Forbes Editorial, the Most Accurate Short Signal in Crypto?

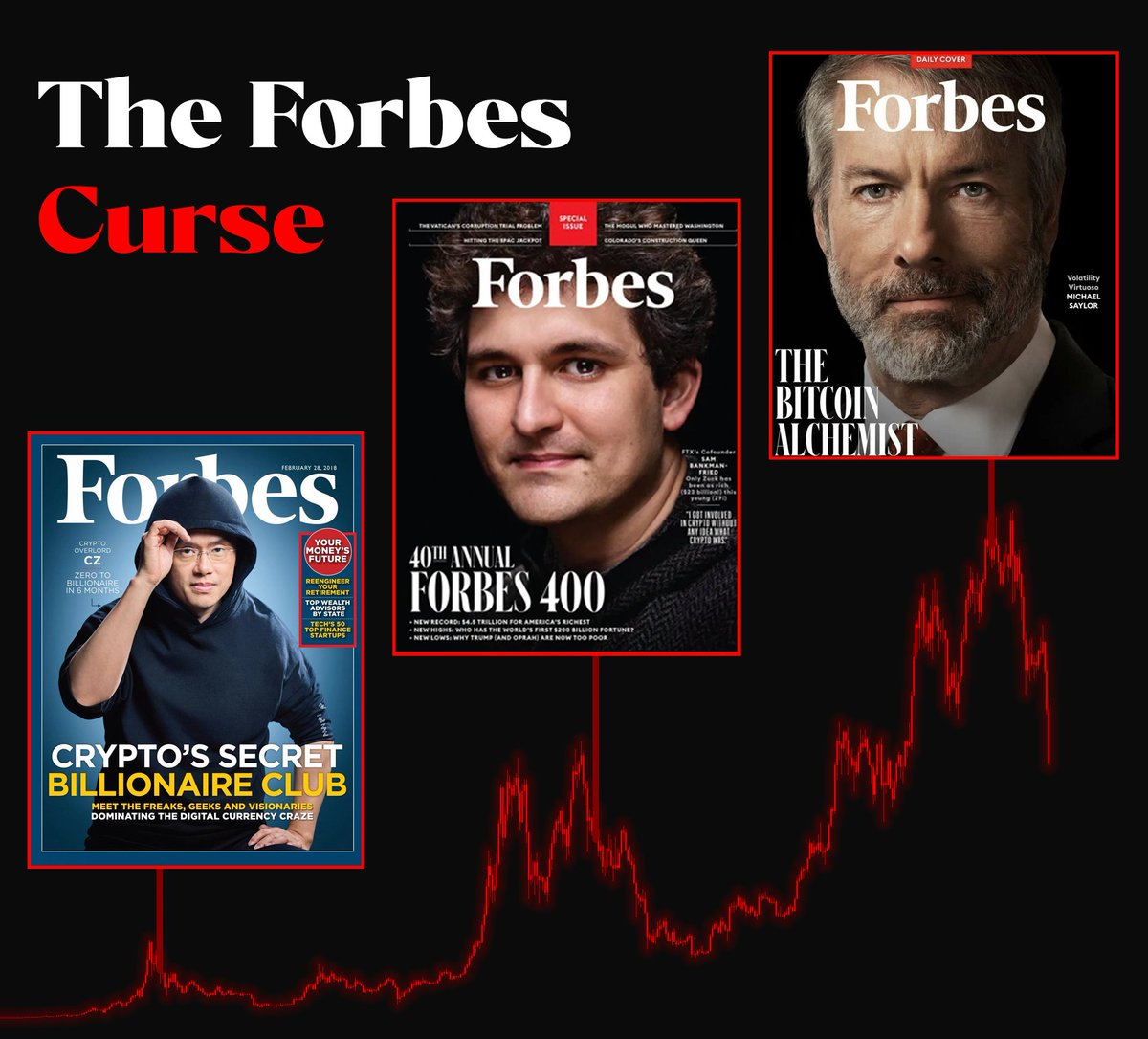

- Core Viewpoint: By analyzing three cases where crypto figures appeared on the cover of *Forbes* magazine followed by a market downturn, the article reveals the manifestation of the "magazine cover indicator" in the cryptocurrency market. It suggests that when a particular trend or individual receives extreme attention from mainstream media, it often signals that market frenzy has reached a cyclical peak.

- Key Elements:

- In February 2018, after CZ appeared on the cover of *Forbes*, the price of Bitcoin fell from around $7,600 to $3,156, a drop of 58%.

- In October 2021, SBF became a *Forbes* cover figure; 13 months later, FTX collapsed into bankruptcy, and he was sentenced to 25 years in prison for fraud and other charges.

- In January 2025, Michael Saylor appeared on the cover as the "Bitcoin Alchemist" while Bitcoin was above $100,000. Subsequently, the price fell by approximately 40%, causing significant floating losses for his company, MicroStrategy.

- The article points out that the "cover" is a symptom of market frenzy peaking, not its cause. When industry narratives become so hot that they are frequently reported by mainstream media, it is often a signal for caution.

- Although there are exceptions, such as Justin Sun appearing on a cover followed by continued market gains, the dense appearance of crypto figures on covers itself is one of the signals of an overheated market.

Original Author: Kuli, Shenchao TechFlow

Bitcoin briefly touched $60,000 these past two days, marking the largest single-day drop since the FTX collapse.

Michael Saylor's company, Strategy (formerly MicroStrategy), holds 713,000 Bitcoin with an average cost of $76,052. As of last night, the unrealized loss stood at $6.5 billion. The stock price has plummeted from its peak of $457 last year to $110, evaporating over three-quarters of its value.

However, a year ago, Saylor graced the cover of the renowned magazine Forbes. The headline read:

The Bitcoin Alchemist. At that time, Bitcoin was priced at $104,000, and Saylor's net worth was $9.4 billion.

Now, an image circulating on Twitter lines up three Forbes covers, overlaid with Bitcoin's price chart. Each cover, however, was perfectly timed at the starting point of a major crash.

And these three individuals: one has served time, one is currently serving time, and the third just lost $6.5 billion.

The Cover, Captured at the Peak of the Noise

The first crypto figure to appear on a Forbes cover was CZ.

In February 2018, Forbes published a cover titled "Crypto's Secret Billionaire Club," with CZ standing in the center, hoodie up, exuding a streetwise aura. The fine print on the cover stated:

From zero to billionaire in just 6 months.

At that time, Bitcoin had just fallen from its near $20,000 peak in late 2017 and was trading around $7,600. Forbes estimated CZ's net worth to be at least $1.1 billion. Binance, having launched just six months prior, was already the world's largest exchange by trading volume.

After the cover was released, Bitcoin briefly rebounded to $10,000. And then, nothing.

By December 2018, Bitcoin had dropped to $3,156. From the day the cover was published, the decline was:

58%.

CZ's subsequent story is well-known. On Forbes' 2025 global billionaire list, CZ's net worth was $62.9 billion, ranking first in the crypto industry.

But he hasn't been on the cover since.

The second crypto figure to grace the Forbes cover was Sam Bankman-Fried.

In October 2021, Forbes released its 40th Forbes 400 list, featuring SBF on the cover. Under 30 years old, with a net worth of $26.5 billion, he was the 41st richest person in the US.

On the cover, he wore his signature gray T-shirt, with curly hair, looking like a college student who had just pulled an all-nighter playing League of Legends.

The tone of that issue, in retrospect, seems surreal. Forbes called him "the most powerful person in crypto," describing him as a blend of Wall Street and Silicon Valley, building an exchange while donating to charity.

When the cover was published, Bitcoin was around $60,000, just a step away from its then all-time high of $69,000.

Thirteen months later, FTX imploded.

SBF had misappropriated over $8 billion in customer funds to plug holes at his other company, Alameda Research. In November 2022, a wave of user withdrawals overwhelmed FTX, turning the world's third-largest exchange into a bankrupt entity within a week. Bitcoin plunged from $20,000 to $16,000.

Finally, SBF was arrested in his luxury apartment in the Bahamas.

Found guilty on all seven charges, he was sentenced to 25 years. Forbes later created a "30 Under 30 Hall of Shame," where SBF was prominently featured.

From cover to handcuffs:

13 months.

The third is Michael Saylor.

On January 30, 2025, the Forbes cover featured "The Bitcoin Alchemist." Bitcoin had just broken above $100,000. Saylor's net worth had surged from $1.9 billion the previous year to $9.4 billion, nearly a fivefold increase. His company, MicroStrategy's stock had risen 700% in a year and had just been added to the Nasdaq 100 index.

The Forbes article recorded a detail:

On New Year's Eve, Saylor hosted a 500-person party at his estate in Miami. Dancers waved orange Bitcoin light balls, and outside, a 154-foot yacht named Usher was docked, ferrying institutional investors and crypto industry heavyweights.

At that time, Saylor told Forbes:

"We put a crypto reactor in the middle of the company, sucking in capital and spinning it. Volatility drives everything." This statement was, of course, sincere. Saylor's alchemy boils down to one thing: issuing debt to buy Bitcoin.

When the Forbes cover was published, Bitcoin was at $104,000. One year and six days later, today, it's at $63,000. The decline:

40%.

Saylor said on an earnings call that Strategy had built a "digital fortress."

The last crypto mogul to call his company a "fortress" was SBF. That was in June 2022. Five months later, FTX filed for bankruptcy.

The Cover: Both Praise and Curse

Wall Street has an old concept called the "magazine cover indicator":

When a trend makes it to the cover of a mainstream magazine, that trend is often nearing its end.

The logic is simple. Forbes editors are not prophets; like all retail investors, they only notice a story when it's at its most frenzied.

The moment a magazine deems "someone in a certain industry worthy of a cover" is precisely the moment market euphoria peaks.

The cover isn't the cause of the curse; the cover is a symptom of the bubble.

However, there was a brief exception to this rule.

Last March, Justin Sun appeared on the Forbes cover with the headline "The Crypto Billionaire Who Made the Trump Family $400 Million."

When that cover was published, Bitcoin was at $87,000. It didn't crash afterward; instead, it rallied all the way to $126,000 by October, setting a new all-time high.

Curse broken?

Not entirely. When Justin Sun's cover appeared, it was only two months after Saylor's. One cover in January, another in March—the fact that crypto figures were densely appearing on mainstream magazine covers was itself a signal. It indicated that the industry's narrative had become so hot that even Forbes editors felt one issue wasn't enough.

When covers start appearing in clusters, thinking back with hindsight, there might be a checklist of symptoms for a bull market top:

Forbes covers, taxi drivers talking about crypto, relatives asking you how to open an account... If two out of three signals appear, it's time to think about your portfolio.

So, the real question isn't "Are Forbes covers accurate?" but rather:

When everyone around you is telling the same story, when that story sounds so good even people who don't trade crypto have heard of it, when mainstream media starts deifying figures from an industry...

Are you the one still buying, or the one already selling?

Bull markets don't end in panic. Bull markets end on magazine covers.

It's just that the moguls on the covers may change, but the long bear market is always paid for by me.