Listed Company U Power Issues RWA on PicWe Platform, Ushering Dynamic Energy Assets into the On-Chain Era

- Core Viewpoint: Nasdaq-listed company U Power is tokenizing dynamic energy assets (revenue rights from charging and swapping stations) by issuing RWA (UCAR), aiming to build a global value network. This provides users traditionally underserved by the financial system with opportunities to participate in high-yield energy projects and explores a new production relationship of "Web3 + Dynamic Energy".

- Key Elements:

- U Power, in collaboration with the PicWe platform, issued RWA (UCAR) on the BNB Chain. The underlying asset is the revenue rights from its charging and swapping stations, with a commitment to inject an annualized return of no less than 16.75% into the base pool.

- PicWe's RWA DEX trading mechanism incorporates downside protection for UCAR. Through a Bonding Curve, it achieves a floor price that only increases, balancing long-term returns with short-term trading.

- This move is a key step in U Power's Web3 strategy, aiming to bring dynamic energy assets on-chain and integrate AI, technology, and Web3 into its business.

- The RWA model lowers the global investment threshold, allowing users in regions with less developed traditional finance to participate in global energy projects and share in growth returns without complex procedures.

- Future ecosystem plans include expanding RWA application scenarios, such as new charging and swapping prepaid cards, allowing users to become "shareholders" sharing profits while consuming.

- U Power recently plans to secure up to $50 million in financing from FTT Holding to accelerate its expansion into the Southern European charging and swapping market.

Nasdaq-listed company U Power, in collaboration with infrastructure platform PicWe (PicWe.org), has completed the compliance process for RWA and issued it on the BNB Chain (RWA Name: UCAR).

As the global penetration rate of new energy continues to rise, the demand for high-frequency, stable, and rapid energy replenishment in the commercial vehicle sector is constantly increasing. Battery swap technology is being widely adopted in scenarios such as taxis, logistics, and public transportation. Leveraging its proprietary UOTTA™ electric vehicle (EV) battery swap technology, U Power has maintained stable operating revenue for many years in China and Southeast Asia. Currently, U Power is establishing a new market in Southern Europe and is expected to secure $50 million in financing from FTT Holding to promote its charging and battery swap infrastructure business in the region.

U Power is issuing RWA with the revenue rights of its charging and battery swap stations as the underlying asset. Based on the investment scale during the IRO (Initial RWA Offering) phase, it will continuously inject funds with an annualized return rate of no less than 16.75% into the UCAR pool. This ensures the rights of UCAR holders under compliant conditions. The RWA DEX trading mechanism pioneered by PicWe empowers UCAR with a built-in downside protection mechanism. Through the Bonding Curve, it achieves a floor price that only increases, ensuring stable returns for long-term investors while also meeting the trading needs of short-term speculators.

This collaboration with PicWe to complete the RWA issuance marks a significant step for U Power in advancing its Web3.0 strategy and expanding its battery token and battery pack business. U Power will continue to leverage its technological advantages to provide fast, low-cost, and environmentally friendly energy services to more regions worldwide, while deepening its layout in the Web3 sector. It aims to become an industry pioneer in bringing dynamic energy assets on-chain, achieving a business integration of AI + Technology + Web3.

UCAR Makes Dynamic Energy Assets Liquid for the First Time, Pioneering New Production Relations

"Coase published his paper 'The Nature of the Firm' in 1937. The production relations constructed by modern enterprises are less than a century old."

A scenario where a Vietnamese user invests $30 in a battery swap station project in Southern Europe and earns continuous returns would be considered a fantasy in the traditional financial system. Today, users can achieve this in seconds through RWA. They can participate in the global 24/7 financial system without any currency exchange or settlement costs.

A Nasdaq-listed company issuing RWA represents a fundamental shift in how real-world assets are organized, financed, and circulated in the digital age. IPOs provide liquidity for corporate assets, while RWA enables companies to build a global user value network.

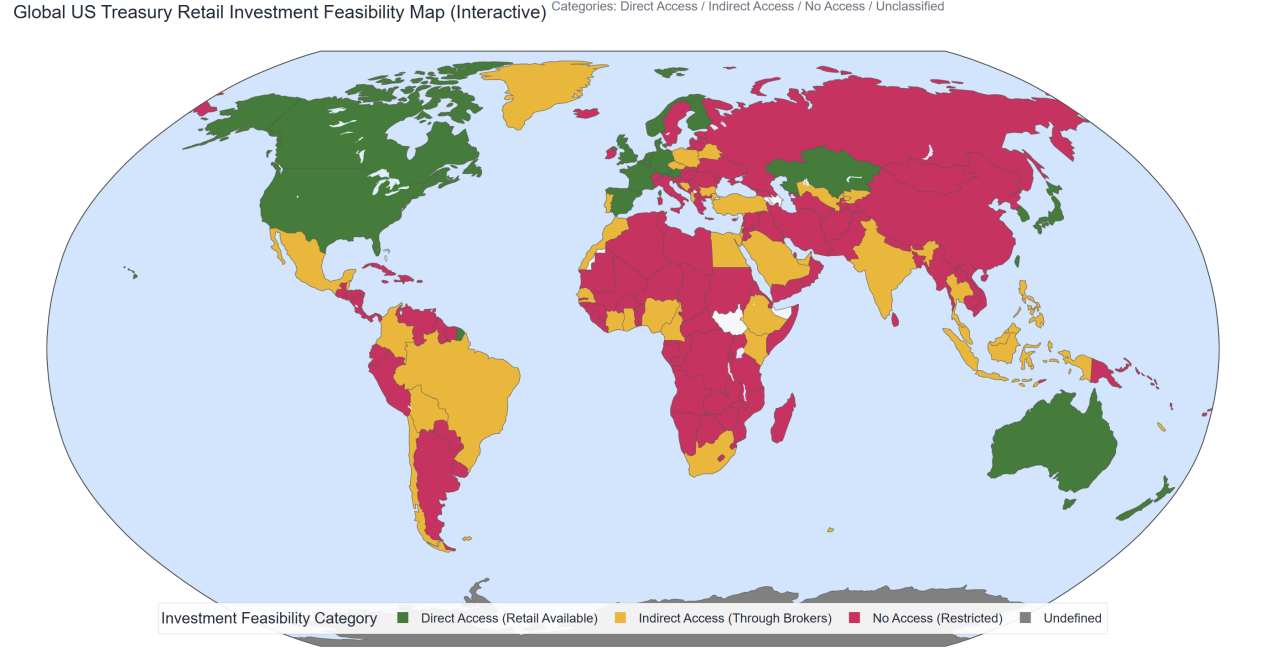

There has always been a significant regional disparity in global financial development. U.S. Treasury bonds, as the largest and most widely covered financial instrument globally, have developed for nearly 200 years, yet 80% of regions still face restrictions on purchasing them today. Stock markets remain independent trading and investment systems scattered across countries, where even the account opening requirements restrict participation for most global users.

Figure: Purchase Restrictions on U.S. Treasury Bonds Across Global Regions

The issuance of UCAR not only provides U Power with an alternative pathway for corporate asset liquidity but also, through RWA, gathers users worldwide who are optimistic about the future of the charging and battery swap business and share a consensus on dynamic energy assets. This forms a complete value network system and is bound to create new production relations through blockchain. Many of these users may have been excluded from the global financial system in the past due to underdeveloped local financial systems. Today, they might still lack bank accounts, but by holding UCAR, they can access high-yield, strongly backed, large-scale world-class energy projects, participate in community co-construction, propose feasible suggestions, and share in the returns from corporate growth.

The Value Network Empowered by UCAR Can Enable More RWA Application Scenarios in the Future

As the value of UCAR grows, more value exchange demands will emerge within the U Power ecosystem in the future. Under compliance with local regulations, RWA can facilitate the value flow of dynamic energy assets in new scenarios, more tightly linking users with U Power's corporate value.

Innovative Scenario: A New Type of RWA Charging/Battery Swap Prepaid Card, Turning Users into Shareholders Instantly

In the past, charging/battery swap prepaid cards could only be used for consumption, creating a one-way service relationship between users and swap stations. Users were not integrated into U Power's value network, and their value was limited to providing feedback.

Through UCAR's on-chain automatic profit distribution mechanism, users can share the profits generated by swap stations or even the entire dynamic energy asset portfolio. By holding a UCAR-powered charging prepaid card, a relationship of co-construction, sharing, and mutual benefit is born between users and the swap stations. In the near future, by establishing a U Power community that fosters Web3 consensus, users will participate in the long-term construction of the U Power value system as if building their own homes.

Of course, it is believed that during the UCAR community building process, more interesting application scenarios combining "Web3 + Dynamic Energy" will be co-created.

Furthermore, U Power's "Power+crypto" model is not limited to RWA issuance. Recently, U Power and crypto fund FTT Holding plan to establish a joint venture, with the latter intending to invest up to $50 million to accelerate the expansion into the Southern European market.

In the future, energy companies will utilize Web3 infrastructure to enable the mutual flow of on-chain assets and real-world dynamic energy assets. This is an inevitable trend in the development of the AI era. As an industry pioneer, U Power has taken the crucial first step.