, 2020 and 2022, with the highest increase exceeding 16.5%. Judging from the number of rising trends, in the last 5 years, the probability of a "red envelope market" in BTC during the Spring Festival is 100%, which means that the probability of a "red envelope market" in BTC during the Spring Festival this year is also very high .

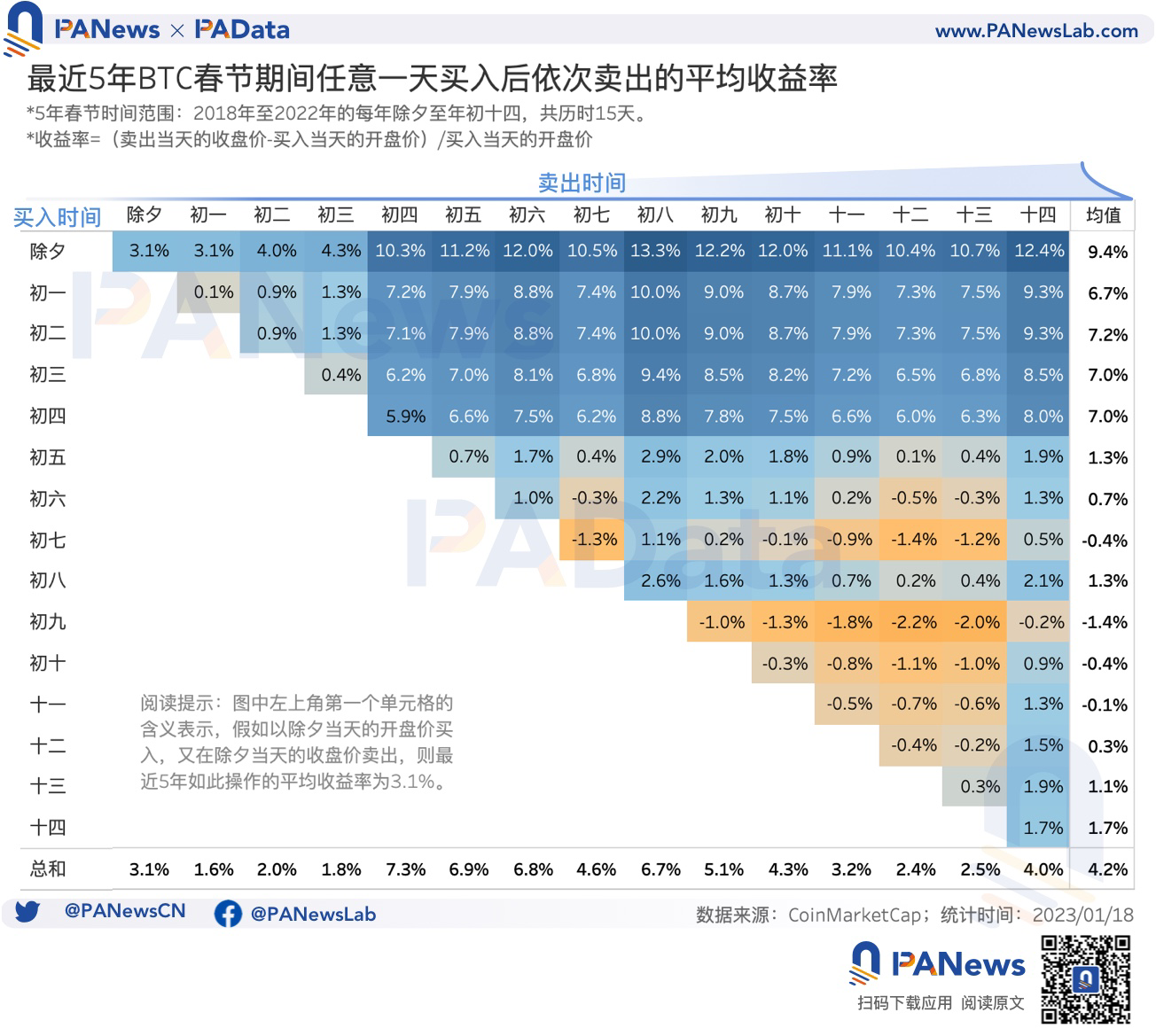

If you buy BTC during the Spring Festival, how much "red envelope" can investors get in the trending market? PAData counted the income of BTC in different currency holding cycles during the 15-day Spring Festival holiday from New Year's Eve to the fourteenth day of the new year. The vertical time in the figure below indicates the buying date, the buying price is the opening price of the day, the horizontal time indicates the selling date, and the selling price is the closing price of the day, and the value is the average theoretical return of the same trading cycle in the last 5 years.

First of all, if the buying time is used as the observation standard (horizontally), then buying BTC on New Year’s Eve and selling on any day thereafter has the highest average yield of 9.4%. In addition, if you buy before the fourth day of the lunar new year, the average yield of selling any day after that is also relatively high, which can exceed 6.7%. However, if you buy after the fifth day of the lunar new year, the average yield of selling on any day thereafter will drop sharply, with a maximum of no more than 2%. The average rate of return for selling on any day after that is negative, which means there is a high probability of losing money.

Secondly, if the selling time is used as the observation standard (vertical point of view), no matter which day was bought before, the average yield of selling on the fourth day of the lunar new year is the highest, about 7.3%. In addition, regardless of the previous day of buying, the average yield of selling on the fifth, sixth and eighth day of the first day is also relatively high, reaching about 6.8%.

Finally, if you do not use a certain trading date as the observation standard, that is, compare all time periods together, then the trading pattern with the highest average return in the past 5 years is to buy at the opening price on New Year’s Eve and close at the closing price on the eighth day. The average yield on such transactions is about 13.3%. In addition, in "New Year's Eve - the fourth day", "New Year's Eve - the fifth day", "New Year's Eve - the sixth day", "New Year's Eve - the seventh day", "New Year's Eve - the ninth day", "New Year's Eve - the tenth day", "New Year's Eve - the tenth day" The average income of the 12 trading modes in the past 5 years: "One", "New Year's Eve - Twelve", "New Year's Eve - Thirteen", "New Year's Eve - Fourteen", "First Day - Eighth Day", "Second Day - Eighth Day" Rates also exceeded 10%. But it is worth noting that if you buy after the sixth day of the new year, 23 of the 45 trading models have negative average returns in the past five years, that is, the probability of loss reaches 51%.

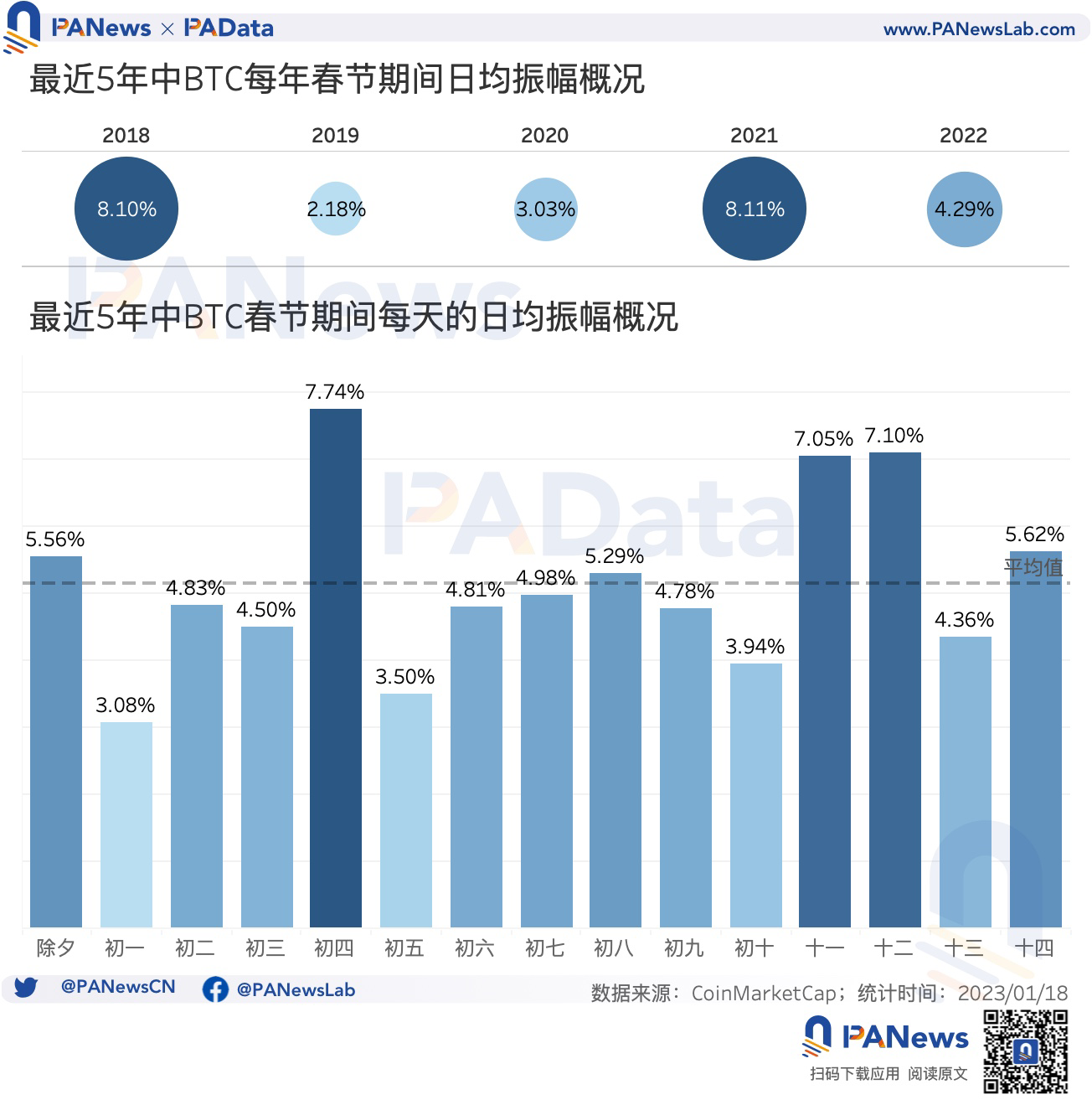

However, under the "red envelope market" during the Spring Festival, investors should still be alert to the risks caused by high volatility in a single day. According to statistics, during the Spring Festival in the last five years (New Year's Eve to the fourteenth day of the new year), the maximum daily amplitude varies greatly, reaching about 8.1% in 2018 and 2021, and less than 4.5% in 2019, 2020 and 2022. % .

Judging from the largest single-day average daily amplitude in the past five years, the average value during the Spring Festival is 5.14%. This level is close to the maximum quarterly average daily amplitude of BTC that PAData has observed many times in the past, that is, under the "red envelope market", the average daily amplitude of BTC for a period of time is comparable to usual, and does not appear to be smaller amplitude and higher increase. Among them, the maximum daily amplitude of the fourth day, the eleventh day of the new year, and the twelfth day of the new year has exceeded 7%, which is a time with large single-day fluctuations. On the other hand, the maximum daily amplitudes of the first, fifth, and tenth days of the first day of the new year were all below 5%, which is a time with relatively small fluctuations in a single day.

In the "red envelope market", are the chips in a profitable state increasing? To a certain extent, this can reflect the corresponding changes in the profit address. It can be seen that in the four years of 2018, 2019, 2020 and 2022, the proportion of profitable chips during the Spring Festival is in an overall growth trend. However, the increase in 2018 and 2022 is not obvious, and they only increase About 4 percentage points, while the increase in 2019 and 2020 is very obvious, with an increase of about 15 percentage points. On the whole, during the period from the second to the fourth day of junior high school, the proportion of profitable chips increased significantly, and has fluctuated since then.

The recent popular tokens have an average return of 20% during the Spring Festival in the past three years, but the average daily amplitude is more than twice that of BTC

As the asset with the largest market value in the encrypted market, BTC’s rise usually represents a rise in the broader market, that is, other tokens are likely to rise as well. Therefore, in addition to looking back at the "red envelope market" of BTC in the past 5 years, PAData also reviewed the Spring Festival market of recent popular assets in the past 3 years.

Popular assets refer to the 30 assets with the highest growth rate and the 30 assets with the highest search volume in the last 7 days, and a total of 52 assets were recorded after deduplication. Including WKC, AGIX, MANA, FXS, HNT, FTT, CVX, SAND, FET, APT, COMP, CRV, SOL, AAVE, AVAX, SHIB, OP, CSPR, FTM, NEAR, FLOW, ENJ, ICP, GALA, PI , KAVA, SNX, JASMY, IMX, FIL, XRPC, HOT, HEX, LRC, HBAR, CELO, XTZ, BTC, DOT, CRO, ETH, QUACK, BONK, QNT, MATIC, XOLO, DOGE, ADA, BNB, DPR , LUNC, XRP. The currency prices of these assets have increased between 7% and 200% in the last 7 days, with an average increase of about 34%.

PAData further selected the top 5 assets among the assets with the highest growth rate and the highest search volume (if the market value is too small, omit them and then recursively select the assets with subsequent rankings) as observation samples, in order to provide insights for other popular assets through samples. A certain basis.

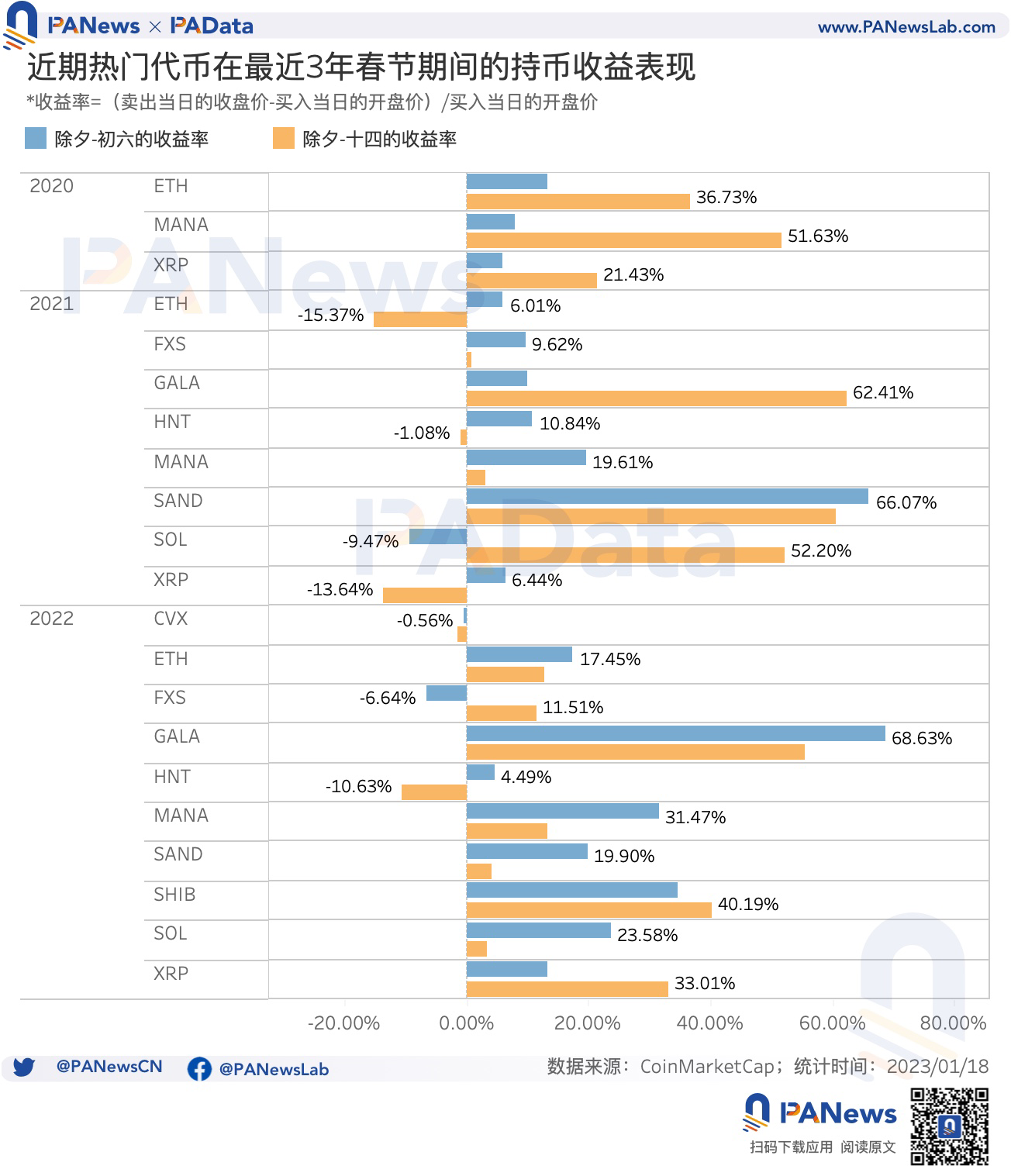

According to statistics, in the last three years, if the 10 sample popular assets are bought at the opening price on New Year’s Eve and sold at the closing price on the sixth day of the new year, the average return rate is about 16.79%. Among them, the average return rate of sample assets under this trading mode is 9% in 2020, 15% in 2021, and 21% in 2022, showing an increasing trend year by year.

In the past three years, if the 10 sample popular assets are bought at the opening price on New Year’s Eve and sold at the closing price on the fourteenth day of the new year, the average yield is about 20.01%. Among them, the average return of sample assets under this trading mode will reach 37% in 2020, about 19% in 2021, and 16% in 2022, showing a gradual downward trend.

In general, during the Spring Festival in the last three years, the returns of the four assets of MANA, GALA, SAND, and SHIB under the two trading modes of "New Year's Eve - the sixth day" and "New Year's Eve - the fourteenth day of the new year" were all positive, while For the six assets of ETH, HNT, SOL, XRP, CVX, and FXS, one of the two trading modes has a negative return. The stability of the popular asset "red envelope market" is not high, which may be affected by the large fluctuations of popular assets.

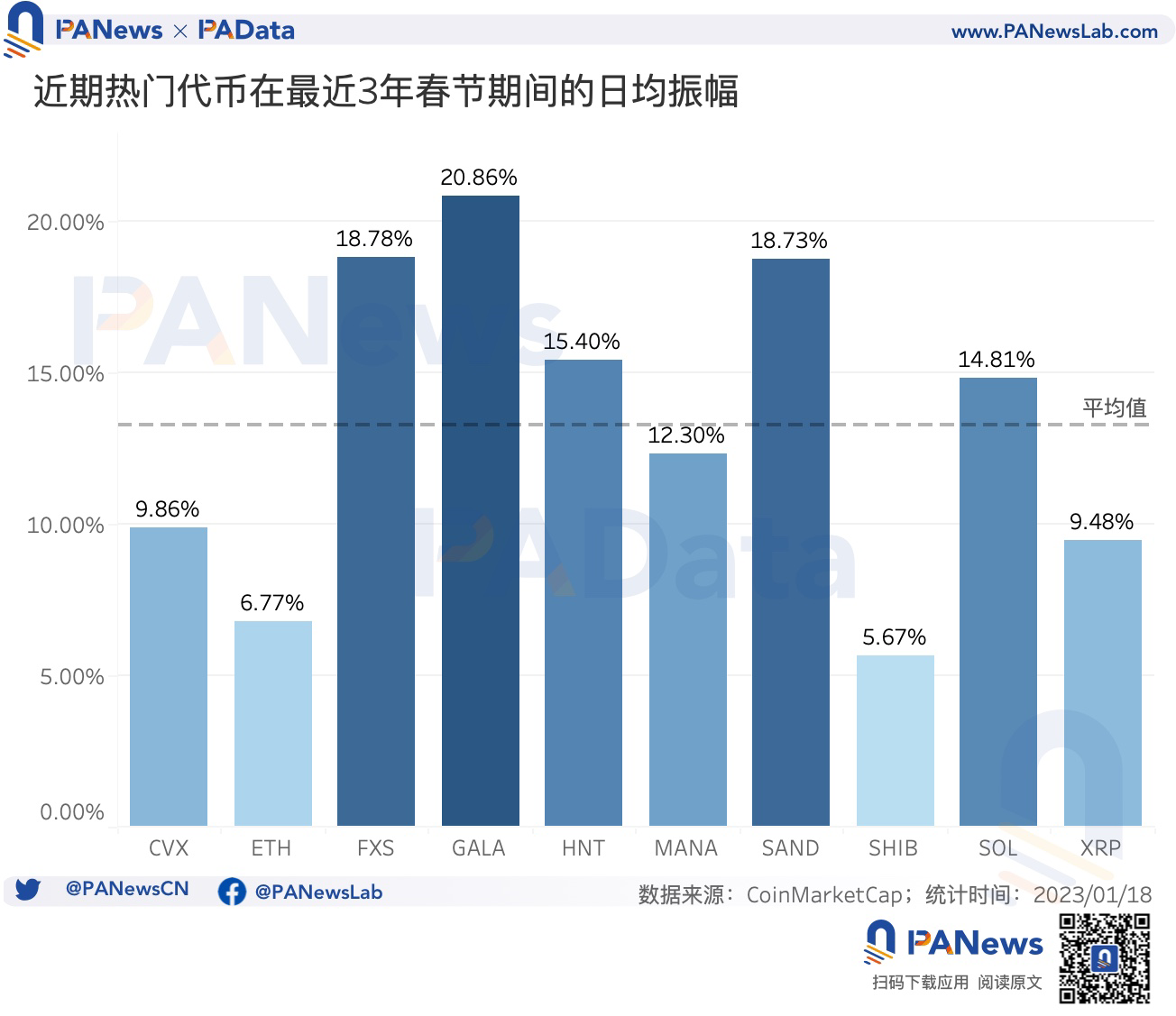

According to statistics, the maximum daily amplitude of the 10 sample popular assets during the Spring Festival in the last three years is about 13.27%, which is about 2.5 times that of BTC. Among them, FXS, GALA, and SAND have had their largest daily average swings of more than 18% during the Spring Festival in the past three years, significantly higher than other assets. It can be seen that the volatility of popular assets is significantly higher than that of BTC, and the investment risk under the "red envelope market" may also be higher than that of BTC.