DoraHacks 2026 Entrepreneurship Trends: Digital Finance in the Circle/Arc Ecosystem

- Core Thesis: The article posits that by 2026, the crypto industry has transitioned from its early chaotic phase into a period of structural maturity. Infrastructure represented by the Circle and Arc ecosystems has addressed core issues such as compliance, liquidity, and efficiency, providing a mature tech stack and immense opportunities for building the next generation of global payments, on-chain forex, AI economy, and financial inclusion applications.

- Key Elements:

- Global Payments Reimagined: Leveraging the Circle Payments Network and Arc to build a "global capital highway." Applications like programmable trade finance and corporate treasury engines aim to replace traditional systems like SWIFT with sub-second settlement and low costs.

- On-Chain Forex Revolution: Combining StableFX quotes with Arc's execution environment enables the creation of autonomous multi-currency treasury systems, forex aggregators, and other applications. This facilitates 24/7, T+0 settlement forex trading, eliminating the delays and opacity of traditional markets.

- Silicon-Based Economy (AI Economy): Empowering AI agents with on-chain identity and payment capabilities via Circle's programmable wallets and the x402 protocol. This supports scenarios like API dynamic negotiation and content micropayments, constructing an economic system where machines participate autonomously.

- Economic Leapfrogging & Inclusion: Utilizing Arc's extremely low transaction costs and USDC's stability to develop products like reputation-based microloans and pay-as-you-go asset networks. This provides affordable financial services to populations traditionally underserved by conventional finance.

- Infrastructure Maturity: The Circle and Arc ecosystems provide compliant integration, liquidity aggregation, and a high-performance execution environment, abstracting away underlying complexities and allowing developers to focus on building application-layer business logic.

Author: Steve Ngok, Chief Strategy Officer, DoraHacks

Introduction

For nearly a decade, the established financial order has viewed the cryptocurrency industry with suspicion, even contempt. To observers in the ivory tower, this industry was nothing more than a casino, a realm of chaotic speculation disconnected from the real economy. For a long time, this criticism was not entirely unfounded.

But in 2026, the early chaos has given way to clear structural opportunities. The industry is not just growing; it is bifurcating.

We are witnessing a fission. On one side is continued speculation: prediction markets, exchanges, volatility optimization. This remains a vibrant but noisy arena. But beyond this, a more serious, professional, and efficiency-seeking scene has emerged.

Stablecoins have become the TCP/IP protocol for money. They are devouring the cross-border payments market, eliminating foreign exchange inefficiencies, and empowering AI agents with new economic primitives.

On this new frontier, the "move fast and break things" ethos of early DeFi has been replaced by the demand for certainty, compliance, and institutional-scale operations. This is why the Circle and Arc ecosystem has become the dominant tech stack. They have built an economic operating system, handling the dull, core, yet unglamorous "dirty work" of regulatory integration and liquidity plumbing for you.

If you are a builder in 2026, you no longer need to reinvent the wheel. DoraHacks and its partners have paved the way. The regulatory moat has been dug. Liquidity is bottomless. The question is no longer *if* we can bring real-world assets on-chain, but *what happens* when money becomes as programmable as bits?

The builder's code is embedded here. The time to build is now.

Direction I: The Global Capital Highway

From Simple Remittances to Programmable Settlement

1. Core Thesis

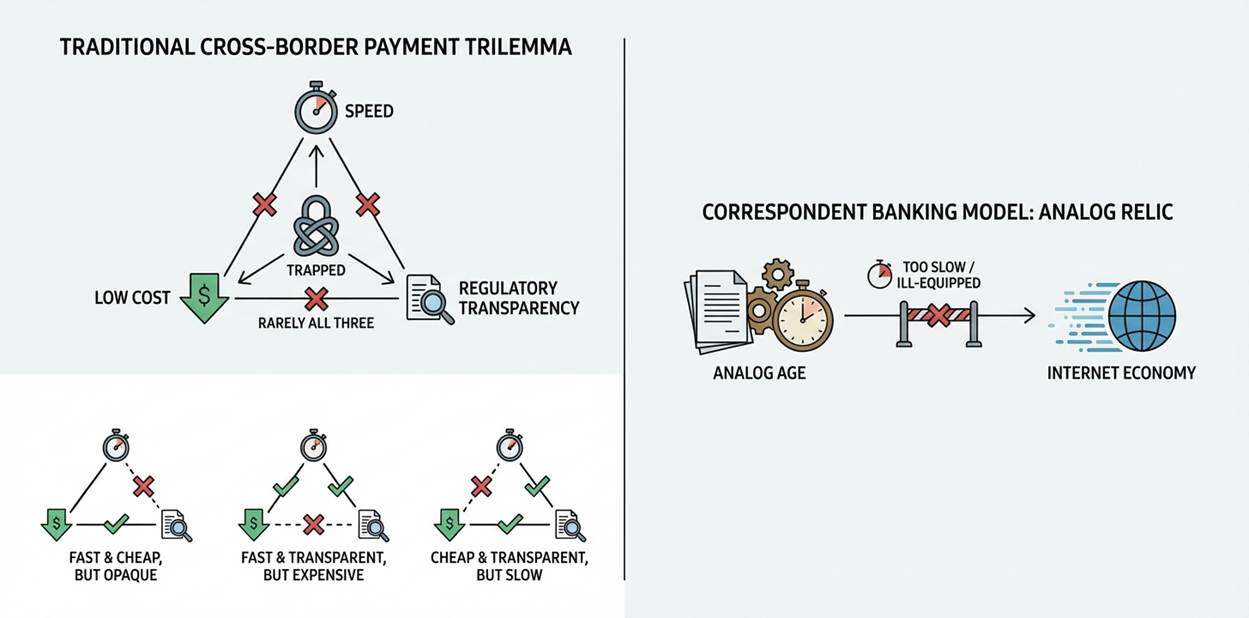

The traditional cross-border payments system is trapped in a structural "impossible trinity": you can have speed, or low cost, or regulatory transparency, but you can rarely have all three. The current model is a relic of a bygone era, utterly unfit for the velocity of the internet economy.

The Circle and Arc ecosystem finally solves this coordination problem:

● CPN (Circle Payments Network): Solves the "last mile" problem, connecting digital ledgers to the global banking system.

● CCTP & Gateway: Solves liquidity fragmentation, unifying assets scattered across different blockchains.

● Arc: Provides the "matching and clearing engine," delivering the sub-second finality and low latency that Wall Street demands.

Mission: Position Arc as the central clearing layer for global capital, building the next generation of commercial payment applications, rendering the SWIFT network obsolete.

2. High-Value Opportunities

We look beyond basic payroll or merchant acquiring. The real opportunity lies in re-architecting B2B money flows and platform economics.

A. Programmable Trade Finance

● Thesis: "The moment the goods arrive, the funds arrive."

● Pain Point: International trade runs on friction. Exporters wait 30-90 days for payment or rely on expensive, paper-heavy letters of credit. Trust is not only slow but costly.

● Solution:

○ Escrow: The importer locks USDC in a smart contract on Arc.

○ Trigger: An oracle feeds real-time logistics data on-chain. "Goods signed for" = "Payment triggered."

○ Settlement: The contract automatically releases USDC.

○ Exit: CPN converts USDC to local currency (e.g., VND) and instantly wires it to the exporter.

● Why Arc? Only Arc's sub-second finality and near-zero fees make trigger-based payments economically viable for high-frequency logistics updates.

● Builder Profile: Supply chain ERP experts and logistics data specialists.

B. Internal Treasury Engine

● Thesis: "Stop bleeding money on internal wire transfers."

● Pain Point: Multinationals like Toyota or Siemens have subsidiaries in 50 countries. When Brazil owes Germany, and Germany owes the US, they wire money back and forth, bleeding value on FX fees and float.

● Solution:

○ On-Chain Pooling: Subsidiaries convert local cash to USDC via CPN and pool into a central Arc treasury.

○ Netting: Run a "netting algorithm" on Arc to calculate who owes whom on the ledger.

○ Settlement: You only move the net difference.

○ Off-Ramp: Subsidiaries convert liquidity back to local fiat only when needed.

● Why Arc? Privacy tools protect internal financial data, while high throughput handles the complex math of real-time netting.

● Builder Profile: Fintech architects and enterprise SaaS founders.

C. "Stripe Connect for Web3"

● Thesis: "Universal payment routing for the gig economy."

● Pain Point: Platforms like Uber, Airbnb, or Upwork struggle to pay a global workforce. Sending $50 to a freelancer in the Philippines is often cost-prohibitive.

● Solution:

○ Aggregate: The platform loads a single USDC pool on Arc.

○ Distribute: One API call triggers thousands of payments.

○ Route: A smart contract acts as a router. Crypto-native user? Send to wallet. Traditional user? Route to their local bank via CPN.

● Why Arc? Batch processing capability makes "micro-payments" possible, which is mathematically infeasible on traditional rails.

● Builder Profile: Payment gateway engineers and platform aggregators.

D. Programmable Corporate Cards

● Thesis: "Give your AI agent a credit card, but control spending with code."

● Pain Point: Enterprises need global software procurement, but corporate cards are clunky. They lack granular control; you can't easily hand one to an AI agent or a temporary contractor.

● Solution:

○ Treasury Pool: An enterprise USDC treasury on Arc.

○ Cards: Instant issuance of virtual Visa/Mastercard credentials via CPN.

○ Rules: Embed logic in a smart contract: "This card only works for AWS" or "Max $100/day."

○ Settlement: Transactions settle instantly on-chain via StableFX.

● Why Arc? It shifts financial control from a bank's policy department to a company's codebase.

● Builder Profile: Expense management and B2B fintech teams.

3. Technical Blueprint

For developers, the architecture is now standardized. Build like this:

1. On-Ramp: Use the CPN API to generate a virtual IBAN. Fiat flows in; USDC is auto-minted to your Arc address.

2. Liquidity: Use the Gateway SDK to aggregate USDC from fragmented chains (Ethereum, Solana) into your central Arc application.

3. Business Logic: Deploy your Solidity contracts on Arc.

○ Payroll: distributeSalary(recipients, amounts)

○ Trade: releaseFunds(proofOfShipping)

4. Off-Ramp: Call the CPN Payout API to burn USDC and trigger a local bank wire, or use Programmable Wallets to settle directly on-chain.

4. Conclusion

"Build a bank that runs on code."

Know your opponent: you are competing against the friction of a 1970s banking system.

By combining Arc's speed with CPN's reach, you have the power to reduce global settlement costs by 80% and accelerate speed from "T+2 days" to "T+0 seconds." This is a ticket to a multi-trillion-dollar market.

Direction II: The On-Chain FX Revolution

From Manual Exchange to Algorithmic Liquidity Networks

1. Core Thesis

The traditional foreign exchange (FX) market, the world's largest financial market, is currently constrained by an outdated "inefficiency trifecta": settlement delays (T+2 standard), gatekeeping (only giants get the best rates), and opacity (layers of hidden fees).

The Circle and Arc combination dismantles this structure:

● StableFX provides institutional-grade price feeds (RFQ mechanism), meaning "request for quote is execution."

● Partner stablecoins (e.g., MXNB, JPYC, BRLA) provide the necessary local currency anchors.

● Arc provides the execution environment where these currencies can be swapped in milliseconds.

Mission: Use code to autonomously manage currency risk, eliminating exchange friction in cross-border commerce.

2. High-Value Opportunities

We look beyond simple hedging or remittance apps. The real opportunity lies in deep financial engineering applied to global trade.

A. Autonomous Multi-Currency Treasury System

● Thesis: "Democratize Apple's treasury capabilities for SMEs."

● Pain Point: A mid-sized e-commerce company earns Euros (EUR), pays for servers in US Dollars (USD), and salaries in Japanese Yen (JPY). Traditional banks charge hefty spreads for these conversions, and finance teams often miss optimal windows due to manual processes.

● Solution:

○ Auto-Strategy: The firm sets rules on Arc: "If EURC balance > 50,000 and EUR/USD rate > 1.08, automatically swap 50% to USDC."

○ Instant Execution: Smart contracts monitor StableFX quotes via oracles, executing instantly when conditions are met.

○ Payroll: At month-end, USDC is automatically swapped to JPYC at the best market rate and distributed to employee wallets.

● Why Arc? Only Arc supports this high-frequency monitoring and low-cost execution. Traditional banks cannot offer this level of programmability.

● Builder Profile: Corporate finance SaaS teams and ERP integrators.

B. The "1inch" for FX

● Thesis: "Global, instant, best execution."

● Pain Point: When swapping USDC to EURC, prices differ between Uniswap, StableFX, and Curve. Users rarely know where liquidity is deepest.

● Solution:

○ Aggregate: Build a dApp on Arc connecting StableFX (RFQ mode) with on-chain AMMs.

○ Route: When a user wants to swap $1M, the algorithm splits the order: 60% via StableFX (deep liquidity), 40% via an AMM.

○ Atomic Settlement: User clicks once. Complexity is abstracted away.

● Why Arc? Its high performance allows querying multiple liquidity sources and executing trades within a single block.

● Builder Profile: DeFi developers and market makers.

C. Tokenized Carry Trade Protocol

● Thesis: "Bring Wall Street's oldest strategy onto DeFi rails."

● Pain Point: Carry Trade—borrowing a low-interest currency to invest in a high-interest one—has historically been the exclusive domain of hedge funds and banks.

● Solution:

○ Mechanism: Users deposit USDC.

○ Operation: The protocol borrows a low-interest currency (e.g., JPYC) in the background, swaps it via StableFX, and invests in high-yield assets (e.g., tokenized treasuries).

○ Risk Management: Leverage Arc's automation; if exchange rates hit volatility thresholds, the system executes millisecond-level liquidation.

● Why Arc? This strategy requires extreme speed. Arc's deterministic finality is the critical safeguard against liquidation failures.

● Builder Profile: Quantitative trading teams and advanced DeFi architects.

D. "Local-First" Checkout

● Thesis: "Pay in Pesos, settle in Dollars. Zero friction."

● Pain Point: A US Shopify merchant wants USDC, but their Mexican customer wants to pay in Pesos (MXN). Current credit card rails charge 3-5% in FX fees for this.

● Solution:

○ Frontend: The buyer sees a price in MXNB (Mexican Peso stablecoin).

○ Payment: The buyer pays MXNB.

○ Backend: The transaction hits Arc, instantly swapping MXNB for USDC via StableFX.

○ Settlement: The merchant receives USDC. No banks involved. Total cost < 1%.

● Why Arc? Instant confirmation makes checkout feel seamless, with no "waiting for block confirmations."

● Builder Profile: Payment gateway developers and e-commerce infrastructure teams.

3. Technical Blueprint

For developers, the integration path is clear:

- Pricing: Integrate the StableFX API (Oracle). This is a stream of executable quotes.

- Assets: Ensure your smart contracts are compatible with the ERC-20 standard for USDC, EURC, and partner stablecoins (JPYC, MXNB).

- Execution: Build a swapCurrency(tokenIn, tokenOut, amount, minRate) function. Internally, call the StableFX settlement contract, passing signed RFQ quotes for atomic swaps.

- Interoperability (Optional): Use the xReserve pattern. If your strategy needs assets from the Bitcoin network, wrap them into the Arc ecosystem via xReserve to access FX liquidity.

4. Conclusion

"FX is the world's largest market, but it runs on 1980s technology."

On this track, you are re-architecting the vascular system of global trade.

Using StableFX and Arc, you have the chance to build the next generation of FX applications: 24/7 operation, T+0 settlement, zero bank fees. This is the crown jewel of fintech.

Direction III: The Silicon-Based Economy

From Human-Computer Interaction to Machine-to-Machine (M2M) Commerce

1. Core Thesis

The current generation of AI suffers from a structural paradox: infinite intelligence, zero financial autonomy. An AI agent can plan a complex Tokyo itinerary but lacks the authority to book a flight. It can write server code but cannot rent hardware. It is a "brain in a vat," brilliant yet severed from the real economy.

The Circle and Arc ecosystem provides the missing limbs:

● Circle Programmable Wallets: Grants each agent a unique, policy-controlled on-chain identity.

● x402 Protocol: Serves as the universal "negotiation language" for value (reviving the web's "402 Payment Required" status code).

● Gas Station: Solves UX friction, abstracting away ETH and gas complexity, making payment feel like a simple API call.

● Arc: Provides the high-concurrency, deterministic environment needed for machine-speed transactions.

Mission: Build infrastructure and applications that allow AI to autonomously earn, spend, and manage assets. Grant machines economic sovereignty.

2. High-Value Opportunities

We seek more than simple "crypto browsers." We seek the foundational rails for a machine-native GDP.

A. The API Negotiator

● Thesis: "The death of monthly subscriptions; the birth of real-time bidding."

● Pain Point: Developers are currently forced to manually subscribe to dozens of APIs (OpenAI, Twilio, SerpApi), managing a tangled mess of keys and credit card limits.

● Solution:

○ Dynamic Gateway: Service providers publish APIs on Arc with dynamic, load-based pricing.

○ Agent: Before calling for data, the user's AI agent asks via x402: "What's the price?"

○ Settlement: The provider responds: "0.002 USDC." The agent verifies its budget and executes payment immediately.

○ Pay-Per-Use: No subscriptions. No waste. Millisecond settlement.

● Why Arc? High-frequency micropayments are economically impossible on traditional rails. On Arc, they are the standard.

● Builder Profile: API aggregators and developer tool architects.

B. "Pay-For-Context" Gateway

● Thesis: "Solve the 'NYT vs. OpenAI' legal deadlock."

● Pain Point: Large Language Models (LLMs) need fresh data, but publishers are blocking crawlers because they aren't getting paid. The legal system is at an impasse.

● Solution:

○ Compliance: Publishers deploy x402 headers on their content.

○ Micro-Access: When an AI crawler