In-depth interpretation of the four major algorithmic stable currency projects, is it a new protagonist in the market or a new tool for speculation?

As a currency exchange medium between fiat currency and encrypted assets, stable currency is an extremely important part of the encrypted market. Because it is linked to the legal tender of the U.S. dollar, it has the characteristics of no borders, relatively stable value, fast transfer, transparent transactions, etc., and has won the favor of crypto investors. According to Coingecko data, as of January 27, 2021, the total market value of stablecoins reached 36.25 billion US dollars.

The current stablecoins in the encrypted market are mainly divided into three categories. One is the centralized stablecoin backed (mortgaged) by legal tender: such as USDT, USDC, GUSD, PAX, etc., which are currently the most widely circulated in the trading market; One is a decentralized stable currency backed by cryptocurrency (over-collateralized), such as DAI, sUSD, etc.; the third is a new product based on DeFi — a decentralized algorithm stable currency, such as AMPL, BAC, ESD, etc.

Algorithmic stable currency is an innovation in the form of non-collateralized stable currency, and it is also a product of people's exploration and pursuit of decentralized stable currency. It has neither the centralized and regulated problems of fiat currency-collateralized stablecoins, nor the low utilization rate of over-collateralized stablecoins. However, the current algorithmic stablecoins still have the paradox of "value stability". There is a mutual game between "rationality" and the "sensibility" of funds.

So, can the algorithmic stable currency be expected to become the protagonist of the stable currency market in the future, or is it a short-lived innovative attempt? The OKEx Intelligence Bureau sorted out the four major algorithmic stablecoin projects, and explored and interpreted the operating logic of algorithmic stablecoins.

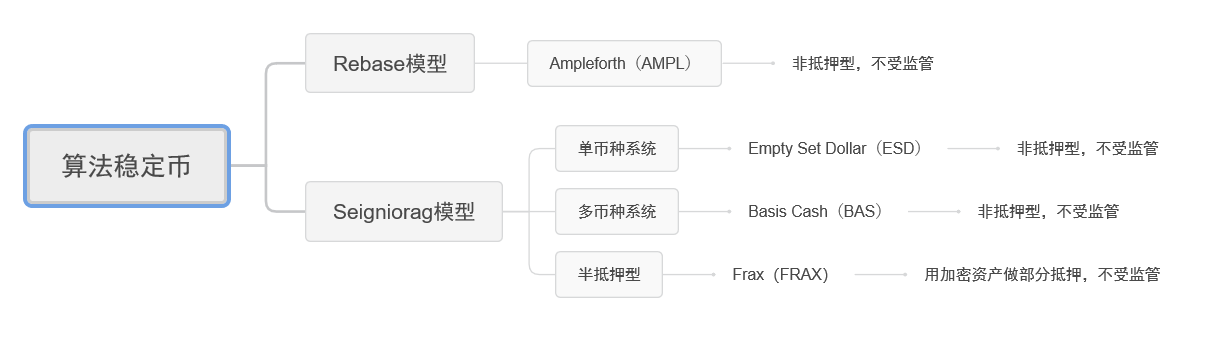

Algorithmic stablecoins are essentially tokens that use algorithms to adjust the supply, aiming to control and stabilize the price of tokens within a reasonable range through different methods and models. As early as 2018, algorithmic stablecoins appeared in the encryption market, but they were not recognized by the public. Until the summer of 2020, with the popularity of DeFi, algorithmic stablecoins such as AMPL made this new category very popular.

secondary title

Current Market Stablecoin Types

1、Ampleforth(AMPL)

image description

Source: ampleforth.org

However, since there is no upper limit on the total amount of tokens, this means that the price of AMPL has risen and has been higher than the target price, so the number of tokens will continue to increase. This feature makes the price of AMPL vulnerable to "artificial" control and presents an extremely unstable state.

This can be confirmed by the price fluctuations and supply changes of AMPL in the past year: In June 2020, affected by the influx of hot money, the price of AMPL continued to rise, reaching a maximum of nearly 4 US dollars. Afterwards, as speculative funds withdrew, AMPL was sold and the price fell below $1, and then the supply of AMPL began to fall rapidly.

Under this logic, the design of AMPL provides investors with opportunities for manipulation and arbitrage. Therefore, in actual operation, the early AMPL seems to be more speculative than "stable".

2、Empty Set Dollar(ESD)

image description

Bind ESD tokens in DAO

In the ESD system, 8 hours is a cycle (epoch), and every time a new cycle starts, the system will automatically detect the price of ESD (time-weighted average price, TWAP). When the ESD price (TWAP) is lower than $1, the system will enter the deflation phase. Users can obtain "coupons" issued by the system by burning ESD tokens, and the system will issue debt to cover the destroyed ESD part. When the money supply increases again, holders of coupons (valid for 90 cycles, or 30 days) can redeem them back to ESD again and get a premium of up to 56%. [The premium is based on the ratio of debt to supply in the protocol (R=debt/supply), calculated as follows: 1/(1-R)²-1. ] And when the ESD price exceeds $1, the system will automatically issue additional ESD until the ESD price returns to $1. The newly issued ESD will first repay the debt (generated when the ESD is destroyed), and the excess part will be shared equally by the users who mortgage the ESD as a reward.

During the period when ESD prices fluctuate greatly, ESD users will gradually become polarized: active holders who work hard to maintain the currency price will receive rich rewards for additional issuance, but at the same time, passive holders who only use ESD as a stable currency For some, its tokens will be diluted by inflation.

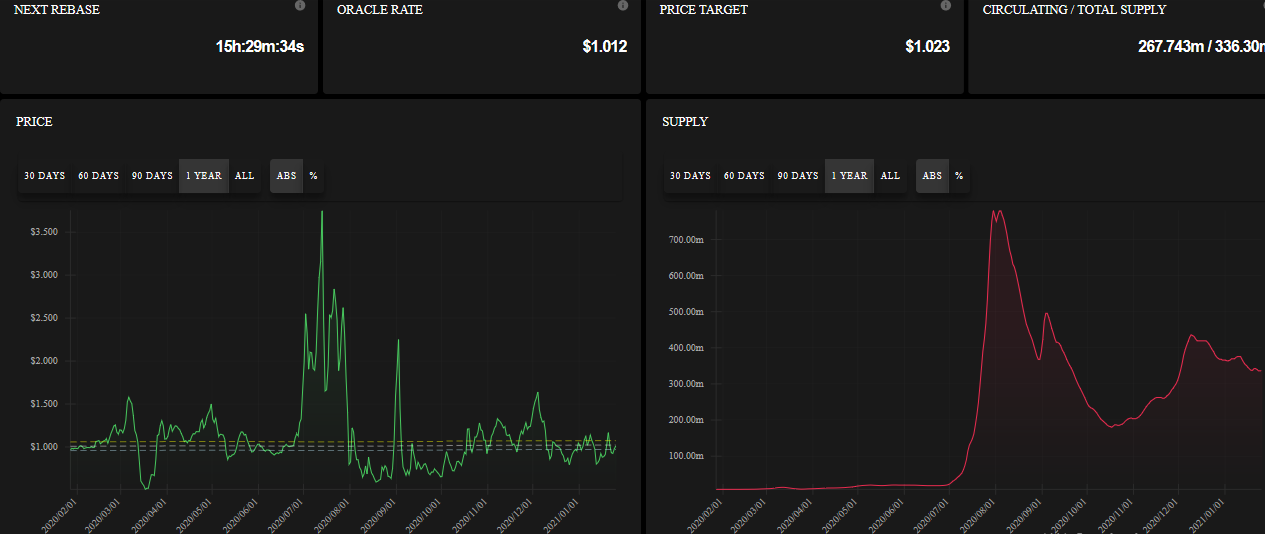

3、Basis Cash(BAC)

BAS is an algorithmic stablecoin based on Seigniorag's multi-currency model, which is similar to the single-token model but introduces additional share tokens.

There are three types of assets in the Basis Cash system: BAC (Basis Cash): a stablecoin that the protocol aims to keep value pegged to $1. BAB (Basis Bond): similar to ESD coupons, bonds are sold at a certain discount, and can be redeemed at a price of $1 when the BAC price normally returns to $1. BAS (Basis Share): Receive the remaining commitment rights after all bonds are redeemed.

Compared with the ESD of the single-currency system, the main difference of Basis Cash is that its cycle is 24 hours, the bond (BAB) has no expiration date, and if the user wants to get BAC inflation rewards from the board of directors (similar to DAO) , they must pledge the stake token BAS, not the stablecoin token BAC itself.

The specific price stabilization mechanism is as follows: when the BAC price is lower than $1, users can use BAC to purchase the bond BAB at a low price (BAB price = the square of the BAC price), thereby reducing the circulation of BAC and increasing the price of BAC; When the price of BAC is higher than $1, users can exchange BAC for BAC; if BAC needs to be issued after the end of the repurchase of BAB, the additional issuance will be distributed to BAS holders as dividends; through the above methods to increase the circulation of BAC, To reduce the BAC price.

However, judging from the current price of BAC ($0.44), the agreement has also failed to exert the "stable" attribute. Although known as an "algorithm-based central bank", Basis Cash uses the bond Basis Bond (BAB) to withdraw liquidity by imitating the central bank's issuance of bills, but it lacks tools to inject liquidity into the market, so market regulation will also fail. At present, the price of BAC has seen a negative premium of 60%, but the price still has no upward trend.

However, compared with previous generations of algorithmic stablecoins, the innovation of BAC is still worthy of recognition. The multi-currency Basis Cash is used to repurchase BAC when tokens are issued, and then distribute them to BAS holders, effectively restraining the impulse of unlimited issuance of tokens and the prevalence of speculative demand.

4、Frax(FRAX)

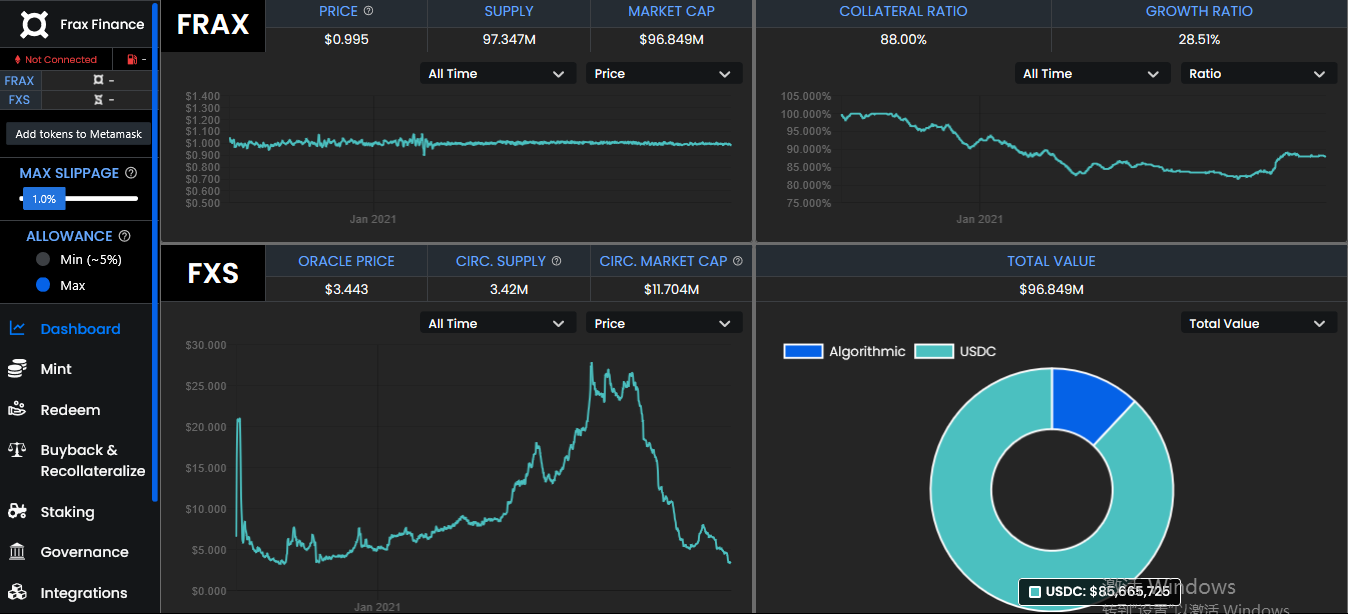

FRAX is a representative of the current semi-collateralized algorithmic stablecoin. There are two tokens in its system—the stablecoin FRAX and Frax’s governance token (Frax Shares) FXS. Unlike the previous several algorithmic stablecoins, FRAX is currently backed by two types of collateral, which are collateralized stablecoins (USDC) and FRAX shares (FXS). The minting and burning of FRAX are based on these two tokens. Users must invest $1 worth of tokens into the system to mint new FRAX. The only difference is that the ratio of collateral and FXS to the value of $1 is How many.

In the origination stage, the mortgage rate of FRAX is 100%, and minting a FRAX requires $1 of traditional stablecoins as collateral. When the protocol enters the fractional stage, minting FRAX requires placing an appropriate proportion of collateral and destroying a proportion of Frax Shares (FXS). For example, at a collateral ratio of 98%, each minted FRAX requires $0.98 in collateral and $0.02 in FXS. At a collateral ratio of 97%, every FRAX minted requires $0.97 of collateral and $0.03 of FXS burned, and so on.

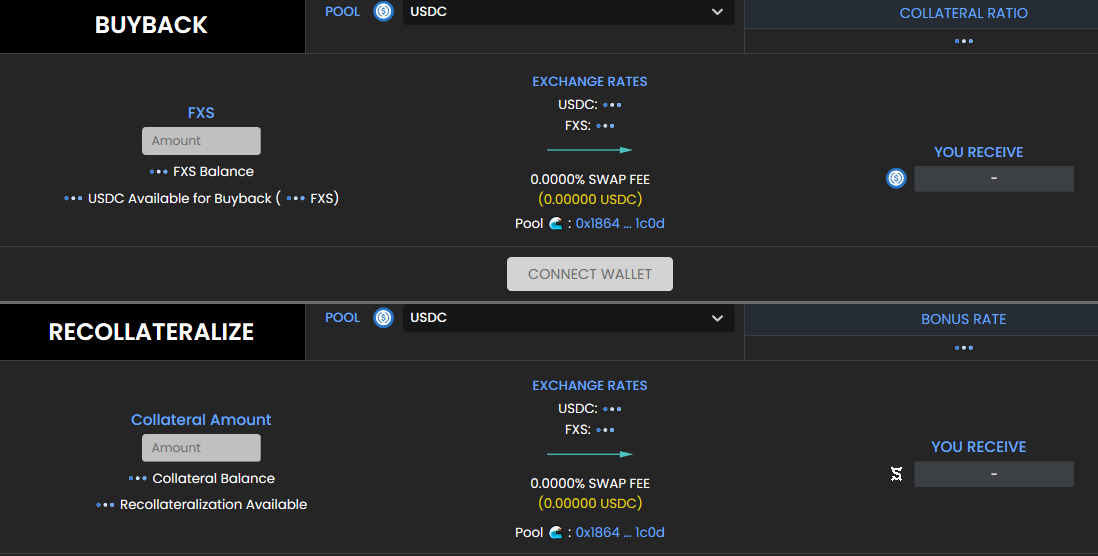

In order to ensure that the actual mortgage rate is equal to the algorithm-adjusted mortgage rate, FRAX has designed Buybacks and Recollateralization mechanisms. The re-mortgage mechanism, that is, when the system mortgage rate is raised, in order to attract users to increase the amount of USDC in the system, the system sets up incentive measures (the current bonus rate is 0.2%): at this time, anyone who adds USDC to the agreement can exchange for more A large number of FXS, for example, users add USDC worth 1 USD to the system in exchange for FSX worth USD 1.0075; the repurchase mechanism is that when the system mortgage rate is lowered, users can exchange USDC of the same value with FXS to the system.

image description

FRAX's buyback and remortgage page

When the price of FRAX is higher than $1, arbitrageurs can put USDC and FXS worth $1 into the system, mint FRAX, and sell FRAX tokens at a price of more than $1 in the open market. In the process, selling pressure on FRAX will pull down the price of FRAX.

When the price of FRAX is lower than $1, arbitrageurs can buy FRAX tokens at a low price in the open market, redeem USDC and FXS at a value of $1 in the system, and then sell these two tokens to earn profit. In the process, an increase in demand for FRAX purchases will drive up the price of FRAX.

Therefore, the Frax protocol basically maintains the stability of the FRAX price through algorithmic control of the mortgage rate of the system and the additional issuance rate of FXS. Compared with the previous several algorithmic stablecoins, Frax greatly reduces the speculative arbitrage component, but at the same time makes its market size grow slowly.

By analyzing the operation logic of the above algorithmic stablecoin projects, it is not difficult to find that the current algorithmic stablecoins on the market have made outstanding innovations in the form of traditional stablecoins at different levels, which is an exploration and interpretation of decentralized finance. But at the same time, they also generally have the "stability" paradox, or the problem that "stability" and "scale" cannot be combined. Algorithmic stablecoins such as AMPL, ESD, and BAC use huge speculative arbitrage space to expand the market size, but lead to the stability of the currency price; while FRAX maintains the stability of the currency price, but cannot quickly expand the market size due to the lack of a debt market .

As a user in the currency circle recently stated in the community, algorithmic stablecoins are the behavior of "algorithms + a large number of high-frequency stabilizers", that is, the result of the arbitrage game between algorithms and free markets. Stablecoins with only algorithms and no massive transactions must fail. If the algorithmic stablecoin wants to become the protagonist of the stablecoin market, it must expand its market size, and this requires them to create a market that can continuously create wealth and apply it to actual needs, such as lending and insurance in the current DeFi field and other services. Otherwise, the algorithmic stable currency may once again be reduced to an unsustainable innovative attempt.