Aptos, Solana and the New Public Chain Periodic Law

Original Author: Wang Ye

This article is part of the Mint Clips series by Mint Ventures. Mint Clips are some of our thoughts on industry events after internal and external exchanges. Compared with our #进入研究报and #运车进入 series of articles, Mint Clips does not discuss specific projects, but mainly presents "period insights" on specific issues.

Our podcast: search for "WEB3 Mint To Be" in Xiaoyu App, QQ Music, Apple Podcast

Our official website:Mint Ventures

Our podcast: search for "WEB3 Mint To Be" in Xiaoyu App, QQ Music, Apple Podcast

This article attempts to position the future development of Aptos as the next Solana. Because under the constraints of the impossible triangle of the blockchain, the new public chain always develops periodically. In the last cycle, the new public chain headed by Solana rose rapidly by virtue of the radical low-fee and high-speed model, but also because of some internal defects. It may be gradually overtaken by new public chains such as Aptos. The old public chain Ethereum already has a strong moat in the multi-chain future.

Some time ago, the author was invited by Babbitt to participate in the "Web3 Builder, Wuwen Xidong" activity. I was asked a question: "A16Z, Binance and FTX are all very optimistic about new public chains such as Aptos. Will these public chains be able to challenge the dominance of Ethereum?”, in view of the large number of readers who are interested in this topic, the author sorts out the thoughts so far and forms the following article on Solana, Aptos and A comprehensive review of new public chains. The author's market positioning of Aptos is roughly the current market position of Solana.

In order to make it easier for readers to understand, this clips has made a simplified description of blockchain consensus and communication technology principles.

first level title

Preliminary division of the public chain track

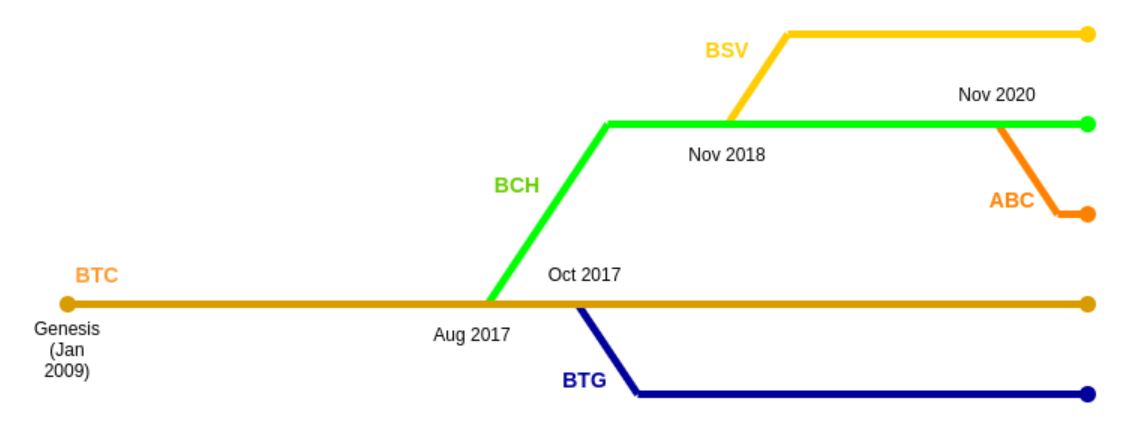

In 2015, the launch of Ethereum ushered in the era of smart contract public chains, and made the public chain an indispensable infrastructure for the entire Web3.

In 2017, the explosion of ICO and Crypto Kitties almost paralyzed the Ethereum network. Since then, all practitioners have realized that the blockchain at this time is completely insufficient to undertake a larger area of real social transaction needs, and expansion must be the golden track that WEB3 just needs for a long time.

In order to facilitate today's discussion on the new public chain, we temporarily put aside Ethereum, which already has a large number of applications, a large number of developers, and super influence, but is constrained by many existing stakeholders and has to slowly transform. Early influence and user accumulation, but a new public chain with a lighter historical burden and a new high-performance solution that can be easily adopted. Solana was once the absolute king of the new public chain track, but now, Aptos is regarded as the "Solana Killer" by many investors.

First of all, I think Aptos has a higher probability of hitting Solana's position.

Before Ethereum officially implements sharding and achieves sufficient high performance, the high-performance new public chain track will show a certain periodicity. Specifically, a new public chain benefits from the rapid growth of the radical high-speed and low-fee options, and at the same time enters into a negative flywheel due to the loopholes brought about by the radical high-speed and low-fee options. The high-performance narrative of Solana in this round began to lose its luster. The nickname of "Downtime Chain" gradually replaced the title of "Ethereum Killer", and capital began to look for new successors under the law of cycles.

The Rise and Fall of Solana - High Speed and Low Fees

The Story of Super High TPS

Solana's high TPS is based on 10 times the block size, low redundancy, 1/30 of the block generation time, and about 10 times the speed after parallel computing, realizing about 3000 times the theoretical TPS of ETH.

(1) Block size

source:

source:https://vitalik.ca/general/2020/12/28/endnotes.html

Although Solana has made many improvements in the communication process to avoid some risks, Solana's large blocks still increase the threshold of full nodes and reduce the number of full nodes, which has a certain impact on the degree of decentralization and network security. negative impact.

(2) Improvements at the consensus level – block generation time and low redundancy

- Centralized transaction processing process

In the centralized system of web2.0, taking Alipay as an example, since there is only Alipay's official server in the background, the transaction processing is very simple:

①The transaction information is sent to Alipay

②Alipay directly confirms and executes the transaction

③No one is responsible for verification, because most people believe that Alipay is unwilling to do evil by default.

A total of 1 send, 1 execution, 0 inspection, the total time is almost negligible.

- Decentralized transaction processing process

Ethereum

Ethereum

Let's observe how Ethereum confirms transactions:

(1) After the transaction is completed, the relevant transaction information is transmitted to n nodes in the entire Ethereum network after 6 seconds

(2) Processed by a random node, pack the processed transactions, and generate blocks

(3) The block is sent to n nodes in the whole network for verification.

Overall, a large number of transmission and inspection times have been increased, and a block generation process takes 12 seconds.

Due to the untrustworthiness of a single node, there must be a multi-round game mechanism in the blockchain era, allowing all nodes to verify each other, so as to maintain the accuracy of the final result of the blockchain, which increases time consumption and redundant calculations. An important reason for the existence of the impossible triangle.

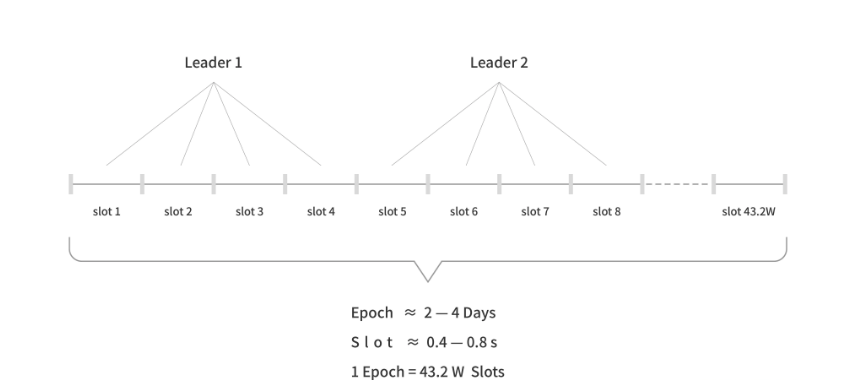

Solana has greatly improved the speed at both the transmission level and the block verification level. Solana reduces the block generation time from Ethereum's 12 seconds to 0.4 seconds (up to 0.8 seconds), thereby achieving about 30 times the expansion.

Solana

Let's take a look at how Solana keeps accounts:

image description

Source: CatcherVC

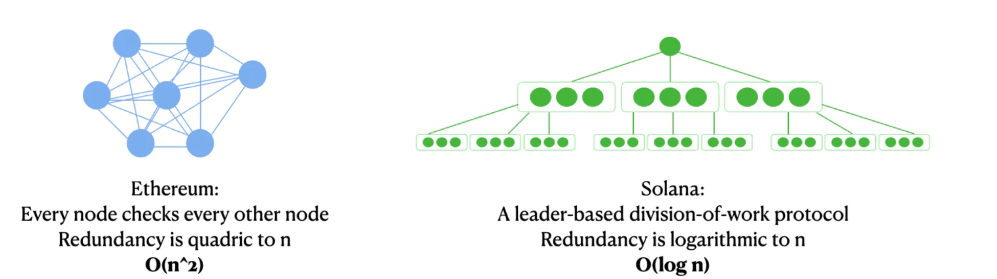

(2) Verification level of transactions: Solana block creators divide the blocks, and other verifiers only need to verify their own parts, not the entire block.

Under Solana’s block generation mechanism, the degree of redundancy of calculation is reduced from n² to logn, thus achieving more efficient operation (the following is a simple science popularization).

Let's recall some classic math problems:

(1) If any two of n people need to exchange ledgers, how many ledger exchanges have occurred in total? The answer is n(n-1) times, or n² levels.

(2) Correspondingly, assuming that any one of n people needs to exchange ledgers with a known "leader", how many times have the ledgers been exchanged in total? The answer is 2(n-1) times, or n levels.

(3) Suppose again, if among n people, the known "leader" exchanges a part of the ledger with everyone, how many times has the ledger been exchanged in total? Obviously lower than the n level, we can simply understand it as the logn level.

Among them, (1) corresponds to Ethereum, and (3) corresponds to Solana.

image description

Source: Twitter @TheAntiApe

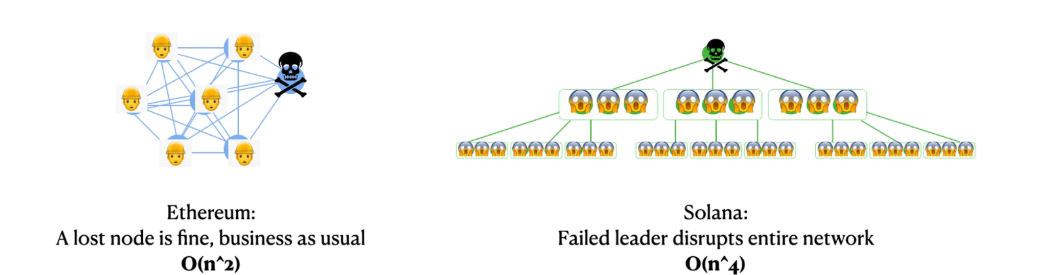

At the beginning of Solana's birth, such a design could indeed allow Solana to achieve rapid operation. But it is easy for everyone to find the disadvantages of this model: accepting various transactions, identifying valid transactions, packaging transactions, splitting blocks, requiring other verifiers to verify and recover verification results, etc., are all done by the leader node.

image description

Source: Twitter @TheAntiApe

In addition, centralization problems such as bribery and targeted attacks on the leading nodes announced in advance cannot be avoided, which also has a certain negative impact on the entire blockchain.

After the Solana ecology broke out in September 2021, there have been many downtime accidents so far. Frequent downtime accidents limit the development space of Solana. In the next round of bull market, users need a new public chain that will not go down frequently (at least temporarily without showing a high risk of downtime).

(3) Parallel computing

In addition to the basic consensus mechanism, Solana has also improved the parallel processing of smart contracts.

Early Ethereum adopted EVM as the smart contract operating environment. The important feature of this choice is serial computing (processing transactions sequentially), which is a relatively inefficient processing mode. Although the Ethereum community also has a plan to upgrade the EVM (to EWASM), it is still far from landing.

image description

Source: Solana Whitepaper

But Solana will also face the following special situations:

(1) Solana needs to correctly judge that transactions can be parallelized, and wrong judgments may cause malfunctions.

(2) If Solana judges and finds that transactions must be serialized, its serial operation speed is slower than that of Ethereum.

To sum up, the characteristics of 4096-core parallel computing make it extremely efficient in programs that can be processed in parallel, but once it encounters transactions that cannot be processed in parallel, its efficiency will be lower than that of Ethereum, and it may even fail and crash machine. In addition, Solana's low-redundancy feature, that is, through the "leader node assignment of tasks" mode, allows Solana to easily obtain higher normal operation efficiency. But once a failure occurs, Ethereum's high redundancy allows it to recover quickly, while Solana's low redundancy can easily crash the network. In general, the Solana project has made a lot of high-value innovations. In the early days, Solana could quickly rise through high TPS, but in the later stage, it had to pay for the features that are prone to downtime.

secondary title

The Ultra Low Fee Story

(1) Revenue and expenditure of the public chain and "money printing"

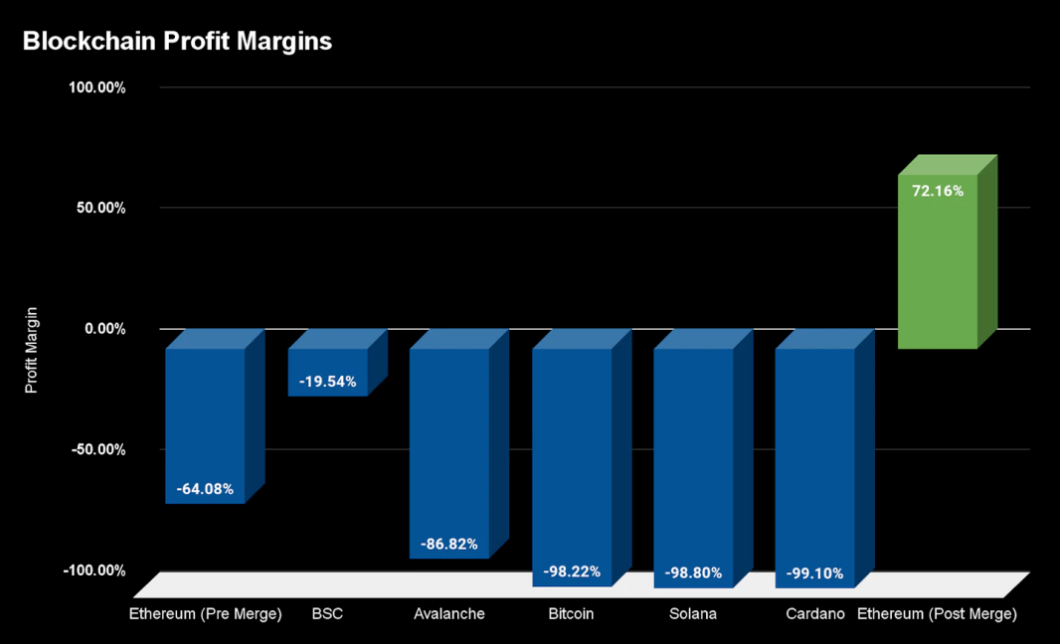

Another big reliance on Solana's rise is low fees. In a nutshell, on the one hand, the low cost comes from the ultra-high processing capacity, and on the other hand, it comes from the system's currency subsidy. We can explain in detail the income and expenditure under this currency subsidy model.

If we think about the business logic of the public chain, which provides a business environment for various commercial projects and collects taxes from all users at the same time, then the public chain will be like a country, and the public chain tokens will be more like tax payment. fiat currency.

For further analysis, we simplify the income and expenditure according to the common characteristics of most public chains. The taxes of these "countries" are the handling fees of all users, and the fiscal expenditures of these "countries" are the incentives for validators. If you look through the government's financial report, you will most likely see this word: "balance of payments".

Just as a country needs a balance of payments, the public chain also needs a balance of payments. But if we check the income and expenditure of each public chain, we will find that the expenditure of most public chains exceeds its income:

Rewards for validators - service fee income = public chain loss

image description

Source: Bankless

text

Loss of the public chain = additional rewards

Then, verification rewards often come from two parts: normal income and "money printing subsidies":

Service fee income + additional rewards = rewards for verifiers

For Solana, when a blockchain verifier should receive a "salary" of 100 yuan, Solana's "money printing subsidy" to the verifier is often as high as 98.8 yuan, and the actual fee from the user is only about 1.2 yuan. Of course, this number will change over time, but Solana is still a long way from breaking even and operating sustainably.

(2) "Money printing" brings inflation in the public chain

We chose to compare the public chain to a country, and the public chain token to a legal currency. For a public chain, the total value of currency and the total value of goods should be completely corresponding.

We can simply think as follows: a country’s commodity is only apples. In the first year, the country produced a total of 100 kilograms of apples and issued a total of 100 yuan in currency, so the market price of apples will be 1 yuan/kg. If the country develops rapidly in the second year, with 200 kilograms of apples, and an additional currency of 100 yuan is issued, the price of apples can also be stabilized at 1 yuan/kg. However, if the country’s development stagnates in the third year and still only produces 200 kilograms of apples, but another 100 yuan of currency is issued, the price of apples will become 1.5 yuan per kilogram, which means that there will be relatively serious inflation.

Correspondingly, for Solana "countries" that issue "currency" at a relatively high rate, the negative impact of additional currency issuance will be almost offset due to the rapid growth of the total value of commodities on the chain in the early stage.

However, when Solana has encountered an obvious development bottleneck, when the total currency volume and the total commodity value begin to be out of balance, Solana continues to print money to make up for the deficit, or to reduce money printing and increase "tax collection", which is essentially not conducive to regional blockchain development. This is also called "the periodic law of the new public chain" by some people.

At least in the next round, the market is looking forward to a public chain that has regained its balance of payments, or at least through the rapid development of the early ecology, will not let users feel that the balance of payments is unbalanced. At present, it seems that Solana may be taken over, and Aptos is also expected to be that successor.

We might as well discuss the business model of Ethereum here: For Ethereum, after realizing the EIP1559 destruction mechanism in 2021 and formally merging in 2022 to reduce operating costs, the corresponding formula has become:

Service fee income + additional issuance - destruction = expenditure to verifiers

If income-expenditure = profit, then for Ethereum:

Profit = Destruction - Additional Issue

Among them, the amount of additional issuance after the merger has dropped from 4.5 million per year to 180,000 to 2.09 million, while the amount of destruction is determined by the use of the blockchain. It is not difficult to calculate that when the gas price of Ethereum exceeds 15, there is a high probability that Ethereum is a blockchain that exceeds the break-even line. If it can be maintained for a long time, it can achieve long-term development and survival.

(3) Some analysis cases from the perspective of income and expenditure

Revenue and expenditure may be a topic that is often overlooked by everyone, but even in the new web3 world, the most basic logic of business is still inseparable from income and expenditure.

text

IMX

For Immutable X, we might as well disassemble its income and expenditure:

As a zkrollup, before June 2022, Immutable X claims to be completely 0 gas, so the main business income is basically 0.

As a zkrollup developed based on starkware, it needs to package transaction records to the Ethereum main chain for verification and storage to ensure security, and pay corresponding fees to Ethereum, the main expenditure is the gas fee of Ethereum. In addition, IMX also needs to pay usage fees to starkware.

text

DYDX and the trend of short-term application chain

Next, we can observe its revenue and expenditure and options from the perspective of DYDX:

For DYDX on Starkware, if it chooses Ethereum layer2, its income = transaction fee, expenditure = payment to Starkex + gas fee to Ethereum system + cost of on-chain applications.

For DYDX who goes to Cosmos to build its own chain, its income = transaction fee + self-built chain gas fee, expenditure = chain building cost.

In other words, if DYDX chooses to go to Cosmos to build its own chain, it will save the payment to Ethereum, increase the cost of chain building and gas fee capture, and of course it will also lose a certain amount of Ethereum ecological traffic. Under the premise of the relatively high block rent of Ethereum and the low cost of Cosmos chain building, it is a logical choice for DYDX to switch to Cosmos self-built chain.

Of course, when Ethereum sharding becomes cheaper and more efficient, self-built chains will no longer be an economically rational choice from the perspective of applications (chains). The original application chain narratives of projects such as DYDX will also become reach a certain turning point.

Then, according to the logic and cycle law of high TPS and low cost, the development of Solana in the new public chain track has obviously encountered a bottleneck, and the successor of the new public chain leader will appear. The successor, from the pursuit of capital, the re-selection of technology and the Move language narrative, can be initially seen, it may be Aptos.

Aptos is expected to take over the new public chain

At present, the investors of Aptos and Solana are highly overlapped. Some of Solana’s executives and on-chain project parties also have a tendency to switch to Aptos. This is a great opportunity for Aptos to take over Solana. In addition, the re-selection of high performance and the new story of the Move language also give Aptos a relatively strong competitiveness. Of course, whether Aptos can take over and the actual development after taking over may have to test the ability of the project team.

On the first day of launch, the Aptos team caused some controversy in terms of Token distribution and community management, which also made the author dare not be too optimistic about the capabilities of the project team.

High performance story

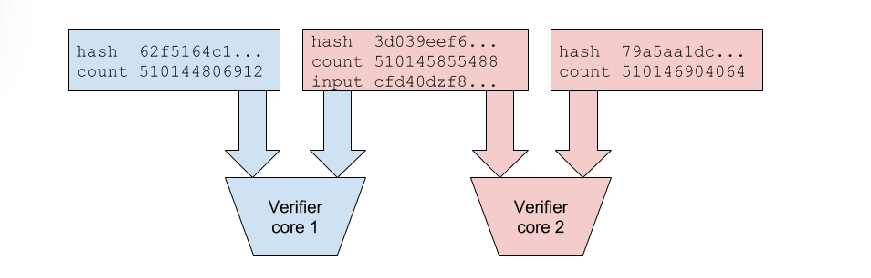

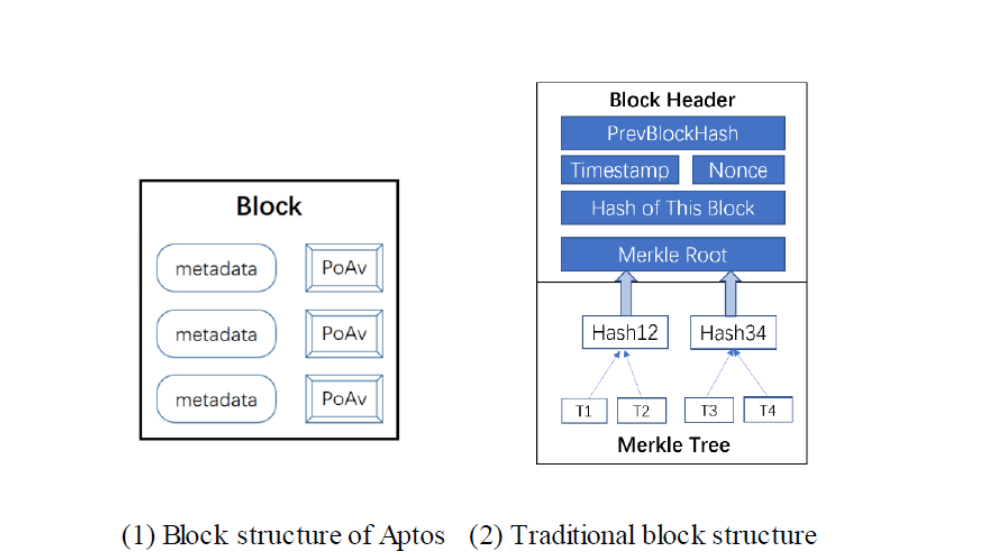

(1) Diem-BFT V4 consensus mechanism

The core innovations of this consensus mechanism are roughly as follows:

① First, the system compresses a large number of transaction records into a "summary" ("PoAv" in the figure) each time.

②Secondly, the block only contains "summary" instead of all transaction records.

image description

Source: Huobi Research

Since the Tokenomics currently announced by Aptos is relatively vague, we will not delve into the sustainability of its economic model for the time being.

(2) Parallel computing

Aptos employs the optimistic assumption that by default transactions are processed in parallel after they have no correlation. If the correlation between transactions is low and can be processed in parallel, Aptos will be greatly accelerated due to parallel computing. But if the transaction correlation is high, Aptos will get a slightly lower processing speed than ETH, but the consequences are relatively insignificant.

Of course, Aptos finally chose 16-thread parallel processing, which also has higher requirements for node hardware, and the number of nodes that meet the requirements will also decrease (some signals can also be seen from Aptos’ current node screening), which will also Sacrifice decentralization and security.

It should be said that looking at parallel computing from a purely technical point of view, Aptos is more of a trade-off rather than a complete innovation. The author has reservations about optimistic assumptions and other solutions.

The Story of the Move Language

The Move language is one of the main narratives of Aptos, and it does have a strong influence.

Move is a static programming language that emphasizes safety. For example, Move does not support Dynamic Dispatch, that is, all codes must have the ability to allow people to understand the various operating relationships at a glance before the official operation. This is a more security-oriented solution. In the financial field have unique value. Solidity supports dynamic calls and emphasizes flexibility.

image description

Source: Buidler DAO

The duel between the new public chain and Ethereum

The author is pessimistic about the impact of Aptos on Ethereum. Although Aptos and Ethereum have their own trade-offs in terms of blockchain performance, from the perspective of multi-chain futures, it is difficult for Ethereum and Aptos to be called competitors in the same dimension:

Ethereum has built a safe and large-scale multi-chain system (including several Rollups such as Optimism, Arbritrum, Starkware, Zksync, etc.), and some Rollups have already reached a level of development close to the leader of new public chains, while Aptos is still a liquidity category for the time being Split single strand. A secure multi-chain system will be an invisible moat for Ethereum.

Multi-chain future

First of all, due to the inherent existence of the impossible triangle in the blockchain, and the increasing number of tracks on the blockchain (Defi, Gamefi, NFT...), etc., it is difficult for a blockchain to meet the needs of various users, so the future will definitely be more chain.

Cross-chain risk

In 2021, high-performance new public chains and dedicated chains for various tracks will develop rapidly, but at the same time, users have also noticed extremely obvious problems, that is, cross-chain risks and fragmented liquidity. If a user buys and uses a domain name on Aptos, plays Stepn on the Solana chain, buys the latest NFT on the Flow chain... the user may need to frequently transfer assets between different blockchains, but so far, there is no safe one Cross-chain interaction means. The application of "cross-chain bridge" has been called "the hacker's cash machine" by the industry because of repeated reports of theft.

It is well known that a single blockchain is bound by a consensus mechanism and is secure. However, when the two blockchains interact, there is no consensus mechanism to constrain them, so cross-chain bridge projects have security risks that cannot be eliminated.

Therefore, the author's prediction for the multi-chain era is a safe multi-chain system, rather than a number of single chains with fragmented liquidity.

The security of the multi-chain system

In the multi-chain era, Ethereum serves as a shared security layer, and Rollups with different characteristics meet different user needs. In fact, it is a very secure multi-chain system.

Imagine that users can deposit assets to IMX to play Illuvium games, or transfer assets to Arbitrum to participate in Odyssey to do tasks through the Ethereum main chain. The security of these asset transfer processes (Cross-Rollup) is guaranteed by the Ethereum main chain , avoiding most of the problems in cross-chain.

Ethereum's powerful multi-chain system

image description

Source: Defillama

In addition, ZK Rollup in Ethereum Rollup is also developing rapidly, and in the long run, ZK Rollup has a higher upper limit than OP Rollup in multiple dimensions such as security, transaction speed, and transaction fees. With the launch of the mainnet of Zksync this month and the development of Polygon zkevm and Scroll, in the near future, the ecology of ZK Rollup is expected to reach the level of the leading new public chain. Aptos and other single chains with fragmented liquidity, even if there are multiple chains It is also extremely difficult for the development plan to impact the powerful Ethereum multi-chain system.