What is the performance of blue-chip NFT under the crypto bear market?

The bear market is coming

Recently, the Federal Reserve has raised interest rates one after another, LUNA and Celsius have had flash crashes one after another, and events such as the correlation between supervision and the stock market and securities market have led to large fluctuations in various assets in the market.

The blue-chip NFT, which is generally recognized by the market as the most valuable and promising, has fallen rapidly in the past week. Since the NFT market is mainly denominated by ETH, and its price has continued to drop close to 1,000 USDT in the past week, the valuation of NFT has also fallen at an unprecedented rate. In the bear market series, we will analyze the market from various aspects such as the performance of blue-chip NFTs, who is buying the bottom, the correlation of the encryption market, and the tracking of giant whales. In Series #1, we will focus on:

Which blue-chip NFTs are more resilient?

How much did investors lose after buying million-dollar NFTs at the peak of the cycle?

Correlation between blue chip NFT and ETH and BTC market trend

We let the data speak and explore the hidden trends of the NFT market through a multi-dimensional perspective.

coping with the slump

In the past year, although the NFT market has experienced an unprecedented bull market cycle. However, the development of NFT is still in its early stages, and there is still the potential to return to historical highs again, or even exceed historical highs.

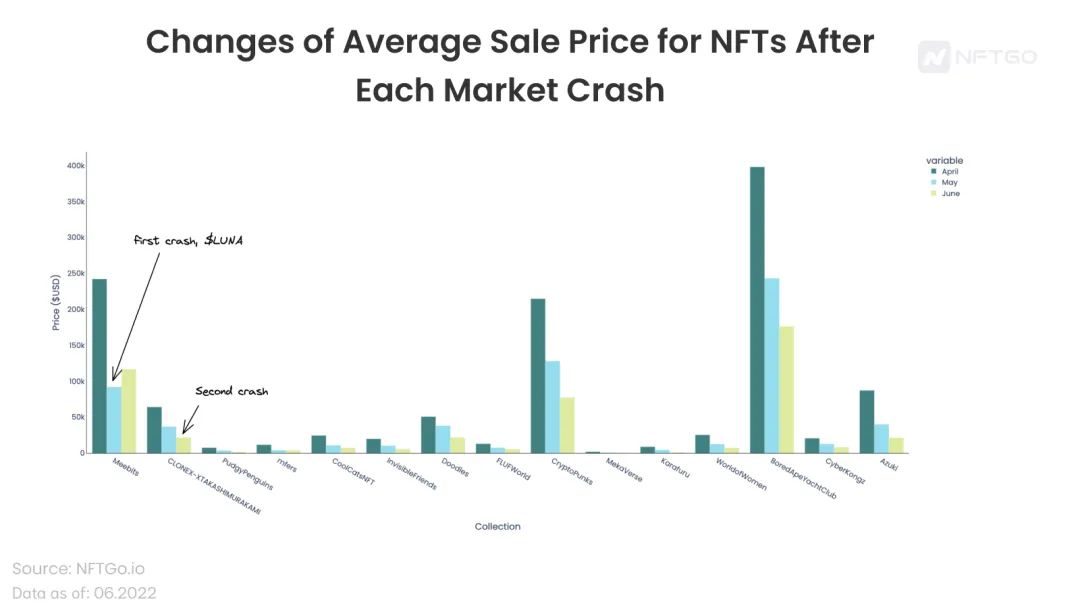

In order to assess the performance of NFTs in the current bear market cycle, we list three data periods that can reflect market sentiment.

1- April 2022: The bear market cycle of cryptocurrencies continues, prices continue to fall, and some analysts still call it a Crab Market (volatile, but no significant rise or fall). The Russian-Ukraine war and the Federal Reserve are the main factors affecting the price of cryptocurrencies.

2- May 2022: The bear market cycle of cryptocurrencies is accelerated due to the flash crash of LUNA coin price.

3- Current stage: experiencing the biggest bear market in the first half of 2022, the price dropped sharply, and some holders began to liquidate their assets.

The cooling market sentiment has greatly affected the average price of NFT. In the most frenetic stage before, the valuation of some blue-chip NFTs reached the highest point. Since then, these valuations have continued to plummet, falling into a cooling cycle.

image description

(Source: NFTGo.io)

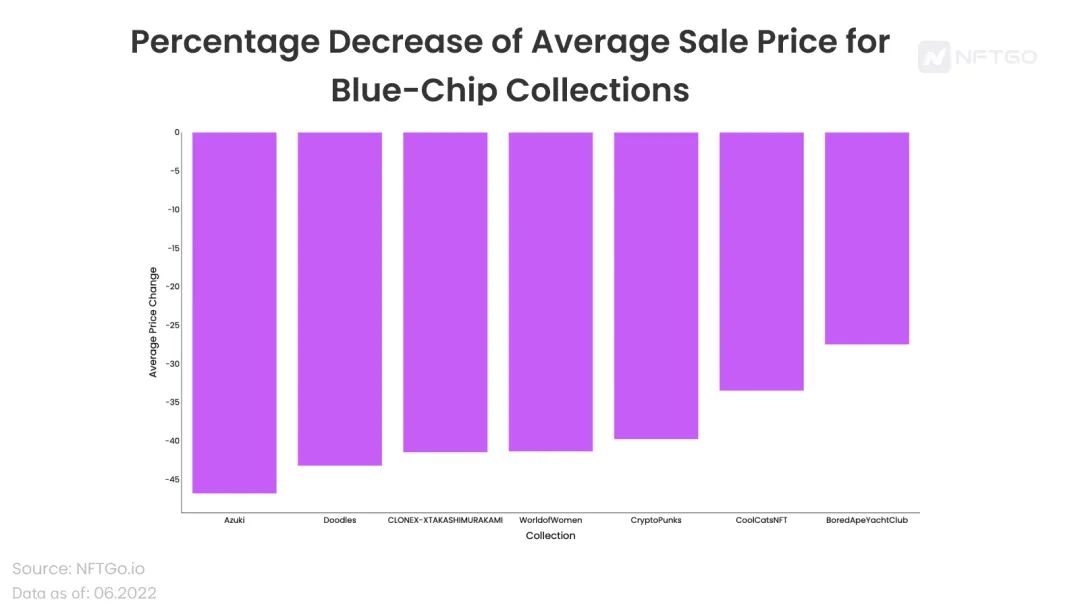

image description

(Source: NFTGo.io)

High-priced NFTs traded at a loss

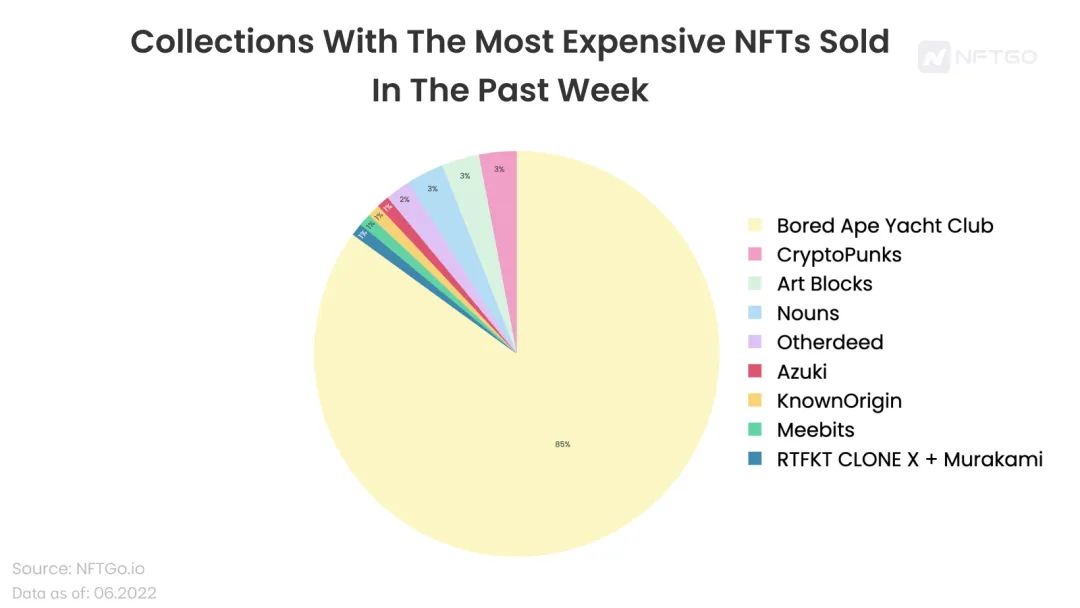

image description

(Source: NFTGo.io)

It can be seen that BAYC has the largest proportion in the NFT trading list. In the past week, more than 85% of the high-priced transactions came from BAYC. After BAYC is CryptoPunks, accounting for about 3% of the total. BAYC dominance is both bearish and bullish in itself.

We found investors trying to buy BAYC in a bear market. When the buying volume of other projects is relatively quiet, BAYC still occupies a dominant position in the real-time ranking list of NFT high-priced transactions.

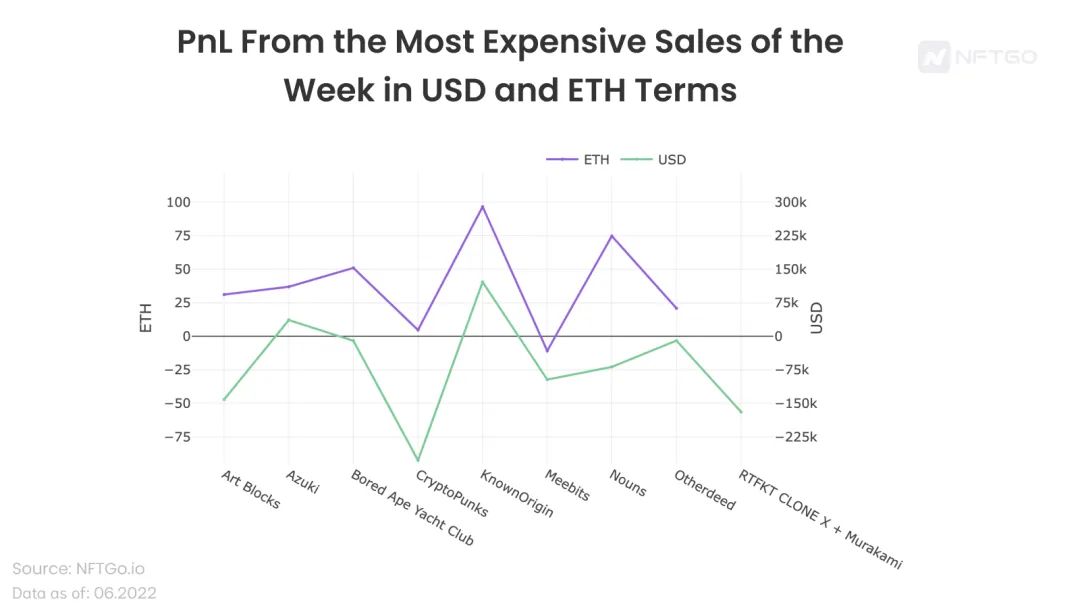

But the question that follows is what is the price for these holders to sell high-priced blue-chip NFTs. We first looked at the average profit and loss of the top 200 most traded trades over the past week. To further illustrate the impact of the drop in ETH prices on market valuations, we have plotted a profit and loss table (PnL) in ETH and USD, calculated by subtracting the bid price from the ask price.

image description

(Source: NFTGo.io)

Blue Chip NFT VS ETH

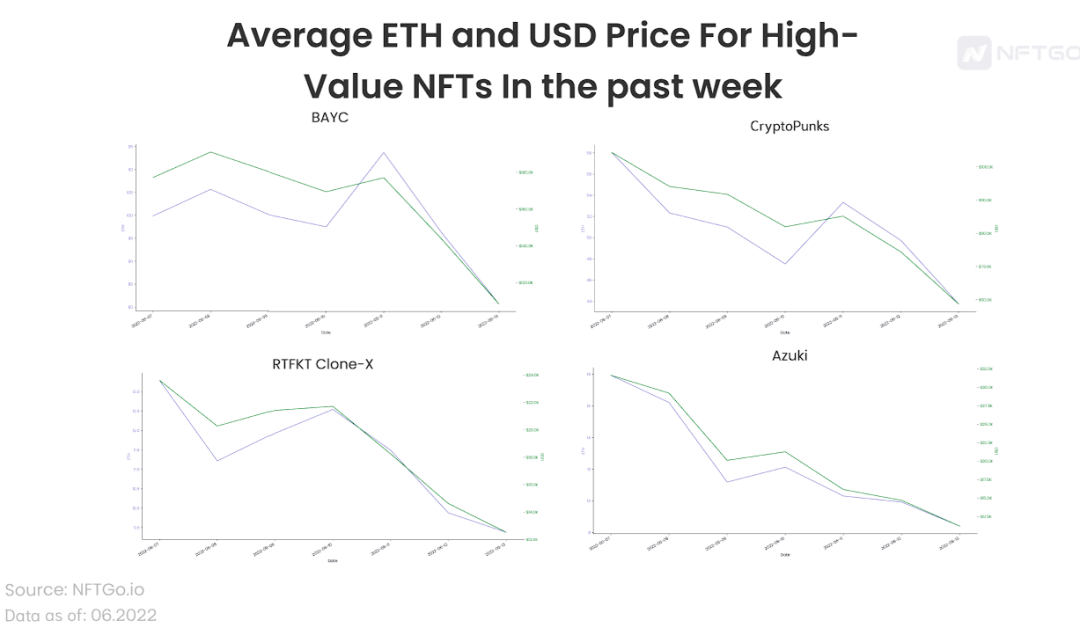

The dollar price of many blue-chip NFTs has fallen in tandem with the price of ETH. As the table below shows, the average ask price for both ETH and USD-denominated NFTs has seen a significant drop.

ETH average price and USD average price of high-value NFT in the past week (source: NFTGo.io)

image description

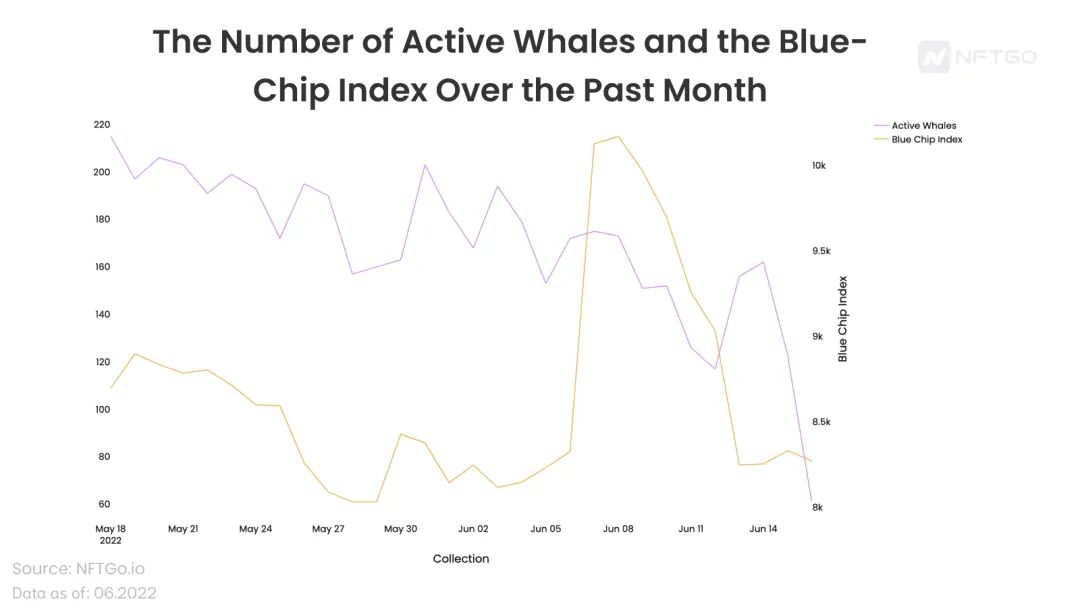

The number of active giant whales and the blue-chip NFT index in the past month (source: NFTGo.io)

image description

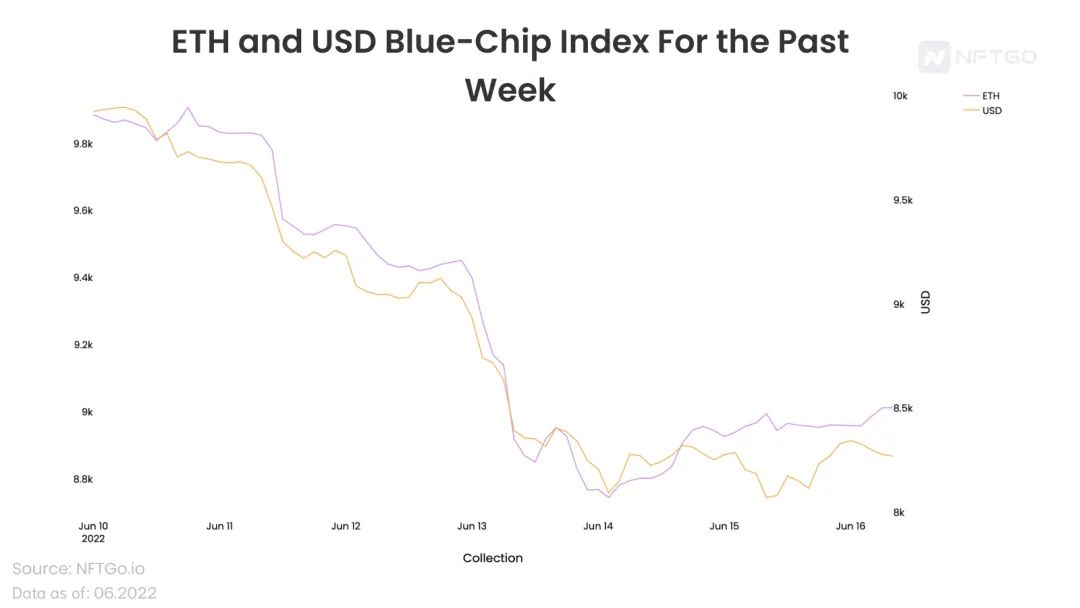

ETH-denominated and USD-denominated blue-chip NFT indices over the past week (source: NFTGo.io)

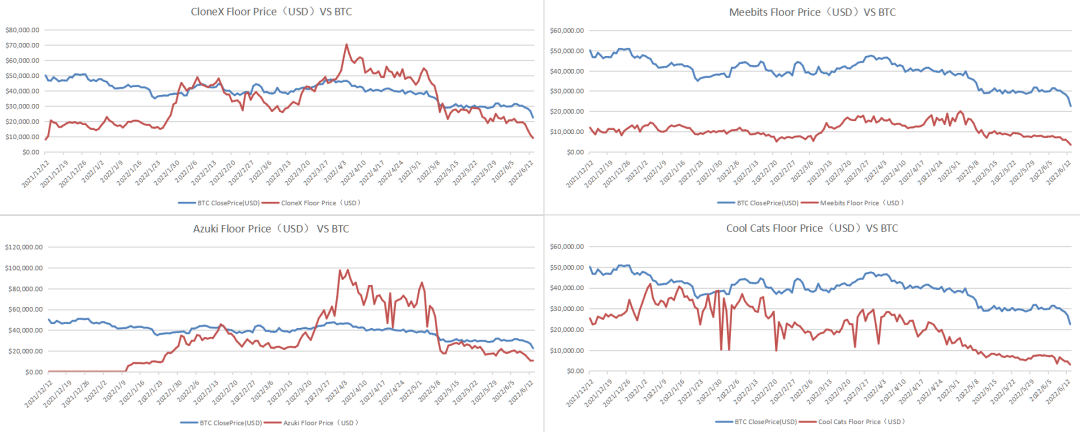

Blue Chip NFT VS BTC

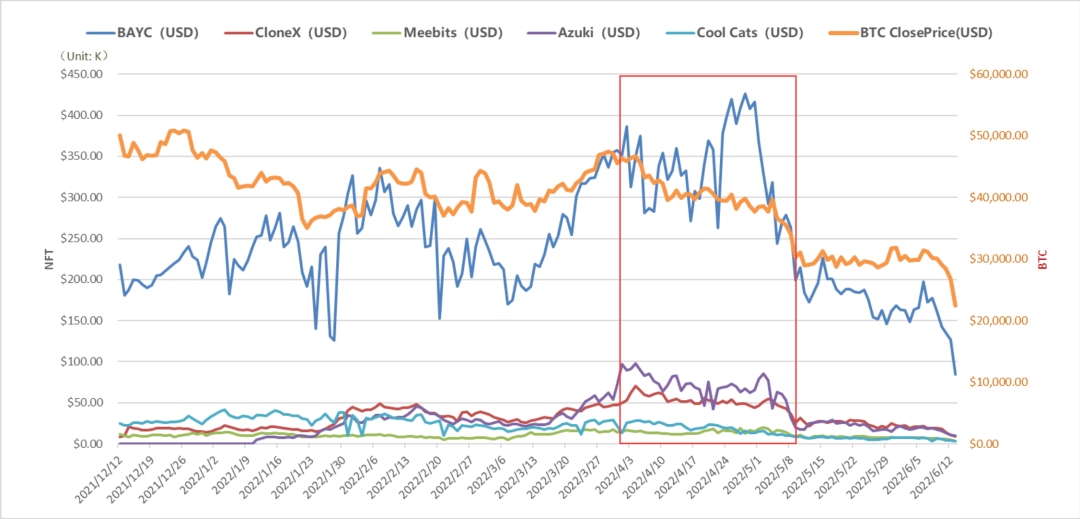

image description

BAYC VS BTC (USD standard) (Source: NFTGo.io)

From March 27 to May 1, during the gradual decline of BTC, the trend of blue-chip NFT is mainly divided into two categories. NFTs represented by BAYC and Azuki did not follow their trend, but started an independent market. Some NFTs even continued to rise, such as: BAYC increased by 9%, Meebits increased by 29%, Azuki increased by 54% (in USD), and the rest For example, Cool Cats and CloneX are following the trend of BTC and falling.

After May 1, most blue-chip NFTs began to fall more than BTC, and the above-mentioned independent NFTs began to make up for the decline. From May 1st to May 10th, BTC fell by -19%, while BAYC fell by -42%, CloneX fell by -32%, Meebits fell by -43%, Azuki fell by -78%, and Cool Cats fell was -39%.

image description

Some blue chip NFTs VS BTC (USD standard) (Source: NFTGo.io)

From this point of view, the U.S. dollar-based blue-chip NFT has two interesting characteristics in this round of bear market. First, some blue-chips will step out of the independent market to fight against the market trend, but will accelerate their decline afterwards. Second, some recent blue-chip NFTs have begun to follow BTC. trend, and magnified the decline.

The Future of Blue Chip NFTs

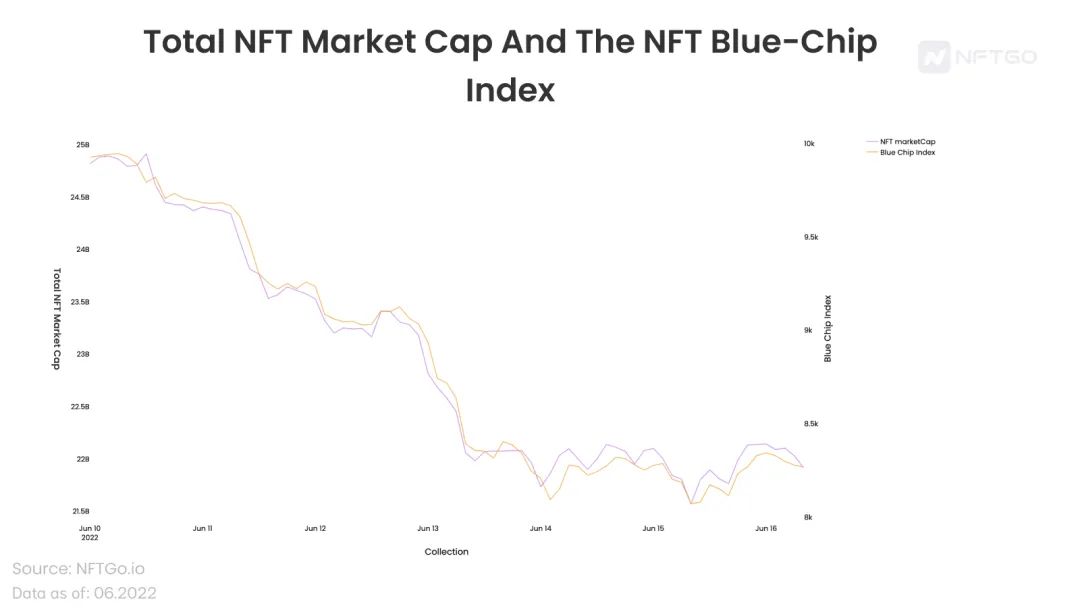

Blue chip NFTs are some of the most valuable collectibles in the NFT ecosystem. If you are not going to invest in blue-chip NFTs, it is also necessary to pay attention to the dynamics of these projects. Our data shows that the blue-chip NFT index is closely related to the total market value of NFT.

image description

(Source: NFTGo.io)

This article explains how blue-chip NFTs have been affected by the bear market in the cryptocurrency market. The NFT market is one of the most promising new industries, and the blue-chip NFT has a lot of room for growth in the future. In addition to the hype cycle and bubbles that are currently going through, NFT still has a long way to go before it can fully demonstrate its value in the market.

We have been studying the latest developments in the NFT market and paying attention to the latest trends. This is the first article in our series of bear market analysis reports, please continue to pay attention. At the same time, you can monitor the latest data of the NFT market in real time on the NFTGo website.