Receiving 2,000 Ether in a single transaction, with a market value reaching tens of millions of yuan! Yao Qian engaged in major power-for-money deals

- Core Viewpoint: The television documentary "Technology Empowers Anti-Corruption" reveals that virtual currencies, due to their anonymity and cross-border circulation, have become a significant vehicle for new types of corruption and hidden corruption. However, disciplinary inspection and supervision authorities, by deeply studying the principles of blockchain technology and employing big data methods, have successfully penetrated layers of disguise and investigated related cases.

- Key Elements:

- Yao Qian, the former Director of the Science and Technology Supervision Department of the China Securities Regulatory Commission (CSRC), abused his power to engage in power-for-money transactions by accepting virtual currencies, among other means. The 2,000 Ether he accepted once had a market value exceeding 60 million yuan.

- Corrupt individuals stored virtual currencies using hardware wallets and used "sock puppet accounts" opened under others' identities for fund transfers, attempting to conceal transaction traces.

- Utilizing the publicly verifiable nature of blockchain, the special task force successfully tracked on-chain and reconstructed the complete flow and redemption path of the virtual currency from the briber to the bribe-taker.

- Yao Qian exchanged part of the virtual currency obtained through bribery for 10 million yuan, which was used to pay for a villa in Beijing. This consumption of physical assets became a breakthrough in the case.

- This case demonstrates that although virtual currency transactions are covert, they inevitably leave traces when converted into real-world assets, accumulating experience for investigating such new forms of corruption.

Author: CCTV.com

Source: CCTV News

The fourth episode of the TV documentary series "One Step Without Rest, Half a Step Without Retreat," jointly produced by the Publicity Department of the Central Commission for Discipline Inspection and the National Supervisory Commission and China Central Television (CCTV), titled "Technology Empowers Anti-Corruption," aired on CCTV's comprehensive channel at 8 p.m. on January 14. It was simultaneously released on CCTV News' new media platforms.

Beyond the spatial separation between domestic and overseas locations, the physical separation between online and offline activities has also become a method used by corrupt individuals to conceal their illicit acts. Gold, cash, and valuables are common mediums for power-for-money exchanges in traditional corruption cases. With the advent of the digital age and the continuous development of virtual currencies underpinned by blockchain technology, corruption has taken on a new form that demands vigilance.

These are key pieces of evidence seized in a case involving disciplinary violations and illegal activities by a leading cadre. They look like mobile phones, USB drives, or remote controls. In reality, they are different models of hardware wallets used for storing and managing virtual currencies. These three seemingly inconspicuous little "wallets" contained virtual currencies with a total assessed value equivalent to tens of millions of Chinese yuan. Those who accepted bribes through such means also harbored illusions, believing their actions were sufficiently concealed.

Yao Qian, former Director of the Science and Technology Supervision Department of the China Securities Regulatory Commission (CSRC): To be honest, I knew it was a covert act. How could you do it? It's just that I previously thought it would be very difficult to find evidence.

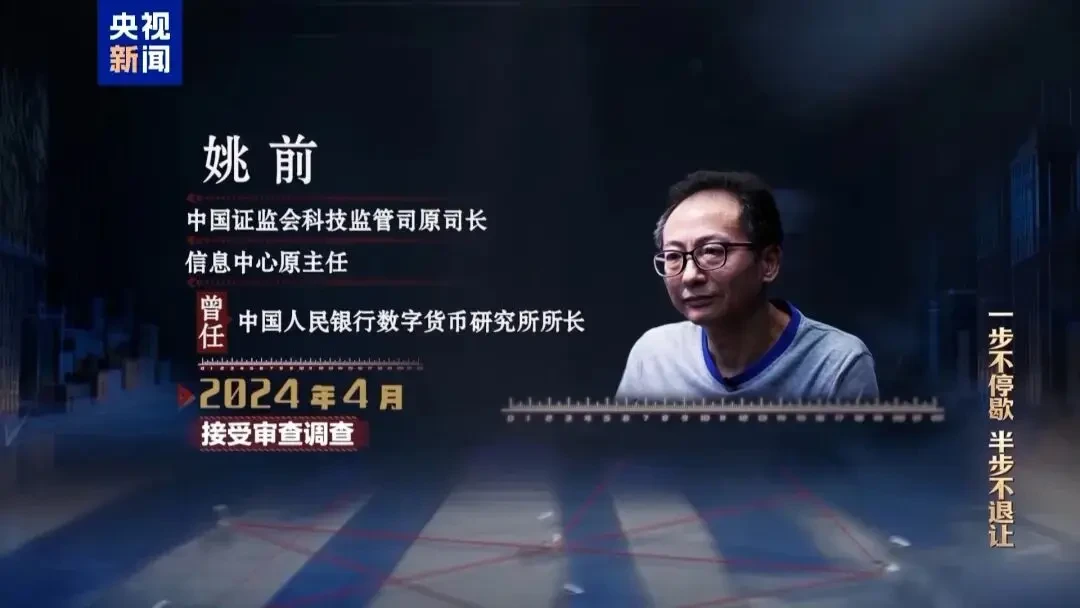

Yao Qian, former Director of the Science and Technology Supervision Department and former Director of the Information Center of the CSRC, previously served as the Director of the Digital Currency Research Institute of the People's Bank of China. He was placed under investigation in April 2024. A special case team was formed by the Discipline Inspection and Supervision Team stationed at the CSRC under the Central Commission for Discipline Inspection and the National Supervisory Commission, in conjunction with the Shantou City Supervisory Commission in Guangdong Province, to handle this case. From the outset, the team conducted an in-depth analysis based on Yao Qian's personal characteristics.

Zou Rong, staff member of the Discipline Inspection and Supervision Team stationed at the CSRC under the Central Commission for Discipline Inspection and the National Supervisory Commission: Supervision of this individual requires profiling. He has extensive experience working with digital currency. Could there be corruption issues involving the use of virtual currencies for power-for-money transactions behind this? In the practice of anti-corruption within the capital markets, new and hidden forms of corruption are quite prominent.

As the investigation deepened, the special case team's initial assessment was confirmed. Several of Yao Qian's large power-for-money transactions employed new and hidden corruption methods, including accepting virtual currencies. Virtual currencies exist merely as strings of numbers online, not only separated from the holder's identity but also completely isolated from the banking and payment institution systems. They can be freely traded on the blockchain and cross borders without geographical restrictions, making them extremely covert and difficult to regulate. However, the special case team was well-prepared from the start. By studying a vast amount of professional knowledge and gaining a deep understanding of the operational mechanisms of virtual currencies, they identified the key points for investigation.

Zou Rong: Holders primarily rely on private keys to control virtual currencies at blockchain addresses. This private key consists of a string of dozens of characters, which is not easy to remember. Typically, a hardware wallet is used for safekeeping.

Cai Kunting, staff member of the Shantou City Commission for Discipline Inspection and Supervision in Guangdong Province: During a search, two items are crucial: first, whether there is a hardware wallet; second, whether there are any notes with seemingly random mnemonic phrases. These are paramount in a search.

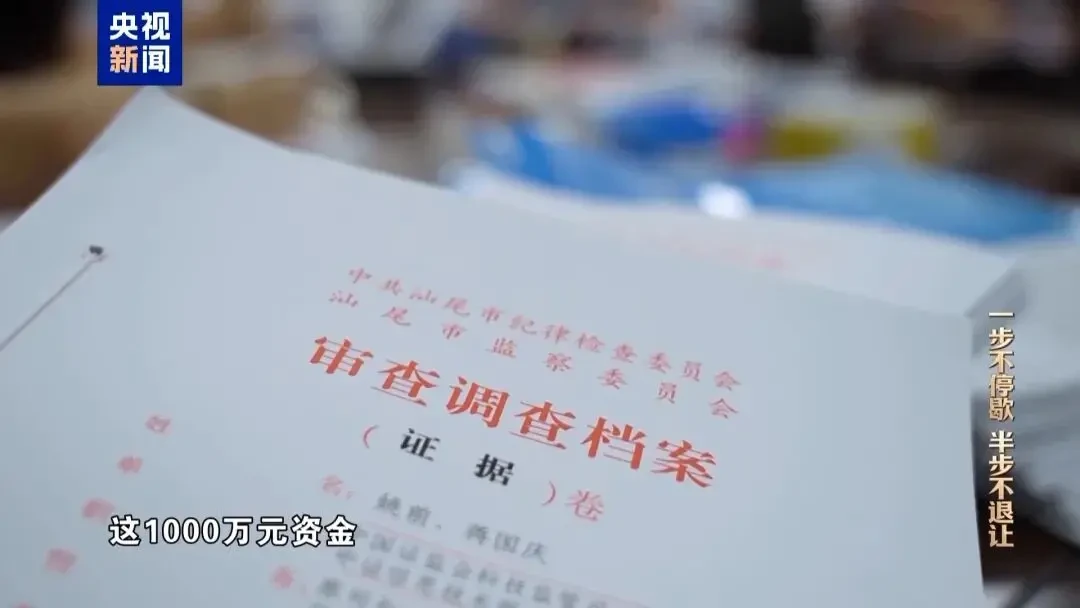

Indeed, the special case team found a hardware wallet in a drawer in Yao Qian's office. Simultaneously, the team strictly adhered to regulations, discipline, and the law, fully utilizing big data and information technology to conduct a comprehensive investigation into Yao Qian's relevant circumstances, also uncovering related traces. From the legally obtained account information, Yao Qian's personal accounts showed no obvious anomalies. However, cross-referencing with big data revealed that several bank accounts opened under others' identities were actually Yao Qian's "shell accounts," under his actual control. By tracing the origins of large fund flows into and out of these "shell accounts," a significant discovery was made regarding a 10 million yuan transaction after tracing it back to its source.

Zou Rong: During the preliminary verification, we also discovered an abnormal transfer of 10 million yuan into Yao Qian's account. After approximately four layers of tracing, we ultimately confirmed that the funds should have originated from a capital account belonging to a virtual currency trader.

The investigation found that shortly after this 10 million yuan entered Yao Qian's "shell account," it was used to pay for part of a villa in Beijing. This villa, with a total price of over 20 million yuan, was registered under the name of one of Yao Qian's relatives but was actually owned by Yao Qian. All the purchase funds came from Yao Qian's "shell accounts." Besides this 10 million yuan, two other large deposits, totaling 12 million yuan, were also used for the villa payment. Tracing the source of this 12 million yuan revealed an equally complex and abnormal origin.

Shi Changping, staff member of the Shantou City Commission for Discipline Inspection and Supervision in Guangdong Province: He thought that by setting up multiple layers, it might create more isolation. But conversely, when the time comes to prove this issue or its existence, there will be more people and evidence, making it more substantial.

The special case team penetrated the layers of "smokescreens," conducted in-depth investigation and evidence collection, and pinpointed the source of this 12 million yuan. The money came from an information service company controlled by businessman Wang Mou. It was further discovered that Yao Qian had used his authority to assist this company in providing technology services within the securities and futures industry, forming a complete evidence chain for this 12 million yuan benefit transfer.

Wang Mou also revealed that a key intermediary named Jiang Guoqing was involved in this power-for-money transaction. Jiang was Yao Qian's subordinate and had a very close relationship with him. The special case team subsequently placed Jiang Guoqing under detention. The investigation revealed that he had participated in almost every one of Yao Qian's large power-for-money transactions, especially when Yao Qian accepted virtual currency bribes, Jiang Guoqing was involved.

Jiang Guoqing, person involved in the case: Initially, they wanted to pass it through me. But later I thought about it and was afraid of getting into trouble. So I set up a transfer address. Then they sent the coins to the transfer address, which then transferred them to Yao Qian's personal wallet. I knew this was a benefit transfer. I was scared, and I knew it was wrong.

Jiang Guoqing followed Yao Qian, transferring first to the Digital Currency Research Institute of the People's Bank of China and then to the CSRC's Science and Technology Department. He was both a trusted confidant of Yao Qian and a pawn on Yao Qian's path to corruption. Many of the businessmen involved in power-for-money transactions with Yao Qian were introduced by or had their requests relayed through Jiang Guoqing, who also took a cut for himself.

In 2018, a crypto circle businessman named Zhang Mou, through Jiang Guoqing, sought Yao Qian's help for his company's token issuance and financing project. Yao Qian accepted the request and made a call to a virtual currency exchange, helping the company successfully issue tokens and raise 20,000 Ether (ETH). Subsequently, Zhang Mou gave Yao Qian 2,000 Ether as a thank-you. At their peak market valuation, these Ether were once worth over 60 million yuan. The reason Yao Qian's call was effective was naturally tied to the influence of his position.

Jiang Guoqing: Yao Qian's influence in the industry is significant because of his position.

To further solidify the evidence chain, the special case team, based on the characteristics of virtual currencies, attempted to reconstruct the entire flow process of Yao Qian accepting virtual currencies on the blockchain.

Zou Rong: Virtual currencies possess concealment, but they are a double-edged sword; they have two sides because they also have the characteristic of being publicly verifiable across the entire network. That is to say, anyone can check the transfer records of any blockchain address at any time. This is determined by the decentralized nature of blockchain, so it also has transparency.

The special case team utilized blockchain technology to query both the flow chain of the 2,000 Ether from Zhang Mou's Ethereum wallet address to Yao Qian's Ethereum wallet address in 2018, and the complete record of Yao Qian transferring out 370 of those Ether in 2021, exchanging them for 10 million yuan. The team conducted electronic evidence collection in accordance with regulations, discipline, and the law, achieving mutual corroboration and forming a closed loop of evidence. Faced with such a solid evidence chain, Yao Qian had to admit to his disciplinary violations and illegal acts.

In November 2024, Yao Qian was expelled from the Communist Party of China and dismissed from public office, and his case was transferred to the procuratorial organs for legal review and prosecution. The successful investigation of this case has accumulated experience for discipline inspection and supervision organs in handling bribery and corruption cases involving virtual currencies. Virtual currencies may seem intangible and shadowless, but once one attempts to use them in the real world, they can no longer remain virtual and are bound to "develop" somewhere. The villa Yao Qian purchased became the "developer" that exposed him. Despite his painstaking efforts to lay multiple layers of deception, they ultimately could not escape being penetrated. When Yao Qian was placed under detention, the villa's renovation was not yet complete, but he had already lost the chance to live there.

Zou Rong: Virtual currency, if not cashed out, is useless; it's just a string of numbers. When virtual assets are converted into real assets, they become very easy to expose.

Using virtual currencies to conceal corrupt gains is just one form of new and hidden corruption. Under the high-pressure stance against corruption, no matter how corruption methods innovate or how they become concealed and mutated, as long as we tightly grasp the essential characteristic of corruption—power-for-money transactions—strictly adhere to regulations, discipline, and the law, fully utilize big data and other information technologies, increase identification and investigation efforts, and continuously enrich effective prevention and control methods, corruption in any form will have nowhere to hide.