风投机构加持的NFT明星项目,是否值得追逐?

尽管八月份整个Opensea的交易量已跌破5000万美金,但似乎资本却正在加速脚步进场。NFT从最早的OG收藏玩家,到all in web3的创业者们,到web2实体产业寻找新业务场景,再到如今越来越多的风投机构们选择直接投资孵化NFT项目。NFT赛道的投资热点似乎不再仅仅是基础设施,或者NFTfi协议了。而这些被资本加持过的NFT项目,究竟会给市场带来怎样的影响?作为个人投资人,又该如何看待自己所持有的NFT项目被明星风投机构加持这个行为?

为此我们专门整理了一些今年到目前为止的一些知名NFT项目融资案例:

2022年知名NFT项目融资案例

可以看到虽然币市和NFT市场从牛转熊,但是机构进场的速度却没有放缓,并且持续加码各种不同类型的NFT项目。其中尤其以DigiDaigaku的freemint发售到稳定在10 eth以上的地板价让八月末的NFT市场不在冷清。而这样的现像也引发了一个新的趋势,即散户玩家是否应该更青睐那些被明星机构加持的项目?

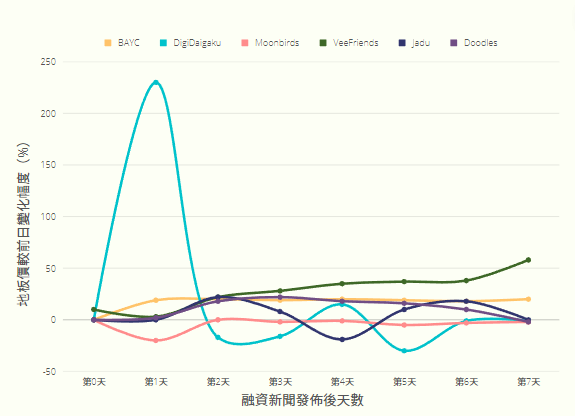

为此我们特意研究了一下这里面部分典型项目从融资信息发布之日起,项目地板价在一周内的变化。令人比较诧异的是,只有DigiDaigaku和老牌项目Veefriends有过显著的地板价上涨,分别超过了200% 和40%。而月鸟、Jadu、Doodles的地板价不增反降,这个现象非常值得思考。

项目地板价在融资新闻发布后七日变化

让我们先抛开NFT不说,聊聊Defi项目的融资。往往那些有大机构背书,拿到足够启动资金的项目意味着项目能加快开发进度,加速上市进程,上市后给早期使用者的空投可能性也越大,空投价值也会越高。这也是为什么大量个人投资者选择在早期去交互体验那些拿到优质机构融资的项目,以取得丰厚的上市空投回报。

但是NFT项目的逻辑不一样。首先作为项目方,发售NFT本质就已经是一个融资行为,通常项目方在早期一无所有的时候,通过发售NFT来为自身未来想要实现的线路图做准备。所以这些项目NFT的早期持有人,可以理解为本身就在做风险投资,而区别在于NFT项目本身的估值逻辑和背后母公司的估值逻辑是不同的。此外,尽管很大一部分NFT项目都会有发币计划,但是做NFT投资的目的究竟是为了NFT本身的升值,还是对于未来发币的预期?NFT本身是否会稀释未来发行的代币的价值?这些都是NFT个人持有人很难去验证的问题。所以说,对于仅仅是参考Defi项目拿到机构融资,而认为自己持有的NFT的项目方母公司拿到融资所以NFT就会上涨,这种思维惯性是不可取的。

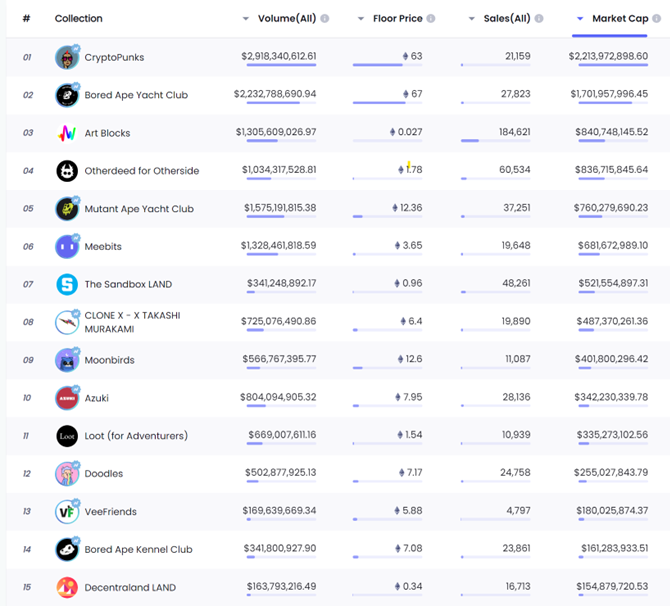

那么,这些NFT项目背后的母公司获得机构融资,和NFT项目的市值之间究竟有什么联系?根据NFTGo的数据显示,目前NFT项目按照市值仅有Azuki一家没有进行过市场化融资,是一个很特殊的例子,因为其母公司Chiru Labs很久以来都没有实名,通过令人印象深刻的合约创新以及目前仍然是最优质的亚洲画风而独树一帜。而Azuki在很早就开始积累国库收入,目前已经累计了上亿的资产。可以说这个项目的爆火让它本身就资本雄厚,所以如果不是出于战略合作需求的话,必然不会选择市场化融资的道路。

但除了Azuki之外,我们可以很明显的看到,项目的成功本身和是否有资源绑定或者资本背书存在着很大的正相关性。巨无霸Yuga Labs早在土地发售之前估值就已经突破50亿美金,通过不断的套娃游戏产生巨量的销售收入、版税收入、IP周边商品收入、线下商业收入,以及最终Apecoin的成功上市。也正是这样稳健的持续创收的能力撑起了其昂贵的估值。Clonex的母公司RTFKT更是早在去年底就被Nike整体打包收购,不断尝试与Nike在线业务进行融合打通。Proof/月鸟更不必说,创始人在矽谷多年的互联网风投经历让项目从上市起就风生水起。

NFT项目估值排名

可是持有这些公司的股权和持有NFT是有本质差异的。

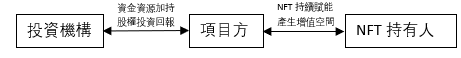

首先作为公司的股东,他们的期待值只有一个,那就是财务投资的回报率。而财务投资的回报率又取决于公司是否能最终上市,或者被以最初投资时数十倍甚至数百倍的价格所收购。而且决定这个最终结果的,是这家公司是否能产生足够多的利润。传统web2公司的逻辑是,自身生产的产品,或者提供的服务,换取了收入,产生了利润。但是作为发行NFT项目的公司来说,这一逻辑就产生了变化。虽然“生产”出了这个虚拟产品,但是购买方或者持有人购买的预期是能够通过这一产品的升值,或者附带的价值,例如项目方空投等,来产生真实收益。而在这个过程当中就会产生一个矛盾,即项目自身产生的收入,或者增值,应该如何分配给母公司和NFT持有人?

如果说项目方为了进一步抬升地板价,将更多的利益例如空投或者项目玩法机制相关而产生的现金流分配给NFT持有人的话,那自然母公司的收入就会减少,利润增长速度也会下降,那么股东对于未来公司的价值增长潜力也会产生很大的怀疑,进而影响后续融资上市。但如果项目方非常看中自己的品牌价值和收入,不愿意发空投或者与NFT持有人分享收益的话,那么NFT的价值就会下跌,最终影响项目整体的发展进度。所以对于中心化的NFT项目方来说,如何权衡股东和NFT持有人之间的利益,成了一个永恒的难题。

而对于NFT持有人来说,也许未来听到自己支持的项目获得了机构融资,很有可能出现的是负面情绪或者砸地板。因为也许投资机构能为项目带来长期的资源和赋能,但是同时也会压缩持有人自己能从这个项目收获的利润空间。所以对于机构背书这个行为来说,NFT项目早期可能地板价更高,但是长期来看却限制了它的上升空间,天花板也变得更低了。

投资机构、项目方、NFT持有人之间的关系

回到本文最开头的DigiDaigaku,项目地板价在一路上升到16+的时候维持了不到几天遍火速下跌到目前10e以下。抛开项目方高度控盘的问题不说,可能下次大众再看到如此令人瞩目的融资新闻的时候,就不会像这次产生如此大的fomo情绪了。毕竟资方进场,是有可能缩小持有人利润空间的。但如果反向思考的话,可能正是这种fomo情绪,才给量化和高频交易员们创造了利润机会。

作者:@ReffoNFT

更多资讯,请关注SATCE 官方网站