"2021 Investment Trends: NFT and Games" Online Summit

Editor's note: This article comes from,Boundless community, reprinted by Odaily with authorization.

, reprinted by Odaily with authorization.

In just three months, the turnover of NBA Top Shot star cards based on NFT public chain Flow surpassed that of CryptoKitties created by the same team Dapper Labs in the last bull market. , the price of the currency soared a hundred times, which attracted the attention of the industry and the outside world-why did Dapper Labs and the Flow public chain it built exploded one after another? Will NFT and games become the engine of the 2021 bull market? Can Flow become a dark horse in the public chain, and what kind of strength can the accumulated ecological layout inject into the industry? What kind of hot spots and opportunities will usher in the bull market that is ready to go in 2021?

From 2:00 pm to 9:30 pm on January 28, Republic.co, a compliant investment platform from Silicon Valley, together with Flow and the OG community, jointly held the "2021 Investment Trends: NFT and Games" online summit, Flow CEO, Republic CEO Together with top fund investors such as Fenbushi Capital, Hashkey Capital, SNZ, NGC Ventures, Digital Renaissance Foundation, etc., we will share the insights of NFT and games in 2021 with 17 blockchain enthusiasts and investors through live video broadcasting at station B. Entrepreneurship secrets, investment insight.

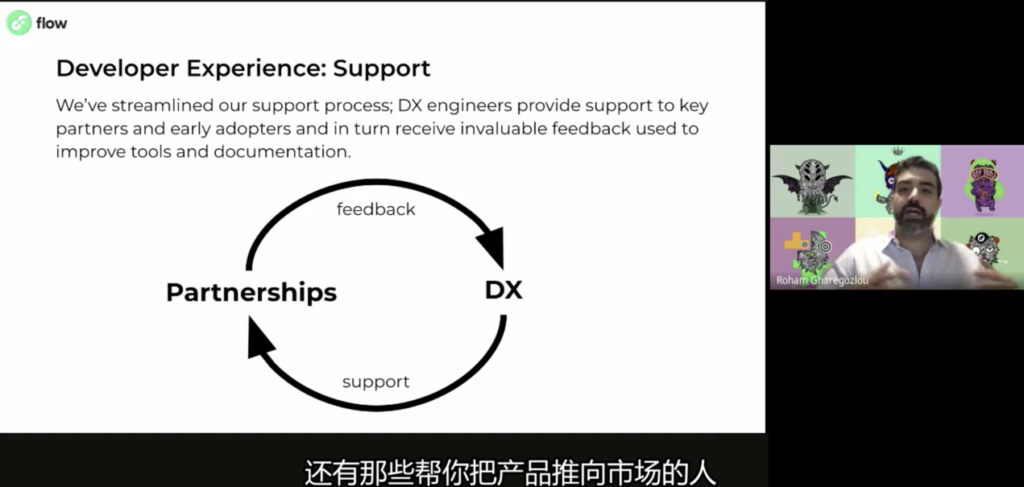

Flow CEO Roham Gharegozlou introduced in his speech entitled "What Causes the World's Top 500 and the World's Largest Brands to Go to a Decentralized Future". The brand-new public chain developed by Mao’s experience and lessons can support large-scale and high-frequency consumer applications without complex expansion solutions such as sharding, layer two or side chains while ensuring decentralization. Many traditional enterprises and encryption teams, including Fortune 500, welcome it.

Roham believes that, just like the PC Internet era, entertainment and games also lead the large-scale popularization and application of blockchain technology, which is the original intention of Dapper Labs to develop the phenomenal application CryptoKitties on Ethereum. At the end of 2017, CryptoKitties became the number one DApp on Ethereum, with a total sales of 40 million US dollars. Flow-based NBA Top Shot absorbed the best factors of CryptoKitties and got rid of its limitations on the Ethereum platform. In just 3 months, with ⅙ the number of CryptoKitties users, the sales performance surpassed that of CryptoKitties, and the transaction between users also exceeded 21 million US dollars, and the user retention rate was as high as 75%. In addition to NBA Top Shot, Flow hopes to support more applications to succeed, so it is promoting a healthy and prosperous ecosystem jointly built by developers, creators, FLOW token holders and network operators, not only allowing token holders to participate in staking Mining, node slot auction, FLOW stable currency and other projects, and make the developer experience more and more comfortable.

Li Xuan, CEO of Blocto, said that Flow is a new public chain developed by Dapper Labs on the Ethereum platform to develop blockchain games such as CryptoKitties and NFT and encountered various performance experience bottlenecks. Blockchain game and NFT developers and user experience have made a very good trade-off and balance, reaching a new height. As the first decentralized exchange on Flow, BloctoSwap will provide blockchain games and NFT users with new and better benefits and experiences.

KAI, director of investment management at SNZ, believes that the increasingly popular NFTs are divided into three categories: IP, assets and data. Flow is not only an NFT public chain, but a vertical public chain for the large entertainment field. Flow not only leads in resources, but also has technological innovations such as node and consensus design, programmable language and asset security.

Taking Disney as an example, Lu Le, Investment Director of Fenbushi Capital, analyzed the four success factors that Flow is expected to create in the digital world of Disney: strong IP, connection between content and users, continuous pursuit of technology, and continuous open cooperation. Moreover, she believes that blockchain technology plays a huge role in promoting the digitization and communityization of entertainment content: the open source nature of blockchain, the programmability of smart contracts and the tradability of NFT help entertainment IP creators, consumers and platforms form new The cooperative relationship between production and consumption can release greater creativity and value. Evolving in this direction, Flow has unlimited possibilities.

In the roundtable discussion of "NFT Out of Circles – NBA Top Shot", Math Wallet product manager Lu Yuanyuan believes that NBA Top Shot, a super IP NFT product, not only meets the consumption, collection and investment needs of 90% of young male users in the encryption world, but also To attract NBA fans from all over the world, it is inevitable to become popular. Cao Yin, director of the Renaissance Fund, pointed out that due to the continuous spread of the new crown epidemic, the global IP consumption and social digitalization, virtualization, and decentralization trends have been promoted. On the basis of the previous encryption cat game attracting a large number of developers to create a good ecology, Flow and The cooperation of well-known brand IP will definitely be able to launch more out-of-the-box blockchain games and NFT. Flow’s Chinese ambassador Xinxing and Caos said that Flow’s technical design overcomes the limitations of the Ethereum platform on NFT, and with the support of various DApps and intermediate services like Blocto, it can promote blockchain technology in the field of games and entertainment. popularization and application.

Republic.co is a compliant investment platform from Silicon Valley in the United States. It has invested in start-ups including Dapper Labs, SpaceX, Robinhood, etc., and maintains deep strategic cooperation with top start-ups and leading investment institutions in the United States. Republic CEO Kendrick Nguyen shared in his keynote speech "Republic Allows More People to Share the Charm of Investment" how his previous work and investment experience in law firms, AngelLIst, and CoinList helped him establish Republic, an early-stage equity investment platform for individuals in 2016 , so that more individuals and professional angels and VCs have equal opportunities to invest in start-ups. So far, Republic has 1 million members from more than 100 countries and communities, and hopes to grow into an investment community with 100 million members in the next 10 years, and issued a token called NOTE for this purpose. This is an equity token based on the Algorand public chain, which is closely related to the financial success of startups raising funds on the Republic platform. At present, 300 companies have raised funds in Republic. If 1/10 of them grow into the next generation of Amazon and Amazon, the benefits shared by NOTE tokens will be greater, and token holders will also indirectly participate in sharing the new generation of innovation and entrepreneurship success.

Cao Zhen, Asia-Pacific partner of Republic, believes that the essence of investment is to predict the future, and it is also the natural right of the public. The most powerful ability of human beings is to establish a common imaginary reality. Startups are the driving force behind a new story, the determination to change and the expression of high-level will. The public can transform their belief in the future into ownership of the company's equity/currency rights. So have the right to invest. At present, there is an unprecedented opportunity in the United States - non-accredited investors can participate in the equity investment of early projects together with financial institutions. Republic allows product users to participate in investment, conduct word-of-mouth marketing through consumption and investment, and become the most solid brand ambassador for startups. Facilitate a positive cycle of investment and marketing. Republic's investment in Dapper Labs is optimistic about the many advantages of the combination of games and blockchains: NFT can help creators to protect and charge copyrights, reduce the distribution costs of game developers, users have real ownership of in-game item assets, and realize game assets. Large-scale transactions with legal currency assets.

KAI said that SNZ’s investment in Republic is to see how more and more young users have joined the cryptocurrency world under the influence of social media and the Internet. This incident shows how new users can discover new investment targets and generate new investment thinking and paradigms under the influence of organizations in the virtual world of social networks. It is worth looking forward to what kind of new possibilities the combination of Flow and Republic.co, two brand-new investment targets and platforms, will produce.