Xiaobai must learn, eight common mistakes in the process of using DeFi|Baked star selection

Blockchain is a revolutionary technology, there is no doubt about it. When Satoshi Nakamoto introduced the world to Bitcoin and the blockchain technology behind it in 2008, he brought with it a radical, decentralized financial (DeFi) system where users first For the first time, peer-to-peer transactions can be conducted online without a third-party intermediary.

Based on blockchain technology, decentralized finance (DeFi) has developed rapidly in the past year. Compared with the traditional financial system (CeFi), DeFi provides transparency, security, invariance and efficiency, and improves user experience. It is the future A major trend in financial development.

secondary title

Little to no understanding of DeFi

Decentralized financial systems differ significantly from traditional financial technology applications. Their respective operating methods are completely different. Not only users who are new to the DeFi world will feel unfamiliar, but experienced "old DeFi people" are also prone to make mistakes.

Some key differences of DeFi compared to CeFi include:

Users are always fully responsible for their own funds;

No third party company or organization controls any aspect of the system;

No middlemen, administrators or official customer service representatives;

Once the transaction is initiated, it cannot be undone and will take effect permanently.

The DeFi field has developed rapidly in recent years, and technology updates are released frequently. It is worth your time to study. Once you invest in this world, you will find countless new knowledge and wealth codes to mine.

Misunderstood the difference between a centralized exchange (CEX) and a decentralized exchange (DEX)

Decentralized exchanges (DEX) such as Uniswap and Oasis support users to conduct peer-to-peer cryptocurrency transactions directly; centralized exchanges (CEX) such as Coinbase or Binance are controlled by users’ funds. controlled by a third party.

What DEX and CEX have in common is that users can trade on them. But the trading methods are different. DEX provides prices calculated based on algorithms, and CEX provides order books and matching buy and sell orders.

One of the benefits of DEX is that users can trade tokens directly from their external encrypted wallets, which is safer and more proactive than trading and holding funds on CEX, and is in line with the core of the blockchain; while funds held on CEX are more Vulnerable to hacking. However, CEX also has its own advantages. It helps novice users who are not good at keeping mnemonic words/private keys to keep their assets. A large and reliable platform will make users feel more at ease.

Send assets to wrong address

In traditional centralized finance, if a mistake or fraud occurs, the user is the victim, and can seek help from the bank, and it is possible to recover the assets. But it's not the same on the blockchain.

Blockchain transactions are irreversible by design, and all encrypted transactions are permanent, which means that users must be very careful when transferring money, checking addresses carefully, and checking clearly before providing their addresses to others, because once transferred If you make a mistake, you can't get it back.

Is there any way to optimize this problem? Minimize the chance of going to the wrong address as much as possible.

There is a safeguard: encrypted addresses have a built-in form of error checking called a checksum, which helps prevent addresses from being mistyped (for example, by accidentally leaving out characters). Ethereum addresses have verified and non-verified versions. The checksum version of an Ethereum address contains some uppercase letters; the non-checksum version contains only lowercase letters. It is recommended to use the verified version, in fact, some wallets only accept this version.

Checksum address: 0x4a44A0XXXXXXXXXX290217C51Df0c6158a59CAD2

Non-checksum address: 0x4a44a0xxxxxxxxxx290212721df0c6158a59cad2

However, while this method mentioned above avoids typos, users can make some other address-related mistakes:

Send tokens to the smart contract address. Smart contracts are operations written in software code that run on the blockchain. Each Ethereum token is represented by a smart contract that manages token balances for users (like real-world bookkeepers). Like all other operations on the blockchain, token contracts are associated with addresses. Taking Dai as an example, users sometimes send Dai directly to the smart contract address of the token, thinking that this can redeem the Dai generated by Maker Vault, instead of interacting correctly with the contract through the Oasis exchange. When this happens, the assets cannot be recovered.

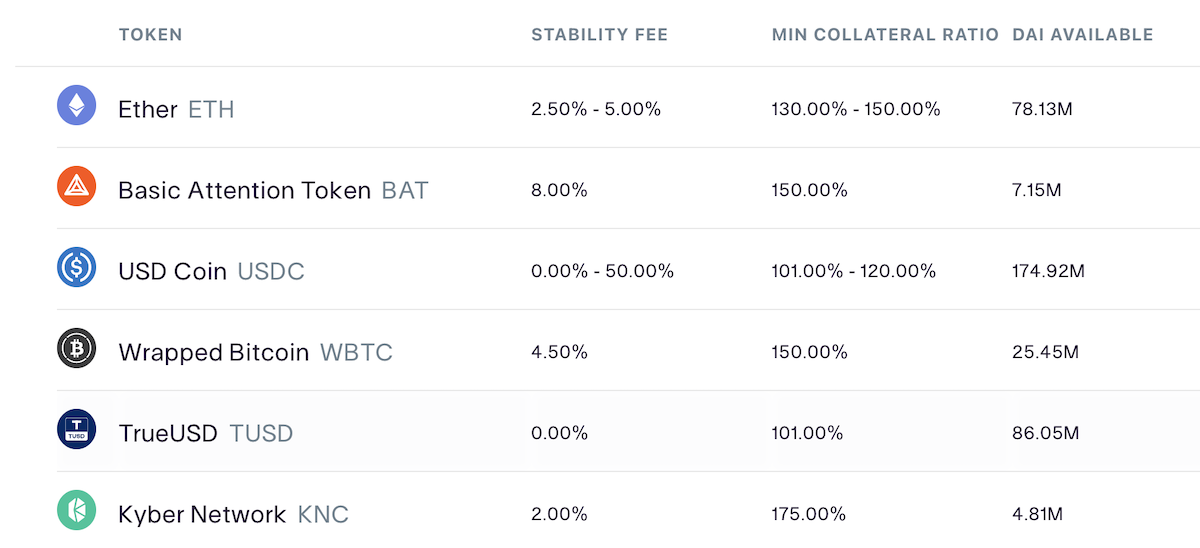

Sending tokens to the wrong address. Exchanges sometimes generate different deposit addresses for each Ethereum token they support (ETH, DAI, BAT, USDC, etc.). Since these all use the same blockchain, some novice users will mistakenly believe that the same address is valid for all Ethereum tokens; Make deposits in one token. If the address of A token receives B token, even though both belong to Ethereum token, the exchange may not credit it, and it is almost impossible to get it back, so be sure to pay attention to this.

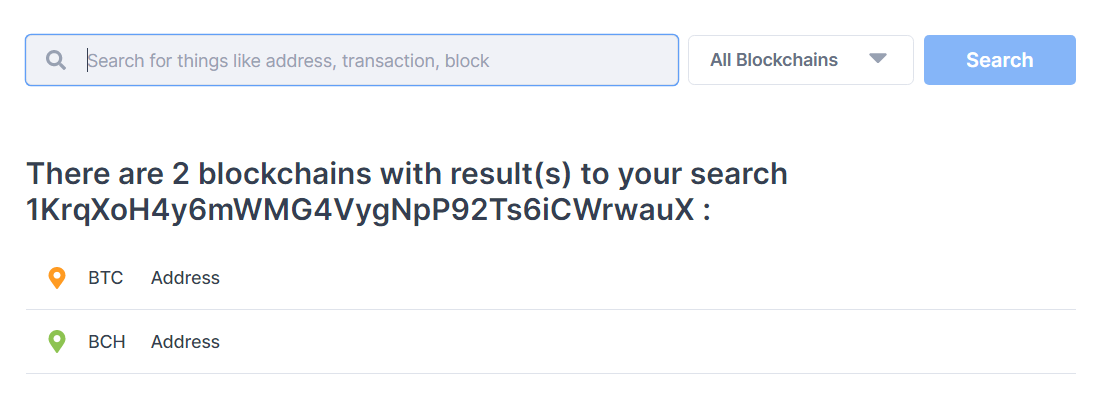

Send digital currency to addresses on other chains. Most (but not all) blockchains have a unique address format. For example, Ethereum addresses start with 0x, while Bitcoin addresses start with 1, 3 or the less common bc1 (Segregated Witness & Non-Segregated Witness). Since the addresses are completely different, it is almost impossible to send tokens on Ethereum to Bitcoin addresses. However, blockchain forks or closely related blockchains often do have the same format, e.g. every Ethereum address also exists on the Ethereum Classic blockchain and every Bitcoin address also exists on Bitcoin Cash on the blockchain, so confusion may arise.

Therefore, in order to avoid the occurrence of the points mentioned above, for example, check multiple times before transferring money to ensure that it is correct.

Unable to secure mnemonic/private key

DeFi applications (dapps) and services require users to hold the mnemonic/private key themselves. This is a long and unique string that can access and control the address and the funds in it. The mnemonic/private key replaces the traditional In financial systems, the standard username or email and password model for accessing accounts. Typically, the private key is derived from a randomly generated mnemonic (seed phrase) of 12 to 24 words. It is very important to protect the mnemonic/private key, not your keys, not your money, this is the only key in charge of the assets in the address, and on a decentralized platform, no trusted third-party administrator can Help them when they lose their private keys.

Keep a copy of your mnemonic/private key off-net instead of unencrypted in the cloud or on your local device. You can buy a special hardware wallet to keep the mnemonic/private key, such as Trezor, Ledger, etc. There are also many useful hardware wallets in China. In addition, mobile wallets that are often used to participate in DeFi can also download extension applets in the browser to facilitate links with DeFi dapps in the browser, such as the MetaMask little fox wallet. You can also use a composite wallet solution to keep assets in several ways. Each solution has pros and cons and must be used correctly to ensure security, and only you can decide which solution best meets your needs.

Keeping your computer in good health is also critical to asset security, download from reputable sources, avoid malware, use antivirus software, and run frequent checks for suspicious emails and links.

not paying enough gas fee

Blockchain users pay fees to miners, who then spend time and energy processing and recording transactions. On the Ethereum network, this type of transaction fee is called a gas fee, and the amount of the fee depends on several factors: including the complexity of the operation, and the number of transactions submitted to the blockchain at a given time.

Before completing the transaction, the user needs to pay the gas fee. If the payment amount is too low, the transaction may take many hours to complete and may even be declined. Most Ethereum wallets will estimate the gas fee for the user, but due to the high amount of blockchain activity, the actual fee will sometimes exceed the suggested amount. Therefore, in order to avoid long-term transaction delays and rejections, you can check the current gas fee on the ETH gas station (https://ethgasstation.info) before the transfer operation; after the transfer is completed, you can enter the address into the Block explorers like Etherscan.io to track the progress of transfers.

Does not use official or secure interfaces

There are many scammers in the blockchain industry. Isn’t there a saying: Is the blockchain a cash machine for hackers? In addition to hacker attacks, there are many lower levels that we must also pay attention to, such as fake websites and fake excuses. Scammers create fake interfaces, ask for seed phrases in social media or chat apps, and use other methods to try to steal funds. When using DeFi applications, browser extensions, software downloaded from app stores, or website interfaces, please be careful to only interact with the real version.

I can't tell the currency

There are some relatively new coins that can be confusing. For example 🌰, such as Dai and Sai, Sai is the original Dai single-collateral token. With the launch of Multi-Collateral Dai (MCD) in November 2019, Sai was shut down. At that time, users were instructed to migrate their Sai to Dai, and many users followed the instructions. Then Sai was no longer available, but users can still Redeem Sai as its underlying ETH collateral. Because both Sai and MCD are called Dai, and because some platforms are slow to update the language, if users still have Sai in their wallets, they may think it is MCD, which will cause some misunderstandings. Now, if the user still holds Sai, some exchanges (such as Uniswap) have limited liquidity, and MCD or other tokens can also be traded in it.

Can't tell the agreement

In addition to currency confusion, different protocols can also be confused. For example, the Maker Protocol, Maker Protocol users, and even members of the Maker community sometimes confuse Maker Protocol, Maker Foundation, and MakerDAO.

Let’s start with the Maker Protocol — a blockchain-based system of smart contracts and decentralized price feeds (oracles) that generate Dai as a store of value.

Followed by MakerDAO. The stability of Dai and the security of the Maker protocol are maintained by a global community of MKR token holders who use the protocol's blockchain voting system to set key parameters such as the stability fee charged to Vault, the debt ceiling, and the addition of New Collateral Types. Together, the Maker Protocol and the Maker community form a decentralized autonomous organization called MakerDAO.

Finally, there is the Maker Foundation. The Maker Foundation helps guide MakerDAO, and after this process is complete, the Maker Foundation will continue to work towards its long-promised dissolution while providing eventual help to the DAO so that it can be self-sustaining and fully decentralized.

Reference:

https://blog.makerdao.com/nine-most-common-missteps-of-crypto-and-defi-users/

https://blog.makerdao.com/how-ethereum-smart-contracts-power-dai-the-maker-protocol-and-defi/