Panoramic Interpretation of the Restaking Sector: Opportunities, Risks, and Restructuring

- Core Viewpoint: The restaking sector has transitioned from rapid growth to a phase of structural adjustment, facing core challenges such as shrinking demand for shared security, security dilution, power centralization, and growth bottlenecks. Leading projects are seeking breakthroughs by pivoting towards diversified directions like AI and cloud computing.

- Key Elements:

- The sector's total TVL is approximately $20.4 billion, but growth has stalled. EigenCloud, with a TVL of $13.9 billion, holds a 68% market share, indicating a highly concentrated landscape.

- Core risks include: contraction in demand for shared security markets; the same staked assets being leveraged multiple times, diluting the security margin; and validation power being concentrated among a few leading platforms and nodes.

- Leading projects are actively transforming. For example, EigenCloud rebranded and pivoted towards AI and cloud computing infrastructure, while EtherFi expanded into real-world payment scenarios to break free from dependence on a single staking narrative.

- The yield aggregation layer (e.g., Pendle) enhances capital efficiency through financialization but also extends the risk chain, making yields more dependent on market cycles and incentive structures.

- Although the Actively Validated Services (AVS) layer absorbs a significant amount of restaked assets, its slashing mechanisms and commercial closed-loop are still in early stages. The genuine security demand and willingness to pay remain to be validated.

Key Takeaways

The essence of restaking is to abstract the economic security of the underlying blockchain into a shareable resource, enabling multiple networks or modular infrastructures to share the security guarantees of the main chain without building their own validator sets. This mechanism significantly reduces new protocols' reliance on independent security mechanisms in their early stages, thereby accelerating cold starts and trust accumulation. Restaking initially underwent proof-of-concept and early deployment primarily within the Ethereum ecosystem. However, Ethereum, as a single network, has certain limitations on its reusable security resources. Consequently, more emerging projects are beginning to seek ways to break free from the constraints of a single-chain structure on restaking, exploring new paths such as cross-chain validation.

Currently, the top three projects by Total Value Locked (TVL) in the restaking sector are: EigenCloud, deployed on the Ethereum mainnet, holding an absolute leading position with approximately $13.86 billion in locked value; followed by Babylon, which focuses on the Bitcoin network, with a total TVL of $5.549 billion; and Symbiotic, also based on Ethereum, with a total TVL of $565 million, focusing on a modular restaking structure.

This report categorizes the core participants in the restaking sector along three main lines: the infrastructure layer, the yield aggregation layer, and the actively validated services (AVS) layer. While the infrastructure layer has established a security foundation worth tens of billions of dollars, it generally faces bottlenecks in TVL growth and is pivoting towards diversified dimensions like AI. The yield aggregation layer lowers the barrier to entry for users and enhances capital efficiency, but it simultaneously lengthens the risk chain, making capital more dependent on market cycles and incentive structures. Although the AVS layer has absorbed a large amount of restaked assets on paper, its slashing constraints and commercial closed loops are still in the early stages of validation.

While the restaking system enhances capital efficiency and security supply, it also exposes a series of risks. The overall market demand for shared security is contracting, with limited new growth space. The same staked assets are reused multiple times, which, while improving capital efficiency, also dilutes the security margin. Validation resources are highly concentrated in a few leading platforms and nodes, increasing the risk coefficient. The restaking ecosystem lacks a unified risk isolation and pricing mechanism. Furthermore, the withdrawal period for underlying assets is relatively long, while the upper layers are highly liquid and layered with multiple yield sources, making the restaking system more prone to amplifying risks during market volatility or loss of trust.

The restaking sector is currently in a phase of structural adjustment following the retreat of the initial hype. Power concentration, layered risk stacking, and limited TVL growth have become unavoidable real-world constraints. Leading projects represented by EigenCloud are actively seeking change, attempting to reshape their positioning within the infrastructure layer by introducing cross-border directions like AI computing resources to reduce reliance on the single staking narrative.

Whether restaking can complete its reconstruction may hinge on its ability to establish predictable, priceable security and yield benchmarks on-chain and transform this security capability into a form of credit that traditional capital can accept through compliance and RWA. If this condition cannot be met, its influence may struggle to expand into the broader financial system. Overall, the restaking sector is attempting to move away from the singular narrative of a "risk nesting doll" and shift towards a more deterministic infrastructure role. Although this transformation faces dual challenges of technical complexity and regulatory uncertainty, its systematic reconstruction of the on-chain credit system will remain a crucial dimension for observing the development of the digital asset ecosystem in the next phase.

Table of Contents

Key Takeaways

I. Development and Current State of the Restaking Sector

1. The Evolution of the Restaking Sector

2. The Multi-Chain Expansion of the Restaking Sector

3. Centralization Phenomena in the Restaking Sector

II. Core Participants in the Restaking Sector

1. Restaking Infrastructure Layer

2. Restaking Yield Aggregation Layer

3. Restaking Actively Validated Services (AVS) Layer

III. Vulnerabilities and Risk Points in the Restaking System

1. Risk of Insufficient Shared Security Demand

2. Risk of Security Dilution Under Capital Leverage

3. Risk of High Trust Concentration

4. Fragile Liquidation Chains and Negative Feedback

5. Liquidity Mismatch and Yield Volatility Risk

IV. Conclusion

V. References

On-chain yield mechanisms are gaining more policy attention at the regulatory level. Although not yet a primary regulatory focus, their potential economic impact and structural innovation value are gradually entering compliance discussions. In April 2025, Paul Atkins assumed the role of the new Chairman of the U.S. Securities and Exchange Commission (SEC). Shortly after taking office, he initiated a series of roundtable discussions titled "DeFi and the American Spirit."

During the fifth meeting held on June 9, 2025, regulators expressed a relatively open attitude towards DeFi for the first time. Concurrently, the enactment of the *GENUS Act* established a clear and unified legal framework for stablecoin issuance, custody, and on-chain usage. The overall regulatory stance is becoming more rational and constructive, releasing positive policy signals for on-chain financial innovation. Meanwhile, regulatory easing is expected to continue in 2026, bringing more possibilities for DeFi.

Against this backdrop, the restaking mechanism, as one of the development directions of the on-chain yield system, has also attracted market attention regarding its compliance and structural design. This mechanism, by reutilizing native staked assets, provides additional security service support and yield compounding capabilities for protocols without altering the underlying consensus logic.

This report posits that a systematic analysis of the current mainstream restaking protocols helps clarify their positioning within the on-chain yield system, identify risk exposures in protocol structures, and provide an analytical foundation for future capital efficiency optimization and cross-protocol collaboration. In the following sections, this report will focus on an in-depth exploration of leading protocols in the restaking infrastructure layer, the restaking yield aggregation layer, and the restaking actively validated services (AVS) layer.

I. Development and Current State of the Restaking Sector

1. The Evolution of the Restaking Sector

Staking, as a fundamental means of securing on-chain security in Proof-of-Stake (PoS) consensus mechanisms, has evolved through multiple stages: from initial native staking to liquid staking, and then to restaking. In the native staking phase, users directly lock assets in the underlying consensus protocol to obtain validator status and block rewards, securing the network. However, this leads to low capital efficiency as assets are completely locked, with staked assets lacking liquidity and composability, limiting their value release.

Subsequently, Liquid Staking Derivatives (LSD) emerged. Users receive liquid staking tokens, such as stETH, rETH, etc., based on their staked assets. These tokens can participate in trading, lending, and liquidity provision within the DeFi ecosystem, significantly enhancing asset utilization efficiency and user returns. However, while liquid staking improves the liquidity and DeFi composability of staked assets, the security of the underlying staked assets remains limited, failing to achieve cross-protocol security sharing and expansion.

The restaking mechanism, as an innovation in the staking sector, breaks through this limitation. It allows users to programmatically leverage the security of natively staked or liquid staked assets, re-empowering other protocols or networks to support actively validated services, thereby earning additional incentives beyond the original staking rewards. The essence of restaking is to abstract the economic security of the underlying blockchain into a shareable resource, enabling multiple networks or modular infrastructures to share the security guarantees of the main chain without building their own validator sets.

This mechanism significantly reduces new protocols' reliance on independent security mechanisms in their early stages, thereby accelerating their cold start and trust accumulation. It provides developers with an open architecture to invoke shared validation capabilities without building their own consensus mechanisms, forming a security-as-a-service market. Among these, Liquid Restaking is an important branch of the restaking mechanism. It packages restaked assets into liquid derivative tokens, allowing users to enjoy restaking yields while flexibly utilizing these tokens in DeFi, achieving multi-layered yield compounding.

2. The Multi-Chain Expansion of the Restaking Sector

The restaking mechanism first achieved scaled application within the Ethereum ecosystem. Its rapid development relies on three key elements: a modular on-chain architecture, sufficient liquid staking assets (LST), and an active validator network. However, Ethereum, as a single network, has certain limitations on its reusable security resources. Emerging projects are beginning to seek ways to break free from the constraints of a single-chain structure on restaking, exploring new paths such as more asset collateralization.

Simultaneously, another category of projects chooses to build native restaking systems starting from non-Ethereum ecosystems. A typical example is Babylon, which proposes a staking mechanism design around the Bitcoin ecosystem that does not require modifying the Bitcoin mainchain, offering Bitcoin security-as-a-service to other chains. Overall, the restaking ecosystem is evolving from an Ethereum-centric single-chain system towards a multi-chain integrated structure.

3. Centralization Phenomena in the Restaking Sector

Currently, the restaking sector is primarily concentrated within the Ethereum ecosystem. The core reason is the leading project, EigenCloud, which has been architected and deployed based on Ethereum since its inception. According to data from DefiLlama, the total TVL of the restaking sector is currently $20.376 billion. Among this, EigenCloud's total value locked (TVL) is $13.86 billion, ranking first in the restaking sector, accounting for 68% of the total.

Source:defillama,https://defillama.com/protocols/restaking

Based on the current total TVL ranking in the restaking sector, the top three projects are: EigenCloud, deployed on the Ethereum mainnet, holding an absolute leading position with approximately $13.86 billion in locked value; followed by Babylon Protocol, which focuses on the Bitcoin network, with a total TVL of $5.549 billion; and Symbiotic, also based on Ethereum, with a total TVL of $565 million, focusing on a modular restaking structure.

II. Core Participants in the Restaking Sector

In the following sections, this report will conduct a systematic analysis of the core projects in the current restaking sector from the perspectives of the infrastructure layer, the yield aggregation layer, and the actively validated services (AVS) layer. This analysis will cover leading protocols across multiple on-chain ecosystems including Ethereum, Solana, Bitcoin, and Sui, delving into their business models, staking models, staking data, and more. Additionally, this report will examine market acceptance and the current status of these projects, aiming to present a comprehensive picture of the highly dynamic restaking sector.

1. Restaking Infrastructure Layer

The restaking infrastructure layer is the cornerstone of the entire restaking ecosystem. The primary function of the infrastructure layer is to allow users to re-utilize already staked assets (such as ETH or LSTs) for securing multiple networks or applications, thereby enhancing capital efficiency and network security. These infrastructures not only support restaking platforms and applications but also enhance the scalability and interoperability of the blockchain ecosystem by allowing them to create customized staking and security models. Below, this report will focus on the main projects in the restaking infrastructure layer: EigenCloud, Symbiotic, and Babylon.

1.1 Representative Projects in the Infrastructure Layer

1.1.1 EigenCloud (formerly EigenLayer)

EigenCloud was originally named EigenLayer. It underwent a product upgrade in June 2025, with the protocol name changing to EigenCloud. Concurrently, the renowned institution a16z invested an additional $70 million into EigenLabs to promote the research, development, and promotion of EigenCloud. EigenCloud positions itself as an AI infrastructure platform for verifiable applications and services. After the rebranding, its goal is to build a Web3-native cloud service platform that combines the flexibility of cloud computing with the verifiability of blockchain, and it has recently integrated with the x402 sector. Measures like the renaming of EigenCloud also indicate the platform's active search for strategic transformation directions.

In this report, we will first focus on EigenCloud's role within the restaking system. EigenCloud was the earliest protocol to propose the concept of restaking within the Ethereum ecosystem. Its core idea is to re-utilize ETH already staked on the Ethereum consensus layer (or via liquid staking derivatives like LSTs) for securing other middleware and infrastructure, thereby extending Ethereum's economic security across protocols.

Actively Validated Services (AVS) is the core architectural design proposed by EigenCloud, aiming to modularize and open up Ethereum's economic security capabilities. Under the AVS architecture, external protocols or validation-type services can obtain security guarantees approaching the level of the Ethereum mainnet by reusing restaked assets and validator sets, without needing to independently build complete consensus and economic security mechanisms.

EigenCloud aggregates validator resources and restaked assets to provide unified security access and operational capabilities for multiple AVS, forming a platform-based market for on-demand security purchasing within the AVS ecosystem. Simultaneously, to ensure stable operation and prevent short-term arbitrage behavior, EigenCloud imposes a 14-day custodial period for asset withdrawals.

Business Model

EigenCloud has established a security services market connecting stakers, Actively Validated Services (AVS), and application chains by introducing the restaking mechanism. The specific operational flow of its business model is as follows:

Stakers re-stake Ethereum or LSDs (like stETH, rETH) into EigenCloud;

These assets are allocated to AVS to provide validation and security guarantees for external protocols and infrastructure services;

The relevant protocols or service providers pay fees for the security obtained. The fees are typically distributed approximately 90% to stakers, approximately 5% to AVS node operators, and approximately 5% is collected by the EigenCloud protocol as platform revenue.

Staking Model

EigenCloud introduces a flexible restaking mechanism that supports not only native staked assets but also extends to various derivative assets, enabling more on-chain capital to efficiently participate in the validation and security provision process. The specific methods include:

Native Restaking: Users can directly transfer their natively staked ETH on the Ethereum mainnet into EigenCloud for restaking. This is the most direct, native staking path, bypassing the DeFi layer, offering higher security but lower flexibility.

LST Restaking: Deposit LSTs (like stETH, rETH) obtained through liquid staking protocols, such as Lido, into EigenCloud for restaking. This staking model introduces the DeFi layer as an intermediary, achieving a combination of liquidity and restaking yield, balancing flexibility and profitability.

ETH LP Restaking: LP Tokens obtained by users providing ETH liquidity in DeFi protocols can also be used for restaking on EigenCloud. This staking model leverages DeFi derivative assets composed of ETH for restaking, unlocking the additional value of LP assets.

LSD LP Restaking: LP Tokens based on LSD assets, such as Curve's stETH-ETH LP Token, can also be restaked on EigenCloud. This method represents the most complex yield stacking path, integrating the yield structures of Ethereum mainnet staking, DeFi liquidity provision, and EigenCloud restaking.

Staking Data

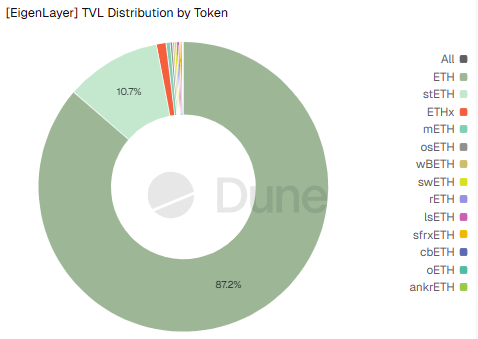

As of the time of writing, EigenCloud's total TVL is $13.86 billion, with 8,465,305 ETH restaked, and 82 AVS integrated. Currently, within EigenCloud's restaking market share, native restaking (i.e., using ETH for restaking) accounts for 87.2% of the market share, while other assets constitute only 12.8%.

Source:Dune,https://dune.com/hahahash/eigenlayer

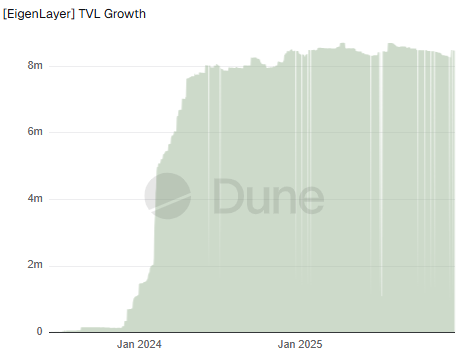

A more detailed observation point is the growth trend of the total value locked (TVL) in ETH for native restaking on EigenCloud, as shown in the chart below. From January to June 2024, EigenCloud experienced explosive growth. After that, its total TVL in ETH (i.e., the largest component, native restaking) has remained fluctuating within the range of $800 million, with no significant new inflows in the later period.

Source:Dune,https://dune.com/hahahash/eigenlayer

<