Original author: DG researcher Tim

first level title

01

The wave of games going to sea

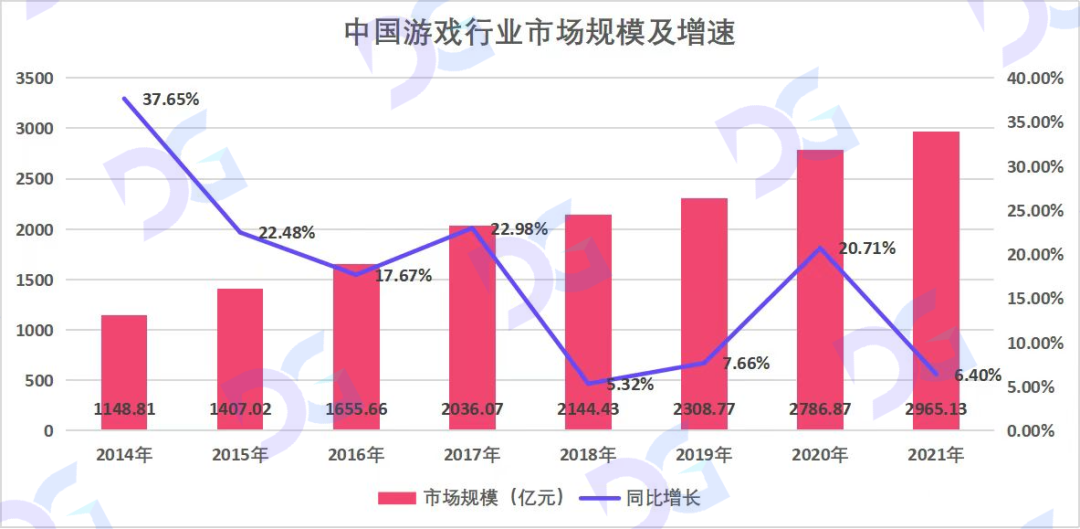

The growth rate of the domestic game market has shown a sluggish trend.

According to the data of the Game Working Committee, the size of China's game market in 2021 will be 296.5 billion yuan, the growth rate will drop to 6.4%, and the number of users will exceed 660 million, an increase of only 0.2% compared with 2020.

The reasons for this phenomenon are, on the one hand, the domestic game industry has experienced more than ten years of development, the user penetration rate has reached a relatively high level, and the ceiling is gradually appearing.

In addition, the increase in policies such as version number and anti-addiction has put a heavy burden on the game industry. The number of game version numbers issued from 2019 to 2021 is 1545, 1405, and 755, respectively, and continues to decrease. Due to the suspension of distribution, the number of version numbers for the whole year of 2021 has decreased by 46.26% year-on-year. The version number has been suspended for eight months since Q3 in 21. Although it has been restarted recently, the amount is still shrinking compared to before.

This makes life difficult for game practitioners. According to the "2021-2022 Report on R&D Competitiveness of Chinese Game Enterprises" released by Gamma Data, game talents will undergo a new round of internal adjustments in 2021, and some companies will also enter a shrinking transformation stage from the expansion stage. In the second half of 2021, the social recruitment demand of game R&D personnel will drop significantly year-on-year, and the overall recruitment demand will drop by 23%.

During these difficult days, many small and medium-sized game companies have stopped recruiting, and leading game companies are also reducing some game projects in order to increase revenue and reduce expenditure. According to the data from Tianyancha, there will be more than 4,300 canceled companies related to online games in 2021. As of May 6 this year, more than 1,060 companies have been canceled. Newly registered related companies are also shrinking. As of April 22, there will be over 160 new registrations of online game-related companies in 2022, a year-on-year decrease of 87.66%.

Under the overall poor domestic environment, going overseas is becoming the development trend of the game industry.After observing the Q1 quarterly reports of more than 20 listed game companies, it was found that 70% of them were involved in overseas strategy.Domestic leading companies have continued to increase their stakes. After Tencent Games launched the overseas game distribution brand Level Infinite, Mihayou and Lilith also released their own overseas brands HoYoverse and Farlight Games. Sanqi Mutual Entertainment has carried out a clearer division of labor internally. At the beginning of game development, it must be based on globalization. NetEase has set an early goal of 50% of future overseas game revenue. Xindong also stated that they plan to invest their main resources and business focus in overseas markets with stronger certainty and growth.

In fact, going overseas has also formed a new profit growth point.

The "2022 Mobile App Going Overseas Trend Insight White Paper" shows that in the past year, the revenue of overseas games has grown strongly, at 27.7%, far exceeding the growth rate of the global TOP250 games. According to the analysis of CITIC Securities, Chinese games have made a breakthrough in the overseas market.first level title

02

GameFi Sprouts

In addition to the trend of going overseas, new vocabulary such as Metaverse, Web3.0, GameFi, and play to earn has also attracted the attention of some domestic game developers. GameFi, or blockchain games, as a new game model combined with blockchain and decentralization, is exploring its own path.According to statistics, its pioneering masterpiece Axie Infinity had a single-month revenue of more than 100 million U.S. dollars during the hot period, and a single-day revenue of 18.48 million U.S. dollars, more than twice that of the global mobile game revenue champion "Honor of Kings".The recent GameFi leader Stepn, Q2 fee profit also exceeded 120 million US dollars. This reveals the huge commercial value contained in the GameFi model. Judging from historical data, the total market value of GameFi token in 2018 did not exceed US$10 million. In 2022, the total market value of GameFi token will be close to more than 20 billion U.S. dollars. DeGame Founder & CEO Lester Li said, "This figure will increase tenfold in the next four years, and it will become a market worth 300 billion U.S. dollars. Projects will reach a trillion."

It is precisely because of the huge potential of GameFi that capital has been deployed in it, making fundraising easier.

According to data from DappRadar, the investment of major global venture capital funds in the GameFi field will reach US$4 billion in 2021, and this figure will only be US$80 million in 2020. A new report released recently by the consulting firm DDM shows that in the first quarter of 2022, a total of 243 investment transactions occurred in the global game industry, with a total capital of 3.5 billion US dollars, a year-on-year decrease of 10.3%. Among them, the investment in blockchain game companies reached 1.7 billion US dollars, accounting for about 48%. In the second quarter, the investment of blockchain game companies still increased compared with the first quarter. The most notable of these is Epic Games' $2 billion in financing, which was used to support the construction of its Metaverse.

In fact, there are only more than 2,000 GameFi-related protocols currently deployed on the blockchain. Since this market still lacks a game development team with mature experience, a large number of them are shoddy and lack of playability products. Even Axie Infinity and Stepn, which have achieved great success before, cannot compare with traditional popular game products in terms of game quality, and the update iteration speed and operation methods of their versions are far behind the level of traditional game manufacturers. These factors have led to its inability to achieve long-term stable income. It can be said that the current GameFi industry is extremely short of high-quality or even normal game works. Many foreign game manufacturers and studios, such as Ubisoft and Epic Game, have realized this and are investing in related research and development. Tencent also invested in chain game developer Immutable in March this year. However, most domestic game developers, due to policy restrictions and other factors, are still in a new or early stage of contact and understanding of GameFi.

Compared with traditional games, GameFi is more friendly to game developers in many ways. Developers can raise a relatively large amount of funds through NFT sales or token issuance before the game is launched, which obviously alleviates the difficulty of funding in the initial stage of the game.

In June, blockchain game Illuvium raised over $72 million through its NFT land sale.

This is unimaginable in the traditional game circle. After the token is listed on the secondary market, the price increase of tens or even hundreds of times can also bring amazing profits.

GameFi allows in-game items to exist in the form of tokens or NFTs. Players have ownership of these decentralized assets and can trade or lease them freely.first level title

03

What is needed for chain reform

Simply put, a mature traditional game, plus the transformation of the blockchain part, referred to as "chain reform", can create a GameFi work.

first level title

04

Contract program deployment

The transformation related to smart contracts is the first thing to do.

Before that, you need to have a comprehensive understanding of the characteristics of each public chain and the GameFi ecosystem, such as gas fee, transaction speed, number of active GameFi protocols, number of active GameFi players, transaction volume, etc., and then choose based on your own game characteristics and player group positioning Appropriate public chain to deploy contracts.

At the same time, choose the appropriate protocol type for your own token and NFT.

first level title

05

economic system

The economic system is very important to GameFi, which can basically determine the life of the game.Traditional games also generally have their own economic systems that can keep running well. However, compared with GameFi, the economic ecology of traditional games is more like a closed system and does not directly interact with the outside world. GameFi financializes game assets through tokens, NFTs, etc., and directly connects the game economy with the external real-world financial system. It is exposed to speculators, investors, arbitrageurs and other forces, and is relatively more vulnerable . If there is a lack of relevant coping experience, the life of the game may end in a very short time. The quality of the game itself is high, but there are many cases where a large number of players are lost due to economic collapse due to unreasonable economic models. Only a reasonably designed high-quality economic model can make the game economy develop healthily, maintain a good liquidity state, and allow players to fully enjoy the fun of games + transactions.

first level title

06

Anti-cheat, anti-studio

There are a large number of cheaters and gold-making studios in traditional games, which are also common in the GameFi ecosystem, and they are more harmful to the GameFi ecosystem. Cheating with plug-ins may cause excessive output of materials, trigger inflation, and directly damage the economy of normal players. The existence of Dajin Studio is the same, and it is even possible to monopolize and manipulate the market with a huge amount of funds, turning the entire game into a tool for its own profit.

first level title

07

User growth and community culture

Traditional games are mainly promoted through advertisements and purchases. Influenced by web3.0 culture,GameFi pays more attention to the atmosphere of the game community and seeks users' sense of participation and belonging.first level title

08

Business Model and Liquidity Realization

GameFi's business model is different from traditional games. Traditional games mainly earn money through player recharges, but GameFi's profit sources are not limited to this. Its mainstream profit methods are generally through the sale of encrypted assets in the form of NFTs, tokens, etc., or by collecting Market transaction fees. Therefore, the price and liquidity of these encrypted assets are particularly important to profitability. In the initial stage of the game's listing, it is likely to face the problem of lack of liquidity of encrypted assets. For traditional game developers, lack of blockchain-related transaction experience may be difficult to start. In fact,Through some market-making means, these assets can be revitalized, liquidity and price can be improved, so as to attract many external players or investors to enter.first level title

09

Operation Adjustment Mechanism

Traditional game developers already have extensive experience in game operations.

For GameFi, due to the fragility of the economic system, game operations need to pay more attention to the monitoring of game health. It is necessary to do a good job in the analysis and monitoring of in-game data and on-chain data indicators, and make timely and reasonable adjustments and countermeasures for abnormal situations.

Generally speaking, traditional game developers entering the GameFi track do have inherent advantages in game quality and game understanding.Original link