2025 Marketing Whitepaper

- Core Viewpoint: The Web3 market is shifting towards pragmatism, with competition focusing on real liquidity and user retention.

- Key Elements:

- Marketing KPIs are shifting from DAU to revenue metrics like trading volume and TVL.

- Project lifecycles are shortening, highlighting the issue of hollowed-out operations post-TGE.

- Over-reliance on KOL marketing, neglecting community culture (KOC) building.

- Market Impact: Drives project teams to focus more on long-term value and sustainable operations.

- Timeliness Note: Medium-term impact

Introduction

With the advancement of AI technology, the technical barriers to entry for Web3 products are relatively lowering, which in turn makes the competition for attention and liquidity in marketing even more intense. Yet, market capability has always been the most easily overlooked critical component for most project teams. Based on this, XDO attempts to launch this "Web3 Market Annual Whitepaper," aiming to document market experiences as much as possible: deconstructing and sharing excellent marketing design strategies, hoping to be helpful for entrepreneurs and market practitioners in the industry.

In 2025, the shift in market activities was clear: project teams were forced to move away from the previous excessive pursuit of "seemingly prosperous" DAU towards more pragmatic data metrics that directly generate revenue, such as trading volume and TVL. Consequently, activity templates became fewer, campaign mechanics simpler, and the mindsets of both project teams and users became more pragmatic. Users began to care more about the safety of their principal and the certainty of returns, while project teams focused more on acquiring real liquidity, genuine trading users, and a sustainable business growth curve visible to platforms and the market before token listings through marketing activities.

To summarize 2025 in one sentence: it was the "inaugural year of new settlement metrics" and also the "inaugural year of gateway competition." When growth goals shifted to being guided by actual profit or value based on "funds staying / transactions occurring," competition naturally turned towards "who can better retain users' fund-related behaviors within their own ecosystem."

This is also why wallets began to be redefined in terms of their strategic significance. Taking Binance as an example, the Binance Wallet gradually evolved into a new ecosystem gateway: directing traffic from the main site, a pre-listing project pool, and points & tasks binding trading behaviors into the product. What platforms want is not just a lively number of participants, but liquidity that can be continuously settled and users who can sustainably generate transactions. Therefore, activities are no longer just one-sided subsidies from project teams, but a tripartite interest structure involving the platform, the project, and the user: the platform leverages liquidity and trading users as advantages, the project team exchanges tokens and budget for traffic and trading behaviors, and users exchange attention and transactions for predictable returns.

But the harsh reality of 2025 lies here: the more pragmatic activity expectations become, the more compressed the attention cycle gets, and the "freshness period" for new projects becomes absurdly short. Once TGE occurs, market attention to the project plummets sharply. Consequently, project teams concentrate resources on the launch and sprint phases pre-TGE, while post-TGE sustained operations are chronically undervalued, gradually turning into a hollow zone. Users are perceptive of whether a project continues to work and remains active after TGE. However, the reality is that few projects manage to stay active after listing. On one hand, projects with a continuous, essential business model are limited. On the other hand, project teams often do not prioritize sustained operations post-TGE. Once a project enters a silent period post-listing, it becomes harder and more expensive to win back lost users—this is the warning left by 2025 and a challenge that must be directly addressed in 2026.

A deeper issue is the cultural disconnect: many projects build impressive pre-listing metrics but neglect that long-term consensus requires culture and spiritual symbols to carry it forward. The relationship between the community and the founding team increasingly risks becoming a one-time cooperation of "completing tasks—receiving rewards—dispersing." Projects exert great effort on data but remain culturally hollow or lack any community consensus beyond collectively shorting and dumping after farming airdrops. Simultaneously, project teams' over-reliance on KOLs has led to more activities being exclusively tailored for KOLs, isolating KOLs from the general user base and turning the community from participants into spectators. When a project only cares about the KOL group, it inadvertently creates a sense of opposition against retail investors. Furthermore, KOCs (Key Opinion Consumers)—the core individuals within the community who participate long-term, are willing to produce content consistently, and spread the word spontaneously—are often overlooked.

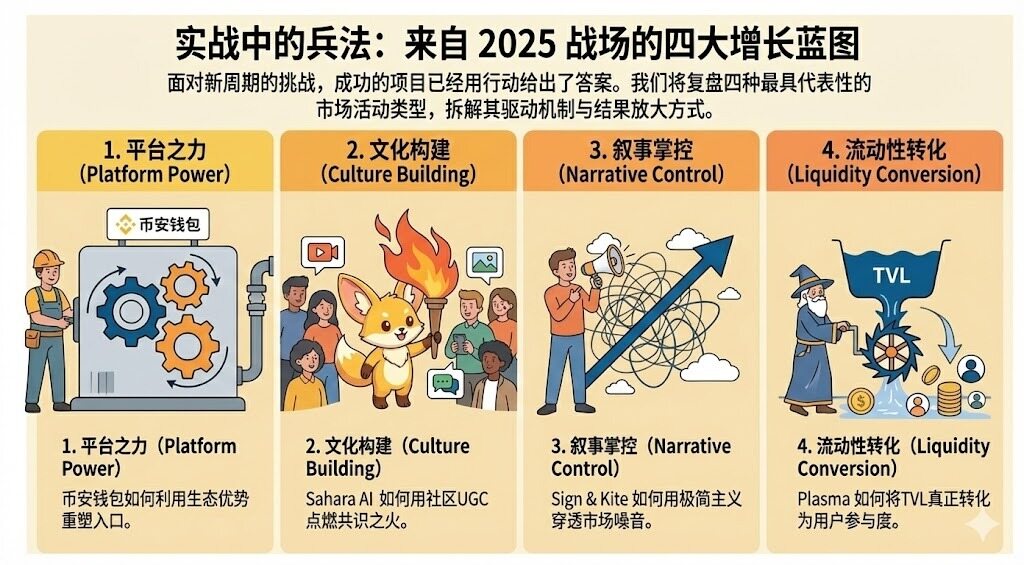

This "2025 Web3 Market Annual Whitepaper" will unfold across three levels:

- Review the most representative types of market activities in 2025: platform-based activities, TVL deposit activities, community participation activities, simplified narratives & promotional rhythm dissemination, and clarify their respective driving mechanisms and methods for amplifying results.

- Summarize the common shift in mindset between project teams and users in 2025: users value certainty and redeemable returns more, project teams increasingly view marketing activities as tools to acquire liquidity, trading users, and pre-listing momentum, while attention cycles shorten, post-TGE hollowness expands, and culture & community management remain chronically undervalued.

- Outlook for 2026: How these activity logics will continue to evolve, and the core trends and challenges project teams must directly face.

- Thank you for reading this far. If you are not a project's marketing staff, you can skip directly to Part 3.

Notable Project Marketing Campaigns That Left a Deep Imprint in 2025

For project teams, because user behavior and psychology change yearly, and attention flows and distribution channels also shift, three things must be clarified before designing long-term strategic marketing. First, which type of user do you want to capture? Second, what benefits can you offer them? (Ideally, this benefit should not deplete your own token but be provided by a third party). Jiayi elaborated in a previous post on how to design a core long-term commercial marketing strategy method of "making the sheep pay on the pig" for further reading. Third, is the activity smooth for users to participate in, are there any bugs to exploit? And the art of balancing interests between studios and current task metrics.

2.1 Leveraging Core Advantages to Exchange for Target Audience's Token Benefits to Plunder the Market: A Representative Case Study of Binance Wallet Crushing OKX Wallet to Secure the Top Spot

Wallets, once passive tools, have now become constructible marketing infrastructure. @Binance Alpha is a classic case of high alignment between platform capability and user motivation. It also surpassed the OKX Wallet and left it far behind using the aforementioned long-term commercial marketing strategy method.

Binance Alpha represents a truly disruptive innovation in crypto marketing. The key change is: the wallet transformed from an "asset storage tool" into a "project discovery hub." Binance placed the discovery gateway for early-stage projects directly inside @BinanceWallet. Users no longer need to go to external platforms to find new projects; they can explore projects and earn incentives right within the wallet. Binance Alpha prominently showcases projects with momentum, and if a project performs well enough on Alpha, it has a future chance of being considered for spot listing. The entire system forms a virtuous cycle:

Projects seek exposure and traffic → Users join and receive rewards → Projects acquire well-matched new users → Binance gains higher wallet usage and more trading activity.

Within Binance Alpha's system, the most crucial point is: rewards are distributed to users who genuinely trade, bring liquidity, and are willing to pursue new projects. Binance's advantages are liquidity and user base, and Alpha simply turns these two advantages into a more efficient distribution channel, while further squeezing the survival space of second and third-tier exchanges:

- Project teams provide tokens as cost → Exchange for Binance's exposure and traffic, striving for liquidity + potential future listing.

- Binance uses the wallet to funnel users in → Users generate trading behavior.

- Users trade and complete tasks → Exchange for rewards → Simultaneously contribute trading and liquidity to the project.

What Binance maintains is the user structure within Alpha that can generate transactions. As projects develop, the user structure also changes, so mechanisms and activities must be continuously optimized to let users who provide core value to projects win effortlessly.

2.2 From Marketing Centered Entirely Around KOLs to Valuing Overall Community Culture Building: Different Volume Marketing Strategies from Kaito to Sahara

In the first half of 2025, an innovative project @KaitoAI addressing public traffic attention for project teams emerged, and most project teams began focusing on Kaito activities as their primary marketing channel. However, Kaito's incentive structure inherently favors "those with greater influence are more easily seen and rewarded." Thus, marketing formed a fixed routine: projects wanting volume partner with KOLs, KOLs produce content, and ordinary users spectate. The process can indeed create a buzz for a while, but retail community participation feels weak, and the shared memory of the project becomes one of caution, viewing it as KOL advertising for airdrops. Consequently, project traffic first gets aggregated onto the Kaito platform. From Kaito's perspective, Kaito is undoubtedly successful because it operates precisely following the core strategic activity design principles I mentioned earlier.

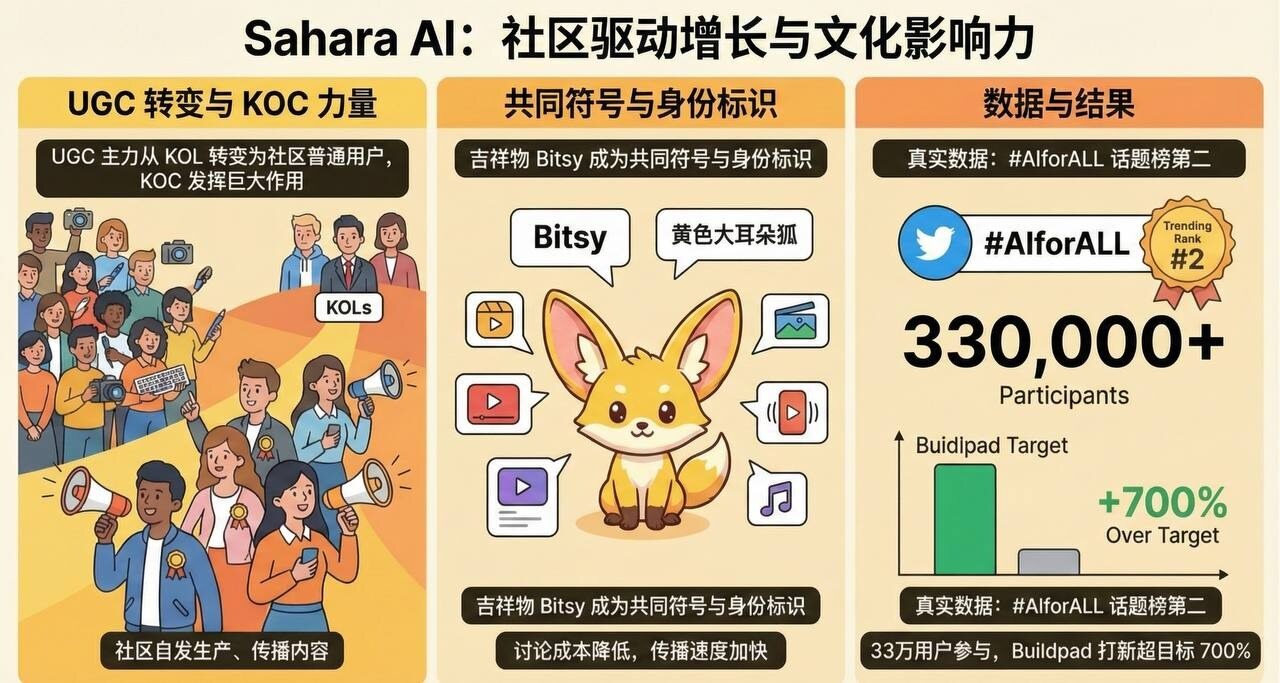

The shift of UGC from third-party platforms to one's own platform began with XDO's client @SaharaAI conducting its ICO on @buidlpad. Its starting point for UGC was "to get the community playing, to have the community participate and benefit before the project's token launch." Sahara's UGC activity didn't rely on giving away money, didn't make users grind tasks, and didn't set up various leaderboards. First, it introduced a clear cultural symbol representing the Sahara AI community and brand—the mascot Bitsy (the ears on my current avatar represent Bitsy's big ears, which are super cute, so much so that I'm still using them). Then, aligning with Sahara's ICO timing on @buidlpad, it encouraged community evangelists to secure better early participation qualifications for the ICO. This group was no longer just eyeing free tokens but was itself a target group of passionate believers with trust in the project.

You would see many users not just submitting assignments, but sincerely expressing themselves as Sahara people. Some made AI videos, some drew, some wrote serialized novels, some produced promotional music and shot MVs for the community, and some even wrote daily handwritten diaries, recording their moments in the Sahara community, why they liked Bitsy and the Sahara AI team. When a user is willing to use diary-writing to record their story with a project on Buidl, it indicates they already see the project and community as part of their own life story.

- The main force of this UGC activity shifted from the KOL group to ordinary community users. The KOC users I mentioned earlier played a huge role in this activity. Sahara AI's UGC content was no longer concentrated in the hands of a few; the community began to spontaneously produce and spread it.

- The community developed a common language, common symbols, and shared memories with the Sahara AI team. The mascot Bitsy became an inside joke and identity marker everyone understood; seeing the yellow big-eared fox immediately signaled Sahara AI. The cost of discussion lowered, and the speed of dissemination increased.

- The real data brought by community sentiment diffusion: the activity hashtag #AIforALL reached the second spot on Twitter's trending list. The entire activity also involved 330,000 users, and Sahara's token sale on Buidlpad exceeded the original target by 700%.

- There was no shortage of user botting behavior. However, the final reward was ICO participation qualification, and the team manually screened every UGC creator's content. Therefore, the ROI was extremely high. Based on this result and innovation, the ICO UGC activity was subsequently adopted by Buidlpad as a regular feature.

But Sahara AI also had a regret: Sahara's UGC activity managed to ignite the community in the market for a month, but it wasn't followed by sustainable cultural extension afterward, and the hype faded back. This is a common problem for many projects: they only know how to light the fire, not how to add fuel. Although Sahara proved to the market that culture can retain users, only continuous cultural output and community mechanism management can become a "religious" firewall and a long-term moat. Cultural continuity post-TGE must continue, even more vigorously.

2.3 Simple Slogan + Precise Rhythm Control = Beautiful Pre-listing Sentiment; Marketing Rhythm Control for Projects like Sign, Kite (To B, weak community sensory perception, products hard to perceive)

@sign created a Web3 orange dynasty through the slogan "Sign Everything." Sign's rhythm goal was to first make the core community large and strong, using the simplest slogan to brainwash users into equating Sign with major projects. It's important to note that for the market, Sign does not belong to the category of projects that can be quickly established as 'top-tier' through technical or product narratives. Founder @realyanxin once said: "What's important is whether we can have 100 people in our community earn 7 figures." He also mentioned that after TGE, the foundation would use tokens to support internal entrepreneurship within the community, essentially making the community realize that "following Sign can make money, TGE is not the end, but the beginning of the next stage."

I still remember during Sign's peak popularity, Yan Xin and Sign's community official Twitter account interacted frequently with users, prioritizing interactions with those whose Twitter profile pages featured Sign elements. This gave users clear feedback: as long as you participate seriously, as long as you are "one of us," you will always be seen by the official (see the sign). Being seen meant a chance to become one of the community members Sign would help make money. Sign's dissemination was more like word-of-mouth; everyone did simple things together, then the official gave ample affirmation, the community shared tweets helping and liking each other, users optimized and packaged their accounts, etc., gradually forming a virtuous cycle where the more users participated, the more easily they were seen, and the more willing they were to continue participating.

Another example is @GoKiteAI, which used minimalist keywords and precise rhythm to convey project value to ordinary users and rapidly 'align' community perception. Kite, as a public chain born for AI-era payments with AI technology as its core advantage, is the type of technical project most worried about the team not speaking human language, causing users to fail to see its differentiated value. To add, in the early crypto industry, public chains not speaking human language would make users more FOMO, but that era has long been淘汰.

Kite's first move was to let people see names like @PayPal Ventures, @generalcatalyst, reducing uncertainty and providing an initial credibility anchor, allowing users to make the most realistic judgment in their minds: if even a payment sector giant like PayPal is willing to place a heavy bet on Kite for the AI payment赛道, then at least it indicates the team's technical capability is reliable, capital resources are strong, and the possibility of becoming a leader is amplified.

The second move was Kite AI connecting its story to the payment standard the AI payment industry would uniformly adopt, making it instantly understandable to community users. Kite clearly understood that the narrative of an AI Payment Chain is inherently difficult to explain. If it obediently explained to users "how AI agents pay, how they settle..." most people wouldn't understand nor have the patience to understand. So Kite first made you believe the project was on the path the mainstream would take. Kite leveraged the then-hot topics of 402 and PayPal, releasing news in rapid succession: 402 partnership & @coinbase investment, PayPal partnership, and other positive developments. By having Coinbase promote x402 towards a universal standard for AI-driven payments, and hinting at which giant companies might become future clients before the official mainnet launch, it created imagination space. When people saw Kite associated with these names mentioned above, they could naturally guess and feel reassured about the project's布局 capability.

Kite AI lowered users' cognitive cost. The community no longer needed to read whitepapers or study technical details; just seeing a few news items could start building trust in Kite AI.

2.4 Transformation Based on Behavior Mining Design – How to Turn "Liquidity" into "Engagement": Cases like Plasma and Other Yield Projects

In 2025, TVL-based yield projects exploded, with a large number of lock-up activities appearing in the market, but few projects truly managed to convert "liquidity into engagement and retention." However, deposit activities that performed excellently mostly combined staking + token launch expectations, achieving FOMO effects quickly through partnerships with liquidity giants. For example, @Plasma and @zerobasezk first attracted massive liquidity through activities on Binance, then pulled this liquidity into their own ecosystems, forming deep engagement—this was the soul of their market design. Additionally, Buidlpad's HODL series—deposits换取 ICO allocation & lower valuation—also achieved excellent results.

The starting point of Plasma's strategy was to attract users by promoting sustained stablecoin holding behavior within its ecosystem. Plasma partnered with Binance Earn to launch an on-chain USDT yield product. Users could enter the $XPL airdrop scope by participating in Plasma's USD₮定期锁仓. This design was not one-off but based on a daily snapshot + time-weighted cumulative reward mechanism, where longer holding periods and higher holdings amplified the final XPL reward.

At that time, the market was densely packed with TVL projects. Many projects' subsidies seemed "high," but the design still followed "whoever rushes