CoinW Research Weekly Report (Issue: Jan 12, 2026 - Jan 18, 2026)

- Core View: The cryptocurrency market exhibited a moderate growth trend overall this week. The total market cap, total value locked (TVL) in DeFi, and the market cap of major stablecoins all increased. However, key metrics such as on-chain activity and trading volume across major public chains showed divergent performances, indicating capital flows and competition between different ecosystems.

- Key Highlights:

- Overall market indicators improved: The global cryptocurrency market cap grew by 0.94% to $3.22 trillion, the total DeFi TVL increased by 5.08% to $130.2 billion, and the total stablecoin market cap rose by 1.9% to $314 billion.

- Divergent performance among mainstream public chains: BNB Chain's daily DEX trading volume surged by 54.15%, while Sui's plummeted by 50.7%; Sui's daily active addresses soared by 69.7%, whereas Aptos's dropped by 37%.

- Sustained ETF inflows: U.S. spot Bitcoin and Ethereum ETFs recorded net inflows of $1.42 billion and $479 million respectively this week, indicating continued institutional capital entry.

- New projects focus on AI and SocialFi: Innovative projects such as Bluff (AI-driven prediction market), Pumex (automated strategy DEX), and Liqfid (SocialFi liquidity layer) emerged, exploring new directions like narrative trading, automated market making, and social asset tokenization.

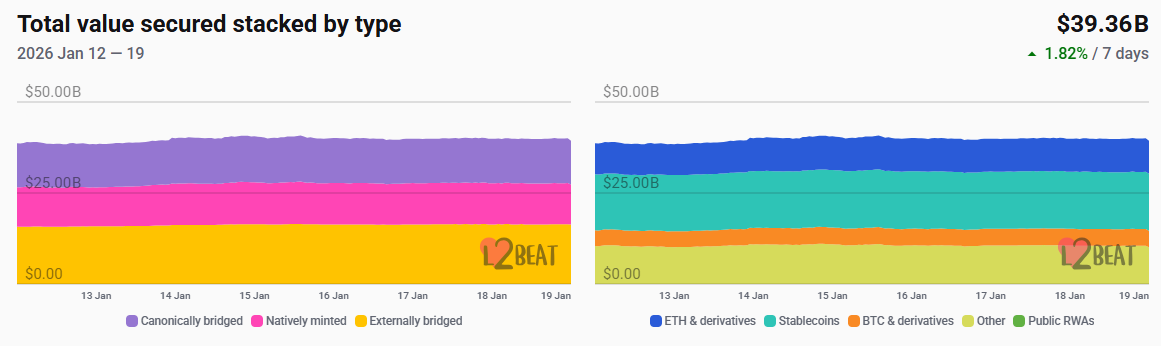

- Stable Layer 2 landscape: The total TVL of Ethereum Layer 2 solutions grew by 1.82% to $39.36 billion, with Base and Arbitrum continuing to dominate the market share.

Key Takeaways

The total global cryptocurrency market capitalization is $3.22 trillion, up approximately 0.94% this week from $3.19 trillion last week. As of press time, the cumulative total net inflow for U.S. Bitcoin spot ETFs is approximately $57.82 billion, with a weekly net inflow of $1.42 billion; the cumulative total net inflow for U.S. Ethereum spot ETFs is approximately $12.91 billion, with a weekly net inflow of $479 million.

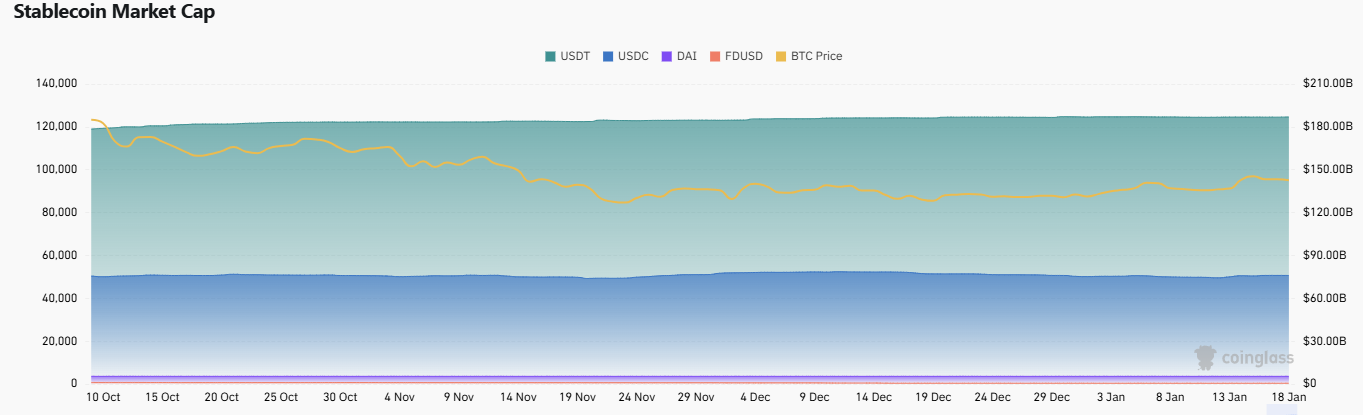

The total stablecoin market capitalization is $314 billion, up 1.9% from $308.1 billion last week. Among them, USDT's market cap is $186.9 billion, accounting for 59.5% of the total stablecoin market cap, up slightly by about 0.2% from $186.6 billion last week. USDC follows with a market cap of $76 billion, accounting for 24.2% of the total stablecoin market cap, up about 1.9% from $74.6 billion last week. DAI's market cap is $5.36 billion, accounting for 1.7% of the total stablecoin market cap, remaining flat compared to last week.

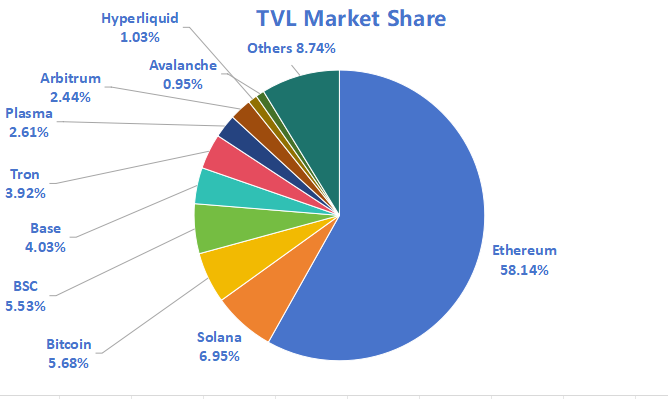

According to data from DeFiLlama, the total DeFi TVL this week is $130.2 billion, up approximately 5.08% from $123.9 billion last week. Segmented by public chain, the three chains with the highest TVL are Ethereum, accounting for 58.14%; Solana, accounting for 6.95%; and Bitcoin, accounting for 5.68%.

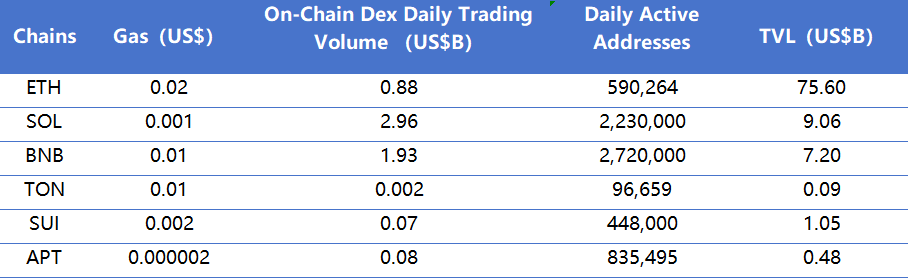

Regarding weekly on-chain DEX daily trading volume, BNB Chain saw the most significant increase, rising from $1.252 billion to $1.93 billion, up about 54.15%; Ethereum increased from $650 million to $880 million, up about 35.38%; Solana increased from $2.587 billion to $2.96 billion, up about 14.42%. Aptos saw a slight recovery to $80 million, up about 9.8%; TON remained at a low level of $2 million; Sui declined significantly, dropping from $142 million to $70 million, down about 50.7%. In terms of transaction fees, overall Gas levels saw limited changes. Ethereum increased from $0.01 to $0.02; Solana and Sui decreased to $0.001 and $0.002, respectively; BNB Chain, TON, and Aptos remained largely flat compared to last week.

In terms of weekly daily active addresses, Sui showed the most prominent growth, rising to 448,000, up about 69.7% from 264,000 last week; BNB Chain increased from 2.35 million to 2.72 million, up about 15.74%. In contrast, Ethereum fell to 590,000, down about 8%; Solana dropped to 2.23 million, down about 17.4%; TON fell to 97,000, down about 10.9%; Aptos saw a larger decline, dropping to 835,000, down about 37%. Regarding TVL, most public chains maintained moderate growth. Ethereum rose to $75.6 billion, up about 5%; BNB Chain increased to $7.2 billion, up about 4.5%; TON rose to $90 million, up about 4.7%; Solana increased to $9.06 billion, up about 1.3%; Sui remained largely stable at $1.05 billion; Aptos grew to $480 million, up about 9.1%.

New Projects to Watch: Bluff is an AI-driven prediction market project, with its core positioning being to allow users to place bets and engage in games around narratives people genuinely care about. Pumex focuses on reconstructing the traditional DEX's heavy reliance on manual operations by LPs and traders through automated and intelligent trading and liquidity management mechanisms. Liqfid is a social finance liquidity layer built on the Base ecosystem. Its core innovation lies in transforming users' social identities into yield-generating on-chain assets based on the Farcaster social protocol.

Table of Contents

Key Takeaways

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Dominance

2. Fear & Greed Index

3. ETF Inflow/Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

6. On-Chain Data

7. Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

1. Top 5 Weekly Gainers: VC Coins and Meme Coins

2. New Project Insights

III. Industry Developments

1. Major Industry Events This Week

2. Upcoming Major Events Next Week

3. Important Fundraising Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Dominance

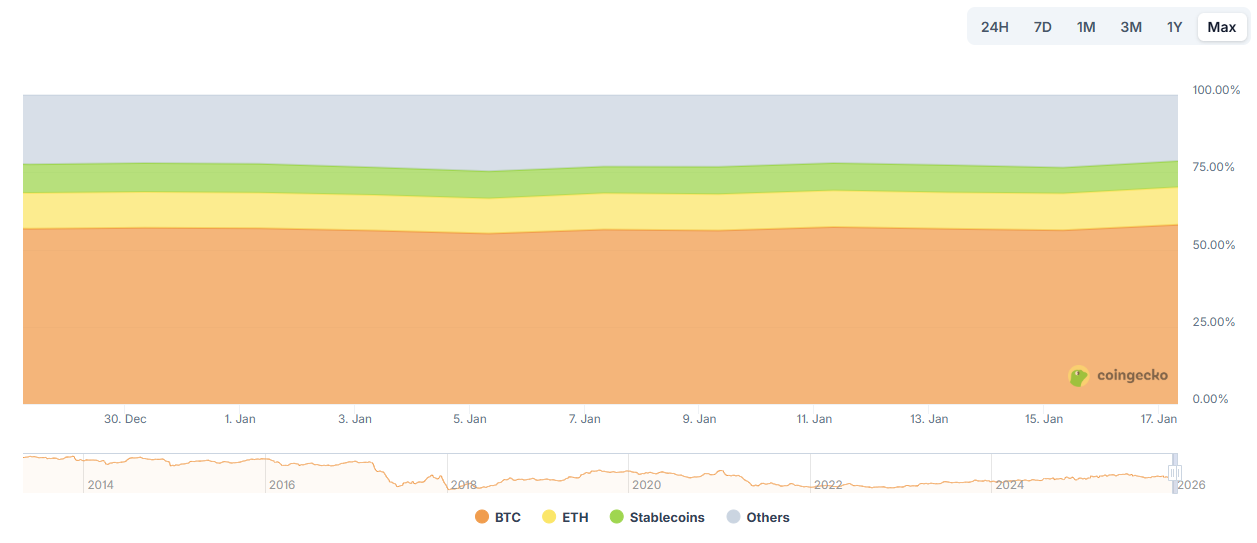

The total global cryptocurrency market capitalization is $3.22 trillion, up approximately 0.94% this week from $3.19 trillion last week.

Data Source: Cryptorank,https://cryptorank.io/charts/btc-dominance

Data as of January 18, 2026

As of press time, Bitcoin's market capitalization is $1.85 trillion, accounting for 57.54% of the total cryptocurrency market cap. Meanwhile, the stablecoin market cap is $314 billion, accounting for 9.77% of the total cryptocurrency market cap.

Data Source: Coingecko,https://www.coingecko.com/en/charts

Data as of January 18, 2026

2. Fear & Greed Index

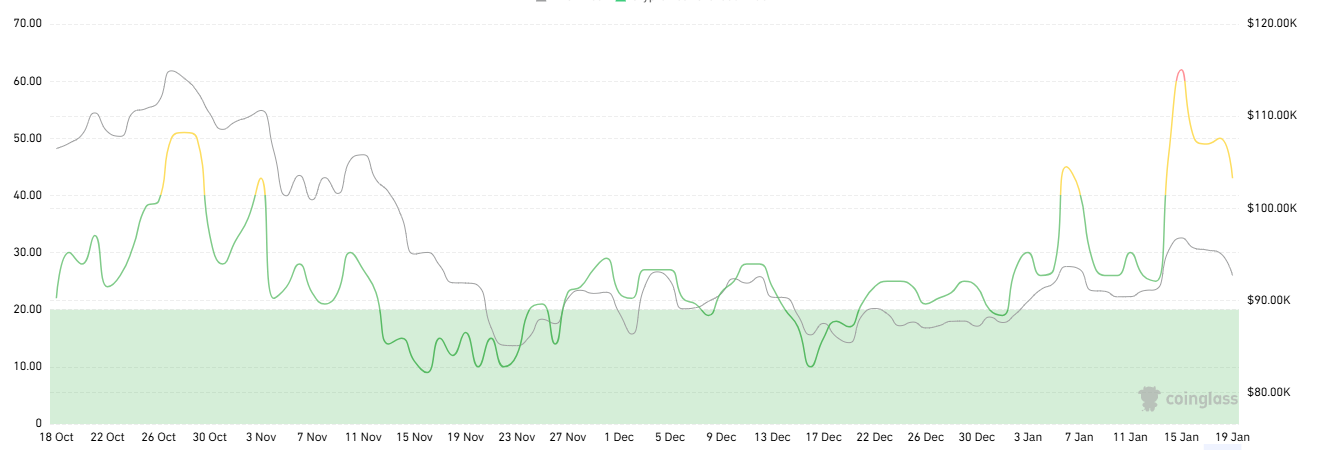

The Crypto Fear & Greed Index is 43, indicating Neutral sentiment.

Data Source: Coinglass,https://www.coinglass.com/pro/i/FearGreedIndex

Data as of January 18, 2026

3. ETF Inflow/Outflow Data

As of press time, the cumulative total net inflow for U.S. Bitcoin spot ETFs is approximately $57.82 billion, with a weekly net inflow of $1.42 billion; the cumulative total net inflow for U.S. Ethereum spot ETFs is approximately $12.91 billion, with a weekly net inflow of $479 million.

Data Source: Sosovalue,https://sosovalue.com/assets/etf

Data as of January 18, 2026

4. ETH/BTC and ETH/USD Exchange Rates

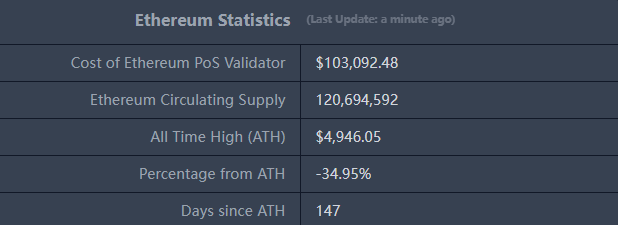

ETHUSD: Current price $3,220, all-time high $4,946.05, down approximately 34.95% from ATH.

ETHBTC: Currently 0.034653, all-time high 0.1238.

Data Source: Ratiogang,https://ratiogang.com/

Data as of January 18, 2026

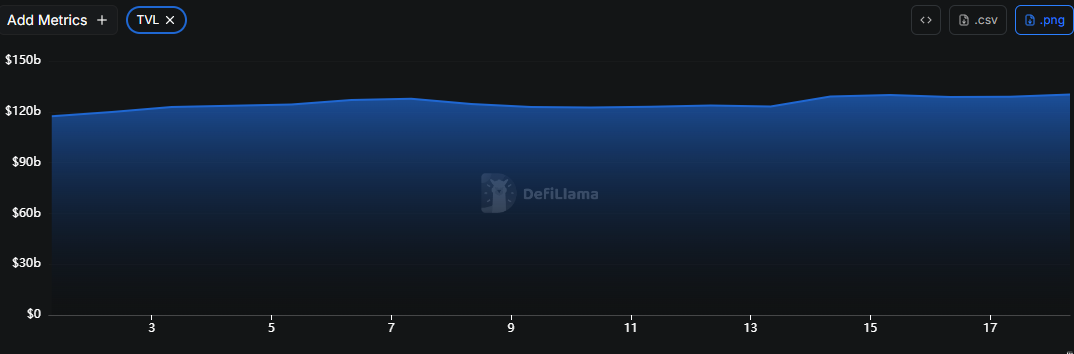

5. Decentralized Finance (DeFi)

According to data from DeFiLlama, the total DeFi TVL this week is $130.2 billion, up approximately 5.08% from $123.9 billion last week.

Data Source: Defillama,https://defillama.com

Data as of January 18, 2026

Segmented by public chain, the three chains with the highest TVL are Ethereum, accounting for 58.14%; Solana, accounting for 6.95%; and Bitcoin, accounting for 5.68%.

Data Source: CoinW Research, Defillama,https://defillama.com

Data as of January 18, 2026

6. On-Chain Data

Layer 1 Related Data

This section analyzes the on-chain DEX daily trading volume, daily active addresses, and transaction fees for major Layer 1s including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research, Defillama,https://defillama.com

Data as of January 18, 2026

On-chain DEX Daily Trading Volume and Transaction Fees: On-chain DEX daily trading volume and transaction fees are core metrics for measuring public chain activity and user experience. In terms of on-chain DEX daily trading volume, BNB Chain saw the most significant increase this week, rising from $1.252 billion to $1.93 billion, up about 54.15%; Ethereum increased from $650 million to $880 million, up about 35.38%; Solana increased from $2.587 billion to $2.96 billion, up about 14.42%. Aptos saw a slight recovery to $80 million, up about 9.8%; TON remained at a low level of $2 million; Sui declined significantly, dropping from $142 million to $70 million, down about 50.7%. In terms of transaction fees, overall Gas levels saw limited changes. Ethereum increased from $0.01 to $0.02; Solana and Sui decreased to $0.001 and $0.002, respectively; BNB Chain, TON, and Aptos remained largely flat compared to last week.

Daily Active Addresses and TVL: Daily active addresses reflect the ecosystem participation and user stickiness of a public chain, while TVL reflects user trust in the platform. In terms of daily active addresses, Sui showed the most prominent growth, with weekly daily active addresses rising to 448,000, up about 69.7% from 264,000 last week; BNB Chain increased from 2.35 million to 2.72 million, up about 15.74%. In contrast, Ethereum fell to 590,000, down about 8%; Solana dropped to 2.23 million, down about 17.4%; TON fell to 97,000, down about 10.9%; Aptos saw a larger decline, dropping to 835,000, down about 37%. Regarding TVL, most public chains maintained moderate growth. Ethereum rose to $75.6 billion, up about 5%; BNB Chain increased to $7.2 billion, up about 4.5%; TON rose to $90 million, up about 4.7%; Solana increased to $9.06 billion, up about 1.3%; Sui remained largely stable at $1.05 billion; Aptos grew to $480 million, up about 9.1%.

Layer 2 Related Data

According to L2Beat data, the total TVL of Ethereum Layer 2 is $39.36 billion, up approximately 1.82% this week from $38.6 billion last week.

Data Source: L2Beat,https://l2beat.com/scaling/tvs

Data as of January 18, 2026

Base and Arbitrum occupy the top spots with market shares of 37.68% and 35.03% respectively. This week, Base ranks first in TVL among Ethereum Layer 2s.

Data Source: Footprint,https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of January 18, 2026

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total stablecoin market capitalization is $314 billion, up 1.9% from $308.1 billion last week. Among them, USDT's market cap is $186.9 billion, accounting for 59.5% of the total stablecoin market cap, up slightly by about 0.2% from $186.6 billion last week. USDC follows with a market cap of $76 billion, accounting for 24.2% of the total stablecoin market cap, up about 1.9% from $74.6 billion last week. DAI's market cap is $5.36 billion, accounting for 1.7% of the total stablecoin market cap, remaining flat compared to last week.

Data Source: CoinW Research, Coinglass,https://www.coinglass.com/pro/stablecoin

Data as of January 18, 2026

According to Whale Alert data, the USDC Treasury issued a total of 565 million