JustLend DAO Anchors JST's Continuous Deflation with Real Yield, Building Steadily Through Market Cycles with Long-Term Vision

- Core Viewpoint: Against the backdrop of a broader cryptocurrency market downturn, the TRON ecosystem and its core DeFi protocol, JustLend DAO, have demonstrated significant resilience and growth. By implementing a large-scale token buyback and burn mechanism funded by real protocol revenue, it has established a long-term deflationary value model for the JST token.

- Key Elements:

- Diverging Market Performance: While Bitcoin prices hit new lows for the period, the issuance of USDT on the TRON chain reached $83.4 billion, and the network's monthly revenue hit $216 million, showing counter-trend growth.

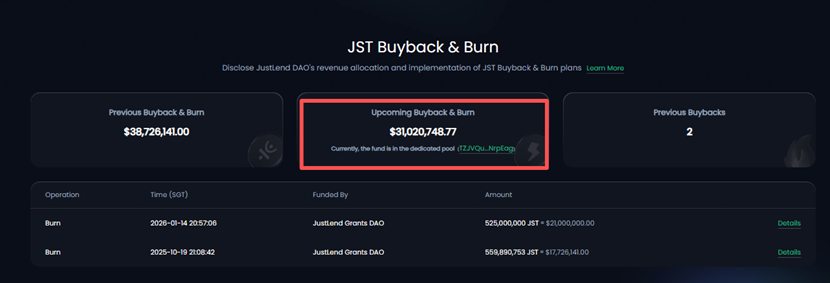

- Large-Scale Deflationary Operations: JustLend DAO has completed two rounds of JST buyback and burns, cumulatively destroying over 1.08 billion JST (10.96% of the total supply) with an investment exceeding $38.7 million.

- Solid Revenue Backing: Buyback funds originate from real protocol revenue. JustLend DAO's net profit for a single quarter has exceeded $10 million, with a TVL over $6 billion, demonstrating strong profitability.

- Token Price Resilience: Amid widespread market declines, JST's price performance has been relatively stable, not following the sharp volatility of the broader market, indicating independent value support.

- Long-Term Transparent Mechanism: The buyback and burn mechanism is regularized and verifiable on-chain, with approximately $31.02 million in retained earnings serving as a reserve for future funding, ensuring sustainability.

- Ecosystem Synergistic Development: The overall growth of the TRON ecosystem, coupled with support from key infrastructure like MetaMask and WalletConnect, provides long-term momentum for the protocol.

Recently, the cryptocurrency market has once again fallen into a deep correction. According to the latest data from HTX, the price of Bitcoin (BTC) has plummeted to the $60,000 mark, hitting a new low since November 2024. The entire market has entered a downward cycle, with industry sentiment remaining persistently low. However, amidst the overall market pressure, key data from the TRON ecosystem has shown remarkable resilience and growth: the on-chain issuance of USDT has exceeded $83.4 billion, continuously setting new historical records; the total revenue of the TRON network has maintained a growth trend, reaching a high of $216 million in January 2026, a month-on-month increase of approximately 4%, demonstrating the unique development resilience and vitality of the ecosystem.

Core projects within the TRON ecosystem have also seen a continuous stream of positive developments. Among them, the second round of large-scale buyback and burn completed by the core DeFi platform JustLend DAO on January 15th is particularly noteworthy. This round involved the destruction of a staggering 525 million JST tokens, accounting for 5.3% of the total token supply, with actual funds invested exceeding $21 million.

Against the difficult backdrop of low market sentiment, increasingly quiet trading, and declining transaction activity, JustLend DAO decisively invested tens of millions of dollars to advance the deflationary JST burn. This move stands in stark and powerful contrast to the overall market weakness, becoming a crucial value anchor in the downturn.

It is especially noteworthy that in the current environment of a significant overall market decline, the market price performance of the JST token has remained relatively stable. Its price movement has not completely followed the sharp fluctuations of the broader market. This independence directly reflects market recognition of its intrinsic value support.

Cumulative Burn Exceeds 1.08 Billion Tokens, Investment of ~$38.7 Million: JustLend DAO Uses Real Capital to Anchor JST Deflation Certainty

Since the JST buyback and burn mechanism proposal was formally passed by the JustLend DAO community in October 2025, the project has progressed efficiently. In just three short months, it has completed two rounds of large-scale on-chain buyback and burn actions, cumulatively destroying over 1.08 billion JST tokens (specifically 1,084,890,753 tokens), accounting for 10.96% of the total token supply, corresponding to a cumulative investment of over $38.72 million in real capital. With tangible capital investment and efficient execution, it has solidified the certainty of JST deflation, demonstrating the project's firm determination to advance a long-term deflation mechanism.

The successful execution of the two rounds of large-scale buyback and burn has achieved a rigid contraction of the JST circulating supply. The total token supply has been significantly reduced from 9.9 billion to approximately 8.815 billion. Such a large-scale deflation magnitude and the investment of real capital are rare in the history of the crypto industry, more intuitively confirming JustLend DAO's substantial financial strength and efficient deflation execution capability.

According to the previously released buyback and burn announcement, the funds for JST buyback and burn primarily come from two core sources: first, the existing revenue and future continuously generated net income of the JustLend DAO protocol; second, the portion of USDD multi-chain ecosystem revenue exceeding $10 million. Currently, as the relevant revenue from the USDD multi-chain ecosystem has not yet reached the established standard, the current JST buyback and burn funds are fully supported by the JustLend DAO protocol.

This funding arrangement fully confirms that the JST buyback and burn mechanism is deeply rooted in the real ecological revenue of JustLend DAO. It is evident that the JST buyback and burn mechanism is not a short-term, marketing-driven one-off operation, but a normalized, long-term value-empowerment plan anchored to the protocol's continuous revenue and written into its underlying mechanism. It establishes a clear and robust long-term deflationary closed loop for JST: "real ecological revenue → drives token buyback → deflation enhances value → feeds back into ecological development," building a solid foundation at the mechanism level for JST's long-term stable development.

As KOL OxPink stated, the core logic of JST buyback and burn is highly consistent with "profit-driven stock buybacks" in traditional financial markets. It directly empowers token value by using the actual profits generated by the protocol to buy back tokens on the secondary market and permanently destroy them, allowing the dividends of ecological development to tangibly benefit token holders.

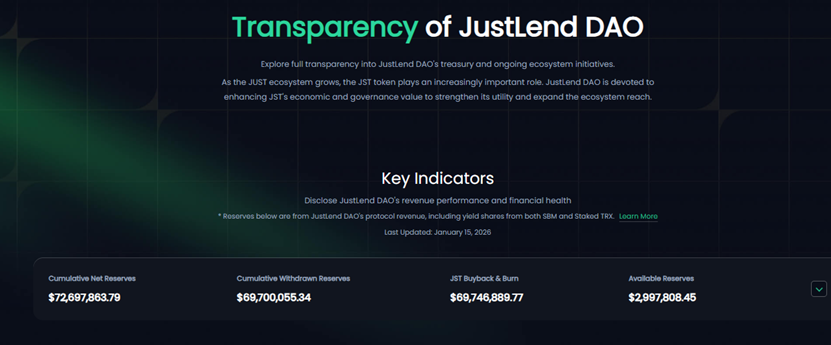

It is particularly worth mentioning that all JST buyback and burn operations are completed on-chain, with every transaction record fully traceable and publicly queryable. Currently, users can view core data such as the progress of buyback and burn and details of funds awaiting destruction in real-time through the Grants DAO section on the JustLend DAO official website or the dedicated Transparency page, truly achieving full-process openness and transparency.

As of February 4, 2026, JustLend DAO still holds approximately $31.02 million in retained earnings awaiting destruction. These funds will be gradually invested into JST buyback and burn in subsequent quarters, continuously injecting stable financial momentum into the normalization and sustainable advancement of the deflation mechanism, ensuring the sustained release of JST's deflationary effects.

JustLend DAO's Diversified Business Forges Strong Profitability, Providing Solid Support for JST Buyback and Burn

As the core fund provider for JST buyback and burn, and also the core financial infrastructure of the TRON ecosystem, JustLend DAO has always anchored itself to real market business needs, constructing a full-chain DeFi solution integrating numerous functions such as lending SBM, liquid staking sTRX, Energy Rental, and the smart wallet GasFree. This diversified and mature business layout not only creates stable, real, and continuous protocol revenue for JustLend DAO, ensuring healthy cash flow growth, but also provides a continuous and sustainable source of funding support for the JST buyback and burn mechanism. More importantly, it provides sustainable and solid support for JST's long-term deflationary value from a financial foundation.

JustLend DAO's strong profitability is the confidence behind its ability to support the long-term operation of the JST buyback and burn mechanism. This was directly verified in the second round of destruction executed on January 15, 2026: this round involved a total investment of $21 million, of which, apart from the planned $10.34 million from retained earnings, the remaining funds came from the protocol's newly generated net profit in the fourth quarter of 2025. This means that JustLend DAO's net profit in the single quarter of Q4 2025 already exceeded $10 million, fully validating the strength and sustainability of its profitability.

Solid earnings stem from a steadily growing business foundation. The overall operational scale of the JustLend DAO platform has steadily increased, with core data showing impressive performance: JustLend DAO's Total Value Locked (TVL) has long been maintained above the $6 billion scale, firmly ranking among the top three in the global lending sector. According to disclosures on the financial operations transparency (Transparency) page, JustLend DAO's cumulative net profit has reached as high as $72.69 million. Since the JST buyback and burn mechanism was passed last October, nearly $69.70 million in reserve earnings have been withdrawn in the past three months, with existing net profit still close to $3 million.

Based on past stable revenue performance, the "JST Q4 2025 Report" released on January 28th predicted that approximately $21 million is expected to be invested in buyback and burn in Q1 2026, with the sTRX business expected to contribute up to $10 million in revenue. The specific scale of destruction will be dynamically adjusted according to the actual operating conditions of the quarter. This provides the market with a clear and verifiable expectation, highlighting the continuity and reliability of the deflation logic: "real business generates revenue — revenue drives buyback — buyback enhances value."

In addition to the core support from JustLend DAO, the decentralized stablecoin USDD ecosystem, as an important incremental fund provider for future JST buyback and burn, is maintaining rapid growth momentum: the total supply of USDD has now exceeded $1 billion, with cumulative treasury revenue reaching $7.4678 million.

Thus, by building a solid business ecosystem through a diversified and high-growth core business matrix, and constructing robust profitability through continuous and stable protocol earnings, JustLend DAO has deeply internalized the JST buyback and burn into a long-term token value growth mechanism supported by real revenue, guaranteed by clear mechanisms, and with a predictable execution cadence. This achieves a deep binding between deflationary operations and ecological development, and synchronized growth between token value and protocol profitability.

The market performance of the JST token also intuitively confirms the effectiveness of ecological construction. In the current environment of a significant overall crypto market decline and deep corrections among mainstream cryptocurrencies, the JST price has demonstrated relative stability and resilience far exceeding the market, avoiding sharp fluctuations in line with the broader market and charting an independent, strong trend. According to the latest market data from Coingecko on February 4th, since the market entered a暴跌 mode on January 30th, mainstream cryptocurrencies have suffered severe short-term declines: BTC fell nearly 15% in the past 7 days, while ETH, SOL, and others fell over 25%. In contrast, JST only微跌 less than 1% during the same period, even rising against the trend at times. This decoupled movement from the broader market is particularly eye-catching in a weak market, directly reflecting the uniqueness and resilience of its value support.

Looking back at the execution trajectory of the JST deflation mechanism, its "value growth logic" has been clearly verified by the market—each large-scale buyback and burn execution has directly driven a steady increase in the token price, forming a significant "deflationary利好 effect."

- First Round Drive (October - December 2025): After the JST buyback and burn proposal was formally passed on October 21, 2025, market expectations were quickly realized. The JST price started a持续走强 trend from 0.032 USDT, climbing to a阶段性高点 of 0.045 USDT by December 3rd of the same year, representing a short-term cumulative increase of approximately 40%.

- Second Round Boost (January 2026): Following the execution of the second large-scale buyback and burn on January 15, 2026, the JST price迎来 another上涨行情, rising from 0.040 USDT to 0.047 USDT on January 27th, a gain of about 17% within half a month.

The market's positive feedback is not only recognition of the deflation model itself but also firm confidence in the long-term development logic of "business growth driving value回报."

In fact, the continuous, transparent buyback and burn operations conducted by JustLend DAO based on real protocol revenue have already built a core value foundation for JST that is distinct from being driven purely by market sentiment. JST's stable performance during the market downturn is the most powerful validation of the deflation model—"business generates revenue — revenue drives buyback — buyback enhances value"—and the long-term development logic of the ecosystem behind it.

TRON Ecosystem Continues to Gain Momentum, JustLend DAO Navigates Market Cycles Through Long-Term Building

The deflation logic constructed by the JST buyback and burn mechanism, by deeply binding real ecological revenue with token value, is essentially a model example of DeFi protocols returning to business fundamentals and creating a sustainable value model. As market cycles change, when the tide recedes, projects relying on short-term hype and lacking ecological foundations will ultimately falter in the industry's storms. Only practitioners who deeply cultivate their ecosystems and adhere to long-term building can stand firm and become the leading forces guiding the industry's next phase of development. JustLend DAO is a core practitioner of this development logic.

Colin Wu, founder of the知名 media outlet WuBlockchain, previously pointed out that most projects in the crypto industry lack value return mechanisms like dividends or buybacks found in traditional finance. Typically, projects without real revenue can only rely on selling tokens to sustain operations, and even projects with revenue mostly allocate profits to the team, with very few cases where earnings are actually fed back to token holders. Therefore, high-quality crypto projects not only need the ability to generate real revenue but must also encode the rules for empowering tokens with that revenue into code and smart contracts. This is the token model that truly possesses long-term value.

The JST buyback and burn mechanism is undoubtedly a vivid实践 and industry benchmark of this concept. JustLend DAO's investment of tens of millions of dollars to steadily and orderly advance JST buyback and burn is powerful proof of its deep cultivation of the ecosystem and construction of a long-term value capture mechanism. By deeply linking the value of the JST token to the real development and revenue status of core protocols like JustLend DAO and USDD, it aligns the ecological development path with the interests of JST holders. More importantly, the entire process is built on complete transparency: from clear funding sources and fully verifiable on-chain operations to sustainable revenue reserves, it has become a long-term value practice grounded in real收益, guaranteed by transparent mechanisms, and centered on continuous execution.

Meanwhile, the overarching TRON ecosystem, the大树 behind JustLend DAO, continues to accelerate across the board, achieving counter-trend growth during the industry downturn, with its ecological momentum持续攀升: on-chain USDT issuance continues to刷新历史新高; TRON network total revenue reached another new high in January 2026, with强劲的增长数据 fully demonstrating the resilience and vitality of the ecosystem's overall development.

In terms of ecological construction and network interoperability, TRON continues to expand its ecological boundaries and引入全新流量: on January 15th, MetaMask, the world's largest user-base wallet, announced official integration with the TRON network, opening a new core traffic入口 for the on-chain ecosystem; on January 26th, the cross-chain protocol WalletConnect completed support for the TRON network, significantly enhancing ecological interconnectivity capabilities, introducing more incremental resources to the ecosystem, and also bringing long-term development动能 to core protocols like JustLend DAO.

Beyond the强劲支撑 of the TRON ecosystem, JustLend DAO itself has weathered multiple market bull and bear cycles while operating稳健ly,始终保持着 a "zero security incidents" record, honing deep risk resistance capabilities. In this market downturn cycle, JustLend DAO's move to invest heavily in advancing JST buyback and burn demonstrates the协议硬核实力 and its firm决心 to深耕长期建设 through concrete actions.

Relying on the深厚积淀 of the TRON ecosystem and its own continuous product innovation, JustLend DAO, by deeply binding protocol revenue with token value, has not only built a value foundation for JST to navigate cycles but has also defined a new paradigm of long-termism in the DeFi领域 through practical actions. When the tide recedes, such builders will become the key forces determining the next chapter of the industry.