Bankless: How to activate NFT liquidity with Sudoswap?

This article comes from BanklessThis article comes from

, the original author: William M. Peaster, compiled by Odaily translator Katie Ku.

The explosion of Bored Apes and CryptoPunks has created huge fortunes for their collectors. NFTs are now a multi-billion dollar asset class. The question is how to get liquidity for the NFT you have on hand. It's an all-or-nothing game. Either sell it or don't sell it. It is not possible to slowly adjust or hedge your position like with fungible tokens.Sudoswap is an option. The protocol uses SudoAMM, utilizing the bonding curve mechanism (bonding curve), which has the best flexibility when buying and selling NFT. The Sudoswap platform has been in the spotlight in recent weeks,. Collectors flock to grab that liquidity. Therefore, Sudoswap has also sparked some controversy about creator royalties, because the platform allows collectors to pay no royalties at all.

secondary title

How to get NFT liquidity

Sudoswap is a new NFT AMM that has chosen a path that previous NFT markets have not taken. It uses an innovative liquidity pool and bonding curve mechanism to bring much-needed liquidity to an emerging multi-billion dollar asset class.

Goal: Learn how to provision NFTs on Sudoswap

Skills: Intermediate

Skills: Intermediate

The reward: Own and manage your own NFT liquidity

secondary title

What is Sudoswap?

Launched by 0xmons in April 2021, Sudoswap was originally an OTC NFT trading Dapp. A few months after launching the system, 0xmons began developing a new NFT automated market maker (AMM) system, also known as SudoAMM.

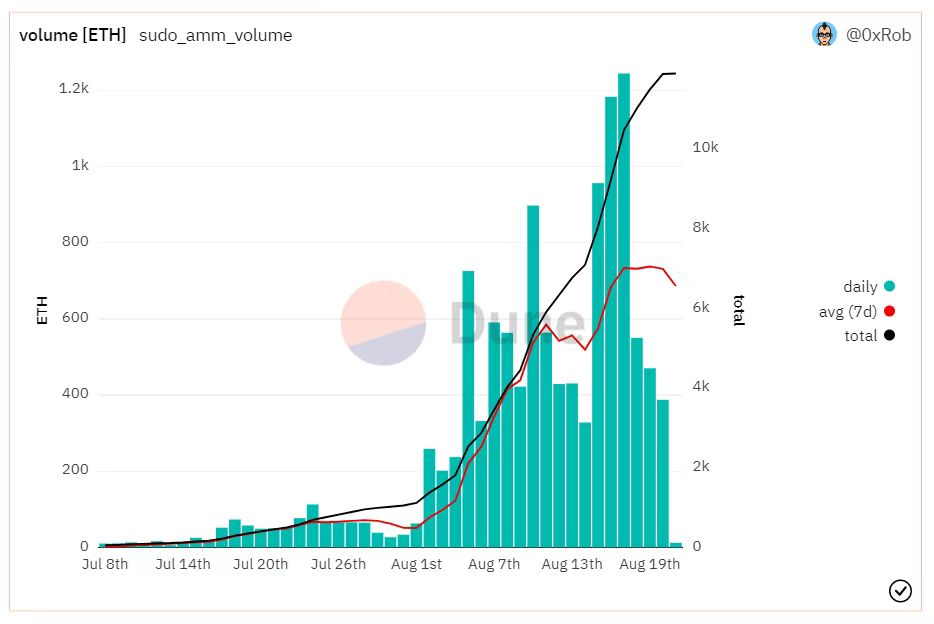

The creators of SudoAMM launched the technology on July 8th, 2022 as a new engine for the decentralized Sudoswap marketplace. Since then, on-chain transaction volume has exploded.

Dune dashboard data: the latest sales of sudoAMM

secondary title

How does sudoswap work?

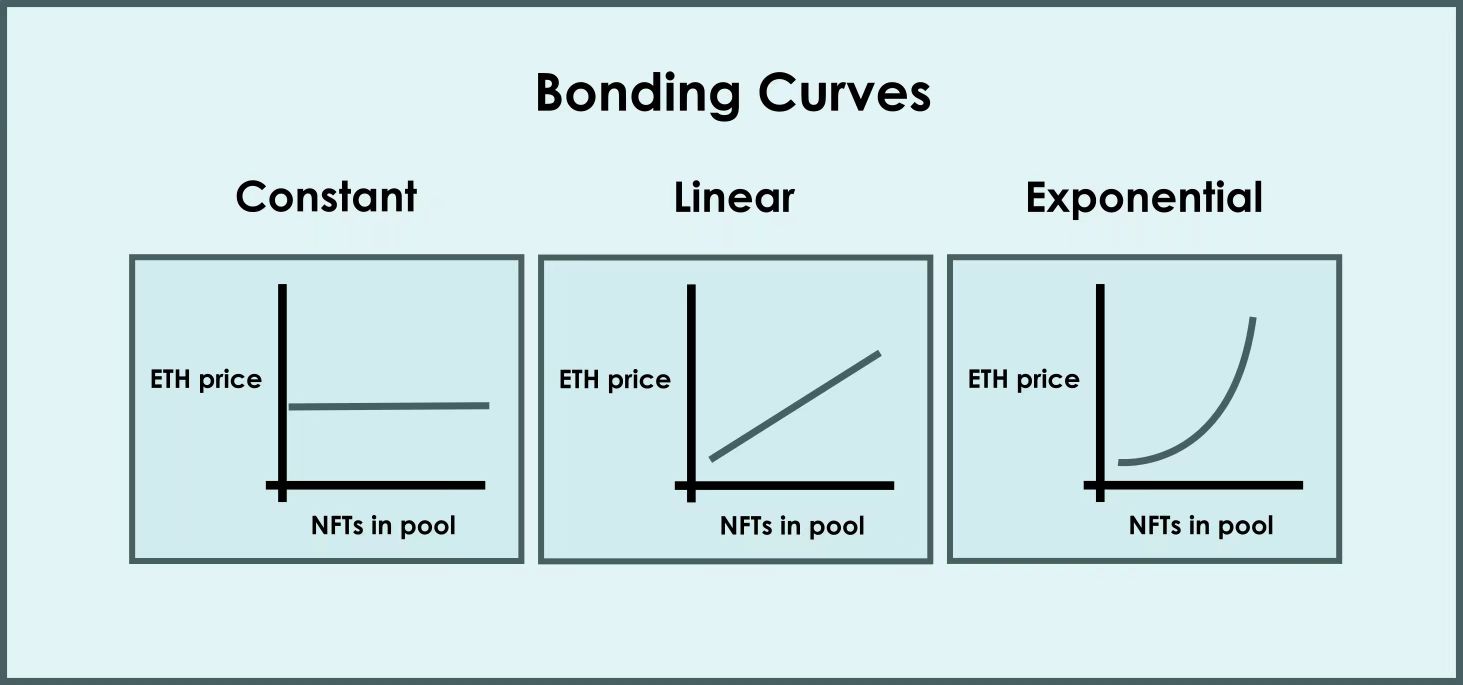

In general, Sudoswap is on the same spectrum as NFTX, as it is a protocol that also facilitates simplified trading around "floor price" NFTs. That said, a router system working on multiple unique parameterized liquidity pools and a customizable bonding curve mechanism is the main point of difference between Sudoswap and NFTX.

“For liquidity providers, unilateral pools allow DCA strategies (regular fixed investment method) to enter or exit large NFT positions. For example, a buyer pool buys at 10 ETH, then 9 ETH, then 8 ETH Its first NFT, and so on (assuming a linearly declining bonding curve mechanism). Or the seller sells the first NFT for 1 ETH, then 1.5 ETH, then 2.25 ETH."

secondary title

royalty dispute

A huge point of contention in the NFT ecosystem recently has been Sudoswap's payment method for NFT royalties. A major selling point of sudoAMM is that its traders pay no royalties compared to using other NFT marketplaces. So this saves collectors around 5-10% per purchase.

To understand why this dynamic is controversial, think back to 2020, when a group of now-legendary crypto artists demanded and won at least a 10% resale royalty on any NFT resold from the famous NFT marketplace. Since then, the 10% royalty has become the de-facto standard for crypto artist work and has gained popularity in the NFT space as Web3 negates the historical status quo and artists often never receive any secondary sale royalties when reselling their work .

As a result, there is a very strong pro-royalty culture among many of the old guard in the NFT ecosystem, and many in this camp believe that competing downhill towards zero royalties is regressive and exploitative, It is an insurmountable red line. Users, on the other hand, have a much more cynical view of the zero-royalty race that, whether you support it or not, is almost inevitable, as exemplified by this recent tweet from Udi Wertheimer:

“NFT royalties are an inefficiency of the market, so it is inevitable that they will be copied. This has nothing to do with deliberation, smart contract technology, or any other market inefficiencies. Ultimately, market inefficiencies will always be eliminated. If your business model does not Respect that and it won't last."

There are also some centrists who say that Sudoswap is mainly suitable for providing liquidity flexibility for large PFP series, many of which have begun to experiment with the patent tax method. For example, two of the three most traded projects on Sudoswap so far are Based Ghouls and 8liens. The Based Ghouls team built their own Sudoswap liquidity pool to control their liquidity, while 8liens charges a 0% usage fee for strategic reasons.

Regardless, NFT aggregators like Gem are adding optional royalties to Sudoswap trades, so it will soon be possible to trade on Sudoswap and cash out royalties.

secondary title

How to Create a Sudoswap Liquidity Pool

Lately I've been focusing on DIY solutions and how to create your own PFP series, and how to create your own Mint UI, and how to create a Mint allowlist.

So, let's say you've created your own collection of NFTs, and now you're ready to show it off to the world. Here's how to create your own NFT liquidity pool on Sudoswap:

Open sudoswap.xyz;

connect your wallet;

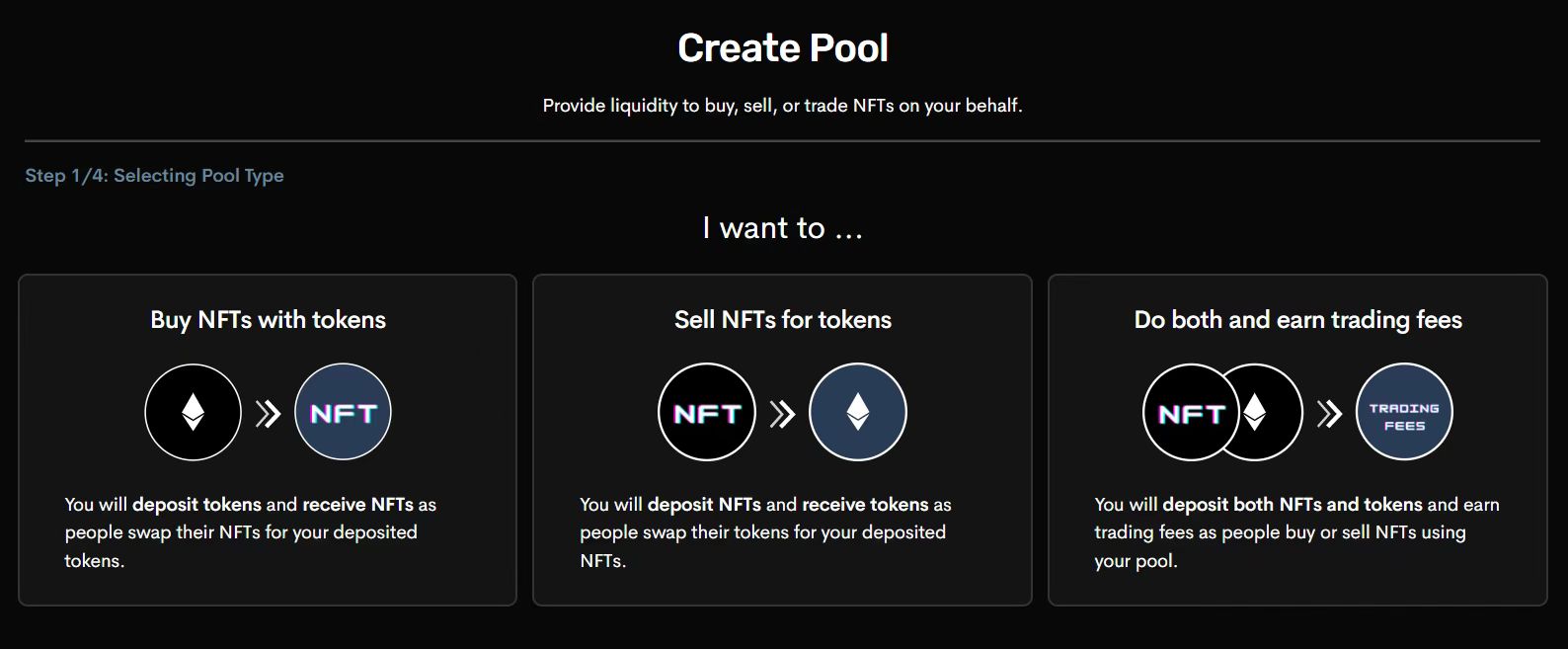

Click the "Your Pools" option, then click "+Create Pool". You will reach this interface:

Click on "Sell NFTs for token" or "Do both and earn trading fees". In this example, we will choose to buy NFTs using only ETH.

Select the NFT series you want to buy and the token you want to receive in the transaction (currently only ETH), and then click "Next".

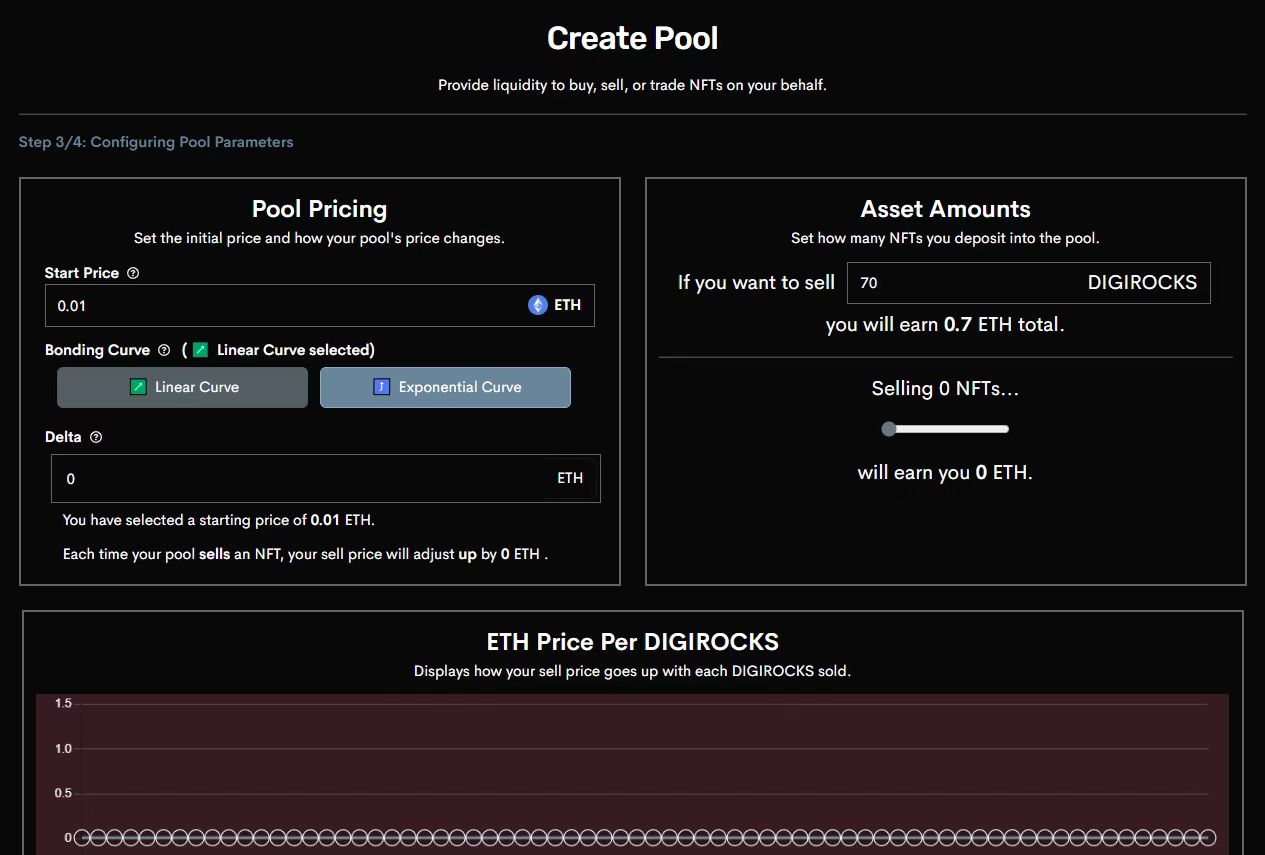

At this stage, you can set the NFT's price point, its bonding curve mechanism type, and the delta value of its price change on new transactions. Click "Next" again.

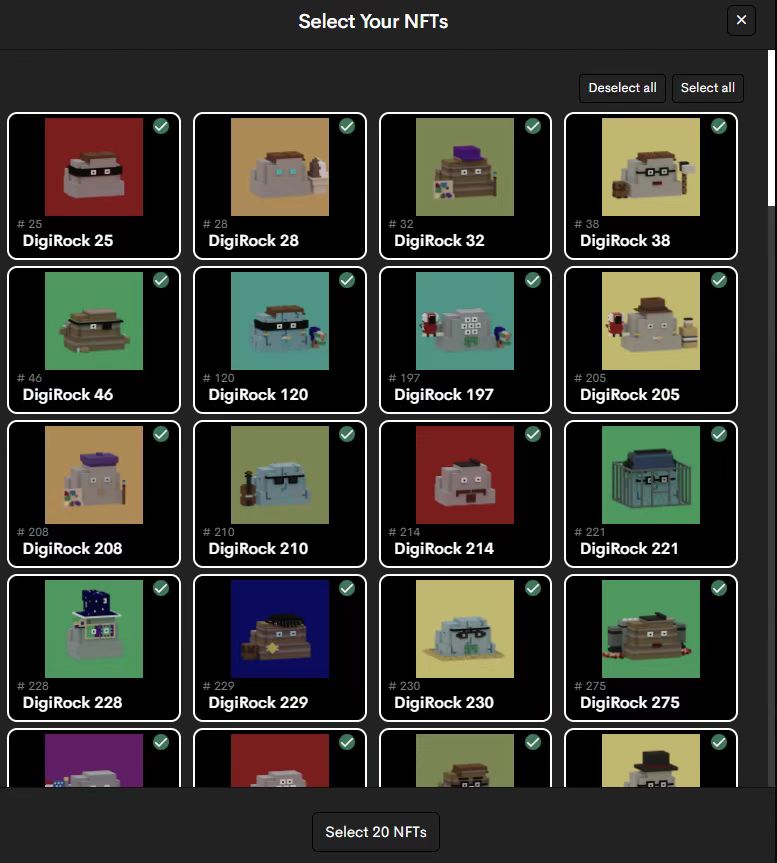

On the next page, click "Choose your NFT+" and select the NFT you want to buy, as shown below:

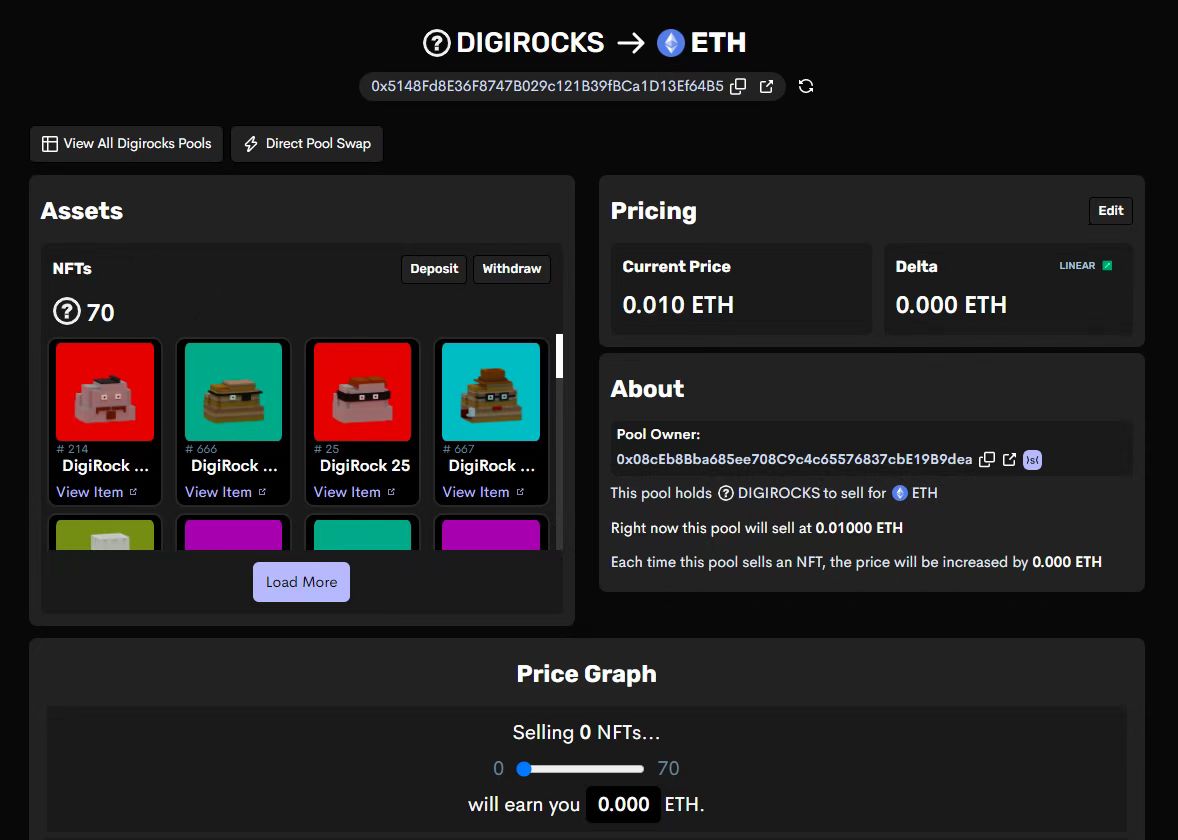

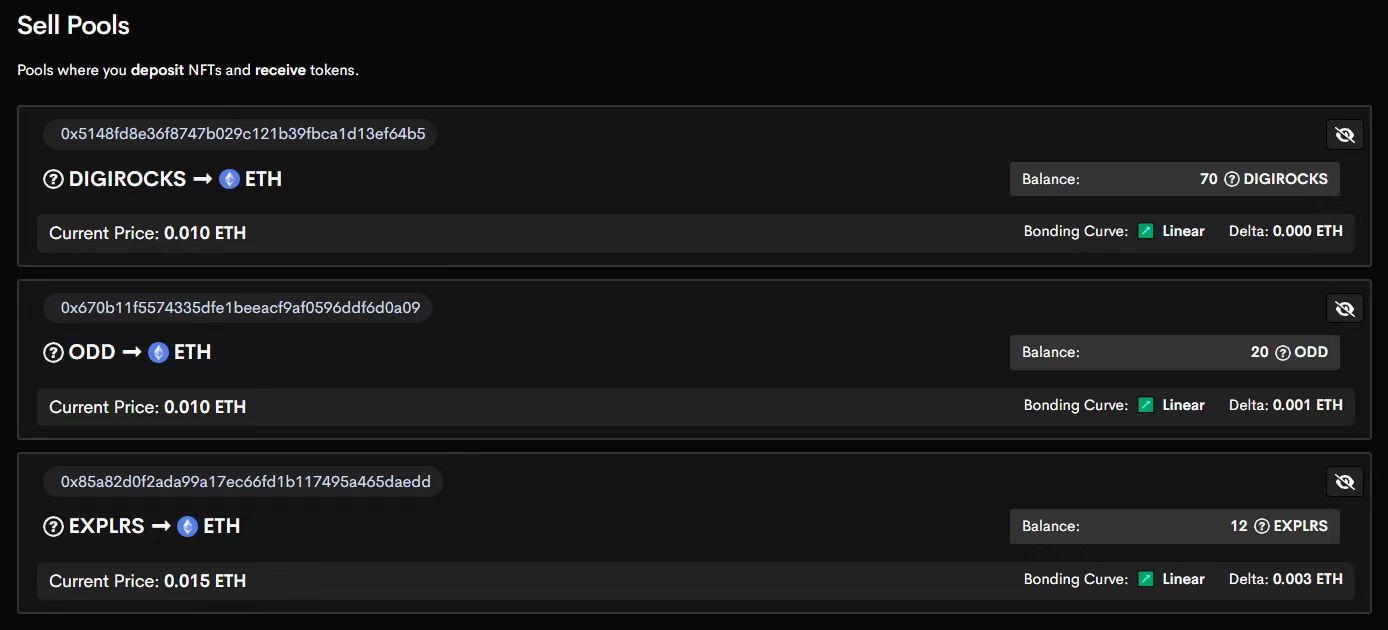

To manage your holdings and track your sales, simply click on "Your Pools" on Sudoswap to enter your Liquidity Pool Command Center:

secondary title

A New Experiment with NFTs