Compliance Stablecoin Competition Heats Up, Tether Launches USAT to Enter the US Market

- Core Viewpoint: Tether has officially launched USAT, a compliant stablecoin designed for the US market, aiming to operate within the framework of the GENIUS Act, compete with rivals like USDC, while maintaining USDT's dominance in offshore markets, forming a dual-track parallel development model.

- Key Elements:

- USAT is issued by Tether through the federally chartered bank Anchorage Digital Bank, with Cantor Fitzgerald as the reserve custodian, and is operated by former White House official Bo Hines.

- USAT was initially issued with $20 million on Ethereum and has gained support from first-tier exchanges like Bybit and Crypto.com, but Binance and Coinbase have not yet supported it.

- Tether has clarified that USAT focuses on the compliant US market, while USDT will continue to serve as the global liquidity cornerstone and gradually move towards compliance with the GENIUS Act.

- Competition in the US stablecoin market is intensifying. USDC's supply has recently shrunk significantly, while competitor USD1 has achieved rapid growth through subsidy campaigns.

- Although Tether is financially strong, its CEO has publicly opposed interest-bearing subsidy models. It remains uncertain whether USAT will adopt similar growth strategies.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

On January 27, stablecoin giant Tether officially announced that its new USD stablecoin, USAT, designed specifically for the U.S. market and the GENIUS regulatory framework, has officially launched.

The promotion of USAT has been building for a long time. As early as last year when the GENIUS Act was being pushed through, Tether had already decided to launch a separate USD stablecoin alongside USDT to compete head-on with other stablecoins in the U.S. market under a compliant system. Since then, Tether has disclosed the development progress and design details of USAT several times. It was previously rumored to launch before the end of 2025, but it finally went live this January.

USAT: A More Compliant USDT

With the official launch of USAT, the veil has been completely lifted on this new stablecoin.

According to Tether's official statement, USAT is tailor-made for the U.S. market, and its design will fully comply with the new federal stablecoin regulatory framework established by the GENIUS Act (you can simply think of it as a compliant version of USDT). Specifically, Tether will issue USAT through the U.S. federally chartered bank Anchorage Digital Bank, with Cantor Fitzgerald designated as the custodian of USAT's reserve funds and the preferred primary dealer. Bo Hines, former Executive Director of the White House Cryptocurrency Council, will serve as CEO to directly oversee USAT's operations.

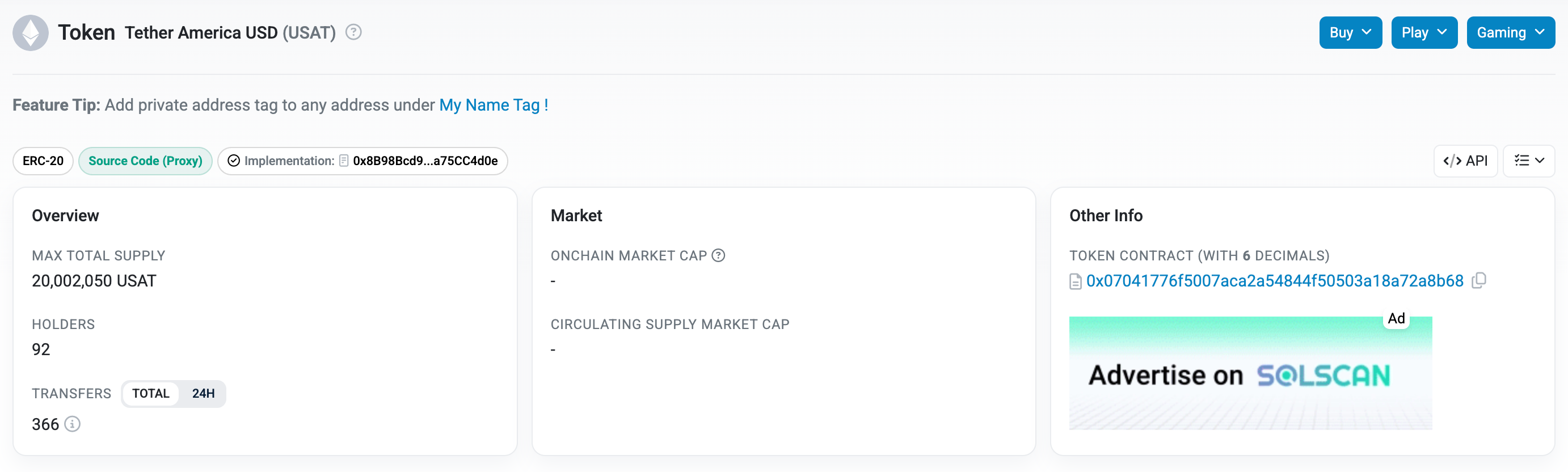

At launch, USAT will initially be issued only on the Ethereum mainnet, with an initial issuance size of $20 million. The official contract address is 0x07041776f5007aca2a54844f50503a18a72a8b68.

In terms of distribution, Bybit, Crypto.com, Kraken, OKX, and Moonpay will be the first platforms to support USAT, with each platform now gradually announcing the listing of USAT. It is noteworthy that Binance and Coinbase are not among the first batch of platforms. Currently, the former is cozying up to World Liberty Financial (USD1), while the latter has long-standing ties with Circle (USDC). Their choice to not support USAT for now may involve certain strategic considerations.

Tether's Future: A Dual-Track Approach

The launch of USAT does not mean USDT's position will be replaced.

In fact, Tether has stated multiple times regarding USDT and USAT, emphasizing a future development model where the two stablecoins operate in parallel — USAT will focus on the U.S. market, competing head-on with rivals like USDC within the compliant system to capture institutional clients from traditional finance; USDT will focus on offshore markets, continuing to serve as the liquidity cornerstone of the cryptocurrency market.

In yesterday's issuance announcement about USAT, Tether also reiterated USDT's gradual compliance strategy: "USDT will continue to operate globally, leading the market as the most widely adopted stablecoin, while gradually moving towards compliance with the GENIUS Act."

In the short term, USDT will remain Tether's main business focus. It is difficult for USAT to replace USDT in terms of scale, but it is expected that Tether will allocate some resources to USAT to boost its early growth.

From First-Mover to Follower, How Will Tether Break Through This Time?

With USAT's entry, the competitive landscape for stablecoins in the U.S. market is destined to heat up again.

Considering the current development trends, Circle's (USDC) temporary lead is not secure. The global stablecoin king Tether (USAT), World Liberty Financial (USD1) backed by the Trump family, internet giant representative Paypal (PYUSD), BlackRock-backed USDtb... various competitors are launching fierce attacks.

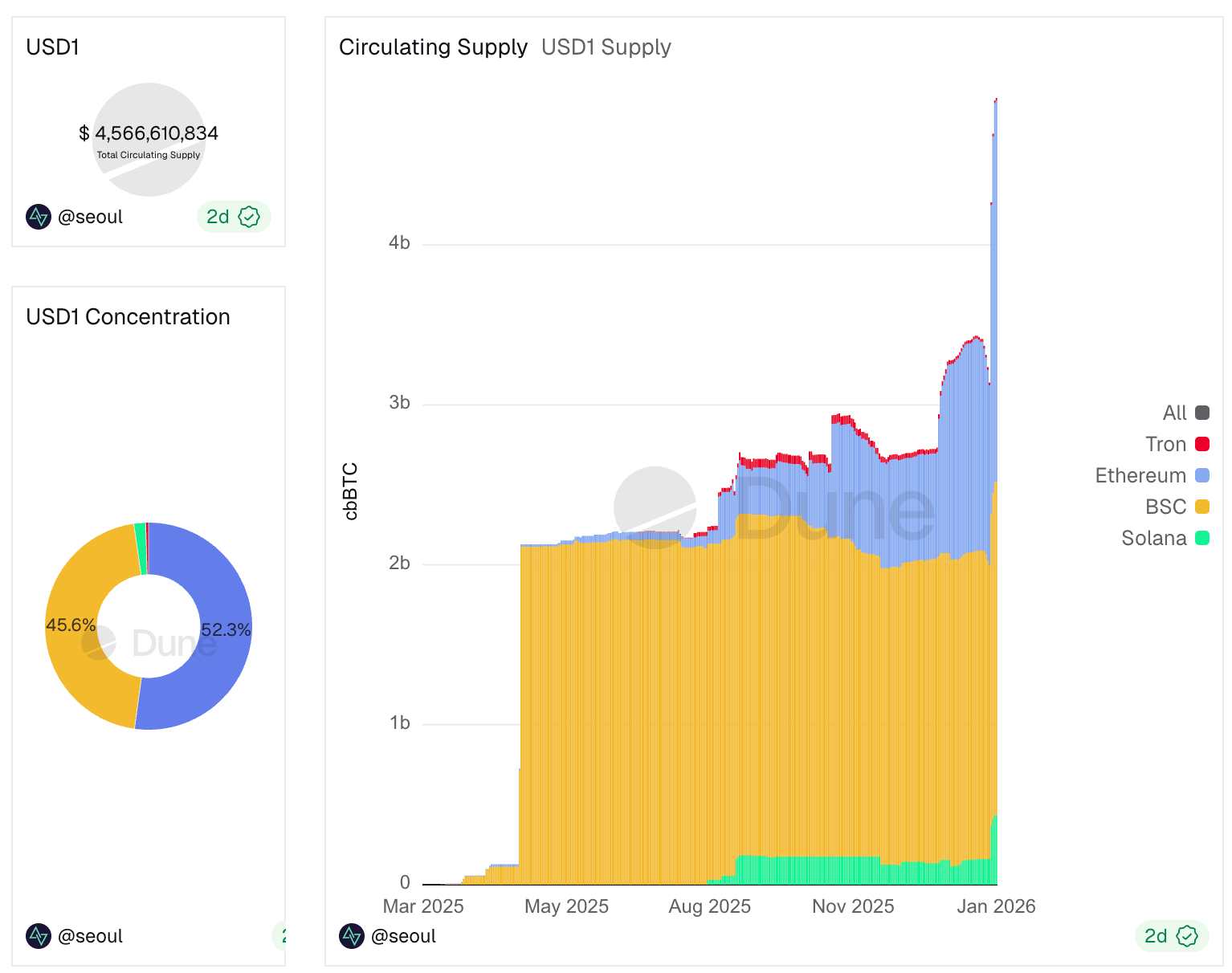

A typical example is that since Binance and USD1 launched a joint subsidy campaign (including the concluded flexible savings and the ongoing airdrop subsidies) on December 24 last year, USD1's supply has grown by over $2 billion, while USDC's supply has shrunk by over $5 billion during the same period — there is likely some correlation in this shift.

A similar scenario could also happen with USAT. As a latecomer stablecoin, if Tether wants to stimulate the growth of its supply, subsidies would obviously be the most efficient measure. As ordinary users, we naturally hope to see major stablecoins engage in an incentive war.

Tether's financial strength is undeniable. In 2025, Tether achieved over ten billion dollars in profit in just three quarters. However, the issue here is that Tether has long been opposed to profit-based subsidies. Tether CEO Paolo Ardoino explicitly expressed disdain last year for the industry's pursuit of interest-bearing stablecoins, bluntly calling it a "bad idea." Therefore, whether Tether will adopt a growth strategy similar to USD1's for USAT in the future remains unknown.

This is the unresolved question for Tether — in the development history of stablecoins, Tether once fully exploited the first-mover advantage with USDT. This time, as a latecomer playing catch-up, Tether's strategy to break through is worth anticipating.