Predictive Markets Stir Up the Trillion-Dollar Gambling Industry, Facing Pursuit from the Old Order

- Core Viewpoint: Predictive markets face state-level regulatory challenges, with their legality in question.

- Key Elements:

- Tennessee accuses prediction platforms of illegally offering sports betting.

- Predictive markets are growing rapidly, threatening traditional gambling tax revenue.

- Multiple states have taken similar regulatory actions, sparking legal battles.

- Market Impact: The development of predictive markets is constrained, with the industry facing compliance uncertainty.

- Timeliness Note: Medium-term impact.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

The thriving prediction market is now facing a real challenge.

On January 9th, US local time, the Tennessee Sports Wagering Council (SWC) issued cease-and-desist orders to prediction market platforms including Kalshi, Polymarket, and Crypto.com, demanding these platforms stop offering sports event prediction contracts to residents of the state. The reason cited is that these companies are engaging in illegal gambling operations without obtaining state licenses.

In the notification letters, the SWC accused the three companies of illegally offering sports betting products under the guise of "event contracts." Although these platforms are registered with the U.S. Commodity Futures Trading Commission (CFTC) as designated contract markets, according to Tennessee law, any entity offering sports event betting services within the state must hold a license issued by the SWC.

The SWC demanded that Kalshi, Polymarket, and Crypto.com cease all activities in the state, close open contracts, and refund resident deposits by January 31st. Failure to comply may result in civil penalties of up to $25,000 per violation and even potential criminal charges.

The Rapidly Growing Sports Betting Market

To understand why Tennessee is taking such a hard stance against prediction market platforms, we need to start with the current state of the US sports betting market.

Since the U.S. Supreme Court overturned the federal law, the Professional and Amateur Sports Protection Act (PASPA), which had prohibited commercial sports betting, on May 14, 2018, individual states have gained the authority to decide whether to legalize sports betting within their jurisdictions. Currently, sports betting in the US is regulated by state-level agencies responsible for licensing, compliance, and enforcement, with each state setting its own tax regime, market entry barriers, and responsible gambling requirements.

According to reports from the sports betting media Legal Sports Report, as of now, 38 US states (including Washington D.C. and Puerto Rico) have legalized sports betting services (both online and retail), with 30 states allowing online sports betting services — Tennessee is one of them and is the first state to allow only online sports betting while prohibiting physical betting venues.

Home to popular leagues like the NFL, MLB, NBA, and NHL, the US is undoubtedly a sports powerhouse, and sports betting is a gambling service clearly defined and heavily taxed by state governments.

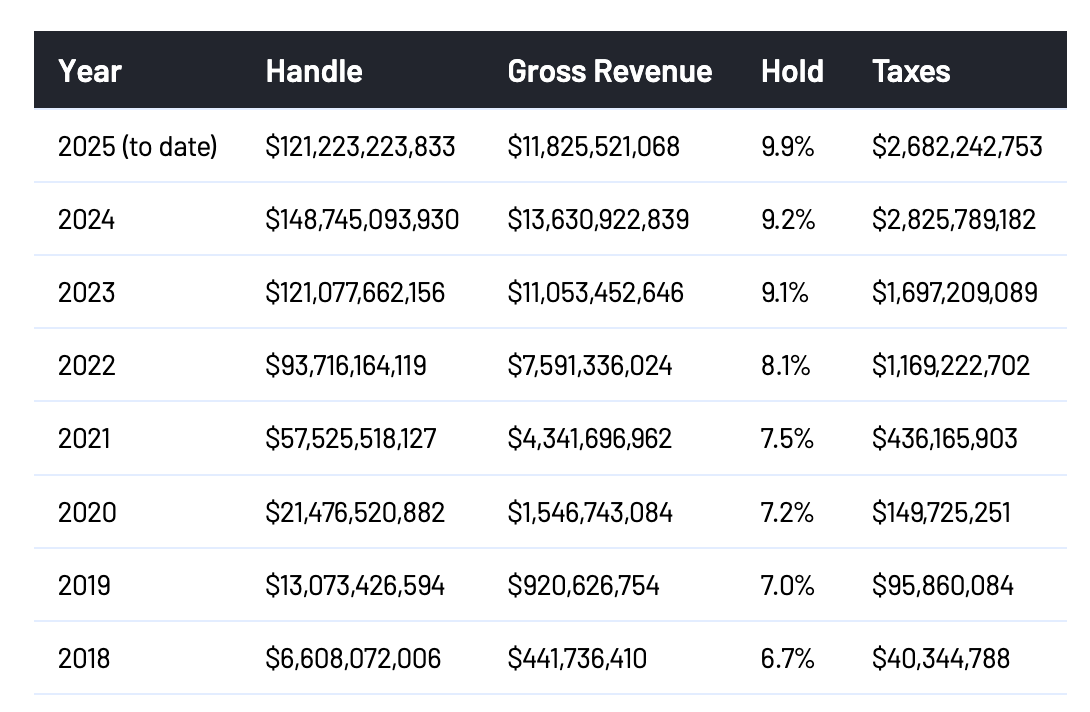

Statistics from another major sports betting media outlet, Sports Book Review (see chart below, data as of August 2025), show that since the regulatory opening in 2018, the total betting handle and tax revenue of the US sports betting market have experienced remarkable growth over the past few years — in 2024, the total market handle reached $148.74 billion, contributing $2.82 billion in taxes; in just the first eight months of 2025, the total handle ($121.22 billion) and tax revenue ($2.68 billion) have already approached the full-year 2024 levels.

Focus on Tennessee: What Does Sports Betting Mean?

Now, let's focus on Tennessee, the protagonist of this incident.

In 2019, Tennessee passed the Tennessee Sports Gaming Act, formally legalizing sports betting. Although then-Governor Bill Lee had reservations about gambling, he allowed the bill to pass without exercising his veto power. Between 2021 and 2022, the Tennessee General Assembly passed laws establishing a dedicated regulatory council to oversee licensing and regulation. This council was initially called the Sports Wagering Advisory Council and later renamed the Tennessee Sports Wagering Council (SWC), the same body that issued the cease-and-desist orders to Kalshi, Polymarket, and Crypto.com.

Currently, the SWC is Tennessee's sole sports betting regulator, responsible for operational licensing, compliance oversight, rule-making, and enforcement. The SWC stipulates that all sports betting providers must obtain an SWC license to offer services in the state. To date, a total of 11 licenses have been issued (see chart above); only residents aged 21 and over can access related services and must pass geolocation verification to ensure bets are placed within the state. Regarding taxation, the state levies a 1.85% tax on the total handle — initially, a revenue-based tax scheme was used, but this was changed to a handle-based tax after 2023.

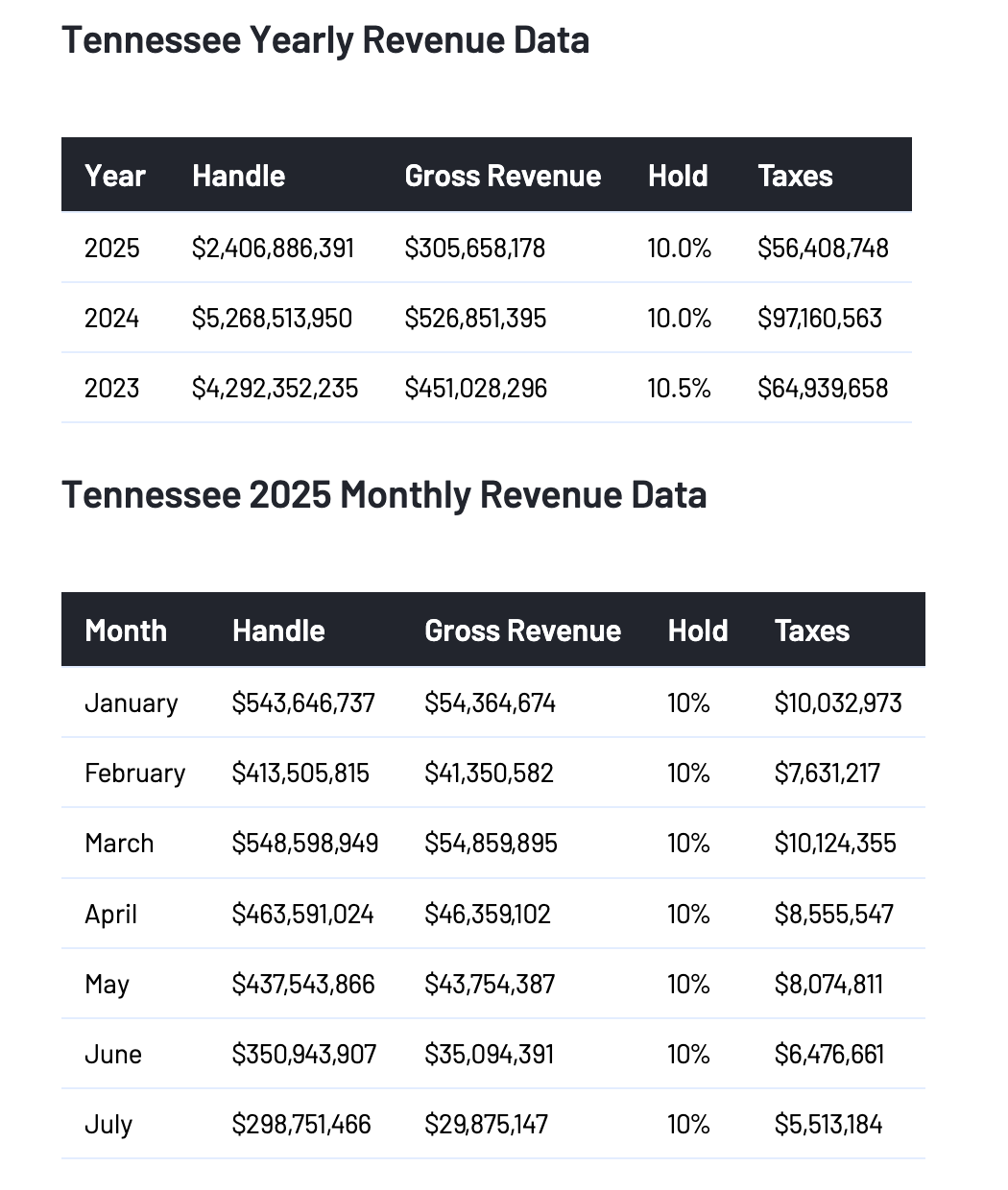

The sports betting market contributes significant tax revenue to Tennessee. Statistics from Sports Book Review (see chart below, data as of July 2025) show that in 2024, Tennessee's sports betting market handle reached $5.268 billion, contributing $97.16 million in taxes. In the first seven months of 2025, the handle has already reached $2.4 billion, with tax contributions amounting to $56.4 million.

However, this massive and still-growing pie is now being gradually eroded by platforms like Polymarket.

How Are Prediction Markets Eroding the Old World?

On December 3, 2025, Polymarket announced it had received CFTC approval to return to the US market after nearly four years. Even earlier, Kalshi and Crypto.com's prediction market platform, Truth Predict, had already opened their doors to US users under CFTC approval.

The current regulatory landscape is that sports betting is clearly classified as a gambling service, regulated by individual states. However, prediction market platforms like Polymarket are generally viewed as new entities offering "event contract" trading services. "Event contracts" are considered financial derivatives in terms of asset nature, falling under the CFTC's regulatory purview. This allows prediction markets to bypass the stringent regulations governing gambling services — they don't need state licenses, don't have to follow user protection rules like addiction controls, and don't pay high gambling taxes to states. Yet, they can offer services similar to betting on sports event outcomes, objectively creating a form of "regulatory arbitrage."

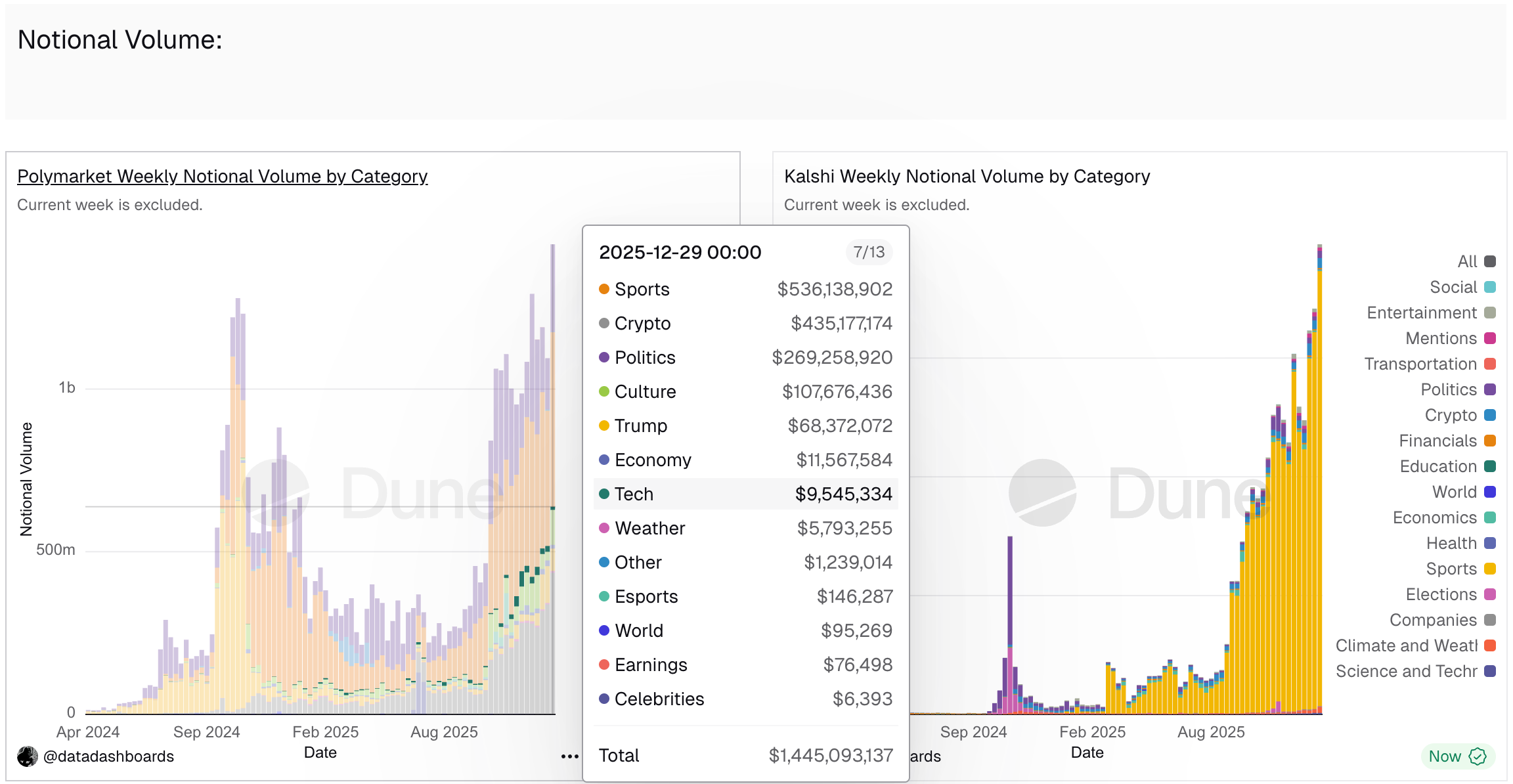

If prediction markets remained small-scale experiments, it might be tolerable. But the reality is that the growth rate of prediction markets is even more staggering than the already impressive growth of the sports betting market — in 2025, the total trading volume of prediction markets was approximately $40 billion, a roughly 400% increase from $9 billion in 2024. Data Dashboards' data dashboard compiled on Dune (see chart below) shows that sports-related event contracts have long become the category with the highest trading volume share in prediction markets.

The capital markets have already sensed the growing threat Polymarket poses to traditional sports betting services. Two giants of the sports betting market, DraftKings and Flutter Entertainment, recorded declines of 11.7% and 16.1% respectively over the past year — during the same period, the US stock market was in a bull run, with the Dow Jones up 12.97%, the Nasdaq up 20.36%, and the S&P 500 up 16.39% for the year; meanwhile, the sports betting market size continued its eight-year upward trend.

Whether it's Tennessee, which relies on sports betting as a tax revenue source, or the capital forces that effectively control the sports betting market, it's difficult for them to agree to let this new player, the prediction market, take a slice of the pie.

Friction Is Not Isolated: How Are Prediction Markets Fighting Back?

In fact, Tennessee's ban on prediction markets is not an isolated incident. States including Maryland, Ohio, Illinois, New Jersey, Nevada, Montana, Michigan, and Connecticut have all cracked down on prediction markets for similar reasons. Since Polymarket only returned to the US market in December last year, Kalshi has borne the brunt of more regulatory pressure.

In response, Kalshi has filed lawsuits against three states — Nevada, New Jersey, and Maryland — arguing that it "complies with higher-priority federal regulations and therefore does not need to comply with state-level regulations." However, the results have not been ideal.

- The lawsuit in Nevada progressed first. The district court initially sided with Kalshi but later, in November last year, ruled against Kalshi. Judge Andrew Gordon determined that sports-related event contracts on Kalshi were very similar to sports betting wagers and thus fell under Nevada's gambling regulations. Kalshi has appealed to the U.S. Court of Appeals for the Ninth Circuit.

- In New Jersey, the district court sided with Kalshi, but the state's gambling regulator has appealed to the U.S. Court of Appeals for the Third Circuit.

- In Maryland, the district court sided with the gambling regulator's request. Judge Adam B. ruled that Kalshi failed to prove "Congress has clearly and manifestly intended to deprive states of the power to regulate gambling." Kalshi has appealed this decision to the U.S. Court of Appeals for the Fourth Circuit.

The law firm Benesch commented on this, stating that as the nationwide debate continues, similar divisions are expected at the appellate court level, setting the stage for the Supreme Court to resolve this issue in the coming years... If appellate courts happen to consistently support Kalshi's position, other prediction markets might emulate its model and proceed with similar businesses before the Supreme Court hears the matter. However, if appellate courts reach different conclusions, companies in similar situations might wait for clearer legal signals before acting. Regardless, Kalshi's lawsuits will create a precedent with direct and profound implications for the national sports betting and gambling industry.

In summary, the question of whether prediction markets need to follow state gambling regulations remains unresolved for now. The fundamental conflict lies in the similarity of the products/services offered by prediction markets and sports betting, contrasted with the differences in their regulatory requirements.

This is a tug-of-war over regulatory fit. Until appellate courts or even the Supreme Court provide a final ruling, the gray area between prediction markets and sports betting will persist, and regulatory conflicts will be hard to avoid. In the short term, states will likely continue to defend their regulatory authority and tax base through enforcement and litigation. Meanwhile, prediction market platforms will attempt to use federal compliance and innovation narratives as shields to fight for greater survival space.

Recommended Reading: