SUN.io Brand Refresh|Chinese Brand "Sun Wukong" Sets Sail with United Strength, Solidifying the Liquidity Foundation of TRON

- Core Viewpoint: SUN.io, a core project within the TRON ecosystem, has completed its brand and strategic upgrade. Unified under the "Sun Wukong" brand, it integrates four core products to build a comprehensive DeFi value chain covering asset issuance, trading, derivatives, and governance. The goal is to become the core liquidity hub and synergistic network driving the development of the TRON ecosystem.

- Key Elements:

- Brand and Product Integration: Post-upgrade, the "Sun Wukong" brand unifies four major products: SunSwap (DEX), SunX (Perpetual Contracts), SunPump (Asset Issuance), and SUN DAO (Governance), forming an ecosystem community with aligned objectives.

- Core Product Features and Data: SunSwap V3 employs a concentrated liquidity model to enhance capital efficiency; SunX's total trading volume has reached tens of billions of USD; Meme assets incubated by SunPump have successfully launched on Binance's Alpha Zone.

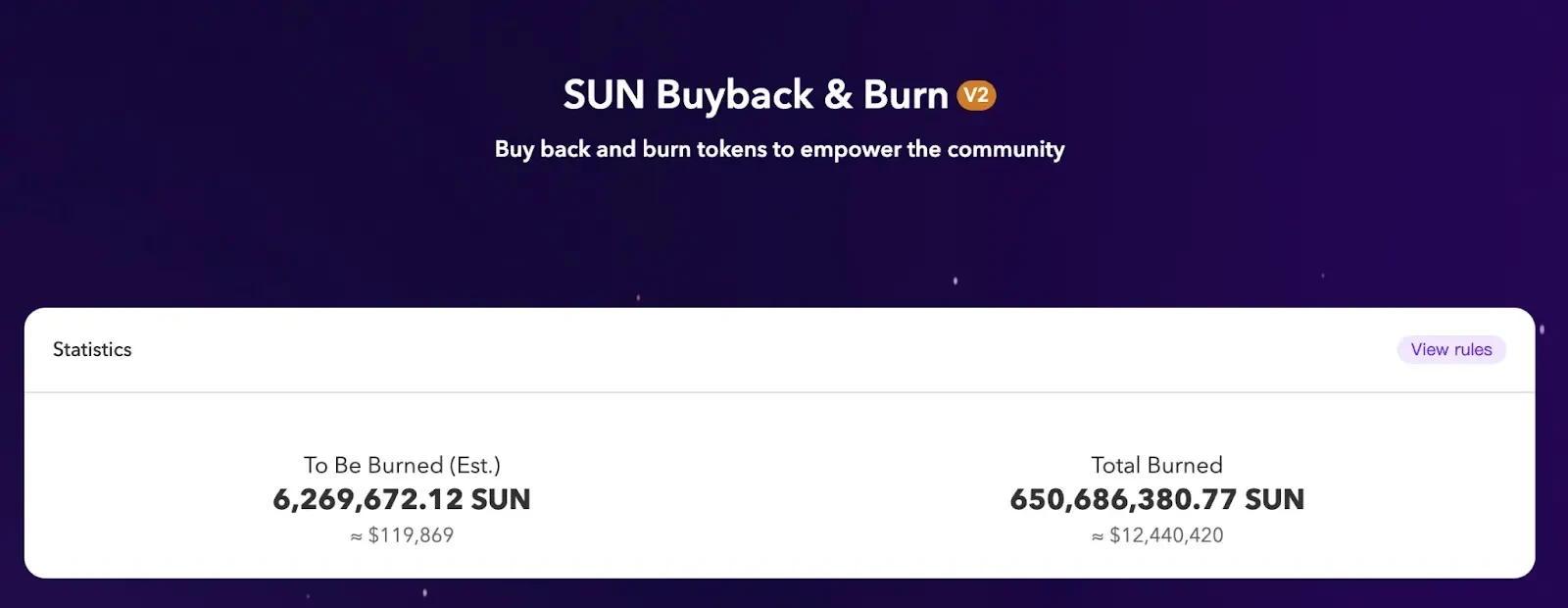

- Value Capture and Deflation Mechanism: SUN DAO implements a revenue buyback and burn mechanism, having cumulatively burned over 650 million SUN tokens, deeply linking ecosystem development with token value.

- Ecosystem Synergy Flywheel: Internally, a value cycle of "SunPump (Issuance) → SunSwap (Spot Trading) → SunX (Derivatives/Advanced Services)" is established, enhanced by the SunAgent AI agent to improve interaction intelligence and efficiency.

- External Ecosystem Collaboration: Deep collaboration with the JUST protocol, building liquidity coupling around the stablecoin USDD, jointly enhancing the resilience and capital efficiency of the TRON DeFi ecosystem.

As decentralized finance (DeFi) enters a new phase of greater maturity, emphasizing ecosystem synergy and capital efficiency, SUN.io, a core project within the TRON ecosystem, has recently completed a comprehensive upgrade. It has launched its Chinese brand "Sun Wukong" (孙悟空), a culturally resonant symbol, to open a new chapter of development.

This upgrade is far more than a simple visual refresh; it represents a profound strategic focus and ecosystem restructuring. Its core objective is to systematically build and strengthen a multi-layered, self-circulating decentralized financial liquidity infrastructure within the TRON network through a complete product matrix.

Based on this, the four core products—SunSwap (Wukong Swap), SunX (Sun Wukong), SUN DAO (Wukong DAO), and SunPump (Wukong Launchpad)—have been systematically integrated and reshaped from independently developed modules. Unified under the powerful brand identity of "Sun Wukong," they now form an ecosystem community with aligned goals. This architecture aims to precisely cover the complete DeFi value chain, from spot trading and risk management to community governance and asset innovation, unlocking the potential value of network effects.

Four Core Pillars: Building a Solid Foundation for the SUN.io Ecosystem

The construction of the SUN.io ecosystem is based on a deep integration of the current DeFi market's full-chain needs, from basic swapping and risk management to community governance and asset innovation. Its four core product pillars collectively form a well-structured and functionally robust financial services network. Its success is reflected not only in the advanced nature of its technical architecture but also in hard metrics such as an active user base, substantial capital deposits, and continuous innovation output.

- SunSwap (Wukong Swap): The Ecosystem's Liquidity Cornerstone and High-Activity Trading Gateway

As a core DEX on the TRON chain that has undergone long-term development and validation, SunSwap is an indispensable liquidity cornerstone and primary trading gateway for the SUN.io ecosystem. Its core function is to build an efficient, low-friction liquidity network and continuously accumulate critical liquidity depth for the ecosystem through sustained incentive models. It serves as the public foundation supporting the stable operation of various financial applications across the entire TRON DeFi ecosystem.

In terms of continuous product innovation, SunSwap's latest V3 version introduces the industry-leading "concentrated liquidity" model, allowing liquidity providers to concentrate their capital within specific price ranges, thereby significantly improving capital efficiency. Simultaneously, its dynamic fee mechanism supports flexible tiers from 0.01% to 1%, allowing optimization for different asset characteristics and market conditions, creating a more attractive and sustainable return model for liquidity providers. Currently, the liquidity for its core assets (such as TRX/USDT) consistently remains above $100 million, providing deep trading depth and price stability for the entire TRON DeFi ecosystem.

- SunX (Sun Wukong): The Derivatives Layer for Professional Risk Management and Capital Efficiency

The decentralized perpetual contracts platform SunX constitutes the ecosystem's risk management and capital derivatives layer, designed to meet market demand for complex financial strategies. The platform provides cryptocurrency perpetual contract trading services, offering users derivative tools for both long and short positions, with leverage options to amplify returns. Its design inherently serves the needs of professional traders for risk hedging (e.g., hedging spot positions with contracts), executing arbitrage (e.g., capturing price differences between spot and futures or across platforms), and trend trading.

Its strategic value lies in the "deep value extraction" of the liquidity deposited within the ecosystem: active derivatives trading on SunX (e.g., hedging, arbitrage) generates significant buying and selling demand for the underlying spot assets. This demand directly feeds back to SunSwap, further enhancing the depth and trading volume of the spot market. This two-way empowerment mechanism elevates the capital utilization efficiency of the TRON ecosystem from the spot level to the derivatives level, attracting professional groups seeking higher capital efficiency and strategic flexibility, thereby enhancing the overall financial maturity and appeal of the ecosystem.

Since its launch, SunX's total trading volume has steadily grown, now reaching tens of billions of dollars. The platform supports spot and contract trading for mainstream digital assets like Bitcoin (BTC) and Ethereum (ETH), offering deep liquidity and tight bid-ask spreads, enabling smooth execution even for large-volume trades. This robust market activity directly positions SunX among the industry leaders.

- SunPump (Wukong Launchpad): The Value Discovery Engine and Ecosystem Growth Source for Innovative Assets

SunPump is positioned as the ecosystem's innovation engine and value discovery layer, focusing on providing low-barrier issuance and launch support for early-stage projects within the TRON ecosystem, especially community-driven assets like Meme coins. Its core innovation is the launch of SunGenX, an AI-powered token launch agent based on the X platform. This tool, through a revolutionary and extremely simplified process, allows users to launch tokens with one click in a nearly barrier-free manner, greatly stimulating community creative potential and returning the initiative for asset issuance to the market itself.

The value of SunPump lies not only in creating market buzz but also in screening and injecting fresh blood into the entire ecosystem: successfully launched projects are listed for trading on SunSwap, bringing new trading activity, community attention, and incremental capital to the DEX. Currently, popular Meme assets SUNGOG and PePe, incubated by SunPump, have successfully listed on Binance's Alpha Zone based on their outstanding community traction and liquidity. This not only validates the success of individual projects but also fully demonstrates SunPump's role as TRON's core "innovation testbed"—its keen sense, explosive potential, and its function as a key pipeline delivering top-tier assets to the broader ecosystem.

- SUN DAO (Wukong DAO): The Transparent Governance and Coordination Layer Based on Value Feedback

SUN DAO is the core governance and coordination layer driving the evolutionary direction of the ecosystem. Its effectiveness is built upon a transparent value feedback mechanism. It establishes an on-chain governance framework based on the SUN governance token, granting holders proposal and voting rights on key matters such as protocol parameters and asset allocation.

The credibility of this governance model is strengthened by a continuous and verifiable token economic model. Currently, the SUN.io ecosystem has established a mature revenue buyback-and-burn mechanism through SUN DAO. A portion of SunSwap V2's trading fees, along with all revenue from the SunPump and SunX platforms, are explicitly used to repurchase SUN tokens on the open market and transfer them to a burn address.

As of January 16th, over 650 million SUN tokens have been cumulatively burned through this mechanism. This deflationary model, which deeply binds platform development with token holder interests, not only injects long-term value support into the SUN token but also tangibly embodies the principles of community co-governance and shared benefits with real capital. It is a key institutional safeguard for the ecosystem's antifragility and sustainable development.

Ecosystem Synergy: SUN.io's Value Cycle and Growth Flywheel

The strategic sophistication of the SUN.io ecosystem lies not only in its comprehensive product lineup but also in its construction of a powerful internal synergy and external linkage network through meticulous mechanism design. Its core goal is to become the central liquidity hub driving the development of the TRON blockchain.

Within the ecosystem, SunPump, SunSwap, and SunX are the three core protocols driving SUN.io's prosperity. Deeply integrated with the ecosystem's SunAgent AI agent, they collectively weave a value network covering the entire asset lifecycle. This system not only achieves seamless internal business flow but, more profoundly, integrates users, developers, and capital into a continuously growing and evolving growth flywheel.

SunPump is the ecosystem's innovation engine and asset source. As a low-barrier asset issuance gateway, it greatly activates community creativity, continuously incubating and delivering new crypto assets and market attention to the entire TRON ecosystem. These nascent assets bring the initial liquidity and trading demand.

Next, SunSwap, as the ecosystem's liquidity core and value exchange hub, receives and amplifies this value. It hosts core assets from SunPump and the broader ecosystem, providing highly capital-efficient trading pools for new assets. This design not only provides necessary liquidity depth and smooth trading experience for assets but also effectively converts market attention into real trading volume and protocol fee revenue.

Building on this solid foundation, SunX further plays the role of expanding ecosystem value and extending its boundaries. Beyond basic issuance and trading functions, SunX extends the ecosystem's reach to other blockchain networks through advanced services like cross-chain swaps. This not only attracts assets and users from external chains but also meets the needs of professional traders for deeper financial tools like derivatives. Ultimately, in synergy with SunPump and SunSwap, it completes the full business cycle from "asset issuance" to "spot trading" to "advanced financial services."

As the intelligent hub empowering and connecting this complete cycle, the SunAgent AI agent is reshaping the ecosystem's interaction paradigm and efficiency boundaries. The upgrade of SunAgent marks a key evolution of the ecosystem from basic automation to proactive intelligence. It can understand user needs in natural language and automatically execute complex multi-step DeFi operations (such as optimal combinations of farming, swapping, and staking across various protocols), significantly lowering the barrier to user participation and improving capital efficiency.

Finally, the SUN.io ecosystem, through a continuous and transparent buyback-and-burn mechanism, directly converts the momentum of protocol growth into a solid foundation for the long-term value of the SUN token. This establishes a clear value transmission path: the higher the ecosystem's business revenue, the more capital available for buyback and burn, and the more significant the deflation of SUN in the market. It ensures that the fruits of ecosystem development are shared by all token holders, not just retained at the protocol level. As the total ecosystem trading volume and business scale continue to expand, this mechanism will continuously strengthen the scarcity of the SUN token, thereby constantly reinforcing the value foundation of its tokenomics. This provides the most fundamental driving force and guarantee for SUN.io's entire value cycle and community confidence.

In summary, the SUN.io ecosystem has constructed a complete ecosystem where the protocol layer provides closed-loop services, AI enhances interaction intelligence, governance ensures community co-governance, and a deflationary model captures value. It is not only a key liquidity hub on TRON but also represents the evolution towards a self-driven, intelligently synergistic, and community-owned next-generation DeFi paradigm.

Importantly, the efficacy of this internal cycle is further amplified through external collaboration with TRON's core DeFi protocols. The synergy between SUN.io and JUST is particularly crucial, as they have built deep liquidity coupling around USDD. Users can collateralize assets in USDD 2.0 to mint USDD and earn basic yields, then deposit the USDD into SUN.io's stablecoin pools for liquidity mining to earn additional incentives.

This process not only provides a clear yield application scenario for USDD minting but also brings continuous, stable, high-quality liquidity to SUN.io. Meanwhile, SUN.io's PSM (Peg Stability Module) ensures a stable 1:1 exchange capability between USDD and other stablecoins, fundamentally enhancing user confidence in using and holding USDD and solidifying its role as a cornerstone currency within the TRON DeFi ecosystem.

This cross-protocol collaboration enables seamless flow of capital, users, and yields between JUST and SUN.io, thereby constructing a more resilient, efficient, and credible decentralized financial closed loop within the TRON ecosystem.

In conclusion, through its sophisticated internal synergy design and open external linkage network, SUN.io has successfully integrated asset issuance, trading, stabilization, and value capture. It has not only become a central hub aggregating users and capital but also, through collaboration with protocols like JUST, jointly drives the continuous improvement of liquidity depth, innovation vitality, and overall competitiveness of the TRON DeFi ecosystem. This is not only the source of power for the continuous acceleration of its own growth flywheel but also provides a scalable and sustainable DeFi ecosystem development model for TRON and the broader blockchain world.