A Day to Gather Wall Street Old Money, LayerZero Begins Telling the Story of the "Wall Street Public Chain"

- Core Viewpoint: Cross-chain protocol LayerZero announced a transformation, launching a Layer 1 public chain named Zero specifically designed for institutional financial markets. It has secured strategic investments and partnership intentions from several top-tier Wall Street institutions, aiming to become a high-performance infrastructure for future tokenized asset trading and settlement.

- Key Elements:

- Explicit support from multiple Wall Street institutions, including a strategic investment in ZRO tokens by Citadel Securities, equity and token purchases by ARK Invest, a strategic investment by Tether, and joint exploration agreements signed with DTCC, ICE, and Google Cloud.

- The new public chain Zero adopts a partitioned (Zone) architecture, optimized for general EVM contracts, private payments, and trade matching respectively, to address institutions' core needs for speed, privacy, and throughput.

- The transformation background is Wall Street's active push for asset tokenization, while existing public chains (like Ethereum) may struggle to meet large-scale, production-grade transaction loads. Zero aims to fill this execution layer gap.

- The valuation logic for the ZRO token shifts from cross-chain protocol governance to becoming the native asset of a future on-chain financial infrastructure. However, it faces short-term pressure from a large volume of unlocked tokens (approximately 80% remain locked) and a lack of direct value capture mechanisms.

- Institutional partnership statements use cautious wording (e.g., "evaluating," "exploring"), indicating current support is more of a strategic, preliminary trial rather than a final commitment. The project's long-term success remains to be validated.

Original Author: TechFlow

On February 10th, LayerZero launched Zero in New York.

This is a self-developed Layer 1 public blockchain, aiming to handle trading and clearing for institutional-grade financial markets.

LayerZero calls it a "decentralized multi-core world computer." Let me translate that for you: a blockchain specifically designed for Wall Street.

Simultaneously, various Wall Street institutions began publicly endorsing it, with some responses involving direct investment.

Among them, Citadel Securities made a strategic investment in the ZRO token.

This firm handles roughly one-third of U.S. retail stock orders. CoinDesk specifically noted in its report on the matter that directly purchasing crypto tokens is not a conventional move for traditional Wall Street financial institutions like Citadel.

ARK Invest also purchased equity and tokens in LayerZero, with Cathie Wood directly joining the project's advisory board; Tether announced a strategic investment in LayerZero Labs on the same day, though the amount was undisclosed.

Beyond buying tokens and investing in equity, there's a quieter layer of signals.

DTCC (the central clearinghouse for U.S. securities trading), ICE (the parent company of the NYSE), and Google Cloud have also signed joint exploration agreements with LayerZero.

Thus, a project originally focused on cross-chain bridging is pivoting and has simultaneously secured collective backing from key players across the entire industry chain: clearinghouses, exchanges, market makers, asset managers, stablecoins, and cloud computing.

Traditional institutions have added another move to their playbook for building on-chain financial infrastructure.

Following the announcement, ZRO surged over 20% that day and is currently trading around $2.3.

Moving from Bridges to Pipes?

LayerZero's work over the past three years has been straightforward:

Moving tokens from one chain to another. Its cross-chain protocol currently connects over 165 blockchains. USDt0 (the cross-chain version of Tether's stablecoin), launched less than a year ago, has facilitated over $70 billion in cross-chain transfers.

This is a mature business, but its ceiling is clearly visible.

Cross-chain bridges are essentially tools; users choose whoever is cheaper and faster. However, with the contraction of the entire crypto market and declining trading volume, cross-chain functionality has become somewhat of a pseudo-demand. It's understandable that LayerZero is choosing to switch tracks.

Moreover, it has the capital to make the switch. a16z and Sequoia have led funding rounds for the project, raising over $300 million in total, with a previous valuation reaching $3 billion.

The portfolio companies of these two VC firms essentially constitute a Wall Street contact list. The fact that Citadel and DTCC are now willing to sit at the table and endorse LayerZero likely has much to do with who's standing behind it.

Returning to the new L1 launched by LayerZero, Zero, it clearly isn't designed for DeFi players or meme traders.

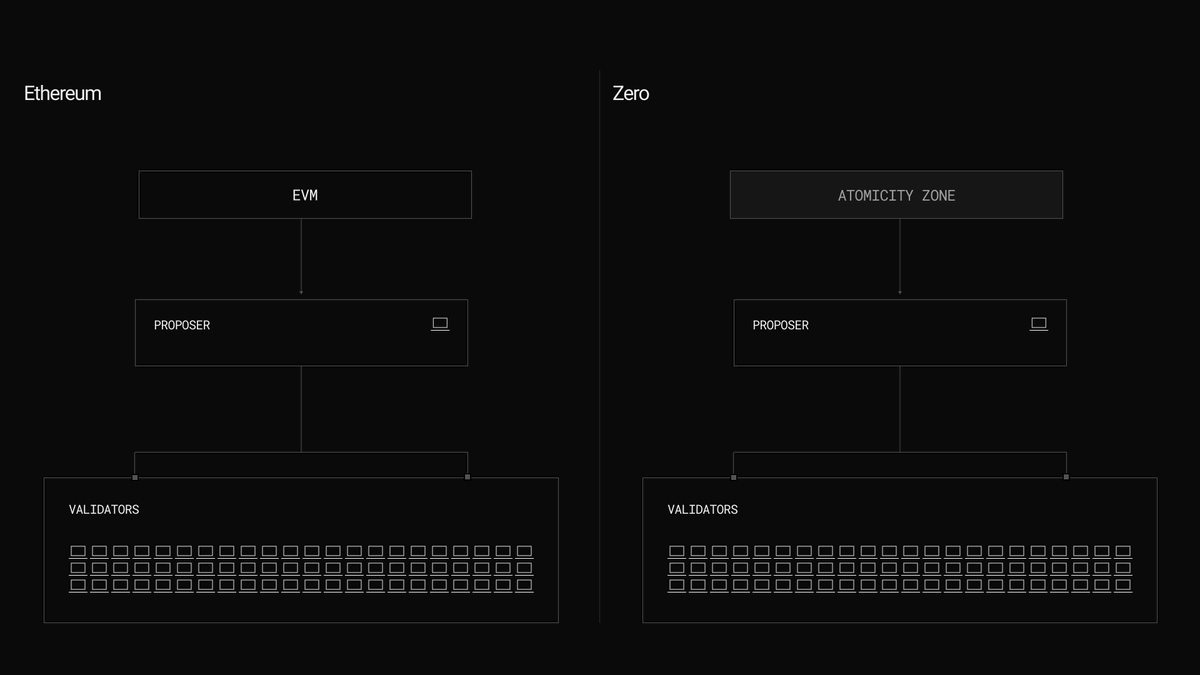

Zero's architecture differs from existing public chains. Most chains are like a single road for all traffic; Zero splits the chain into multiple independently operating partitions, which LayerZero calls Zones.

Each Zone can be individually optimized for different scenarios without interfering with others.

At launch, three Zones were opened: a general-purpose environment compatible with Ethereum smart contracts, a private payment system, and a dedicated trading and matching environment.

These three Zones target three types of clients.

The general EVM environment retains existing crypto developers with low migration costs. The private payment system addresses an old institutional problem: on Ethereum, counterparties can see your positions and strategies, and large capital is unwilling to "swim naked."

The dedicated trading Zone has a more direct aim: handling the matching and settlement of tokenized securities.

Looking back at the list of participants makes this clear. DTCC clears securities transactions worth hundreds of trillions of dollars annually; it wants to know if clearing can be faster. ICE operates the NYSE, where stock markets are only open on weekdays; it wants to experiment with 24/7 trading. Citadel handles massive order flow; every step faster in post-trade processes means money.

So, viewed together, these are not crypto industry demands; they are Wall Street's own pain points.

LayerZero CEO Bryan Pellegrino was quite blunt in a public interview:

"It's not that existing solutions aren't good enough; it's that the scenarios truly requiring 2 million transactions per second belong to the future global economy."

Incidentally, this new chain, Zero, claims to achieve 2 million TPS in test environments, which indeed meets the production-grade needs of traditional finance. However, the performance narrative for public chains has long been played out; no matter how high the claimed performance, it hardly surprises me anymore.

The story can remain the same, but the audience can change. This time, it's the turn of the "old money."

Wall Street Wants to Move Trading On-Chain, But Ethereum Can't Handle It

The backdrop for institutions flocking to LayerZero isn't a crypto bull market; it's Wall Street's own push for tokenization.

BlackRock's BUIDL fund launched on Ethereum last year, with assets exceeding $500 million. JPMorgan's Onyx platform, built on Ethereum technology, has already processed trillions in repo transactions.

Wall Street has used Ethereum for proof-of-concept, demonstrating that tokenization is feasible. The next step is finding a place that can handle production-level loads.

Zero's three Zones are precisely targeting this gap. EVM compatibility means assets and contracts on Ethereum can migrate over.

This might be the real divergence between LayerZero and Ethereum.

Ethereum is currently using standards like ERC-8004 to assert definitional authority, issuing on-chain IDs for AI Agents, setting rules for the future on-chain economy...

LayerZero's current move is to ignore definitions and directly build the pipes, telling institutions their trades can run here.

One is writing the rulebook; the other is laying the pipes. They are betting on different things.

Ethereum is betting on its irreplaceability as a trust layer, backed by its TVL scale, security audit ecosystem, and institutional recognition. LayerZero is betting on the demand for alternatives at the execution layer: Wall Street needs speed, privacy, and throughput, and will use whoever provides it first.

Whether these two paths will eventually intersect is unclear. But the flow of capital has already given a directional signal.

What Does This Mean for $ZRO?

ZRO's previous positioning was simple: the governance token for the LayerZero cross-chain protocol. Total supply of 1 billion tokens, used for voting and staking, nothing more.

After Zero's launch, the narrative for this token has changed.

ZRO is the native token of the Zero chain, anchoring network governance and security. If Zero truly becomes institutional-grade financial infrastructure, ZRO's valuation logic shifts from "how much volume does the cross-chain bridge have" to "how much asset value runs on this chain."

You all understand the difference in potential ceiling between these two valuation anchors. But narratives aside, several hard variables will determine ZRO's future trajectory.

Supply Side: 80% of tokens are still locked.

ZRO's current circulating supply is approximately 200 million tokens, just over 20% of the total supply. According to CoinGecko data, around 25.71 million ZRO (worth about $50 million), representing 2.6% of the total supply, will unlock on February 20th, allocated to core contributors and strategic partners. The entire unlock cycle extends to 2027.

This February 20th unlock is the first supply shock post-announcement; whether the market can absorb it will be a litmus test for short-term sentiment.

Demand Side: The fee switch hasn't been turned on yet.

Currently, ZRO has no direct value capture mechanism. A governance vote in December proposed charging a fee for each cross-chain message, with revenue used to buy back and burn ZRO, but it failed due to insufficient voter turnout. The next vote is scheduled for June this year.

If passed, ZRO would gain a burn mechanism similar to ETH's, reducing circulation with each transaction. If it fails again, the token's "governance right" remains merely voting power, lacking cash flow support.

Therefore, overall, players interested in ZRO might watch three key dates:

1. June: The second fee switch vote. Passing or failing directly determines whether ZRO has intrinsic demand.

2. This Fall: Zero mainnet launch.

3. Until 2027: ZRO tokens will not be fully unlocked until then. Before that, each unlock round presents selling pressure, compounded by the current crypto bear market. Positive news may not necessarily drive ZRO's price higher.

Finally, LayerZero calls Zero a "decentralized multi-core world computer," which is clearly positioning it against Ethereum's "world computer" concept, attempting to play a more significant role at the settlement layer, especially for financial settlements, while transitioning and distancing itself from the thin narrative of being just a cross-chain bridge.

However, the official statements from several partners are worth noting.

Citadel refers to its participation as "evaluating how the architecture can support high-throughput workflows"; DTCC says it's "exploring scalability in tokenization and collateral."

Translated: they think this might be useful, but haven't committed yet.

Wall Street money is smart—smart enough to place many small bets simultaneously to see which one pays off first. Therefore, when a project receives endorsements from various star institutions, it doesn't signify a complete, strong binding, but rather acts more as a short-term positive catalyst.

What LayerZero has obtained might be an entry ticket, or it might just be an interview opportunity.