foreword

secondary title

foreword

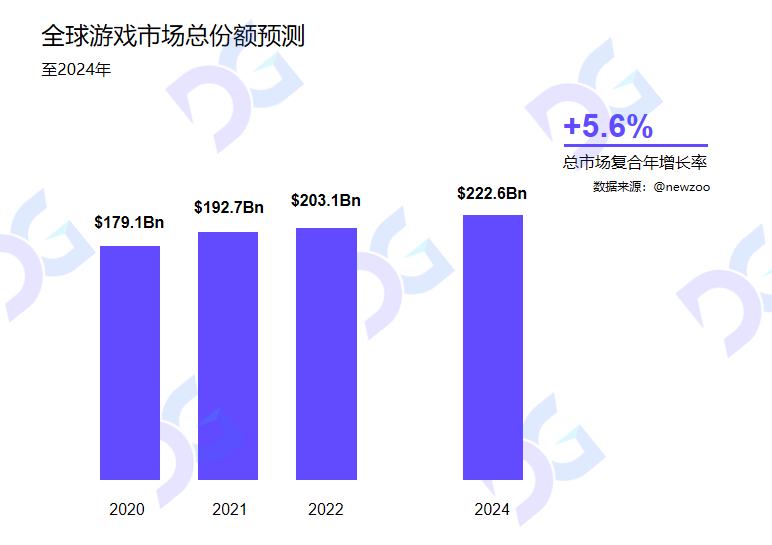

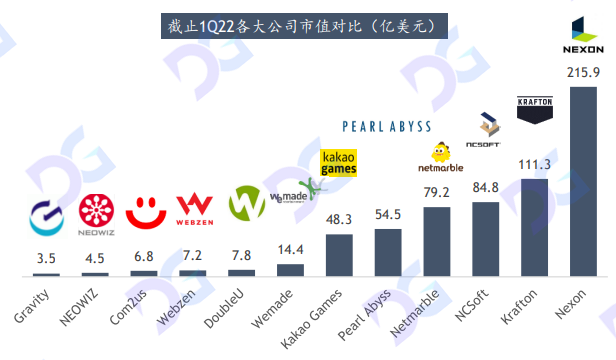

The game industry has developed rapidly in the past 20 years. The global game market revenue is expected to reach US$200 billion in 2022, a year-on-year increase of 5.4%. The number of global players is also expected to exceed 3 billion, reaching a record high. There are also hidden worries along with the growth. The relative growth rate has slowed down compared with previous years. In some regions, game revenue has even decreased and players have lost.

Among them, the negative growth of the Korean game industry is particularly obvious: in 2022, the number of mobile game downloads in the Korean market will drop by 15% year-on-year, and the number of monthly active players of mobile games will drop by 10.6% year-on-year, reducing nearly 2.7 million people; There were big drops (NCsoft down 53.12%, Nexon down 30.59%, and Netmarble down 17%).

Wemade, as the first Korean traditional game company to lay out the chain game track, achieved good performance through the chain reform game "Mir4" in 2021, which will let everyone see the life-saving straw. Even with the pressure of various policies, Korean game companies are still scrambling to integrate PlaytoEarn, NFT and other chain game elements into their newly released games, but how to change the chain is still unclear, and it has become a problem that game manufacturers need to face.

In this context, we decided to disassemble and sort out the current situation of chain reform of Korean game manufacturers from the perspective of facts and data, so as to understand the current development status and future trends of chain reform of traditional game manufacturers.

Global game growth slows down

In 2022, the growth rate of the global game market will slow down, with a growth rate of 5.6%, which is 1.9% lower than last year's growth rate of 7.5%.

Global Game Market Total Share Forecast

In June 2022, the overall number of online games in the world showed a downward trend compared with the same period last year, and the decline in major countries and regions reached more than 9%.

The number of online games in the App Store in major countries/regions in the world in the first half of 2021 vs. the first half of 2022

secondary title

Overview of Korean Game Industry

Scale and Growth Rate of Korean Game Industry

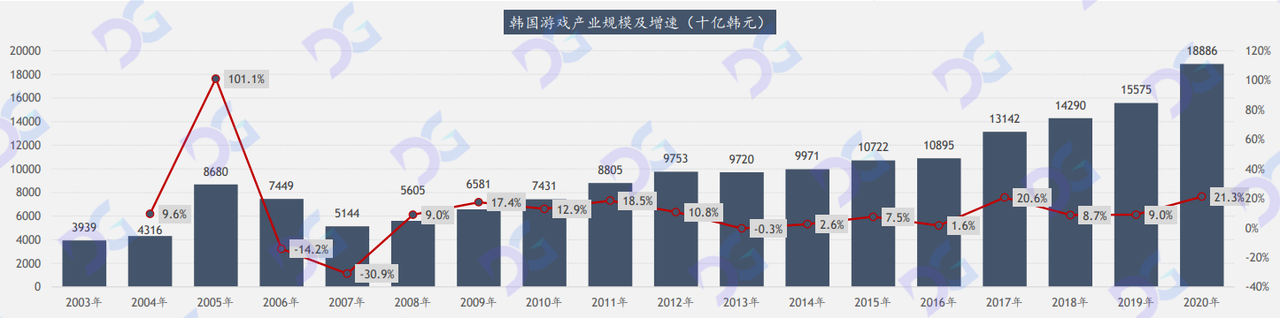

Korean game culture originated from arcade games. It sprouted in 1970 and became popular in the early 1980s. During this period, the number of domestic game halls and players increased significantly, and the game industry developed rapidly. After the Asian financial crisis in 1998, there was a short stagnation, but as the South Korean government officially proposed the "Cultural Nation" strategy, the South Korean game industry ushered in a golden decade. The leading game research and development capabilities enabled it to launch many popular games. global export. Until 2011, the end game market became saturated, and the domestic online game time was restricted for teenagers under the age of 16. The growth rate of the Korean game industry began to slow down and showed negative growth in 2013. In 2014, the emerging market of mobile games emerged, and Korean game manufacturers began to enter the game. Classic IPs were continuously transformed into mobile games, ushering in the second growth of the industry. By 2020, the Korean game industry will have positive growth for 7 consecutive years. In the past two years, the Korean game industry has once again shown signs of sluggish growth due to the combination of various factors such as the saturation of the mobile game market, the fading of the epidemic dividend, and the escalation of competition.

Global Game Market Overview

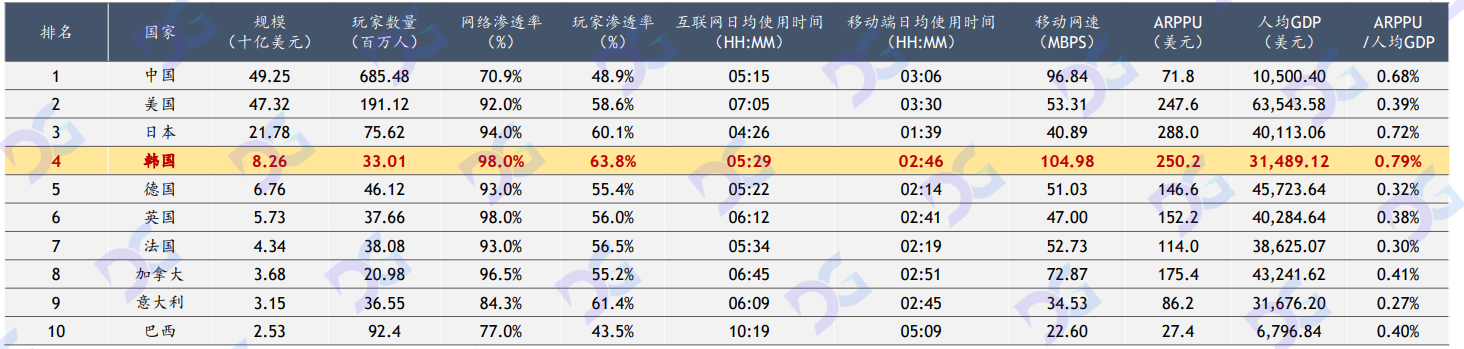

The South Korean game market ranks fourth in the world, reaching US$8.2 billion. The penetration rate of netizens is 98%, ranking first, players are willing to pay, and the per capita game expenditure (ARPPU) is 250 US dollars, ranking second in the world. It can be seen that the Korean local game ecology is extremely vital.

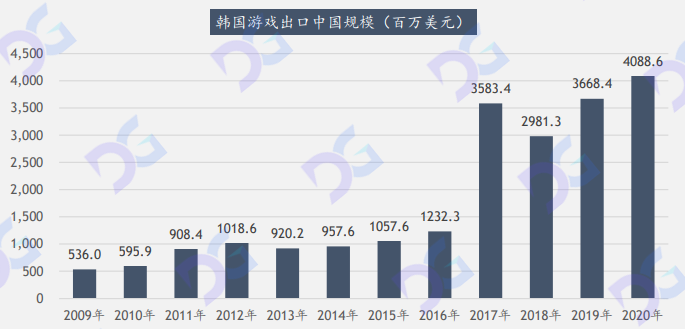

Scale of Korean game exports to China

secondary title

Revenue growth of South Korean game companies slows down

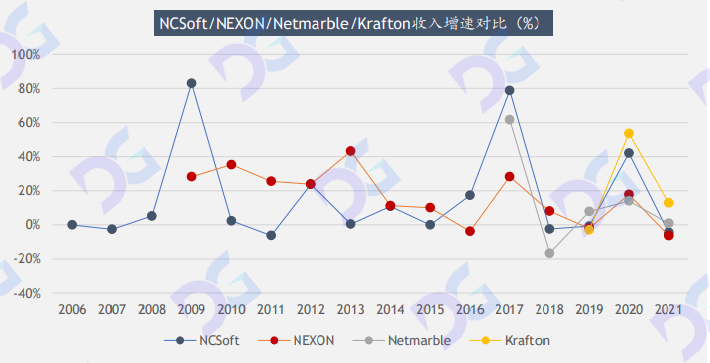

Comparison Chart of Revenue Growth Rate of Four Korean Game Manufacturers

As mentioned in the preface, the South Korean game market has experienced a decline in the number of monthly active players in the past two years, and the stock prices of game companies have plummeted. From the figure, we can also clearly see that the revenue growth rate of the top 4 game manufacturers in South Korea has dropped to a low level.

image description

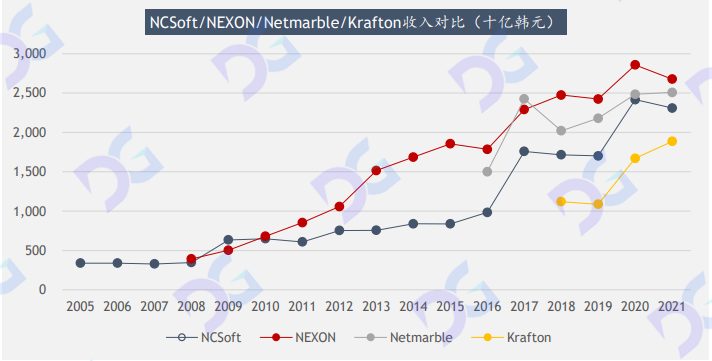

Revenue Comparison Chart of Korea’s Four Major Game Manufacturers

These four leading Korean game companies have all announced to varying degrees to enter the blockchain game and Metaverse-related tracks.

image description

secondary title

Wemade, the first Korean company to enjoy chain game dividends

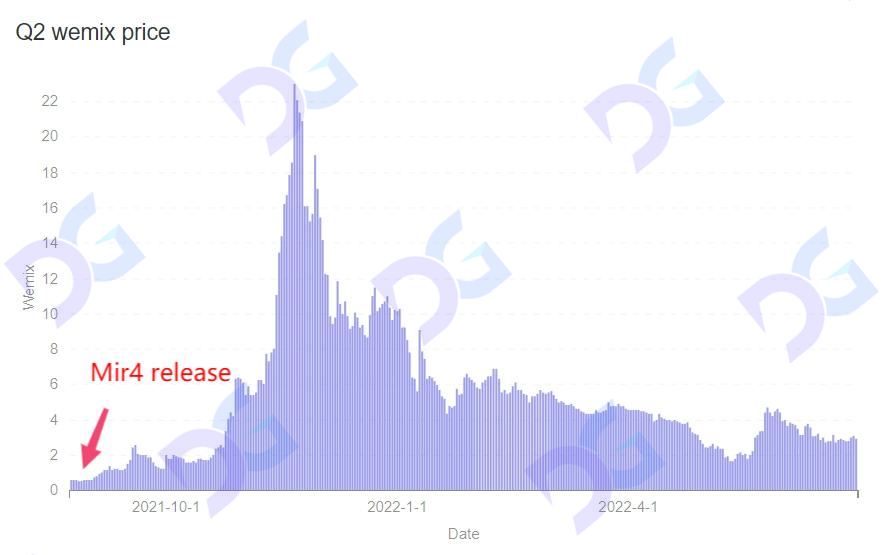

image description

On August 26, 2021, Wemade launched the blockchain-based game Mir4, which was sought after by new and old players around the world as soon as it was launched. It ranked top 5 in the best-selling list of Google stores in many countries. At the peak, the number of simultaneous online users worldwide exceeded 1.4 million, with a monthly activity of one reached 6.23 million people.

Its chain game platform currency Wemix has also risen sharply with the popularity of Mir4, and it has been very popular for a while.

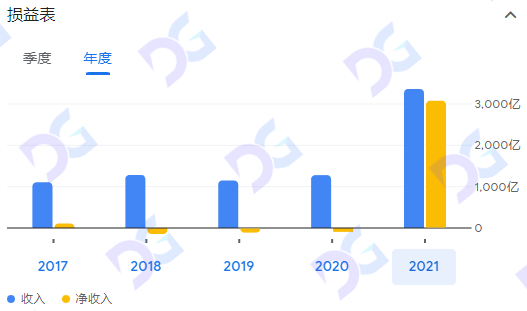

Financial Changes Mir4 Brings to Wemade

image description

text

In the four years from 2017 to 2020, Wemade's annual income fluctuated around 100 billion won, and its net income was negative for three consecutive years. The outbreak ushered in 2021, with annual revenue of 334.98 billion won, a year-on-year increase of 164%, and annual net income of 306.69 billion won, a year-on-year increase of 4515%.

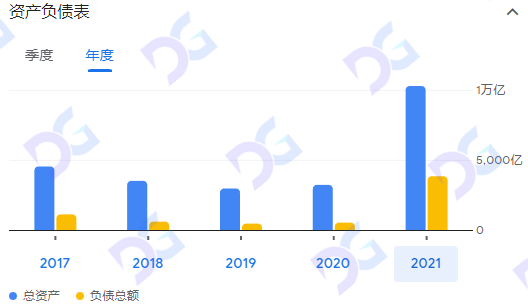

Wemade balance sheet

image description

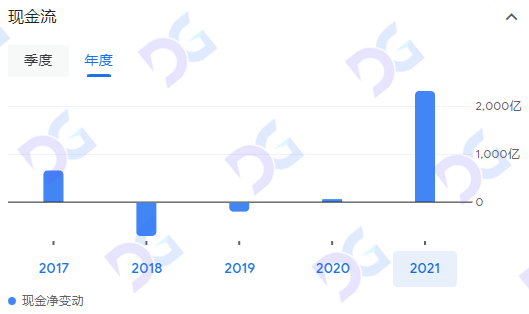

Wemade cash flow statistics

text

The net change in cash flow was 231.5 billion won, a year-on-year increase of 5584%; the net income in 2021 reached a record 306.6 billion won, or about 234 million US dollars, a year-on-year increase of 4515%.

The preemptive deployment of Metaverse and chain game tracks has indeed brought immediate and explosive growth to Wemade's finances. Wemade's share price has also risen from 30,000 won to 230,000 won after the global release of Mir4, which shows that the market at that time was very interested in chain games. With the confidence of Wemade, the market value has also jumped into the first echelon of Korean game companies. Some Korean media even said: ""Mir4" is expected to make Yumeide a game changer in the industry and lead the paradigm shift of the P2E model."

South Korea’s leading game companies then rushed to deploy chain games related tracks, trying to revive the stagnant revenue growth.

secondary title

Wemade Financial Review

How Mir4 will change Wemade's financial situation specifically, we need to sort out Wemade's financial situation in recent quarters.

How Mir4 will change Wemade's financial situation specifically, we need to sort out Wemade's financial situation in recent quarters.

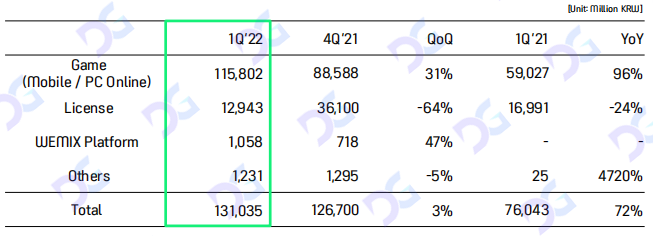

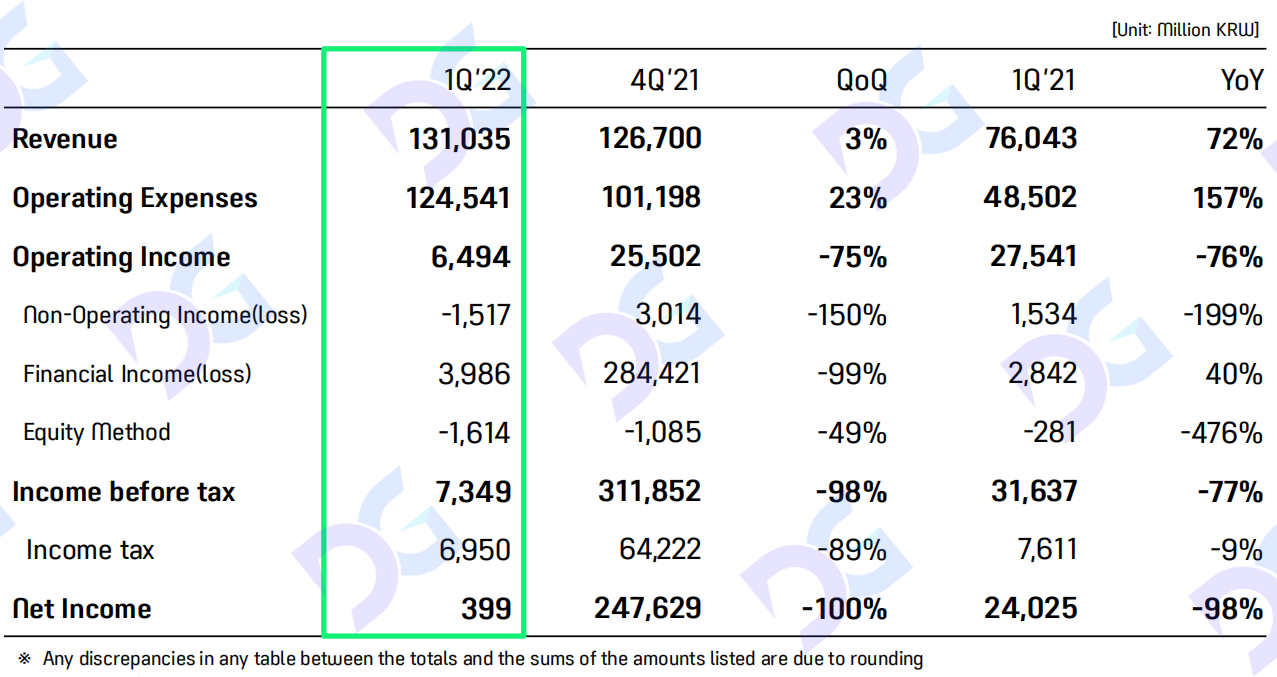

The picture below shows the revenue in Wemade's latest financial report.

In the fourth quarter of 2021, revenue mainly includes operating income of 126.7 billion won and financial income of 284.4 billion won;

In the first quarter of 2022, the revenue is mainly operating income of 131 billion won, while financial income fell by 99% to 3.9 billion won;

It is worth noting that there was 284.4 billion won in financial income in Q4, of which 225.4 billion won was obtained from the sale of Wemix platform tokens, which accounted for 73% of the net income in 2021.

In general, Mir4 has indeed led to an increase in game revenue, but Wemade's net income in 2021Q4 has soared, largely due to the sale of Wemix tokens, and this revenue does not seem to be continuous at present.

Wemade stock price chart

secondary title

image description

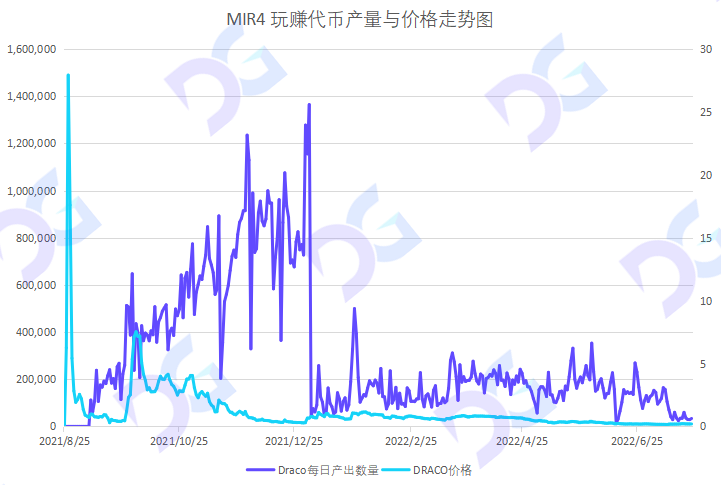

Mir4 Token Production and Price Chart

text

Draco, as Mir4's Play to Earn token, can truly reflect changes in the popularity of the game.

Since the launch of Mir4, the number of Darco's trading addresses has fluctuated and reached a peak of 1.4 million, which is basically consistent with the official announcement of the highest number of simultaneous online users of 1.4 million and the highest monthly active users of 6.23 million.

The price of Darco once touched $8 in the fourth quarter, but then fell rapidly. This is because there are a large number of gold-making studios. Their mechanical gold-making and selling make the price of Draco constantly depreciate, and it also affects the game experience of real players.

Subsequently, the price of Draco fell below $1, and the income from gold mining dropped sharply. At the same time, the official's continued pressure on script gold made the studio begin to switch to other high-yielding new projects. It can be seen from the figure that the number of Draco active addresses has fallen off a cliff since January 2022, fluctuating between 100,000 and 200,000 for a period of time, and then gradually returning to zero.

Generally speaking, from the perspective of game revenue, Mir4 is the first chain game in Korea. Although the game quality is far superior to that of Gamefi in the same period, the actual revenue performance is hard to say. The token economy in the chain game also makes the game life cycle greatly shorten. On the other hand, due to early dividends and a large amount of cash cashed out from Wemix, Wemade's operating conditions have improved significantly.

It can also be seen from this that the market does not buy into the traditional game chain reform at this stage, the rough implantation of P2E elements and the NFT of props.

secondary title

Wemade's ambition - Wemix3.0

Wemade's ambition - Wemix3.0

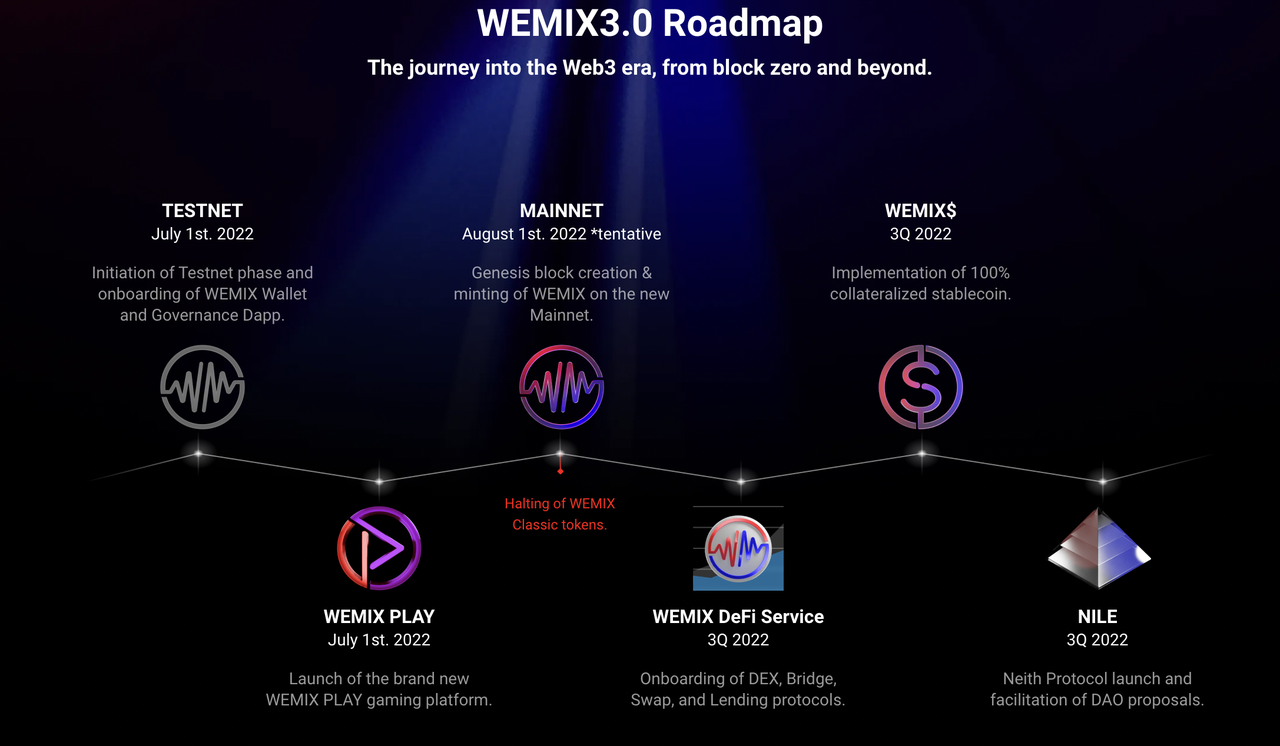

In 2022, Wemade will continue to invest in the metaverse track with a large amount of cash in hand, and launch the Wemix3.0 plan.

Wemix3.0 covers the mainstream tracks of metaverse such as chain game platform, Wemix main network, Defi service, Wemix Wallet, NFT trading market, stable currency and NILE Dao.

It can be seen from Wemade’s 1Q22 financial report that the Wemix platform-related revenue (excluding games) was only 1 billion won in the first quarter, accounting for less than 10% of the total revenue; while related costs and expenses have risen to 124.5 billion won in the first quarter, a year-on-year increase The soaring expenses made Wemade's net income in the first quarter only 33.9 billion won, a 99.9% drop from the previous quarter.

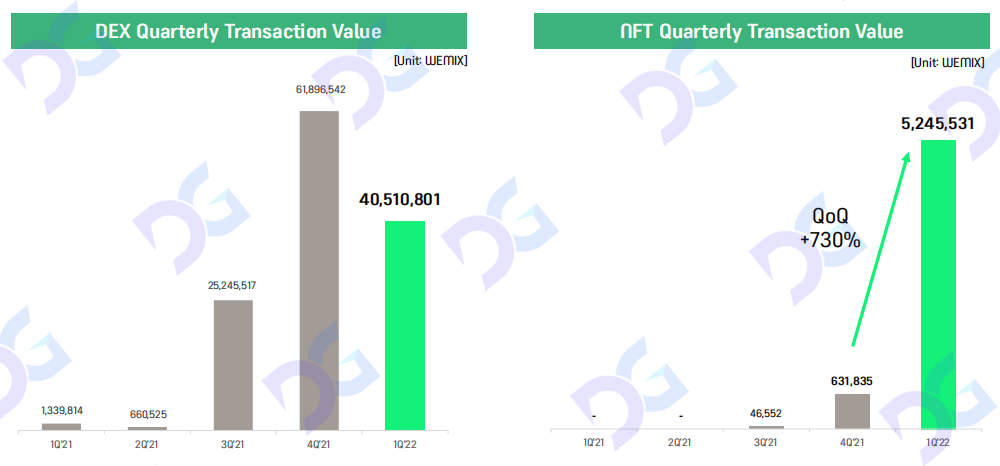

image description

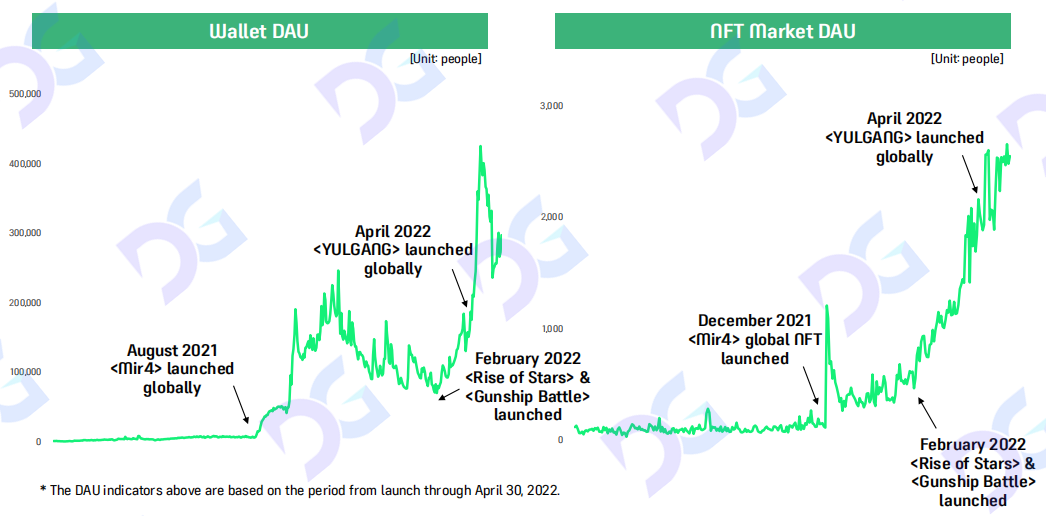

Wemix wallet and NFT trading market are on the rise with new game releases

The trading volume of DEX declined in the first quarter, while the trading volume of the NFT trading market rose sharply in the first quarter

Generally speaking, Wemade has made every effort to enter the chain game and related blockchain business, and it remains to be seen how the follow-up development will be.

Wemade has been reloaded, and Korean counterparts are actively following up

image description

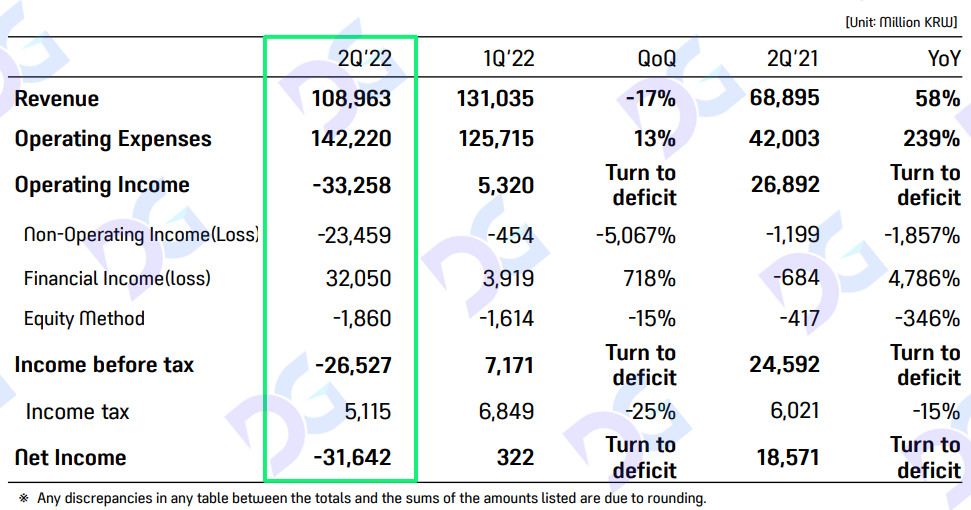

Wemade's second quarter financial report

text

As mentioned above, Wemade’s Korean counterparts are also optimistic about chain games: Netmarble announced the establishment of chain game platform MarbleX in 2022, and will launch 6 P2E games; Com2uS Holdings released 4 games through its blockchain game platform C2X Chain game, its blockbuster "Summoners" is the first Korean game with a cumulative revenue exceeding 1 trillion won. Its chain-modified version Summoners War is worth looking forward to.

As Unity said in the latest 2022 game industry report, our game industry often catches up with the next outlet. Now, this outlet is the Metaverse.

secondary title

Full text summary

Through the analysis of the status quo of Korean chain reform and the game industry, we can extract the following points:

• After a long period of high-speed growth, the global game industry has shown a downward trend in growth rate, among which Korean game companies have even experienced negative growth.

• The "success" of Mir4's chain reform made Korean game companies see life-saving straws and entered the game one after another.

• Although Mir4 has led to explosive growth in Wemade's finances, the follow-up development and cycle continuation still need to be observed.