An article to understand the token economy of MobiFi, an on-chain travel-as-a-service platform

This article comes fromMediumThis article comes from

, the original author: Team MobiFi, compiled by Odaily translator Katie Gu, in case of any objection, the original English text shall prevail.

secondary title

Dual Token System

Dual Token SystemHaving a dual token strategy is not new. MakerDAO is probably the most famous example of this concept.

In the case of MobiFi, we will be using a dual-token model to ensure that the solution is compliant with large, regulated companies, i.e. mobility service providers. We will create two utility tokens, one public and one private. The MoFi token is public and will run on Ethereum, and the SMile token is private and will run on the Corda enterprise network. As the rules of cryptocurrencies are further clarified, their usage and structure will iterate accordingly.

secondary title

SMile Token

Developed by R3, Corda is the most popular commercial blockchain or distributed ledger technology (DLT) solution. Corda has one of the most active ecosystems involving banks, insurance companies, exchanges, and many other large corporations. The main reasons for its adoption include its transparency, efficiency, and strict, controlled data exchange characteristics.

These capabilities enable businesses to transact directly and privately using smart contracts, reducing transaction and record-keeping costs, and streamlining business operations. MobiFi decided to use Corda for similar reasons. We hope that the in-flight business, that is, the travel service provider, will use Corda to improve its reputation in the industry.

Each SMiles token will be backed by real fiat currency and its value will remain stable. For example, one SMile token might be equal to $10. The cost of using mobility services varies in different parts of the world. In Amsterdam, you can use 100 SMile tokens to ride the bus, but in Zurich, that might not be enough. In terms of the SMile token support system, if it is a reward, it will reserve cash from the service provider, and if it is transportation credit, then it will receive it from the user

secondary title

SMile Token Brief Summary

Corda-based private SMile token for high-frequency trading;

It will serve as a stable payment medium to simplify mobility services and as a reward unit;

SMile tokens will be backed by real legal tender.

secondary title

MoFi TokenIn addition to simplifying mobility, MobiFi intends to solve the problem of unused cash in the millions of transit cards.

We believe that consumers are entitled to whatever benefits their money gets. MobiFi Wallet is the solution to convert these unused mobile credits into tokens, thus connecting them with various DeFi services. Thanks to the flexibility of the cryptocurrency market, users can convert mobile credits into MoFi tokens for transactions 24 hours a day, 7 days a week, 365 days a year. The interest income is immediate.

secondary title

A Brief Summary of MoFi Tokens

MoFi tokens will be tradeable with SMile tokens, i.e. mobile services;

MoFi will allow unused mobile credits to be used in various DeFi services.

secondary title

MoFi indicators

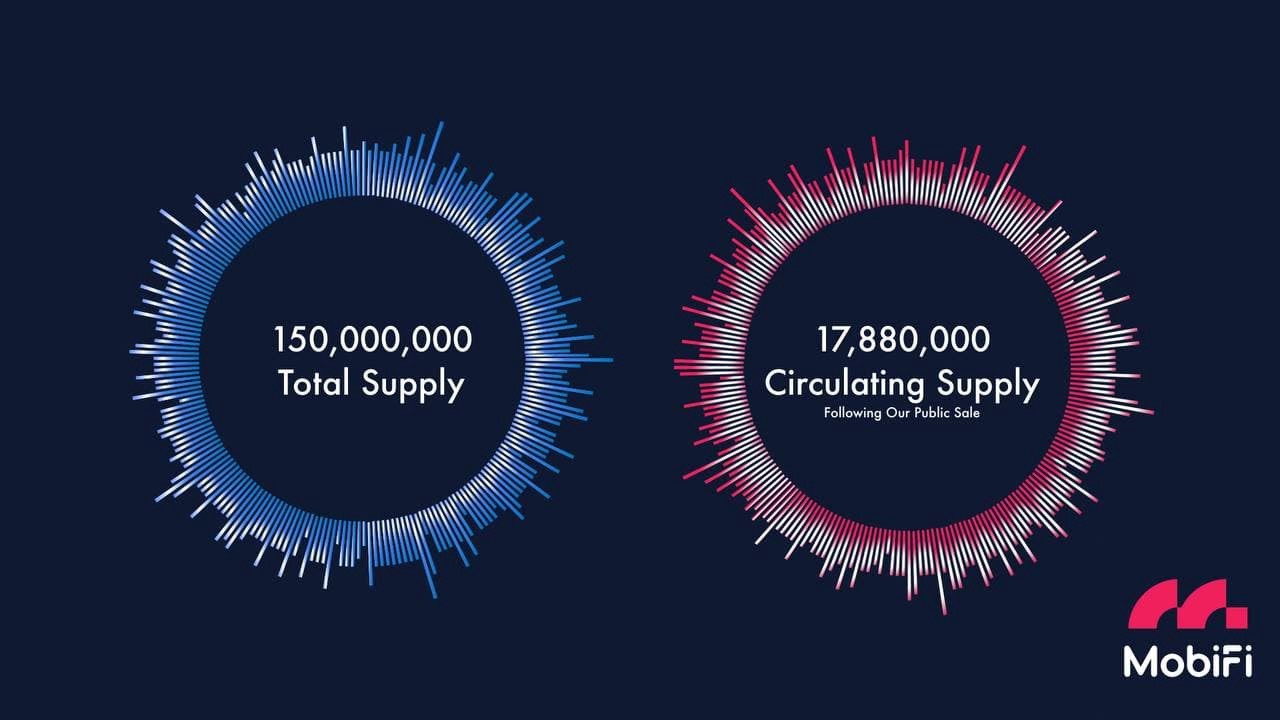

Below is a basic synopsis of the MoFi token metrics, which illustrate the initial market capitalization and total supply of the token. We also include development statistics to clarify the distribution and issuance of initial tokens and form a distribution model to stimulate rapid and sustainable growth of the MobiFi community.

Total Supply: 150.000.000

Currency: $MOFI

secondary title

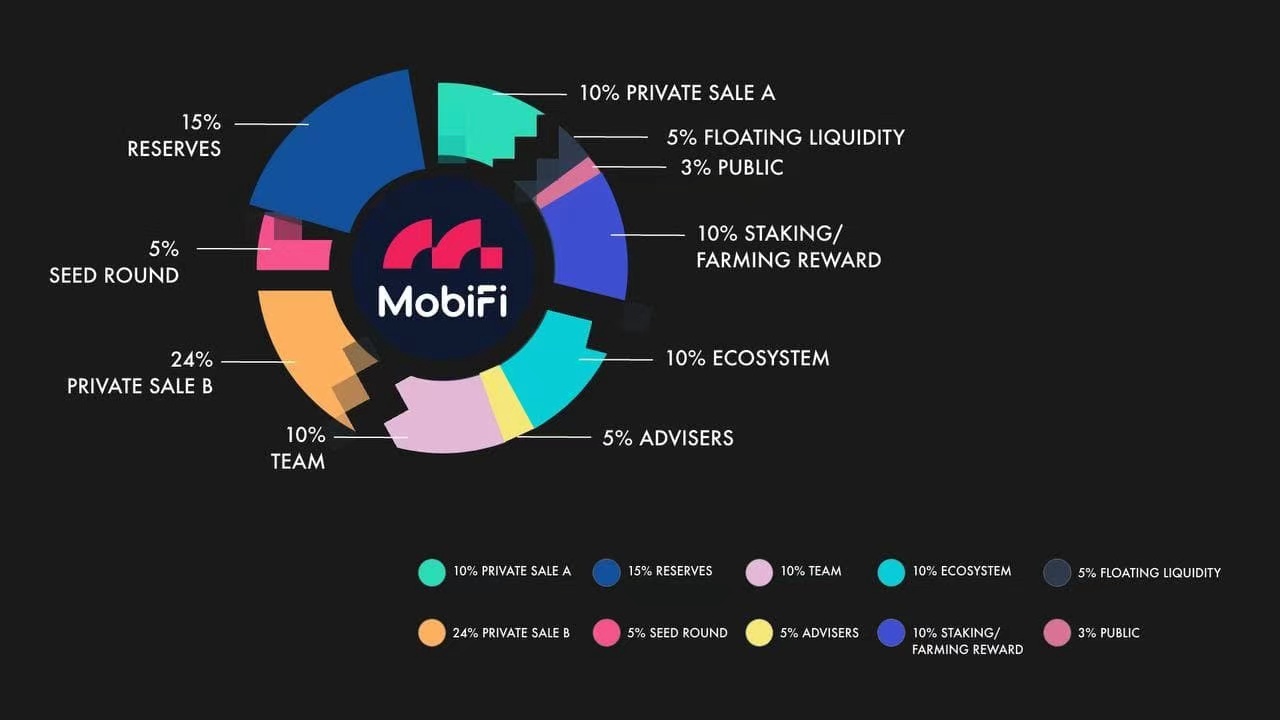

Token distribution:

Seed round: 8%

Private Sale A: 10%

Private Sale B: 24%

Public: 3%

Reserve: 15%

Staking/farming reward: 10%

Floating liquidity: 5%

Ecosystem: 10%

Team: 10%

secondary title

Next plan:

Listing date on Uniswap: April 6, 2021

secondary title

*sales details

Dates: From April 2, 2021

Final price: $0.0565 per token

secondary title

Sell cash:

Seed stage: 1 month cliff / 12 months vested interest

Private sale A: 10% TGE / 10% vested interest every month

Private Sale B: 33% TGE / 33% vested interest every month

Public Sale: Fully Unlocked

Advisor: 6 months cliff / 12 months vested interest

Team: 12-month cliff / 12-month vested interest

Ecosystem: 3-month cliff period / 18-month vested interest

Reserves: 3-month cliff period / 24-month vested interest

secondary title

token mechanism

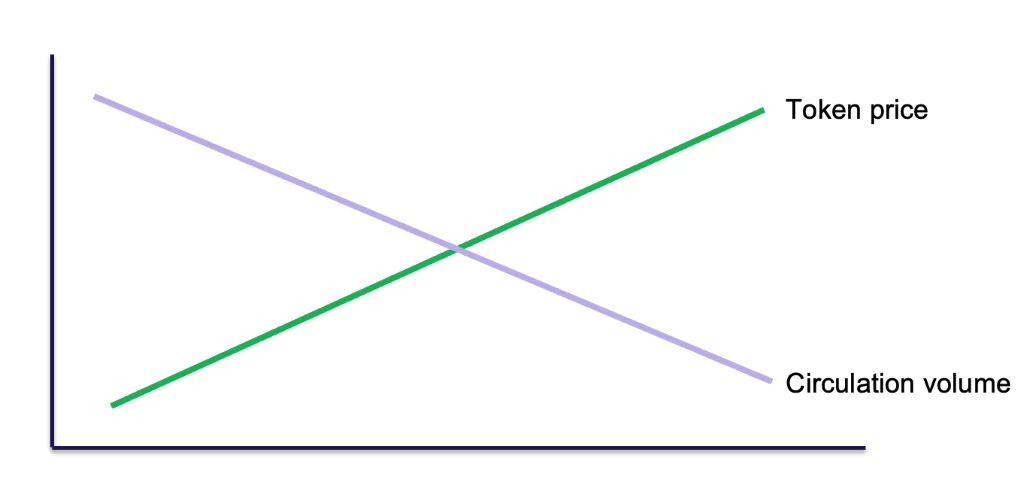

MoFi Token uses Ethereum's ERC20 standard and it is the main utility token used to exchange SMile miles, i.e. mobile services. When users exchange MoFi tokens for SMiles, MoFi will be burned. In this way, the MoFi token is deflationary, reducing the total transaction volume over time. This limited supply and ever-decreasing quantity mechanism is designed to increase the value of MoFi tokens. (See Figure 1 below)

image description

The relationship between MobiFi token price and circulation based on burning mechanism

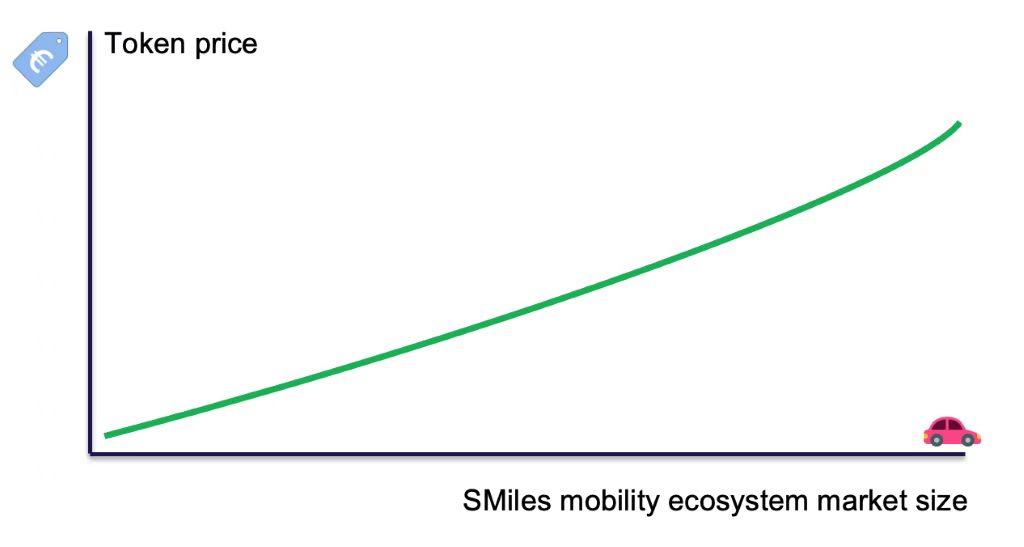

In addition, users can only redeem SMile tokens through MoFi in the early stage (such as 1-5 years). If the SMiles mobile network grows rapidly, there will not be enough MobiFi tokens in the market to exchange.

image description

As the mobile ecosystem grows, the price of MobiFi Tokens also rises.

This design aims to solve two problems:

secondary title

Summarize

Summarize

MobiFi's dual-token system is designed with many contingencies in mind, and it ensures the effective circulation of tokens for all stakeholders in the ecosystem. This extends from our platform to our transit partners, liquidity providers and everyday users.

If one day, the product is implemented on a large scale and our vision of sustainable mobility is realized, the value of MoFi will double. We also plan to realize the function of cashing SMile tokens in other cryptocurrencies directly or through CBDC, or even fiat currency.

secondary title

About MobiFi